-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US MARKETS ANALYSIS - ECB's Villeroy Provides Drag For Terminal Rate Pricing

Highlights:

- ECB's Villeroy weighs on ECB terminal rate pricing

- AUD/NZD sits lower after RBNZ hike, poor Aussie wages

- 5y supply due ahead of FOMC minutes

US TSYS: Modestly Richer With Session Focus On Fed Comms & 5Y Supply

- Cash Tsys have seen a mixed overnight session but ultimately sit 1-2.5bp richer across the curve, most recently rallying in a continuation of move firmer after ECB’s Villeroy talked down the terminal rate.

- Front end yields sit in the middle of yesterday’s ranges but still towards the high end for the belly and beyond after yesterday’s stronger than expected PMIs. Upcoming Fed commentary headlines a light docket although 5Y supply is also in focus prior to the FOMC Minutes.

- 2YY -1.7bp at 4.679%, 5YY -2.5bp at 4.150%, 10YY -1.6bp at 3.937%, 30YY -1.4bp at 3.958%.

- TYH3 trades 3 ticks higher at 111-05 on above average volumes. Support is seen at the earlier low of 110-30+ after which sits 110-07 (2.0% 10-dma envelope), whilst to the upside sits resistance at 113-05 (20-day EMA).

- Fed: Bullard (non-voter) speaks to CNBC (0700ET), FOMC Minutes (1400ET) and then late on NY Fed Williams (1730ET).

- Data: Weekly MBA mortgage data (0700ET)

- Note/Bond issuance: US Tsy $22B 2Y FRN reopen (1130ET), US Tsy $43B 5Y Note auction (1300ET)

- Bill issuance: $36B 17W bills (1130ET)

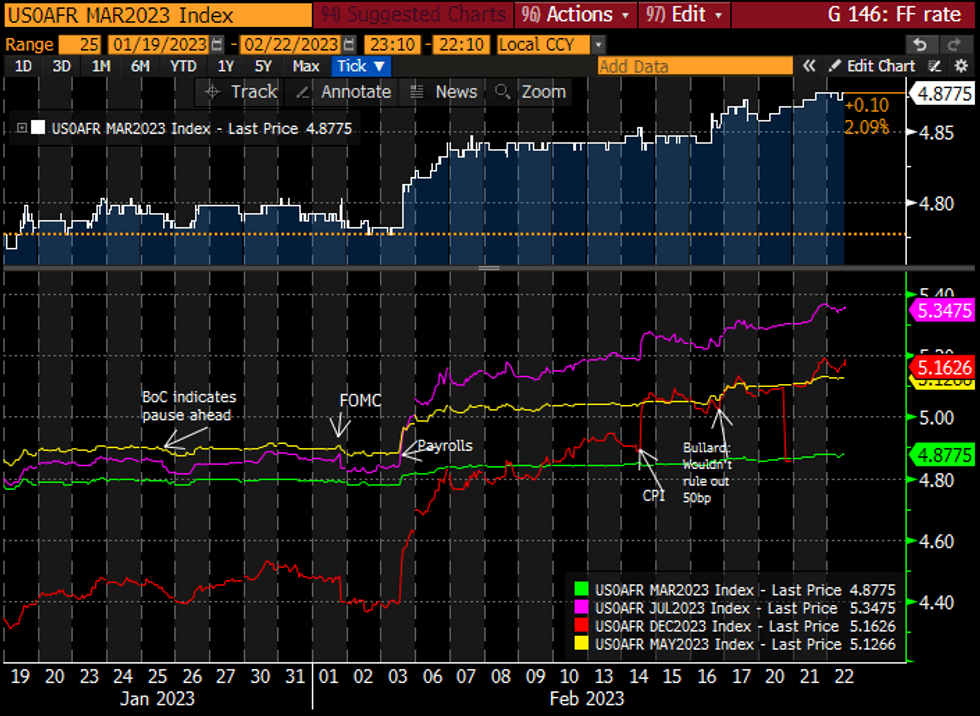

STIR FUTURES: Fed Terminal Holds Just Off Post-PMI Cycle Highs

- Fed Funds implied hikes remain off yesterday’s post-PMI highs, with a rise off overnight lows stalling in modest spillover as the ECB terminal rate dipped from a new cycle high after Villeroy comments.

- 29.5bp for Mar (unch), cumulative 55bp for May (-0.5bp), 77bp to 5.35% Jul (-2bp, close to 5.34% in Sep) before 18bp of cuts to 5.16% Dec (-2.5bp).

- Bullard (non-voter) speaks on CNBC at 0700ET having said he wouldn’t rule out supporting a 50bp hike in March on Feb 16 (at the time driving a step higher in rate expectations), before FOMC Minutes at 1400ET.

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

EUROPE ISSUANCE UPDATE:

Gilt auction results:

- This morning we saw a decent 30-year green gilt auction, particularly after yesterday's disappointing auction of the 0.50% Jan-29 gilt. The tail of 0.6bp was close to the 0.7bp tail seen at the last long-dated gilt auction (the 1.125% Jan-39 gilt on 8 February) while the LAP was above the mid-price immediately ahead of the auction. The 1.50% Jul-53 Green Gilt dipped a little following the auction result but is now trading above the LAP but below the average auction price.

- GBP2bln of the 1.50% Jul-53 Green Gilt. Avg yield 4.018% (bid-to-cover 2.42x, tail 0.6bp).

- BTP futures continued to move lower following the BTP-ST / BTPei auction despite some decent results. The results of the 0.10% May-33 BTPei auction were very much in line with those seen in the January auction while there was strong demand for the new 3.40% Mar-25 BTP Short-Term. The latter had moved higher 5-10 minutes ahead of the bidding deadline but outside of that 5 minute period, the price achieved exceeded any price seen in the grey market in the 90 minutes ahead of the auction deadline.

- E3.75bln of the 3.40% Mar-25 BTP Short Term. Avg yield 3.67% (bid-to-cover 1.51x).

- E1.5bln of the 0.10% May-33 BTPei. Avg yield 2.19% (bid-to-cover 1.43x).

- Another strong German auction result this morning with the 2.30% Feb-33 Bund seeing the highest volume of bids for a 10-year Bund auction since April 2020 (E8.394bln). In the same time period the allotted amount has only been exceeded once (again for the 2.30% Feb-33 Bund on 11 January - the auction before last. The 2.30% Feb-33 Bund was trading above the average price of 97.70 shortly following the auction.

- E5bln (E4.26bln allotted) of the 2.30% Feb-33 Bund. Avg yield 2.56% (bid-to-cover 1.68x)

- 10-year Mar-33. Spread set at MS flat. Books in excess of E5.6bln.

- 20-year Mar-43. Spread set at MS+40bp. Books in excess of E5.2bln.

- MNI expects combined size of E2-3bln (most likely E2.5bln).

FOREX: EUR Slips as Villeroy Talks Down ECB Terminal Rate View

- EUR is slightly softer headed through to US hours, with EUR/USD extending the recent (modest) downtrend. EUR/USD printed a low of 1.0631 on the back of an interview with ECB's Villeroy in Les Echos, in which he stated that markets had been excessively volatile over the view on the ECB's terminal rate over the past few sessions, and that the ECB is not obliged to hike rates at every meeting between now and September.

- AUD trades poorly headed through to the NY crossover on the back of a lower than forecast wage price index release overnight. Wages grew at a slower-than-expected 0.8% vs. forecast 1.0% for Q4 - although still a faster clip relative to the recent running average. In contrast, NZD gained overnight on the RBNZ 50bps rate hike, with the bank also making clear that further tightening is a likelihood at the coming policy meetings. AUD/NZD sits well below the 200-dma, with 1.0929 support next up.

- Elsewhere, SEK is adding to recent gains as Riksbank governor Thedeen spoke this morning, flagging further concern over the unacceptably high level of underlying inflation. Nonetheless, Thedeen pushed back on Ohlsson's recent suggestion that an unscheduled Riksbank decision is a possibility at this stage, leaving the April meeting the next expected meeting for policy tightening.

- The Fed minutes take focus going forward, with markets looking to gauge the board's sensitivity to stepping up the pace of rate hikes should inflation issues persist over the medium-term. Fed's Williams is set to discuss inflation in a speech after the US close.

FX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.3bln), $1.0635-50(E571mln), $1.0670-75(E833mln)

- USD/JPY: Y134.00($599mln), Y134.25($715mln)

- AUD/USD: $0.7000(A$828mln)

EQUITIES: E-Mini S&P Shows Below 4000.00 Handle Following Tuesday Slip

- Dip buyers emerged in EUROSTOXX 50 futures Tuesday, with prices rapidly bouncing off the 4215.00 lows. Nonetheless, prices remain just below first resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, but still above 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- Slippage Tuesday put the S&P E-Minis lower through the London close, with weakness extending into the Wednesday European open. This puts prices below first support at the 50-day EMA at 4031.50 and tilts the near-term view lower. 3901.75 marks next support, the Jan 19 low.

COMMODITIES: WTI Futures Dip Lower to Friday Lows

- WTI futures drifted into the Friday close, returning the outlook to neutral for now. Prices now sit back below the 50-day EMA, at $78.34, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $72.25, the Feb 6 low for the continuation contract.

- Trend conditions in Gold are bearish for now, despite the late recovery into the Friday close. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback. Vol band support (the 2.0% 10-dma envelope), successfully contained prices Friday, keeping the focus on the level this week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams | |

| 23/02/2023 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 23/02/2023 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.