-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Copper Hits New 10yr Highs

HIGHLIGHTS:

- Copper surges to hit a new decade high, with Biden's infrastructure plan in focus

- Equities broadly flat, market awaits FOMC

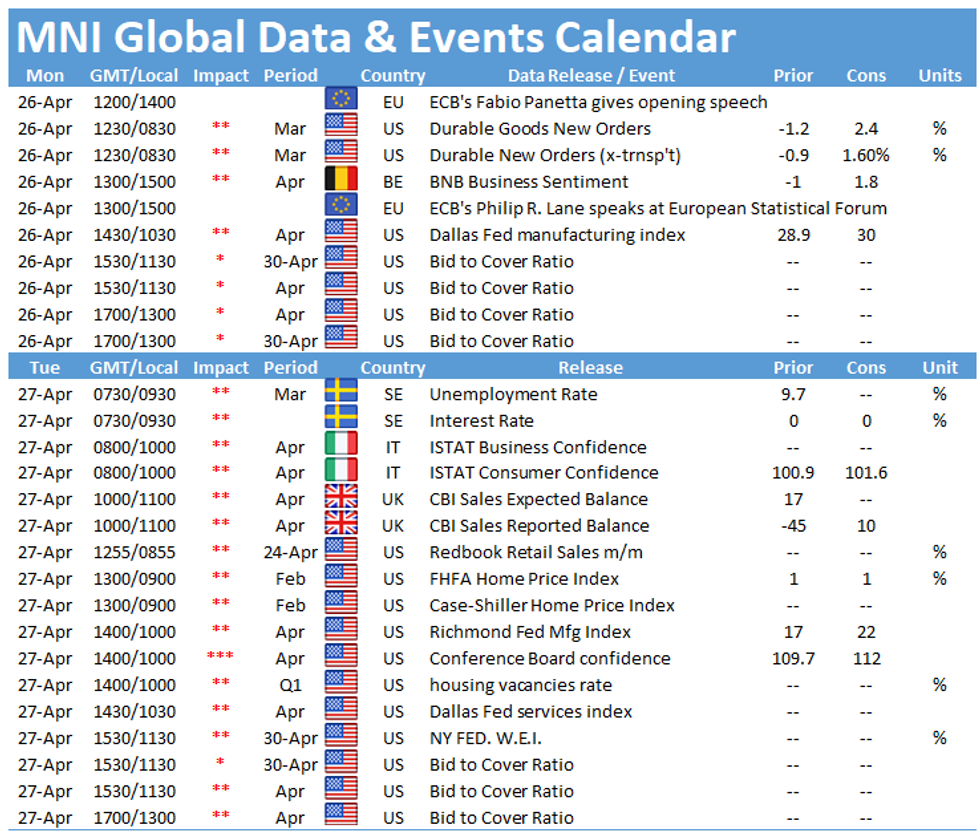

- Durable goods and a handful of ECB speeches mark a quiet start to the week

US TSYS SUMMARY: Weaker Ahead Of Durable Goods And 2-/5-Yr Supply

Tsys are a little lower to start the week, with durable goods data and 2-/5-yr supply coming up, and ahead of the FOMC decision and Pres Biden's address Weds.

- Curve a little steeper: the 2-Yr yield is up 0.2bps at 0.1595%, 5-Yr is up 1.6bps at 0.8327%, 10-Yr is up 2.5bps at 1.5826%, and 30-Yr is up 2.5bps at 2.259%.

- Jun 10-Yr futures (TY) down 5/32 at 132-09 (L: 132-07.5 / H: 132-15), with avg volumes (278k) amid light headline flow in Asia-Pac / Europe.

- Most attention overnight on India COVID crisis, EU opening up to vaccinated US travellers this summer, and anticipation re Biden's address to Congress.

- While Fed meeting this week is seen largely as a placeholder, some see risks of a hawkish tweak of messaging and/or a change in administered rates. Our preview will be out later today.

- Data for the week starts with durable goods at 0830ET. Retail sales revisions out at 1000ET, with Dallas Fed manufacturing at 1030ET.

- In a front-loaded supply week (due to FOMC Weds), we get two note auctions today: 1130ET $60B 2-Yr Note (alongside $54B 26-week bills) and 1300ET $61B 5-Yr Note (alongside $57B 13-week bills).

- NY Fed buys ~$3.625B of 7-20Y Tsys.

EGB/GILT SUMMARY - BTPs Underperform

European sovereign bonds have traded weaker morning with Italian BTPs underperforming.

- Gilts opened lower and have traded sideways through the morning. Cash yields are 1-2bp higher on the day with the short-end/belly underperforming.

- Bunds yields have drifted higher with the curve marginally steeper.

- OATs trade broadly in line with bunds. Yields are 1-2bp higher with the curve 1bp steeper.

- BTPs have led the EGB selloff. Yields are the longer end are 4bp higher.

- The German IFO survey for April came in weaker than consensus with the expectations component reading 99.5 vs 101.2 survey.

- Supply this morning came from Germany (Bubills, EUR3.746bn allotted) and the ESM (10Y, EUR2bn)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM1 172c, bought for 27.5 in 3k and 33.5 in 3k (6k total)

UK:

2LZ1 99.00/98.50ps vs 99.62/99.87cs, bought the ps for 1 in 2.5k

US:

TYM1 132/131.25ps 1x2, bought for -2 in 6.5k

EUROPE ISSUANCE UPDATE: ESM Syndication

ESM Issuance:- Final terms for long 10-year issue:

- E2bln WNG Fixed (Oct. 15, 2031) at MS-10

- Books above EU12bln

FOREX: AUD, NZD Buoyed While Copper Strikes Decade High

- Antipodean currencies outperform early Monday, with AUD/USD, NZD/USD nearing last week's best levels as commodity markets - particularly industrial metals - trade well at the start of the week. Copper prices have hit new cycle highs this morning, trading again at the best levels in a decade having cleared the previous top in late February.

- The greenback trades marginally lower, with the USD slipping against most others. This has helped buoy EUR/USD, which continues to defy the bearish signals emanating from last week's gravestone doji candle (Tuesday). Instead, the EUR/USD uptrend remains in tact and is approaching bear channel resistance at 1.2119.

- GBP trades modestly firmer, erasing some of the damage done at the tail-end of last week. Lower crude prices are working against the likes of NOK ahead of this Wednesday's OPEC+ meeting.

- Preliminary US durable goods numbers cross later today, with speeches from ECB's Lane and Panetta also due.

FX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E654mln)

- USD/JPY: Y107.97-108.03($471mln), Y108.15-20($815mln)

- USD/CHF: Chf0.9300($600mln)

- AUD/USD: $0.7945-50(A$732mln)

- AUD/JPY: Y81.50(A$753mln)

- USD/CAD: C$1.2700-10($570mln)

- USD/CNY: Cny6.45($500mln-USD puts)

- USD/MXN: Mxn19.60($650mln)

Price Signal Summary - EURUSD Approaches Its Bear Channel Resistance

- In the equity space, S&P E-minis ended last week on a firm note and a fresh trend high of 4186.75. The outlook remains bullish with attention on 4195.50, 1.618 projection of the Feb 1 - Feb 16 - Mar 4 price swing. Key support is at 4110.50, Apr 21 low.

- In the FX world, EURUSD traded higher Friday to resume the current uptrend. Key near-term resistance is at 1.2119, the bear channel top drawn off the Jan 6 high. A break would strengthen the bullish theme. GBPUSD remains below last week's high of 1.4009 on Apr 20. A bearish risk dominates while 1.4009 remains intact. Support to watch is at 1.3824, Apr 22 low. USDJPY is testing and has probed trendline support drawn off the Jan 6 low. A clear break would signal scope for a deeper pullback and open 106.78, 50.0% retracement of the Jan - Mar rally.

- On the commodity front, Gold maintains a bullish tone. The focus is on $1805.7, Feb 25 high. Brent (M1) remains below last week's high. Key support to watch is $63.42, the 50-day EMA. WTI (M1) found resistance last week at $64.38 on Apr 20. The 50-day EMA at $60.08 is seen as a firm intraday support.

- In the FI space, Bunds (M1) have defined a short-term resistance at 171.18/2, the 20-day EMA and Apr 22 high. On the downside support is at 170.05, 76.4% of the Feb 25 - Mar 25 rally. Support to watch in Gilts (M1) remains 127.81, Apr 14 low. The key resistance is at 129.27, Mar 2 high and the reversal trigger.

EQUITIES: Markets Mixed, Few Fresh Signals

- European markets are trading either side of unchanged early Monday, with the EuroStoxx50 only marginally in the green, but holding just above the 4,000 level. Spain's IBEX-35 outperforms, with the index higher by 0.8% thanks to a strong turnout from Spanish banks' Santander and BBVA.

- In Europe, real estate and financials are the firmest, but weakness in consumer staples and tech names are countering any upside.

- In futures space, indices are similarly unchanged as markets await both the FOMC and Biden's congress speech on Wednesday. The e-mini S&P is in very minor negative territory, sitting just below the fresh all time highs posted late last week.

COMMODITIES: Copper Strikes New Decade High, Counters Oil Weakness

- Copper prices cleared the late February highs early Monday, hitting the best levels since 2011 at $442.00 as markets further price in a swifter economic recovery later in 2021.

- Traders continue to focus on the sizeable infrastructure plans expected to be laid out by President Biden this week, with a focus on clean energy and electric vehicles seen driving demand for industrial metals. Steel and iron ore prices are similarly strong.

- Countering strength in metals, the energy complex is soft, with both WTI and Brent crude futures in negative territory ahead of Monday's open. This week's OPEC+ meeting takes focus, with the JMMC starting Monday, before the full ministerial event on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.