-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI US MARKETS ANALYSIS - CNH Slides as PBoC Hike FX RRR

HIGHLIGHTS:

- USD/CNH rallies as PBoC hike FX RRR by 2ppts

- Policy tweak is only the second such move since 2007

- Focus turns to weekly jobless claims, wholesale trade sales

US TSYS SUMMARY: Bull Flattening Retracement On Omicron Restrictions

- Cash Tsys have bull flattened this morning on fears of Omicron-related restrictions, partially retracing yesterday’s sell-off into the afternoon after headlines of Pfizer neutralizing Omicron with three doses.

- USTs have lagged the moves seen in Europe this morning in 10Y space, down -2.7bps compared to -3.4bps for Bunds and -4.8bps for Gilts.

- 2Y yields are -0.6bps at 0.676%, 5Y -2.3bps at 1.252%, 10Y -2.6bps at 1.496% and 30Y at -3.0bps at 1.863%.

- TYH2 futures have slowly rallied off the weekly low, currently up five ticks on the day at session highs of 130-11+. This takes them above the 20-day EMA of 130-09, reinstating a bullish outlook with 131-16 (Dec 3 high) seen as the next resistance level and a bull trigger.

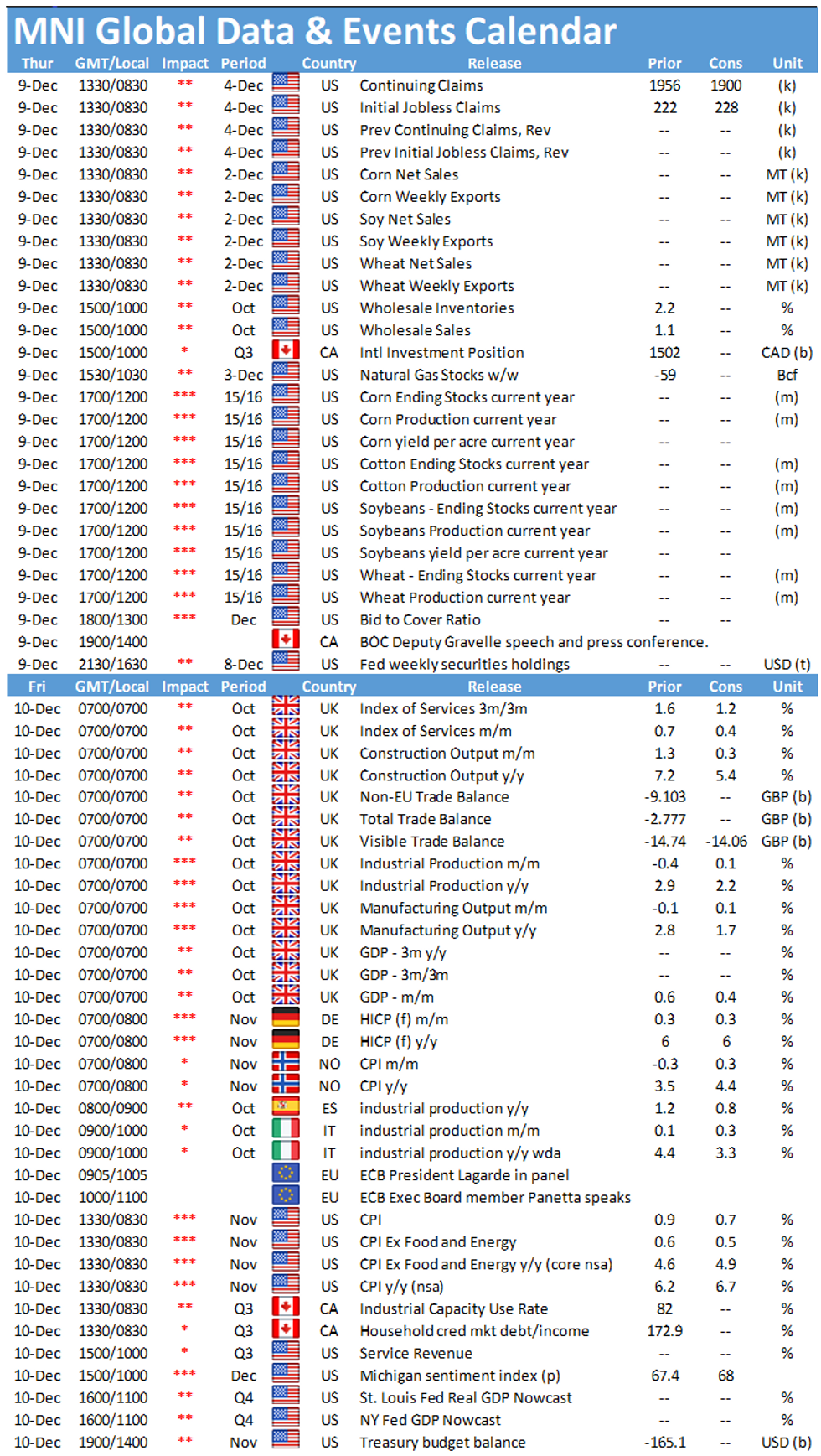

- A quiet day for data with weekly jobless claims and household net worth for Q3 the pick. The focus is instead on tomorrow’s CPI report ahead of the FOMC decision on Wed.

- NY Fed buy-ops: Tsy 0Y-2.25Y, appr $10.875B (1030ET) followed by Tsy 10Y-22.5Y, appr $1.425B (1120ET).

- Last Tsy issuance of the week today with the $22B 30Y Bond R/O auction (1300ET).

EGB/GILT SUMMARY: Pushing Higher

European government bonds have turned bid this morning with gilts leading the charge.

- Gilt cash yields are now 5-6bp lower on the day with the curve bull steepening.

- The bund curve, meanwhile, has bull flattened. The 2s30s spread has narrowed 2bp.

- It is a similar story for OATs where yields are 1-3bp lower with the longer end of the curve outperforming.

- BTP yields are down 2-4bp with the curve ~1bp steeper.

- UK PM Boris Johnson announced 'Plan B' social restrictions yesterday evening with workers now being told to WFH where possible. At the same time, Johnson is coming under increasing pressure within his own party following allegations that No. 10 staff held a party last Christmas that violated the government's own Covid rules.

- Aside from Italy's EUR2.25bn exchange auction, there was no European supply this morning.

- The European data calendar has similarly been light with the only release of note being German trade trade data (October trade surplus: EUR12.8bn vs EUR14.3bn expected). There were also no scheduled policy speakers this morning.

- Focus shifts to US claims data later today.

EUROPE ISSUANCE UPDATE: Italy Exchange Auction

Italy sells:- E2.255bln of the Apr-29 CCTeu at 100.22, yield of 0.10%, bids of E2.859bln, maximum offered E2.50bln, bid-to-cover 1.27x

- E562mln of the May-22 CTZ at 100.273

- E806mln of the Sep-22 CTZ at 100.419

- E529mln of the Jun-22 CCTeu at 100.308

- E354mln of the Dec-22 CCTeu at 100.708

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXF2 171.5/173.5 RR, bought the call for 86 in 30k vs RXG2 171.5/173.5, sold the call at 103 down to 101 in 30k

2RZ1 100/100.12cs, sold at 8 in 4k

SX7E 16/12/22 expiry, 90/80/70p ladder, bought for 0.2 in 20k

FOREX: Modest Risk-Off Tone Boosts JPY

- JPY trades solidly ahead of the NY crossover, with USD/JPY edging off yesterday's highs of 113.95 as markets consolidate and look to book profits. Newsflow and macro catalysts have been relatively few and far between, although there remains a modest risk-off tone with equities and commodity markets both trading lower.

- The USD Index has remained supported throughout, allowing prices to hold above the 96.00 handle, although the greenback remains well off the week's highs of 96.592 printed Tuesday.

- The NOK is the poorest performer Thursday, reversing a decent chunk of the Wednesday gains as USD/NOK reverts back toward the 9.00 handle. Oil prices rolling off the overnight highs haven't helped, with WTI trading either side of the $72/bbl handle.

- Weekly US jobless claims data takes focus going forward, with markets expecting IJC to dip to 220k in the most recent week. Wholesale trade sales numbers for October also cross. The speaker slate is particularly light, with no notable CB representatives due today.

PBOC: USD/CNH Rallies as PBoC Raise FX RRR by 2ppts

- The PBoC announce they are to raise the Forex reserve requirement ratio by 2 percentage points, thereby incentivising commercial banks to hold more in FX reserves, implicitly boosting demand for USD while restricting supply.

- The PBoC's tweak to FX RRR today is effective from Dec15 - the same day theheadline RRR cut announced on Monday will also come into force.

- Today's FX RRR hike is the second of the year (they last hiked the rate to 7%from 5% at the end of May), but it's a very rarely used tool - before May it was last tweaked in 2007 and could be a sign that authorities are uncomfortable with recent CNY strength.

FX OPTIONS: Expiries for Dec09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1380-00(E978mln), $1.1425(E534mln), $1.1560-70(E1.1bln)

- USD/JPY: Y113.00-25($1.6bln), Y114.00-20($2.4bln)

- EUR/GBP: Gbp0.8550-60(E694mln)

- AUD/USD: $0.7250-60(A$567mln)

- USD/CNY: Cny6.34($2.3bln), Cny6.43($1.1bln); Cny6.3500($1.8bln)

Price Signal Summary - Sterling Remains Vulnerable

- In the equity space, S&P E-minis are holding onto the bulk of recent gains following this week's strong rally. Futures remain above the 50-day EMA, at 4568.46 today. The focus is on 4717.00 next, the Nov 26 high ahead of the all-time high of 4740.50. EUROSTOXX 50 futures maintain a bullish theme despite pulling back from yesterday's high. The contract has recently breached resistance at 4186.00, the Dec 1 high and both the 20- and 50-day EMAs. Attention is on 4311.70 next, the 76.4% retracement of the Nov 18 - 30 downleg.

- In FX, EURUSD attention is on 1.1383, the Nov 30 high and key short-term resistance. A break would signal potential for a stronger short-term recovery. This would open 1.1460, the 50-day EMA and 1.1514, Nov 5 low. The bear trigger is unchanged at 1.1186/85, Nov 24 and Jul 1, 2020 low. GBPUSD traded lower yesterday and breached support at 1.3195, Dec 1 low. The break confirms a resumption of the downtrend and opens1.3351, the 20-day EMA. 1.3351 is resistance, the 20-day EMA. EURGBP rallied sharply higher yesterday to confirm a resumption of the recovery since Nov 22. An extension would open 0.8658, the Sep 29 high and a key resistance. USDJPY is unchanged. Attention remains on Monday’s price action, a bullish engulfing reversal day. If correct, it suggests the pair has found a base. The 20-day EMA at 113.70 is still being challenged. A clear break would reinforce the reversal pattern and open the November high of 115.52. Key support is 112.53, the Nov 30 low.

- On the commodity front, Gold is consolidating. The yellow metal remains vulnerable and attention is on the base of the bull channel at $1763.8, drawn from the Aug 9 low. This level represents a key short-term support. Watch resistance at $1815.6, high Nov 26. WTI futures remain firm. The focus is on $74.79 next, the 50-day EMA. Initial support lies at $69.52, the Dec 7 low.

- In the FI space, Bund futures fell sharply yesterday. At this point, the pullback appears to be a correction. The contract has found support ahead of the 20-day EMA. at 173.35 today. Yesterday’s high of 175.02 is the bull trigger and a break would confirm a resumption of the uptrend. A break of the 20-day EMA is required to suggest scope for a deeper pullback. The Gilts trend outlook remains bullish. The focus is on 128.00 next, the Aug 31 high.

EQUITIES: Energy / Financial Names Weigh

- Asian markets closed mixed: Japan's NIKKEI closed down 135.15 pts or -0.47% at 28725.47 and the TOPIX ended 11.45 pts lower or -0.57% at 1990.79. China's SHANGHAI closed up 35.474 pts or +0.98% at 3673.041 and the HANG SENG ended 257.99 pts higher or +1.08% at 24254.86

- European equities are a little higher, with the German Dax up 8.14 pts or +0.05% at 15687.09, FTSE 100 up 0.54 pts or +0.01% at 7337.05, CAC 40 up 19.81 pts or +0.28% at 7014.57 and Euro Stoxx 50 up 3.9 pts or +0.09% at 4233.09.

- U.S. futures have dipped slightly, with the Dow Jones mini down 35746 pts or -0.18% at 35683, S&P 500 mini down 8.5 pts or -0.18% at 4690.5, NASDAQ mini down 29.25 pts or -0.18% at 16363.

COMMODITIES: Weaker Across The Board

- WTI Crude down $0.14 or -0.19% at $72.81

- Natural Gas down $0.05 or -1.21% at $3.794

- Gold spot down $0.16 or -0.01% at $1786.36

- Copper down $3.75 or -0.85% at $437.45

- Silver down $0.11 or -0.5% at $22.35

- Platinum down $10.41 or -1.08% at $958.28

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.