-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

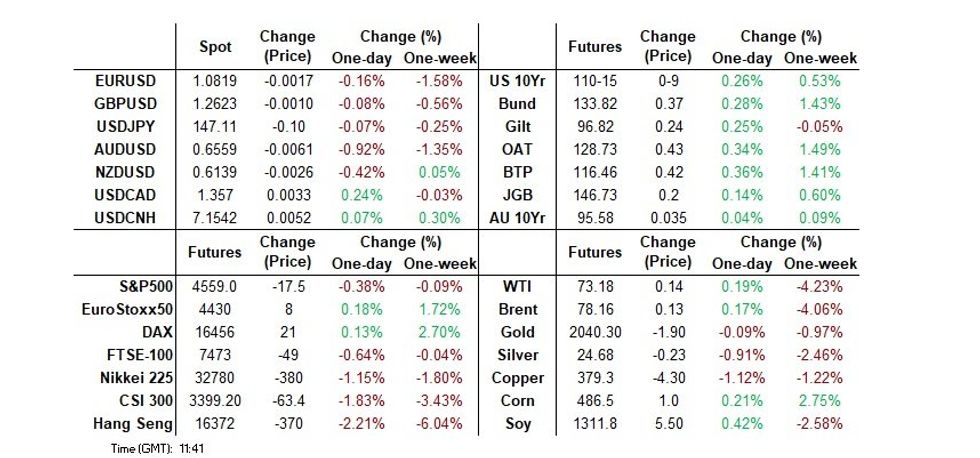

Free AccessMNI US MARKETS ANALYSIS: Dovish Schnabel & China Downgrade Worries Headline Thus Far

- European & UK data helps the broader USD off early London bests, before second round bid kicks in. EUR hampered by dovish ECB comments.

- China moved to negative outlook at Moody's.

- U.S. JOLTS & ISM services data headlines the docket in NY hours.

US TSYS: Trimming Gains Following EU PMIs

- Cash Tsys are firmer, inside relatively narrow range with rates recovering from Monday's sale. Support eased slightly following higher than expected inflationary measures in core European PMIs in early London trade.

- TYH4 currently at 110-13.5 (+7.5) vs. overnight low of 110-10, moderate volumes (TYH4 appr 300k so far). Initial resistance at 110-28 (Dec 1 high) followed by 111-00 (round number resistance). Trend direction still bullish with pullbacks considered corrective: technical support well below at 109-06 (20-day EMA).

- Session data: S&P PMIs at 0945ET, JOLTS and ISM Services at 1000ET. Main focus remains on Friday's employment data for November.

- Federal Reserve is in their blackout period regarding monetary policy through December 14. However, Fed Gov Bowman will give a speech on inclusive financial systems at 1500ET (text, no Q&A, live streamed from Aspen Inst).

- US Treasury will auction $70B 42D CMB bills at 1130ET.

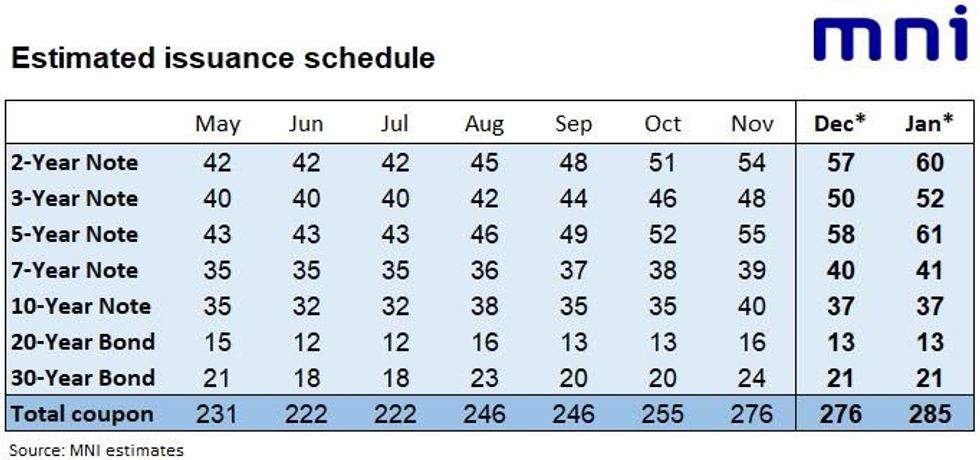

MNI UST Issuance Deep Dive: Dec 2023

EXECUTIVE SUMMARY:

The November 1 Treasury refunding announcement brought a more market-friendly announcement than had been expected/feared by some analysts as seen in our preview, both on long-end auction sizes and on Treasury's guidance that "Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today" (some had expected rises through not just Feb 2024’s refunding but potentially May’s).

- Even so the upsizing was substantial, with the November refunding month bringing $276B in coupon sales, vs $246B in August’s refunding.

- November’s coupon auctions were generally mixed, with 4 coupons tailing and 3 trading through. However, three of the tailing auctions were extremely weak, while the 20Y trade-through stood out as the strongest.

- We don’t usually single out individual auctions in our monthly Deep Dives but November’s 30Y Bond auction was historically weak and - while possibly a one-off - does not bode well for demand for duration.

- The December auction schedule kicks off with 3Y Note and 10Y Note on Dec 11 – details to be announced on Dec 7.

- Please see PDF for full analysis:MNI_US_DeepDive_Issuance_2023_12.pdf

STIR: OI Indicates Short Setting Dominated In SOFR On Monday, Pockets Of Long Cover Also Seen

The combination of yesterday's move lower in SOFR futures and preliminary OI data point to fresh net short setting as the dominant positioning swing during Monday trade, although pockets of apparent long cover were also seen. Indeed, the reds seemed to see long cover in net pack terms.

- A quick reminder that participants started to question the viability/degree of the Fed rate cuts priced in for '24, which triggered a move away from Friday's dovish session extremes.

| 04-Dec-23 | 01-Dec-23 | Daily OI Change | Daily OI Change In Packs | ||

| SFRU3 | 1,084,515 | 1,000,697 | +83,818 | Whites | +93,531 |

| SFRZ3 | 1,490,155 | 1,486,274 | +3,881 | Reds | -22,135 |

| SFRH4 | 1,086,588 | 1,091,815 | -5,227 | Greens | +14,276 |

| SFRM4 | 1,007,253 | 996,194 | +11,059 | Blues | +7,350 |

| SFRU4 | 981,215 | 989,036 | -7,821 | ||

| SFRZ4 | 926,772 | 943,798 | -17,026 | ||

| SFRH5 | 542,834 | 544,428 | -1,594 | ||

| SFRM5 | 602,785 | 598,479 | +4,306 | ||

| SFRU5 | 627,858 | 632,878 | -5,020 | ||

| SFRZ5 | 564,062 | 552,692 | +11,370 | ||

| SFRH6 | 410,972 | 405,330 | +5,642 | ||

| SFRM6 | 356,303 | 354,019 | +2,284 | ||

| SFRU6 | 324,777 | 320,026 | +4,751 | ||

| SFRZ6 | 257,816 | 260,796 | -2,980 | ||

| SFRH7 | 155,314 | 151,128 | +4,186 | ||

| SFRM7 | 137,758 | 136,365 | +1,393 |

MNI BoC Preview, Dec'23: How Dovish Is The Question

EXECUTIVE SUMMARY

- The BoC is almost unanimously seen keeping its policy rate on hold at 5% for the third meeting running.

- Remarks from Gov. Macklem two weeks ago could heavily dictate the message we receive from the single page statement, including that excess demand is now gone and policy may now be restrictive enough.

- More nuanced remarks will have to come from Dep Gov Gravelle on Thursday, with Scotia noting potential for a change in framework with focus on ending QT.

- Markets have rallied significantly since the Oct 25 decision, potentially skewing greater risk of a hawkish market reaction, at least for FI, but one that is unlikely to persist.

- Data will ultimately set the tone, with recent trends showing a non-trivial increase in the unemployment rate along with core inflation moderation.

- PLEASE FIND THE FULL PREVIEW HERE:BOCPreviewDec2023.pdf

FX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0800 (455mln), 1.0805 (338mln), 1.0825 (1.51bn), 1.0830 (341mln), 1.0860 (1.03bn) 1.0900 (1.56bn).

- USDJPY: 146.00 (893mln), 146.50 (750mln), 146.75 (410mln), 147.00 (1.07bn), 147.10 (630mln), 147.50 (1.52bn).

- USDCAD: 1.3550 (830mln).

- AUDUSD: 0.6550 (965mln).

- USDCNY: 7.15 (524mln).

EUROPEAN ISSUANCE UPDATE

3.10% Dec-25 Schatz

- E4.5bln (E3.655bln allotted) of the 3.10% Dec-25 Schatz. Avg yield 2.64% (bid-to-cover 2.01x).

- A decent Schatz auction - very good bid-to-offer / bid-to-cover and a nice premium for the LAP over the pre-auction mid-price.

- However there was a decent concession in the secondary market going into the auction (we moved from around 100.900 around 7 minutes before the auction to a low of 100.859 just after the bidding window closed - so the premium isn't as strong as it would appear at first glance.

0.75% Nov-33 I/L Gilt

- GBP1.5bln of the 0.75% Nov-33 linker. Avg yield 0.724% (bid-to-cover 2.68x).

- A very weak 10-year linker auction with the real price of 100.252 coming in notably below the pre-auction mid-price of 100.365.

- Indeed, prior to the auction the pre-auction low was 100.343, and we have fallen from around 100.400 to a post-auction low of 100.265 (and still falling at the time of writing).

- The weak linker auction saw follow through in nominals - 10-year nominal gilt yields were up from 4.136% pre-auction results to hit a high of the day of 4.154%.

- Gilt futures from 96.97 to hit an intraday low of 96.78.

EQUITIES: EUROSTOXX 50 Trend Outlook Remains Bullish

- A bullish theme in S&P E-Minis remains intact and last Friday’s push higher is a positive development. So far, corrections have been shallow - a bullish signal. Note too that moving average studies are in a bull-mode position and this highlights positive market sentiment. A resumption of gains would open 4690.75, the Aug 2 high. Initial support lies at 4596.86, the 20-day EMA.

- A bullish theme in EUROSTOXX 50 futures remains intact. The contract traded higher last week and breached 4387.00, the Nov 24 high. The break confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. The focus is on 4446.00, the Aug 10 high. Initial firm support to watch is at 4328.20, the 20-day EMA.

COMMODITIES: Oil Futures Remain Vulnerable

- Gold traded in a volatile manner Monday. The trend condition is bullish and yesterday’s initial gains reinforce this theme. The precious metal touched a fresh all-time high of $2135.39 and this signals potential for a climb towards 2177.58 next, the 1.236 projection of the Oct 6 - 27 - Nov 13 price swing. Price has since retraced and is trading closer to this week’s low, so far. A short-term pullback is considered corrective - for now. Initial support is $2004.1, the 20-day EMA.

- In the oil space, the trend outlook in WTI futures is unchanged, it remains bearish and the move lower from last Thursday’s high, reinforces this set-up. Resistance to watch is at $79.65, the Nov 14 high. A breach of this hurdle would strengthen any developing bullish threat and open $83.20, the Nov 3 high. Sights are on the bear trigger at $72.37, the Nov 16 low. Clearance of this level would confirm a resumption of the downtrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/12/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/12/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/12/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 05/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/12/2023 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 06/12/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/12/2023 | 1030/1030 |  | UK | BOE FPC Summary and Record | |

| 06/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/12/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/12/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/12/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 06/12/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/12/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.