-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Euro Stocks at Post-COVID High

HIGHLIGHTS:

- EuroStoxx 50 hits post-COVID high as AstraZeneca add another set of strong vaccine test results

- GBP/USD nears multi-month high ahead of big week for Brexit talks

- Fed speakers in focus with Barkin, Daly, Evans all due

US TSYS SUMMARY: Retreating Alongside Other Safe Havens With 2-/5-Yr Supply Eyed

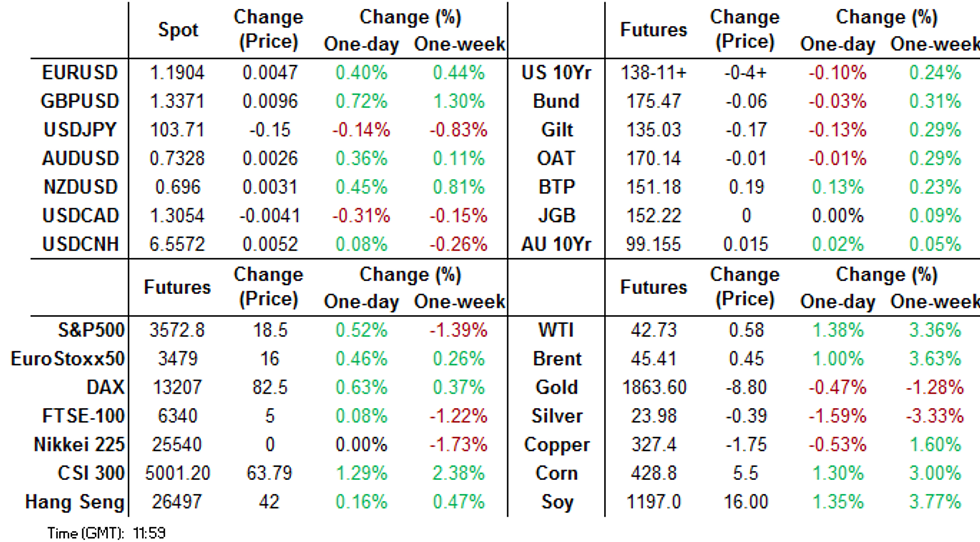

Treasuries dropped sharply between ~0315-0400ET in European trading alongside other safe havens, but other than that has been a fairly quiet overnight session to start the week (flat trade in Asia-Pac amid Japan holiday).

- Vaccine optimism remains the theme w AZN/Oxtord efficacy results out earlier (0200ET) w global equities advancing and USD retreating. Supply also eyed with 2-Yr and 5-Yr Note auctions later.

- Dec 10-Yr futures (TY) down 4.5/32 at 138-11.5 (L: 138-09 / H: 138-17.5)

- The 2-Yr yield is up 0.4bps at 0.1614%, 5-Yr is up 1.3bps at 0.3844%, 10-Yr is up 2.3bps at 0.8472%, and 30-Yr is up 2.8bps at 1.5472%.

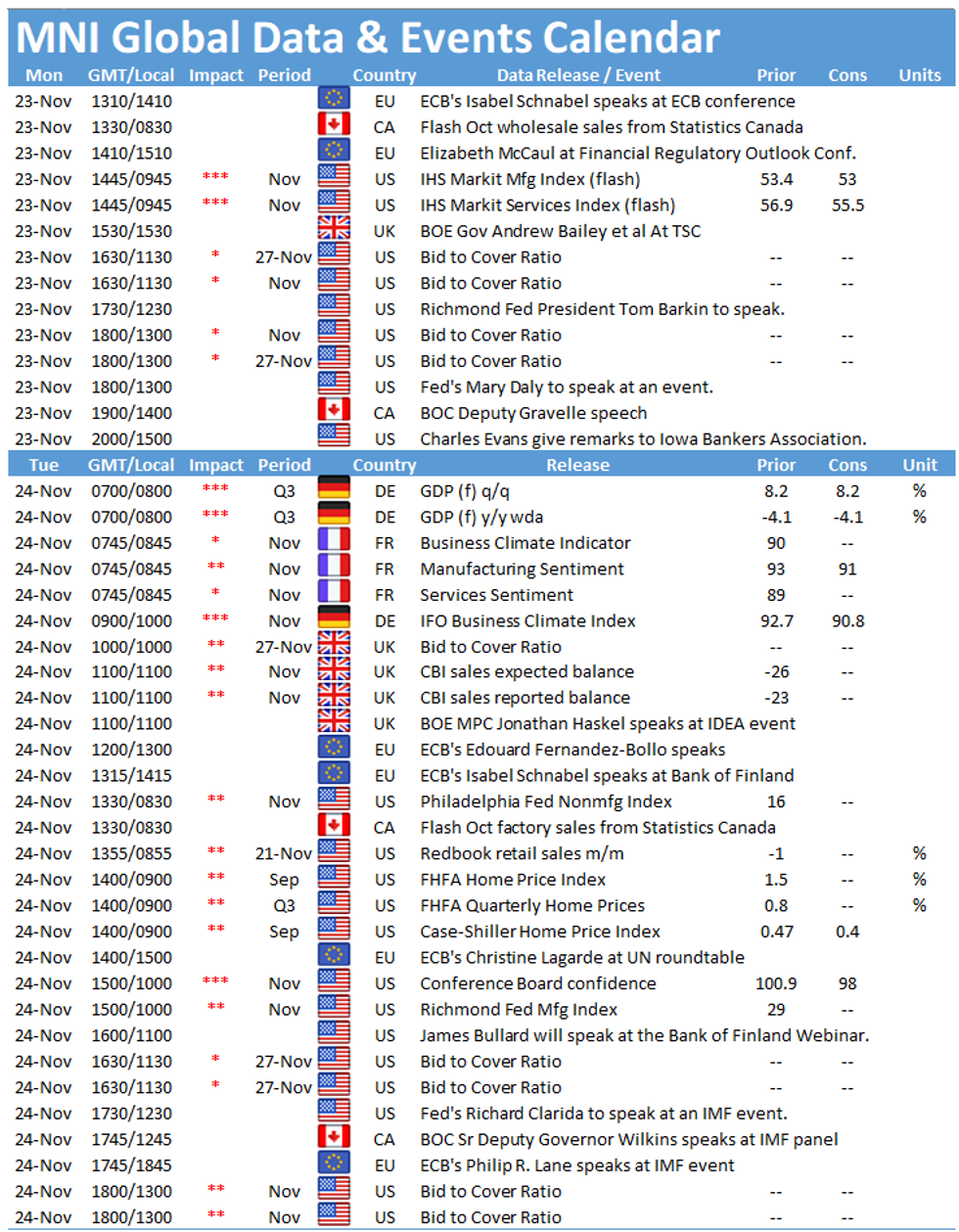

- Chicago Fed Oct nat'l activity index at 0830ET; prelim Nov PMIs at 0945ET.

- A few Fed speakers today; again COVID/econ outlook and Tsy lending facility expiration likely in focus: Richmond's Barkin at 1230ET, SF's Daly at 1300ET, Chicago's Evans at 1500ET.

- Busy supply schedule in a holiday-shortened week. We get $56B 2-Yr Note sale at 1130ET, alongside $51B of 26-wk bills, and $57B 5-Yr Note auction at 1300ET, alongside $54B in 13-wk bills. NY Fed buys ~$1.750B of 20-30-Yr Tsys.

EGB/Gilt Summary: Risk-On

Markets have started the week on a risk-on setting with the dollar on the backfoot against G10 FX, oil rallying, equities inching higher and core European sovereign bonds selling off.

- The Oxford-AstraZeneca vaccine has performed better than expected in phase 3 trials, adding to the positive momentum from the recent Pfizer and Moderna vaccine announcements.

- Supply this morning came from Germany (Bubills, EUR2.58bn allotted) and Belgium (OLOs, EUR1.494bn). France will sell a combination of 3-/6-/12-month BTFs this afternoon for EUR5.8-7.0bn).

- European preliminary PMI data for November confirmed the a slowdown in economic activity, albeit with manufacturing appearing to fare a little better. The UK performed markedly better with the manufacturing print reading 55.2 vs 50.5 survey and services reading 45.8 vs 42.8 expected.

- Gilts have sold off with yields 1-2bp lower and the curve close to flat.

- Bunds have similarly traded weaker. Last yields: 2-year -0.7622% 5-year -0.7641%, 10-year -0.5804%, 30-year -0.1673%.

- The OAT curve has steepened slightly on the back of the short end trading firmer and yields drifting higher at the longer end. The 2s30s spread is 2bp wider on the day.

Belgium Sells E1.494bn Vs E1.3-1.5bn Target

- E0.797bn of the 0.80% Jun-25 OLO: Average yield -0.704%, bid-to-cover 2.82x

- E0.697bn of the 1.25% Apr-33 OLO: Average yield -0.284%, bid-to-cover 4.05x

FI OPTION FLOW SUMMARY:

Eurozone:

DUF1 112.30/112.20ps 1X2, bought for 1.25 in 15k

0RM1 100.37/50/62/75c condor, bought for 8.75 in 4k

UK:

LM1 99.75/99.87/100/100.12 broken c condor, bought for 10.25 in 5k

FOREX: Markets Buoyant as Another Vaccine Candidate Reports Strong Results

Following promising updates from Moderna and Pfizer/BioNTech in recent weeks, equity markets are trading well, with core European indices higher across the board. Futures in the US are similarly higher, indicating a firmer open on Wall Street later today, with the e-mini S&P higher by over 20 points at pixel time.

GBP is the strongest performer in FX space, with reports over the weekend adding to hopes surrounding a potential Brexit deal being struck as soon as this week. GBP/USD sits at a multi-month high in response and just shy of the 1.34 handle. This narrows the gap with the September highs of 1.3482 which remain the medium-term target.

The greenback is the weakest currency in G10, with CHF and JPY also soft. AUD and NZD rise alongside global equity markets.

Focus turns to prelim November US PMI data and speeches from BoE's Bailey, Haldane & Tenreyro as well as Fed's Barkin, Daly & Evans. UK PM Johnson is expected to provide an update on post-lockdown life in the UK, with an announcement seen on a relaxation of restrictions over Christmas.

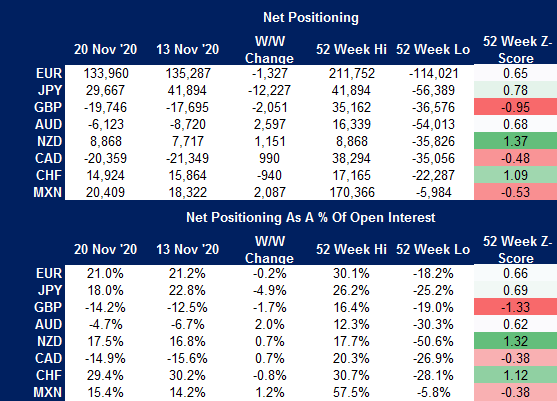

CFTC: Speculators Trimmed JPY Net Position in Most Recent Week

Friday's CFTC report showed markets trimmed net JPY positioning in the week ending Tues 17th, with the net JPY position dropped by 12k contracts. Speculators also shed GBP, with the net position inching lower by 1.7% of open interest to -14.2%.

Other currencies saw minor tweaks, with AUD, MXN positions improving slightly (+2.0%, +1.2% respectively).

Full update:

OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1700(E1.1bln), $1.1800-10(E563mln), $1.1850-60(E792mln)

USD/JPY: Y105.15-25($540mln)

GBP/USD: $1.3295-1.3305(Gbp647mln-GBP calls)

EUR/GBP: Gbp0.8899-8900(E443mln-EUR puts)Gbp0.8990(E659mln)

USD/CNY: Cny6.65($600mln)

TECHS: Key Price Signal Summary

- Sterling appreciation has dominated the FX space this morning.

- EURGBP trendline resistance at 0.9021, drawn off the Sep 11 high remains intact. Attention is on the key support at 0.8861, Nov 12 low and the bear trigger. Cable is firmer too and bulls are eyeing the key 1.3482 resistance, Sep 1 high. The next hurdle is 1.3403, Sep 2 high.

- EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact.

- USDJPY key support lies at 103.18, Nov 11 low.

- FI resistance levels to watch:

- Bund fut: 176.08, 76.4% of the Nov 4 - 11 sell-off

- Gilts: 135.55, 50-day EMA at is the next key chartpoint.

- has thus far stalled ahead of 138-21, its 50-day EMA.

- E-Mini S&P futures still trade below 3668.00, Nov 9 high. A break would resume the uptrend to open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle and still highlights a reversal threat. Watch 3506.50 key support, Oct 11 low.

- Key Gold support is $1848.8, Sep 28 low. Brent (F1) is firmer eyeing $46.86, Sep 2 high. WTI (F1) bull trigger is $43.33, Nov 11 high.

EQUITIES: Stocks Uniformly Higher as AstraZeneca Throw Hat into Vaccine Ring

European indices are higher across the board, with broad-based gains of around 0.8% posted across German, Spanish and Italian markets. the FTSE-100 lags slightly as the stronger GBP counters domestic equity strength. EuroStoxx 50 showed at a new multi-month high and above the 3500 level. The gains follow AstraZeneca/Oxford updating on the progress of their COVID-19 vaccine, reporting a 90% efficacy rate and easier distribution channels as the vaccine only requires regular refrigeration - an easier path to immunity given the Pfizer/BioNTech's candidates requires ultra-low storage temperatures.

Energy, financials and materials are the firmest sectors, with defensive utilities, consumer staples and healthcare the poorest performers. Airlines are among Europe's best performers, with IAG & Deutsche Lufthansa higher by 4% or more.

The e-mini S&P sits just shy of the Friday high, facing resistance at 3587.25 ahead of the 3668 November high.

COMMODITIES: Gold Slightly Softer as EuroStoxx50 Strikes Post-COVID High

Spot gold trades under minor pressure, with the risk-on theme across equity markets countering any support the precious metal may be receiving from the weaker USD. Gold is lower by just over $4/oz but is yet to test the Friday low at $1,861.01 , a slip through here opens congestion support at the September, November lows of $1,848.80-1,850.51.

Energy markets are higher, with the oil price flattered by the weaker greenback and seeing follow-through buying alongside equities. Reports of a Houthi attack on an Aramco installation in Jeddah, Saudi Arabia have also propped up the price. WTI futures today touched 43.36, the highest since early September.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.