-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

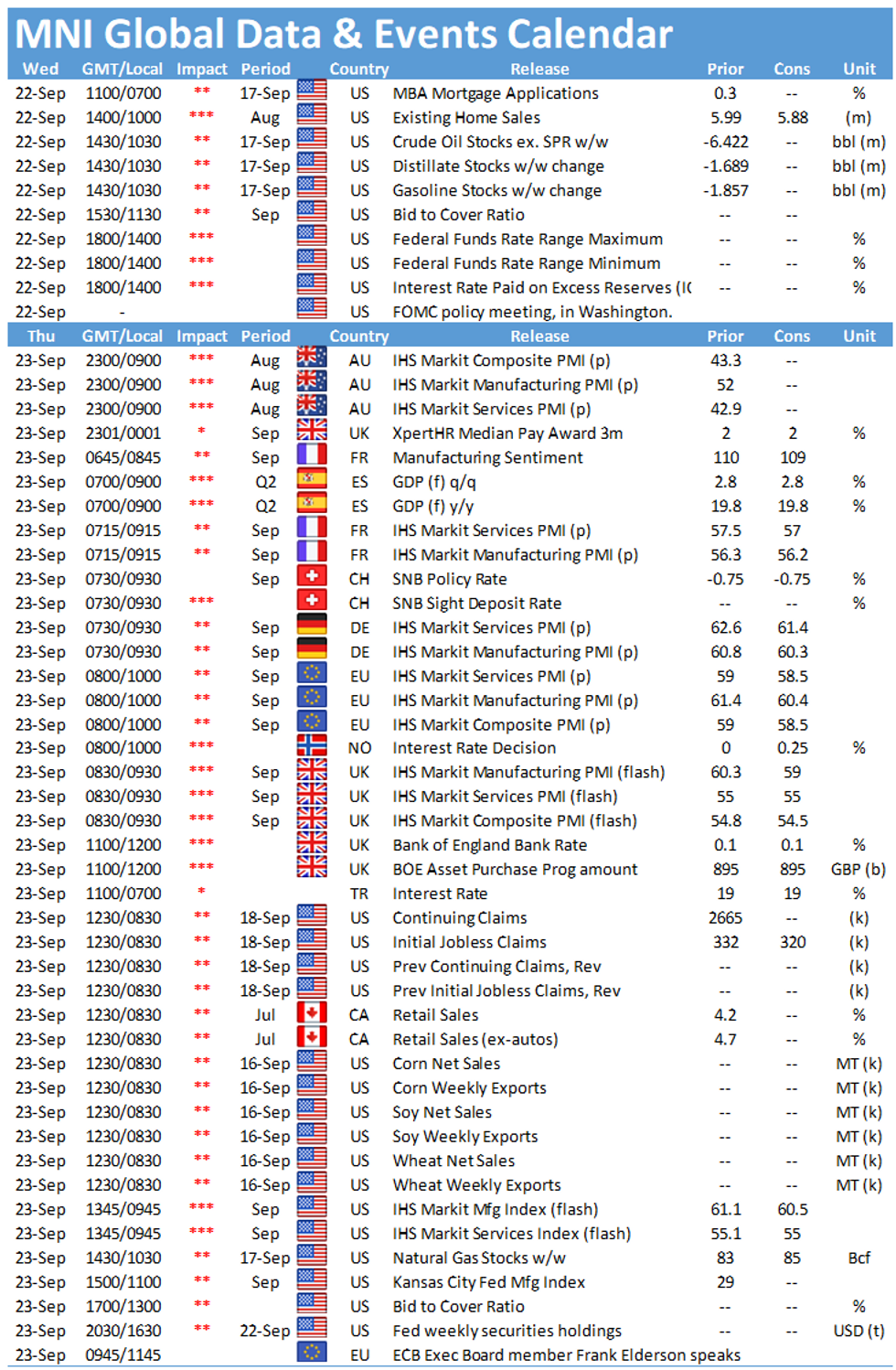

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI US MARKETS ANALYSIS - Focus Rests on Powell, Taper Timing Key

HIGHLIGHTS:

- Focus is on the Fed, with taper timing key

- US 10y yield remains inside near-term uptrend

- Equities improve as Chinese stocks re-open positively

US TSYS SUMMARY: Mild Recovery Continues Ahead FOMC

Focus back on FOMC mon-pol annc today (1400ET) as rate futures trading modestly weaker, equities firmer (ESXZ1 +24.0 at 4367.25).- FOMC will set up a taper start in late 2021, likely Nov. Details of FOMC's taper plan may not emerge from this meeting, a taper is likely to include $15B/meeting pace and optionality to adjust at each meeting, opening up the possibility of an end-2022 rate hike. Consensus expects the median Fed funds rate 'dot plot' path to remain fairly static at this meeting vs the June projections, setting up hawkish risks.

- Otherwise, markets continue modest recovery from Monday's sharp risk-off move. Contagion angst over China's Evergrande default risk continues to cool after headlines the real estate developer makes interest payments directly to noteholders overnight (and uncorroborated rumors of a restructuring made the rounds).

- Decent volumes (TYZ1 >278k), yield curves nominally steeper with 30Y Bonds trading near early overnight lows (30YY 1.8705%).

- Limited data today, $26B 2Y FRN bill auction and $30B 119D bill CMB auctions both at 1130ET. No NY Fed buy-back due to FOMC.

- Currently the 2-Yr yield is up 0.4bps at 0.218%, 5-Yr is up 1.5bps at 0.8439%, 10-Yr is up 1.5bps at 1.3379%, and 30-Yr is up 1.5bps at 1.8705%.

EGB/GILT SUMMARY: Evergrande Deal Sets Stage For Risk Recovery

European sovereign bonds are broadly weaker while equities edge higher ahead of today's FOMC meeting.

- An agreement between Evergrande and its bondholders over interest payments on a domestic bond have soothed fears of imminent default and contagion to international markets.

- The gilt curve has bear steepened with the 2s30s spread widening by 2bp.

- Bunds are a touch weaker with the curve 1bp steeper.

- It is a similar story for OATs, which trade in line with bunds.

- BTPs have firmed and trade marginally above yesterday's closing levels.

- Supply this morning came from the UK (Gilt linker, GBP350mn), Germany (Bund, EUR1.862bn) and the EU (Bills, EUR3.993bn). Portugal also organised an OT exchange selling EUR279mn of the 2.125% Oct-28 OT and EUR235mn of the 2.25% Apr-34 OT to buy EUR330mn of the 2.20% Oct-22 OT and EUR184mn of the 5.65% Feb-24 OT.

- US President Joe Biden appears to have dashed UK hopes of a swift bilateral trade deal.

EUROPE ISSUANCE UPDATE:

Germany allots:

- E1.862bln 0% May-36 Bund, Avg yield -0.06% (Prev. -0.18%), Bid-to-cover 0.83x (Prev. 0.80x), Buba cover 1.11x (Prev. 1.11x)

UK DMO sells:

- GBP350mln 0.125% Nov-56 linker, Avg yield -2.289% (Prev. -1.972%), Bid-to-cover 2.12x (Prev. 2.17x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXV1 173/172/171p ladder sold at 75 in 2,050

DUZ1 112.30/112.40cs 1x3, bought for -2.5 in 2k vs RXZ1 173.5/175cs 1x3 sold at 22 in 300x900

UK:

2LZ1 99.125/98.875 ps with 2LZ1 99.125/99.00 ps, bought the strip for 9.25 in 4k

FOREX: Better bid in Equity keeps the lid on USD

- The Dollar has been offered during our European morning session, and this was a continuation from the Overnight/Asian session.

- Equities have been the driver of cross assets this week, following the big slump on Monday.

- Today is not different, as Equity consolidate higher, the Dollar turns offered.

- Regardless, Equities are still far away from Friday's best levels.

- The Greenback trades in the red against all G10s, besides the Yen, on Risk on flow.

- Pound continues to struggle this morning, Energy risks are still weighing, EURGBP is through the initial resistance at 0.8595 High Sep 20/21.

- And now eye 0.8614/18 High Sep 7 / 76.4% of the Jul 20 - Aug 10 sell-off.

- The Kiwi, NOK, CAD and AUD are all leading versus the USD.

- USDNOK has tested initial support noted at 8.6492, printed a 8.6484 low.

- NZDUSD resistance moves down to 0.7041, followed by yesterday's high at 0.7056. So far 0.7031 is the high.

- Looking ahead, we have no tier 1 data and all the attention is on the FOMC and presser.

FX OPTIONS: Expiries for Sep22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1675-85(E1.2bln), $1.1745-50(E703mln)

- USD/JPY: Y109.00($595mln), Y109.45($685mln), Y109.80-00($1.2bln)

- EUR/JPY: Y128.50(E630mln)

- AUD/USD: $0.7250-65(A$787mln)

- USD/CAD: C$1.2750($1.5bln), C$1.2775($640mln), C$1.2840-55($542mln)

Price Signal Summary - GBPUSD Near Its Triangle Base

- In the equity space, S&P E-minis have recovered somewhat following Monday's sell-off. The outlook is bearish however following the clear breach of the 50-day EMA and a key short-term support and bear trigger has been established at Monday's low of 4293.75. Price needs to trade above 4418.00, Sep 20 high to suggest the tide may have turned, signalling scope for stronger recovery. Note a break higher would also mean price is once again above the 50-day EMA and this would represent a positive development. EUROSTOXX 50 futures also started the week on a bearish note and cleared former support at 4060.50, Aug 19 low. This signals scope for weakness towards 3962.50, 76.4% retracement of the Jul 19 - Sep 6 rally. The next resistance is at 4127.40, the 20-day EMA. Current gains are considered corrective.

- In FX, EURUSD outlook remains bearish. Monday's weakness resulted in a breach of 1.1722, 76.4% of the Aug 20 - Sep 3 rally. This opens the key support at 1.1664, Aug 20 low and an important bear trigger. GBPUSD traded sharply lower Monday and cleared support at 1.3727, Sep 8 low. The next key support is at 1.3602, Aug 20 low. Note too that there is a triangle base at 1.3632 that also represents an important support. The triangle is drawn from the July 20 low. Recent USD Index (DXY) gains have exposed the key resistance at 93.73, Aug 20 high and the bull trigger. A break would confirm a resumption of the uptrend that started May 25.

- On the commodity front, the Gold near-term outlook remains bearish. The focus is on $1724.5, 76.4% retracement of the Aug 9 - Sep 3 rally. Resistance is at $1786.8, the 20-day EMA. WTI futures maintain a bullish outlook. Yesterday's price pattern is a bullish doji candle, reinforcing the current uptrend. Initial support is seen at $69.39, Sep 21 low. The focus is on $73.58, Jul 6 high and the bull trigger

- In FI, Bund futures remain in a downtrend. Recent weakness signals scope for a move towards 170.52, 3.00 projection of the Aug 5 - 11 - 17 price swing. Initial firm resistance is at 172.12, Sep 14 high. Gilt futures remain in a bearish cycle too. The focus is on 126.83, 2.00 projection of the Aug 20 - 26 - 31 price swing.

EQUITIES: Stocks Float Higher Pre-Fed

- Equity market sentiment globally is more positive, with the re-opening of Chinese markets being well received despite concerns surrounding the property development sector.

- European equities sit higher ahead of the NY crossover, with upside led by the UK's FTSE-100 and the France's CAC-40 which trade higher by 1.0% or more. Germany's DAX lags slightly, with gains of just 0.6% at pixel time.

- Europe's energy and financials sectors are leading the gains, while healthcare, tech and utilities are the sole sectors in the red.

- US futures are similarly positive, with the e-mini S&P on the front foot by 0.4-0.6%.

- The e-mini S&P has recovered back above the 100-dma, but are yet to touch the Tuesday or Monday highs at 4395.75 and 4418.00 respectively.

COMMODITIES: Copper leading commodities higher

- WTI Crude up $1.1 or +1.56% at $71.53

- Natural Gas up $0.05 or +1% at $4.855

- Gold spot up $1.07 or +0.06% at $1775.38

- Copper up $8.75 or +2.12% at $421.25

- Silver up $0.21 or +0.95% at $22.7028

- Platinum up $17.83 or +1.86% at $973.68

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.