-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities Make Headway Ahead of Inauguration

HIGHLIGHTS:

- Biden first actions look to reverse flagship Trump policies on energy, climate

- Equities, commodities, yields all higher

- Inauguration opening remarks from 1630GMT/1130ET onwards

US TSYS SUMMARY: Weaker Within Ranges On Inauguration Day

Treasuries are a little weaker (within Tuesday's ranges and on lackluster volumes) ahead of the Biden presidential inauguration and 20-Yr supply.

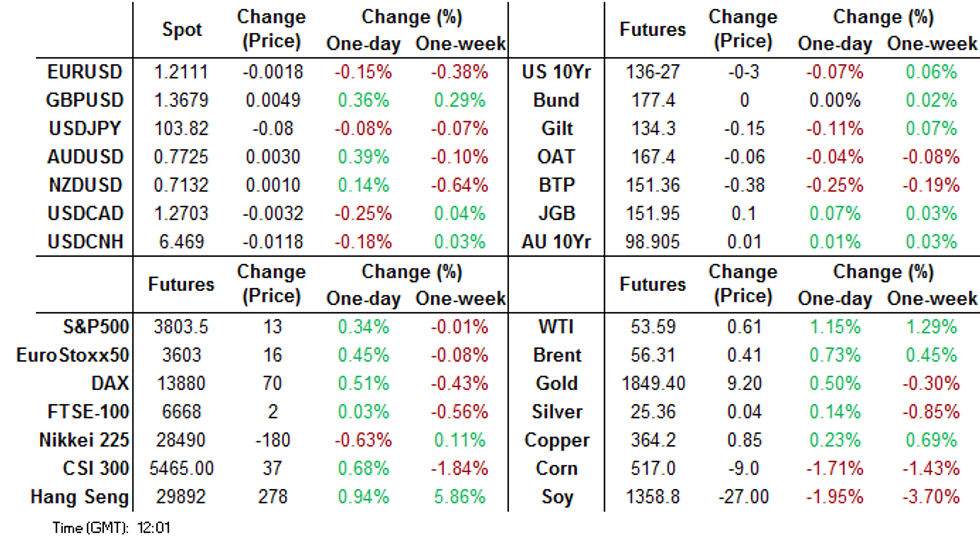

- Mar 10-Yr futures (TY) down 4/32 at 136-26 (L: 136-25.5 / H: 136-30.5), ~210k traded.

- The 2-Yr yield is up 0.2bps at 0.1331%, 5-Yr is up 1.1bps at 0.4566%, 10-Yr is up 1.2bps at 1.1006%, and 30-Yr is up 1.1bps at 1.8451%.

- Dollar is mixed/weaker, with equities stronger led by tech.

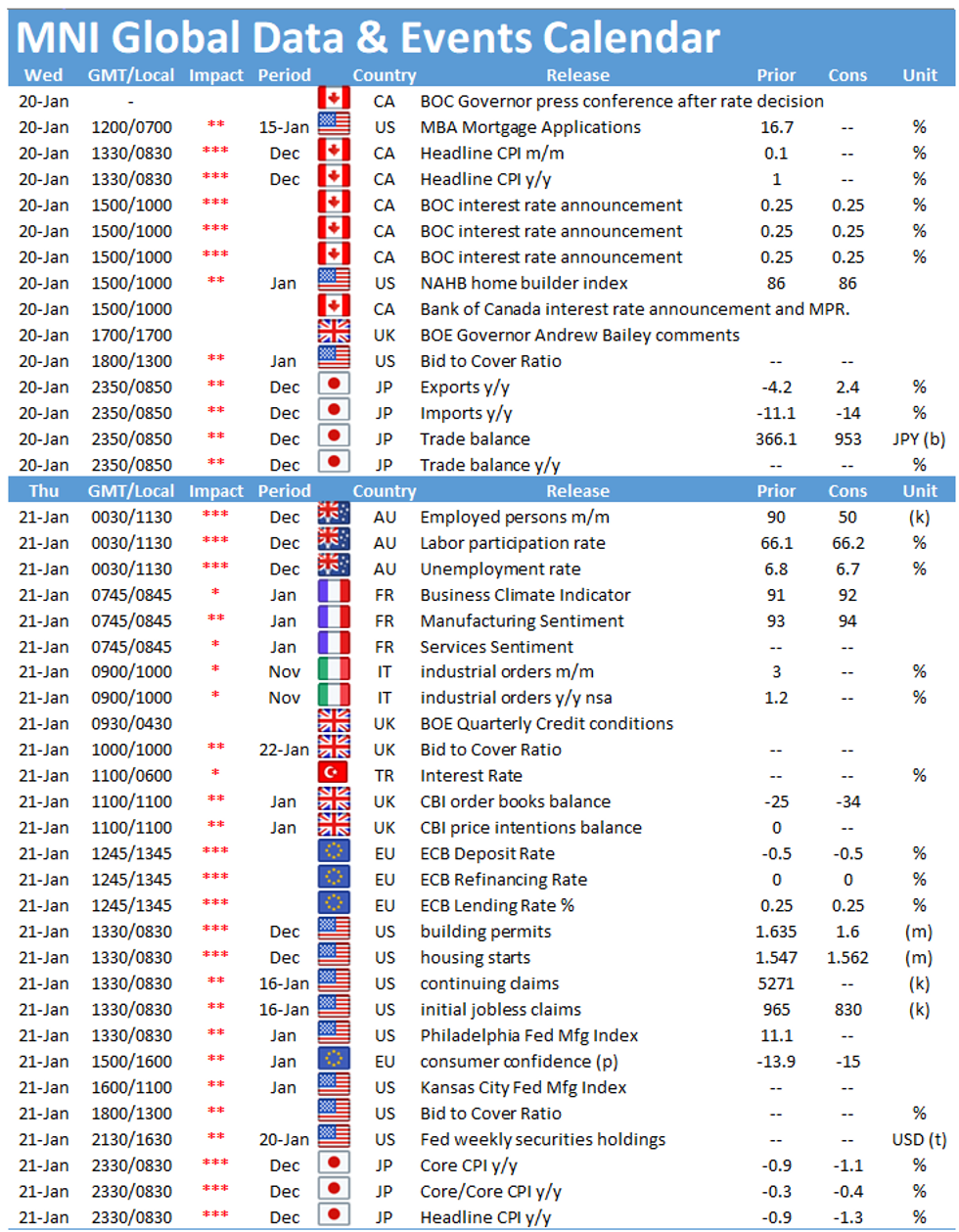

- Inauguration gets underway at 1130ET with the national anthem and invocation. Biden sworn in at 1200ET, followed by a 20-30 min inaugural address.

- Light data calendar (NAHB Housing Market Index at 1000ET).

- In supply: $55B 105-/154-day bill auction at 1130ET, with $24B 20-Yr Bond re-open at 1300ET. NY Fed buys ~$2.425B of 1-7.5Y TIPS.

EGB/GILT SUMMARY: Mixed Session So Far

It has been a mixed session so far for European sovereign bonds.

- Gilts have traded weaker with yields 1-2bp higher and the curve marginally steeper.

- Bunds started off weaker but clawed back early losses to now trade close to unch on the day.

- The OAT curve has steepened 2-3bp on the back of the short-end rallying.

- BTPs have sold off with yields 1-3bp higher.

- UK CPI came in marginally above expectations for December (0.6% Y/Y vs 0.5% survey, Core 1.4% vs 1.3%). The house price index published the Land Registry continued to surge in November, with growth of 7.6% Y/Y, up from 5.4% the previous month, and partly reflecting the impact from the government's (soon-to-expire) stamp duty holiday.

- Supply this morning came from Germany (Bund, EUR1.264bn allotted).

- The ECB monetary policy meeting is next on the agenda tomorrow with no material changes expected. MNI has published its ECB preview, which is available online and by email.

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 177.5/178.5cs 1x1.5 trades 23 in 1.5k

UK:

3LH1 99.625p, bought for 2.75 in 4k

LH1 100^, sold at 5.25 in 4k

3LH1 99.75p vs 2LH1 99.87p, bought the blue for 1.75 in 4k

FOREX: USD A Touch Lower as Markets Await Inauguration

With outgoing President Trump concluding his final day in office, markets await the inauguration of President-Elect Biden. Reports have already made clear Biden's intentions on assuming office - namely reversing Trump's previous actions on climate change, border walls and the revocation of a permit for the Keystone XL pipeline. The USD is a touch softer early Wednesday, but recent ranges have largely been respected.

GBP outperforms slightly, helping GBP/USD challenge, but not quite top, the Jan14 highs at 1.3710. The gains come as inflation numbers came in ahead of expectations and as house price growth continues to surge higher.

GBP is the firmest currency in G10, while SEK, EUR and USD underperform. Equities are generally higher, with the e-mini S&P trimming the gap with alltime highs to just 20 points.

Canadian CPI and the Bank of Canada rate decision take focus going forward. An appearance from BoE's Bailey is scheduled at 1700GMT/1200ET.

Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2185-90(E512mln), $1.2300(E966mln)

- GBP/USD: $1.3700(Gbp387mln-GBP puts)

- EUR/NOK: Nok10.35(E713mln)

- AUD/USD: $0.7690-0.7700(A$1.0bln)

- NZD/USD: $0.6900(N$913mln)

- USD/CAD: C$1.2500($900mln), C$1.2700-15($1.1bln-USD puts), C$1.3000($540mln)

- USD/CNY: Cny6.50($1.6bln)

- USD/MXN: Mxn19.70($500mln-USD puts), Mxn19.90($500mln-USD puts)

TECHS: Price Signal Summary - EURGBP Cracks Key Support

- In FX, EURGBP is weaker and has cleared a key support between 0.8867 and 0.8861, marking the Nov 23 and Nov 11 lows. This paves the way for a move towards 0.8800 and 0.8784.

- 1.2054, Jan 18 low where a break would open 1.2011, Sep 1 high.

- Resistance is at 1.2171 20-day EM

- USDJPY attention remains on key resistance at 104.13, the bear channel top drawn off the Mar 24 high. A break would highlight a reversal. 104.40, Nov 11 high is the bull trigger.

- Watch support too at 103.53 too, Jan 13 low. A break would represent a bearish development.

- A bullish engulfing candle in EURJPY yesterday highlights a possible bullish reversal and perhaps a signal of Yen weakness near-term.

- On the commodity front, Gold remains vulnerable despite this week's recovery. Watch support at $1804.7, Monday's low and resistance at $1869.9, the 50-day EMA. Oil contracts have held above support. Brent (H1) support to watch is at $53.75, the 20-day EMA and WTI (G1) support lies at $51.50, Jan 11 low.

- In the FI space:

- Bunds (H1) are off recent highs but the outlook is bullish. Support is at 176.96, 61.8% of the Jan 12 - 14 rally.

- Gilts (H1) resistance is seen at 134.58/66, the 20- and 50-day EMAs. A bearish outlook dominates while activity remains below these EMA levels.

EURUSD is seen maintaining a bearish short-term theme. Support levels to watch are:

EQUITIES: US Futures Trim Gap With All Time Highs Ahead of Inauguration

US futures are trading well early Wednesday, with the e-mini S&P higher by around 15 points to trim the gap with all time highs to just 20 points or so. Equities trade well ahead of the inauguration of President-Elect Biden, with reports already crossing on a series of executive orders the President will enact to reverse many of Trump's climate goal, border wall and Keystone XL pipeline activities in the previous presidential term.

Across Europe, continental indices are uniformly higher, with tech and consumer discretionary names outperforming. Lagging sectors are defensive, including consumer staples and utilities.

Earnings retain the focus in the US, with updates today from BNY Mellon, UnitedHealth, Morgan Stanley and Proctor & Gamble.

COMMODITIES: Oil, Metals Benefit From Risk-On

Both WTI and Brent are adding to recent gains early Wednesday, with general risk-on and a softer USD helping flatter energy products for another session. This reinforces the bullish focus for WTI, opening the $54.50 Feb 20 high and key resistance for the continuation contract.

The weekly DoE inventories are delayed until Friday due to the MLK public holiday this week.

Despite firmer global equities, gold and silver are again strong, with gold re-entering the gap between the 50- and 200-dmas at $1859.92 and $1845.40.

Biden's inauguration takes focus going forward, with the President-Elect looking to move swiftly in reversing many of Trump's flagship border control, climate change and energy policies.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.