-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR/AUD at New Multiyear High on Soft CPI

Highlights:

- USD decline prompts rebound in EUR/USD, GBP/USD off weekly lows

- EUR/AUD hits new multi-year high on soft Australian inflation, weaker iron ore prices

- Prelim durable goods orders expected to rebound in March

US TSYS: Steadying Ahead Of 5Y Supply, Potential House Debt Limit Vote

Treasuries have steadied out in overnight trade Wednesday compared with the bullish risk-off moves of the previous two sessions.

- The Tsy curve has reversed a bit of Tuesday's bull steepening overnight, with the short end underperforming. 2Y yields +3.3bp vs 10Y +0.8bp.

- Yield movements are taking their cue from equity futures, which have recovered a little from Tuesday's lows set following reports of potential First Republic Bank asset sales - helped by strong tech/cloud earnings (Microsoft, Alphabet).

- Data today includes March durable goods and trade balance (0830ET).

- Supply today includes auctions of $24B in 2Y FRNs (1130ET) and $43B 5Y Note (1300).

- On that note, reports suggest a debt limit vote in the House could come as soon as today after a very late night of wrangling over the bill; the House Republicans meet behind closed doors at 0900ET.

Current levels:

- The 2-Yr yield is up 3.3bps at 3.922%, 5-Yr is up 1.2bps at 3.4611%, 10-Yr is up 0.8bps at 3.4071%, and 30-Yr is up 0.1bps at 3.6594%.

- Jun 10-Yr futures (TY) down 3.5/32 at 115-22 (L: 115-18 / H: 115-25.5)

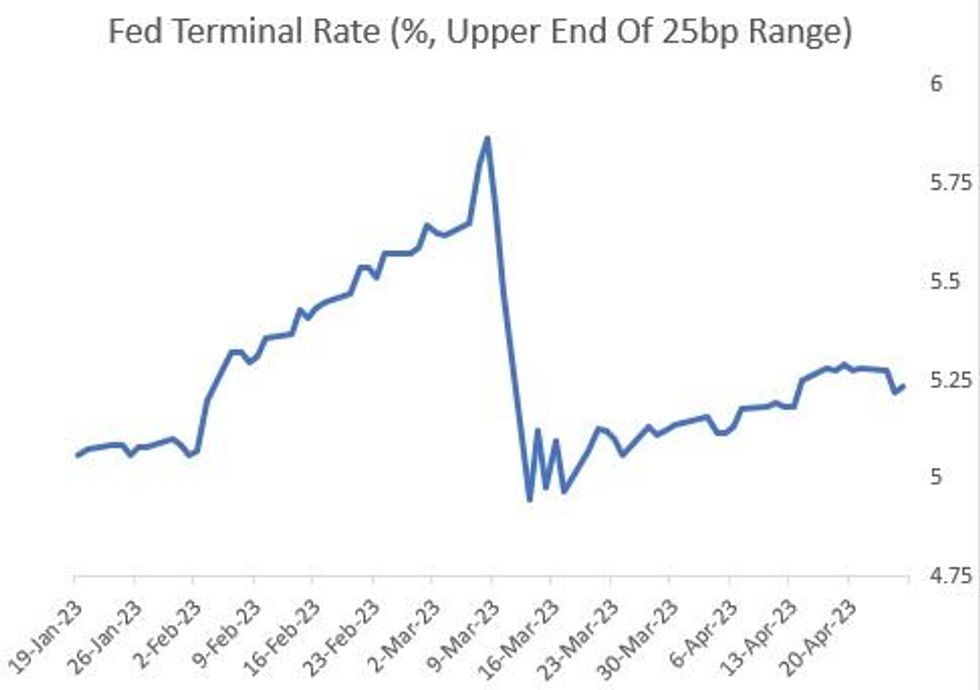

STIR FUTURES: May Fed Hike Not Done Deal, But Pricing Off Overnight Lows

May FOMC hike pricing has steadied out after Tuesday afternoon's dip on First Republic asset sale headlines.

- At 21bp currently, a 25bp hike is not quite a done deal (84% prob implied vs the 92%+ going into Tuesday), but that's above the 17bp post-FRC overnight low.

- Fed terminal Funds rate is +1.6bp this morning to an implied target range of 4.99-5.24% by June, so 25bp in tightening is still expected by then.

- Futures are implying about 70bp of cuts from peak to the end of the year, basically unchanged from Tuesday's close.

EUROPE ISSUANCE UPDATE:

German allots:

- E732mln 4.00% Jan-37 Bund, Avg yield 2.46%, Bid-to-cover 1.17x

- E1.546bln 1.00% May-38 Bund, Avg yield 2.51% (Prev 2.79%), Bid-to-cover 2.06x (Prev 2.07x)

FOREX: EUR/AUD at New Multiyear Highs on Soft CPI, Iron Ore

- The single currency trades well, leading the rest of G10 and pushing EUR/USD back toward the better levels of the Tuesday session to narrow the gap with first resistance of 1.1067. A break north of here eyes 1.1076 bull trigger and clears the way for the highest levels since April last year.

- AUD makes up the bottom-end of the table, slipping against all others as several factors conspire against the currency. A softer-than-expected core inflation release (trimmed mean at 1.2% vs. Exp. 1.4% for Q1) argues against the RBA re-starting their tightening cycle and a seventh session of lower lows for iron ore further dampens the outlook.

- EUR/AUD has rallied through 1.67 to the upside for the first time since October 2020, clearing the way for the 50% retracement for the 2020 - 2022 downleg at 1.7045.

- Banking concerns have resurfaced, as renewed concern surrounding First Republic's plans to sell as much as $100bln in assets drove their shares lower still. Further regional banking earnings are due Wednesday, and will shed further light on systemic fragility.

- Focus for the coming session turns to US trade balance data for March, as well as prelim March durable goods orders. The speakers slate is light, with just ECB's de Guindos & Herodotou on the docket ahead of the BoC minutes.

FX OPTIONS: USD/TWD a Highlight Amid Thinner Currency Options Trade

- A healthy session for currency options volumes tracked by the DTCC yesterday, with total notional traded clearing $80bln for the first time since Apr14 thanks to higher-than-average activity in USDCAD, USDCNY and USDMXN.

- A slightly more lacklustre start Tuesday, although USDTWD is drawing focus thanks to trades consistent with a large 31.00/31.60 call spread and a 28.885/32.02 strangle, both of which crossed in late Asia/early Europe.

- The intraday bounce in GBP/USD is doing little to deter downside insurance buys, with 1.2050 and 1.2375 put strikes trading in decent size (£201mln and £260mln respectively).

- Today's NY cut is stacked for EUR/USD, although the bounce in the pair has opened a solid gap with the most sizeable strikes of the day ($1.0930-50(E4.8bln) and $1.0955-75(E2.4bln). Price is within range of E1.7bln notional rolling off at $1.1035-45.

Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-55(E2.4bln), $1.0900(E2.7bln), $1.0930-50(E4.8bln), $1.0955-60(E1.2bln), $1.0970-75(E1.2bln), $1.1000(E1.5bln), $1.1035-45(E1.7bln)

- USD/JPY: Y130.00($1.1bln), Y132.25-30($585mln), Y133.00($585mln), Y135.00($1bln), Y135.30-50($747mln)

- GBP/USD: $1.2400-10(Gbp670mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CNY: Cny6.90($558mln), Cny6.9250($553mln)

EQUITIES: Sharp Sell Off in E-Mini S&P Results in Break of 20-Day EMA

- The Eurostoxx 50 futures contract has pulled back from recent highs. A key short-term support at 4279.90 remains intact. This is the 20-day EMA where a break is required to signal a short-term top and highlight potential for a deeper pullback - towards 4202.40, the 50-day EMA. Trend conditions remain bullish for now and attention is on the bull trigger at 4363.00, the Apr 21 high. A break would open 4381.50, Jan 5 2022 high (cont).

- A strong sell-off in S&P E-minis Tuesday resulted in a break below support at 20-day EMA, at 4125.55. This exposes a more important support - the 50-day EMA - that intersects at 4086.99. A clear break of this average would highlight a top and expose 4061.11, a Fibonacci retracement. On the upside, initial firm resistance is seen at 4164.25, the Apr 24 high. A breach of this level would ease the developing bearish threat.

COMMODITIES: Tuesday Price Action Reinforces Bearish Threat to WTI Futures

- The outlook in WTI futures remains bearish. Last week’s move lower resulted in a break of $79.04, the Apr 3 low and the gap high on the daily chart. The continuation lower has seen price breach the 20- and 50-day EMAs, exposing $75.83, the Mar 31 high and a gap low on the daily chart. Key short-term resistance has been defined at $83.38, the Apr 12 high.

- A break would resume the recent uptrend. Gold is in consolidation mode and is trading closer to its recent lows. The broader trend condition remains bullish, however, the yellow metal has entered a short-term corrective cycle. Price has pierced support at $1988.1, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/04/2023 | 1200/1400 |  | EU | ECB de Guindos Panels Delphi Economic Forum | |

| 26/04/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/04/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/04/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 27/04/2023 | 0130/1130 | ** |  | AU | Trade price indexes |

| 27/04/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/04/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/04/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 27/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/04/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/04/2023 | 1230/0830 | *** |  | US | GDP |

| 27/04/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/04/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/04/2023 | 1615/1815 |  | EU | ECB Panetta at EACB Board Meeting | |

| 27/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.