-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fish Still a Sticking Point

HIGHLIGHTS:

- GBP Softens as EU Reject UK's Fishing Proposal

- Treasuries Rangebound as Fiscal Drama Recedes

- Calendar Light, US GDP Unlikely to Inspire

US TSYS SUMMARY: Range Trade As Fiscal Drama Recedes

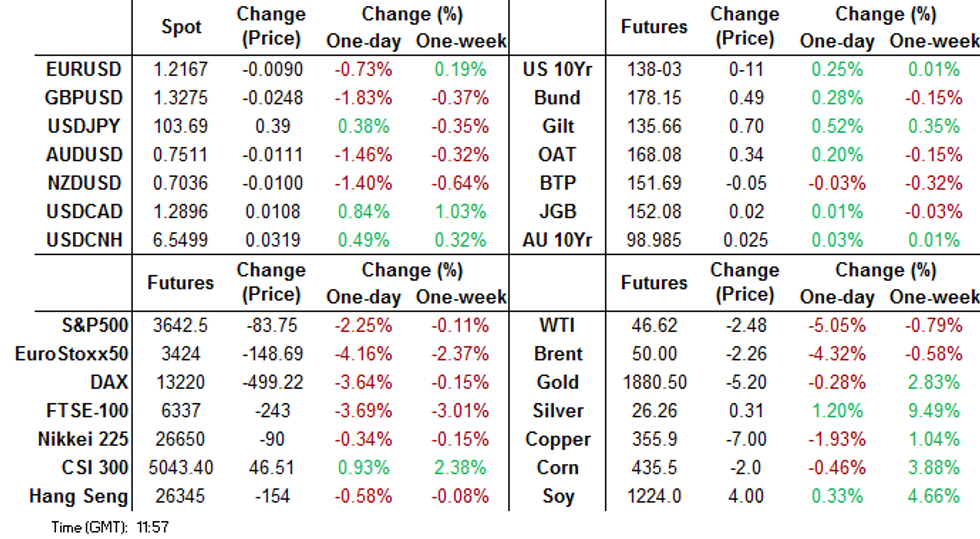

Tsys have traded well within Monday's relatively wide ranges and on low volumes (TYH1<165k) so far Tuesday.

- A feel of tentative stability vs the previous session, with the long-awaited $2.3T relief/stimulus bills agreed by Congress overnight, and most attention in European trading on COVID lockdown impact and Brexit talks (mixed news as ever).

- Early flattening has dissipated and curve largely flat. The 2-Yr yield is unchanged at 0.121%, 5-Yr is unchanged at 0.3798%, 10-Yr is up 0.2bps at 0.9363%, and 30-Yr is up 0.1bps at 1.6736%.

- Mar 10-Yr futures (TY) up 1/32 at 137-25.5 (L: 137-25 / H: 137-30.5)

- Pres Trump is yet to sign the deals but expected to do so by Dec 28. Attention already turning to the question: is the relief funding sufficient?

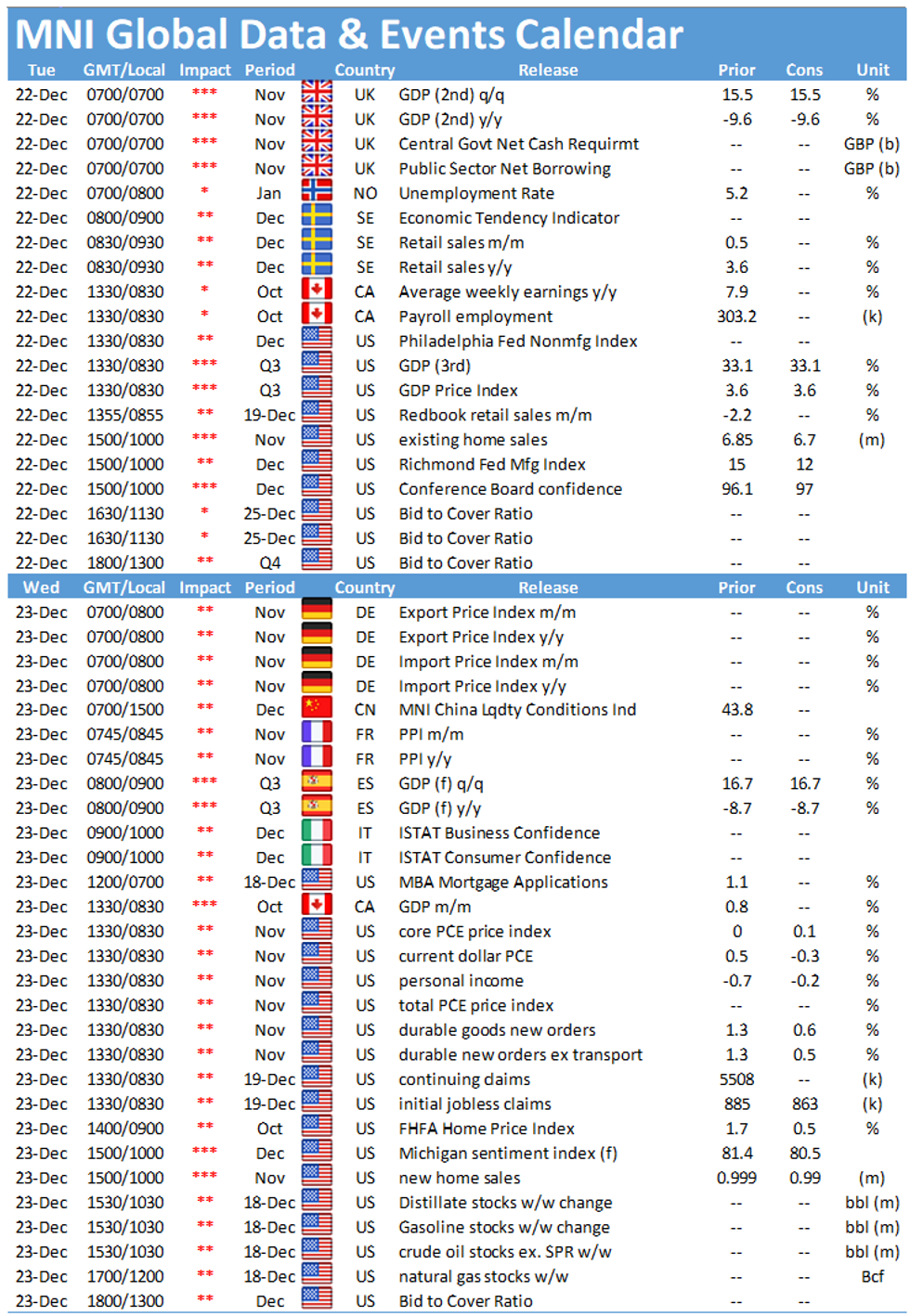

- Third reading of Q3 GDP unlikely to move the needle (no chg expected) at 0830ET. Dec Consumer Confidence, Nov Existing Home Sales and Dec Richmond Fed Manuf at 1000ET the more consequential sets of data.

- In supply, 1130ET sees $60B in 42-/119-day bill auction, with 5Y TIPS Re-Open for $15B at 1300ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGBs/GILT SUMMARY: EGBs Weaker as Equities Inch Higher

Equities have inched higher and core sovereign bond markets have traded weaker this morning, unwinding some of yesterday's risk-off move.

- Gilt yields are 2-3bp higher with the curve bear steepening.

- Bunds have similarly weakened alongside marginal curve steepening. Last yields: 2-year -0.7429%, 5-year -0.7562%, 10-year -0.5769%, 30-year -0.1753%.

- BTPs have slightly underperformed bunds, with yields broadly 2bp higher.

- Britain and France are exploring ways to reopen borders after transport routes were frozen following the UK's decision to plunge the South East of England into Tier 4 restrictions amid surging Covid infections.

- The UK and EU are reportedly making some progress on negotiations over access to UK fishing waters with EC President Ursula von der Leyen asking member states to consider Downing St's latest offer.

- The headline final Q3 GDP estimate for the UK came in better than the previous read (16.0% Q/Q vs 15.5%).

EUROPE OPTION FLOW SUMMARY

Eurozone

RXG1 177.50/178.50 c/s vs RXF1 178.50/179.50 c/s sold at 46 in 1k (-Feb, +Jan)

UK

0LZ1 99.875/99.625 put spread bought for 6 in 6k (d -0.23%, ref 99.965)

3LH1 99.75/99.625 put spread vs 2LH1 99.875/99.75 put spread, buys the blue for 0.5 in 3.6k

Markets Remain Concerned Over Vaccine Efficacy Against New Strains

There has been much concern among markets over the suitability of the tried-and-tested vaccine candidates from Pfizer, Moderna, AstraZeneca against new mutations of COVID-19, particularly the new super strains appearing in the UK and South Africa.

Both Pfizer/BioNTech and Moderna have announced they're testing their candidates against the UK strain and both companies have made positive comments:

- Moderna: says expects immunity from its vaccine to protect against variants and is performing more tests in the coming weeks.

- Pfizer/BioNTech: Pfizer is 'generating' data on how well blood samples from immunized candidates reacts against the new UK strain. BioNTech CEO is 'confident' their vaccine works, but further studies are needed to make sure.

UK Government have already said there's no evidence suggesting that UK-approved vaccines will not work against the new B.1.1.7. lineage.

The US CDC on Dec19 have said they're evaluating whether the Moderna vaccine is effective against the new strain, but so far everything appears 'okay'.

However, other academics are less sure. Alexandre Le Vert of French vaccine firm Osivax said mutations in surface proteins could even cause some vaccines to exacerbate the infection.

CEO of Emergex vaccines stated their results suggest surface protein-targeting vaccines may not produce an equivalently safe, effective, and long-lived immune response compared to that seen with live attenuated vaccines.

FOREX: Another Dose of Bad News for GBP

Equities are bouncing very modestly in Europe after yesterday's pullback, with core European indices higher by around 1% or so. This has failed to translate into currency markets, however, with AUD, NZD among the weakest in G10 so far. USD, JPY are slightly stronger.

Another dose of bad news for GBP, as the EU rejected the UK's latest approach on fish. There was a decent pick-up in GBP volumes on the back of the headline - around 5k contracts crossing in GBP futures in the minutes following release - around £320mln cash equivalent. This followed the UK reaching out with a revised offer on fish, with Johnson ready to let EU boats retain two thirds of their catch. Markets now await the UK's response.

Focus turns to the tertiary reading of US Q3 GDP, expected largely unrevised. This is followed by consumer confidence data for December and existing home sales for November.

TECHS: Price Signal Summary - E-Mini S&P Hammer Highlights A Top

- A volatile start to the week saw the E-Mini S&P contract trade within a large range. A candle pattern known as a hammer marks yesterday's price action and is a concern for bulls. It suggests a top and highlights the risk of a deeper near-term pullback. Watch key support at 3596.00, Dec 21 low.

- On the commodity front, Gold is volatile but maintains a bullish tone. The focus is on $1918.2 next, 76.4% of the Nov 9 - 30 sell-off. Oil remains vulnerable. Brent (G1) support and the intraday bear trigger is at $49.20/18, Dec 21 low and the 20-day EMA. Key WTI (G1) support to watch is $46.25, Dec 21 low.

- In the FX space, the USD is firmer this morning. EURUSD key near-term support is seen at 1.2103, the 20-day EMA and trendline support drawn off the Nov 4 low

- Sterling remains vulnerable.

- Cable key parameters are1.3624 resistance, Dec 17 high and 1.3135 support, Dec 11 low.

- EURGBP support at 0.8983, Dec 4 / 17 l remains a key pivot level - bullish above, bearish below. Key resistance is 0.9230, Dec 11 high.

- In the EU FI space, key support in Bund (H1) lies at177.37/27, trendline support drawn off the Nov 11 low and the Dec 16 low. A 135.08 print in Gilts would fill a gap in the chart. This is a key intraday support, Dec 18 high.

OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000-02(E1.5bln), $1.2070-75(E538mln), $1.2100(E1.1bln), $1.2120-25(E814mln-EUR puts), $1.2150-55(E1.4bln-EUR puts), $1.2200(E2.3bln), $1.2225-35(E903mln-EUR puts), $1.2250(E410mln-EUR puts), $1.2275(E477mln-EUR puts), $1.2300-10(E1.0bln)

USD/JPY: Y103.00($1.2bln-USD puts), Y103.50-60($1.1bln), Y103.70-90($1.2bln), Y104.00($550mln), Y104.20-40($639mln), Y105.00-05($807mln)

EUR/JPY: Y127.10(E598mln-EUR puts)

EUR/GBP: Gbp0.9000-10(E670mln-EUR puts)

USD/NOK: Nok8.75($695mln-USD puts)

AUD/USD: $0.7440-50(A$1.1bln), $0.7500(A$630mln-AUD puts), $0.7530-50(A$711mln-AUD puts), $0.7570-80(A$1.4bln-AUD puts)

USD/CNY: Cny6.50($1.1bln-USD puts), Cny6.55($536mln-USD puts), Cny6.65($560mln-USD puts)

USD/MXN: Mxn19.50($673mln), Mxn20.00($1.3bln-USD puts), Mxn20.50($535mln)

EQUITIES: Europe Bounces, US Flat Ahead of GDP

European equity markets are retracing some of the Monday pullback, with most European indices higher by around 1% or so. Futures in the US are broadly unchanged, with the e-mini S&P up around 3 points or so at pixel time.

Spanish stocks are outperforming modestly, while UK's FTSE-100 lags, posting gains of just 0.3%. In Europe, tech and financials are strongest, with comms and healthcare names slightly lagging, but still positive.

COMMODITIES: Oil Futures Remain Soft, Firmer USD Partly Responsible

Having pulled lower Monday on renewed virus and lockdown concerns, WTI and Brent crude futures remain weak ahead of the Tuesday COMEX open, although yesterday's lows remain in tact for WTI at $46.18. API inventories data due after-market today take focus.

A modest equity bounce in Europe (indices are higher by around 1%) spot gold and silver are in negative territory, with a firmer USD also adding some weight. Directional parameters for gold remain in tact at the 50-dma support of $1870.32 and the Dec21 high above at $1906.82.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.