-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Fed Downshift in Focus

Highlights:

- Equities hold Tuesday gains headed into FOMC decision

- Fed seen downshifting to 25bps hikes, with eyes on March magnitude

- ISM Manufacturing could draw focus, with prices paid expected below 50.0

US TSYS: FOMC Day, Qtrly Refunding and Solid Data Docket

- Cash Tsys sitting modestly richer on the day after little reaction to a much anticipated EZ CPI that saw a sizeable miss at a headline level but one tenth beat for core. Various important releases today include ADP, ISM mfg and JOLTS, but initial market reaction will firmly be with the FOMC in mind. Whilst highly unlikely to impact today’s decision, they could help further shape expectations on the likelihood of a second 25bp hike in March.

- Treasury yields approach the meeting with benchmarks broadly in the middle of last month’s range: 2YY -0.2bps, 5YY -1.4bps at 3.603%, 10YY -2.0bps at 3.486% and 30YY -2.1bps at 3.612%.

- TYH3 trades 8+ ticks higher at 114-25, off a session high of 114-30 that forms initial resistance. Above that sits 115-13 (Jan 25 high) whilst support is at 114-05+ (Jan 30 low) with a sterner test at the 50-day EMA of 114-00+.

- FOMC: Announcement 1400ET, press conference 1430ET.

- Data: ADP Jan (0815ET), final US PMI Jan (0945ET), ISM mfg Jan (1000ET), JOLTS Dec (1000ET), Construction spending Dec (1000ET) plus weekly MBA mortgage data (0700ET).

- Treasury Quarterly Refunding report – 0830ET. Preview here.

- Bill issuance: US Tsy $36B 17W bill auction – 1130ET

- Earnings: A lighter day for reporting before it picks up again tomorrow including Apple, Alphabet and Amazon.

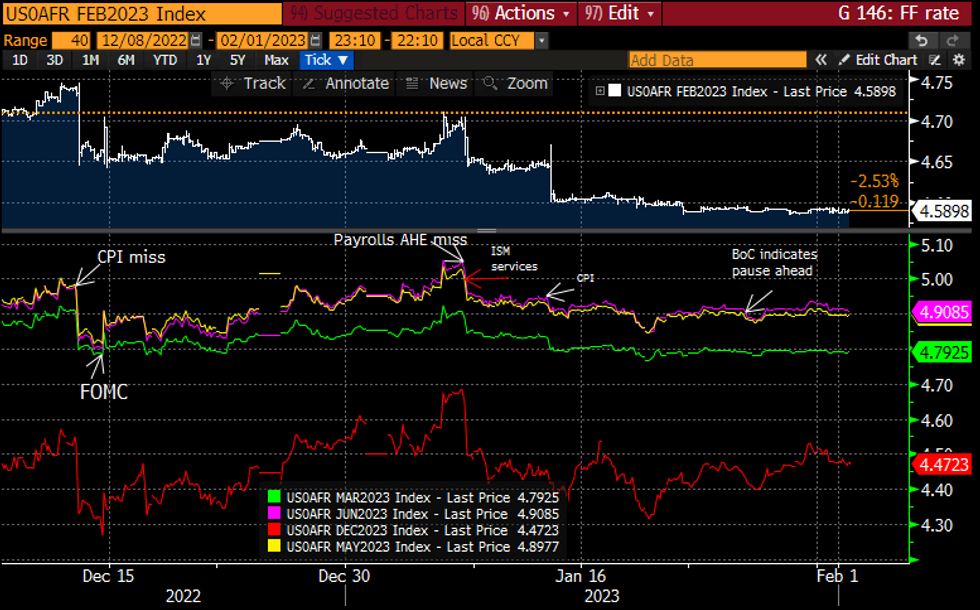

STIR FUTURES: Fed Seen With 25bp Locked In, Terminal ~4.9%

- Fed Funds implied hikes are little changed post EZ CPI, instead consolidating yesterday’s move back lower kickstarted by a softer than expected ECI Q4 print.

- Sitting with 25.5bp priced for today’s decision, a cumulative 46bp for Mar and 58bp to a terminal 4.91% for Jun (holding that 4.86-4.94 range since last month’s payrolls/ISM services) before 44bp of cuts to 4.47% end-2023.

Source: Bloomberg

Source: Bloomberg

FOREX: Markets Respect the Range Pre-Fed

- G10 FX trades quietly, amid relatively muted ranges ahead of Wednesday's FOMC rate decision. The Fed are broadly expected to downshift to a 25bps rate hike today, with focus on any hints from the Fed chair on their views of the peak Fed Funds Rate. The USD Index is marginally lower on the day at typing, and is within range of the multi-month low printed in late January at 101.504.

- Elsewhere, the NZD has slipped modestly on the back of a poorer-than-expected jobs release for Q4 - a release that's prompted a number of sell-side analysts to moderate their calls for imminent RBNZ tightening. NZD/USD remains within range of the 50-dma support at 0.6362 - a break below which would be the first since August of last year.

- Outside of the Fed decision, final January PMI data from across Europe have drawn little attention ahead of the Eurozone CPI release for January - a much-watched figure due to the absence of the German input that was originally due Tuesday. Manufacturing ISM for January may see some interest, expected at 48.0.

FX OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0765-70(E675mln), $1.0790-05(E996mln), $1.0850-55(E718mln), $1.0885-10(E3.0bln)

- USD/JPY: Y129.00($596mln), Y130.50($636mln)

- AUD/USD: $0.6920(A$527mln), $0.7000(A$572mln), $0.7140-50(A$683mln), $0.7185(A$1.1bln)

- USD/CNY: Cny6.82($1.1bln)

EUROPE ISSUANCE UPDATE

Gilt auction result

- GBP3bln of the 0.875% Jul-33 Green Gilt. Avg yield 3.428% (bid-to-cover 2.22x, tail 0.7bp)

- The bid-to-offer was a little lower than seen at the last auction but the tail was marginally tighter with the LAP above the pre-auction mid-price.

- E5bln (E4.019bln allotted) of the 2.30% Feb-33 Bund. Avg yield 2.27% (bid-to-cover 1.19x).

EQUITIES: E-Mini S&P Bounce Off Tuesday Low Looks Bullish

- EUROSTOXX 50 futures are consolidating. Support lies at 4097.00, the Jan 19 low. The contract is also trading just ahead of key short-term resistance at 4206.00, the Jan 18 high. A break of this level would resume the uptrend and pave the way for a climb towards 4215.00, a Fibonacci projection. Note that the trend remains overbought. A pullback, if seen, would represent a healthy correction. A break of 4097.00 would signal the start of a S/T bear cycle.

- S&P E-Minis recovered from yesterday's low. The recent move down appears to be a correction and the uptrend remains intact - yesterday’s bounce reinforces bullish conditions. The recent breach of resistance resulted in a print above the 4100.00 handle and an extension higher would open 4180.00, the Dec 13 high and a bull trigger. Initial firm and key support has been defined at 3963.07, the 50-day EMA.

COMMODITIES: Trend Conditions in Gold Remain Bullish Despite Tuesday's Sharp Pullback

- WTI futures traded lower Monday and in the process breached support at $78.45, the Jan 19 low. The move lower undermines the recent bull theme and a continuation would signal potential for an extension towards $72.74, the Jan 5 low. On the upside, the bull trigger has been defined at $82.66, the Jan 18 high. A break of this level is required to reinstate the recent bullish theme. Yesterday’s recovery from the day low is considered corrective.

- Trend conditions in Gold remain bullish and the latest pullback is considered corrective. Recent cycle highs confirm an extension of the uptrend and maintain the price sequence of higher highs and higher lows. Moving average studies remain in a bull mode position - reflecting the uptrend. The focus is on $1963.0 next, a Fibonacci retracement. Initial firm support to watch lies at $1902.2, the 20-day EMA. A break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/02/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 01/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/02/2023 | 1900/1400 | *** |  | US | FOMC Statement |

| 02/02/2023 | 0030/1130 | * |  | AU | Building Approvals |

| 02/02/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 02/02/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 02/02/2023 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/02/2023 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 02/02/2023 | 1345/1445 |  | EU | ECB Press Conference following Rate Decision | |

| 02/02/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/02/2023 | 1830/1930 |  | EU | ECB Lagarde Speech at Franco-German Business Awards | |

| 03/02/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.