-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - GBP/USD 2020 High in Range

HIGHLIGHTS:

- Betting odds swing in favour of a deal, reports suggest as soon as this week

- GBP outstripping all others, GBPUSD in range of 2020 high

- All quiet on data front, focus on flurry of central banks later in the week

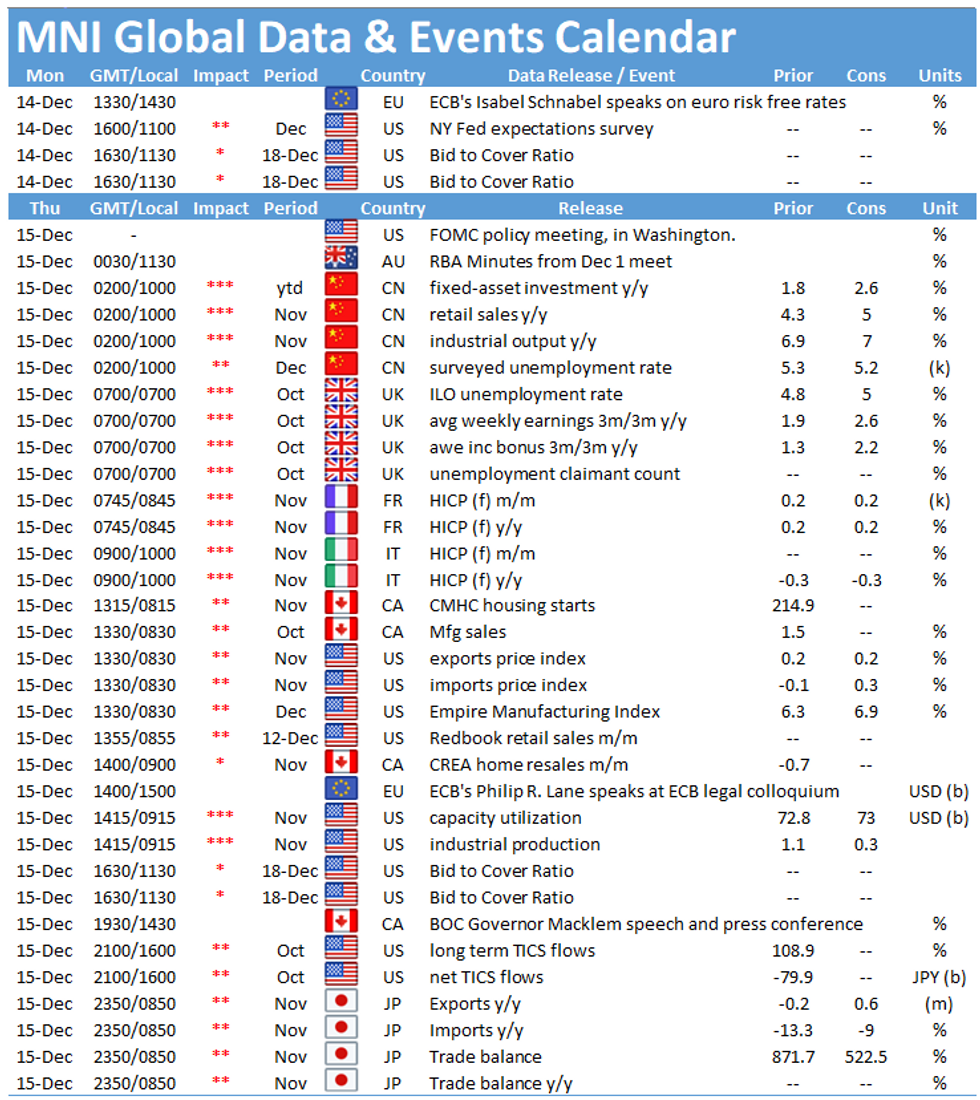

US TSYS SUMMARY: Heading Lower On Light Volume, Fiscal Talks Eyed

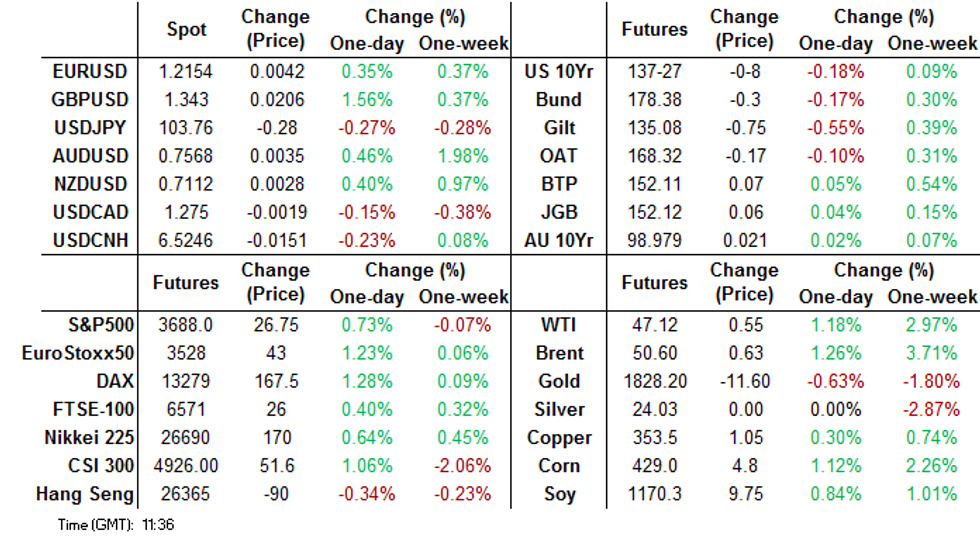

Treasuries have turned lower in the late European morning (as S&P futures hit highest levels since Weds), though still within Friday's ranges and on light volume (TYs <160k).

- The 2-Yr yield is up 0.8bps at 0.123%, 5-Yr is up 1.1bps at 0.3766%, 10-Yr is up 2.5bps at 0.9212%, and 30-Yr is up 3.3bps at 1.6595%. Mar 10-Yr futures (TY) down 7.5/32 at 137-27.5 (L: 137-27 / H: 138-00.5).

- No surprise on underlying themes: another Brexit deadline extension boosted risk appetite overnight. On the U.S. fiscal front, Pelosi and Mnuchin are due to speak today on COVID relief while the bipartisan group will formalize its $908B proposal.

- And FOMC eyed later this week - our preview should be out this afternoon ET.

- An empty data and speaker slate.

- In Supply, $105B of 3-/6-month bill sales at 1130ET. NY Fed buys ~$1.75B of 20-30Yr Tsys.

EGB/GILT SUMMARY: EU-UK Headlines Underpin Bear Steepening of Curves

An agreement between the UK and EU on Sunday to continue trade negotiations past the weekend deadline has delivered some relief to markets and has underpinned the rally in European equities and bear steepening of sovereign curves.

- The EU's chief Brexit negotiator Michel Barnier has stated that he sees a narrow path to a trade settlement with the UK.

- Gilts have unwound some of last week's bull flattening with yields 4-8bp higher on the day and the longer end underperforming.

- The bund curve has similarly bear steepened with the 2s30s spread 2bp wider.

- OAT yields are broadly 1-2bp higher. Last yields: 2-year -0.7336%, 5-year -0.7034%, 10-year -0.3756%, 30-year 0.3221%.

- BTPs have traded firmer with yields within 1bp of Friday's close..

- There is no EGB supply this week. This afternoon France will sell 3-/6-/12-month BTFs for E3.8-5.0bn.

- Eurozone industrial production data for October came in slightly above expectations (-3.8% Y/Y vs -4.2% survey).

BoE: Early thoughts on this week's MPC meeting

Against this Brexit backdrop, the Bank of England MPC meet this week.

- After announcing its intention to increase asset purchases to last until the end of 2021 at its November meeting, the focus at this meeting will be on the implementation of QE.

- The initial pace of QE has yet to be confirmed (although it was previously suggested that the pace would remain unchanged). We suspect there may be a case for increasing the pace in the case of a no deal Brexit, but whether we have any more clarity on this by the time of the MPC meeting is anyone's guess.

- We are also expecting the details of any technical changes to QE – buckets, gilts eligible for purchases etc. We will write on this in more detail in our BOE Preview out Wednesday but we wrote our preliminary thoughts on this in our November BOE Review.

EUROPE OPTION FLOW SUMMARY:

Eurozone:

RXG1 177.50/175.50ps 1x2, bought for 23 in 3.5k

RXF1 178/177ps 1x2, bought for 11 in 1.75k

DUG1 112.30p, sold at 2 in ~4.3k

UK:

0LH1 100.00/100.12cs,sold at 2.75 in 2k

0LF1 100.00/100.12cs, sold at 2.5 in 1.5k

LH1 100p, sold at 4.75 in 8k

FOREX: Sterling Firmer as Betting Odds Swing in Favour of a Deal

In typical EU style, an agreement was reached to 'go the extra mile' and extend EU-UK free trade talks beyond Sunday's deadline which juiced GBP both at the open on Sunday evening and throughout the European morning. GBP/USD rallied smartly through the Friday high in early Asia-Pac hours and has continued to progress north of 1.34 ahead of the NY crossover. Unsurprisingly then, GBP is the strongest currency in G10 so far.

At the other end of the table, USD trades poorly, with the USD index making an early attempt on the multi-year lows printed on Dec 4 at 90.476 - a level that could be reached should EUR/USD break north of Friday's 1.2163.

The data calendar is typically empty this Monday, with focus resting on the deluge of central bank rate decisions later in the week, with UK, US, Norway, Switzerland among others releasing policy decisions this week.

FX OPTIONS: Expiries for Dec14 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1900(E521mln), $1.2000(E1.1bln), $1.2050-60(E664mln), $1.2175(E860mln-EUR puts), $1.2240-50(E614mln-EUR puts)

USD/JPY: Y103.00-10($800mln), Y103.50-55($878mln), Y104.00($557mln), Y104.94-00($519mln), Y105.15($500mln), Y106.00($2.1bln)

EUR/JPY: Y126.00(E606mln)

GBP/USD: $1.3300(Gbp400mln), $1.3500(Gbp545mln), $1.3600(Gbp657mln)

EUR/GBP: Gbp0.8800-20(E540mln), Gbp0.9015-25(E564mln)

AUD/USD: $0.7450(A$607mln-AUD puts)

AUD/JPY: Y78.30-35(A$574mln-AUD calls)

AUD/NZD: N$1.0623(A$678mln-AUD puts)

USD/CAD: C$1.3300($692mln)

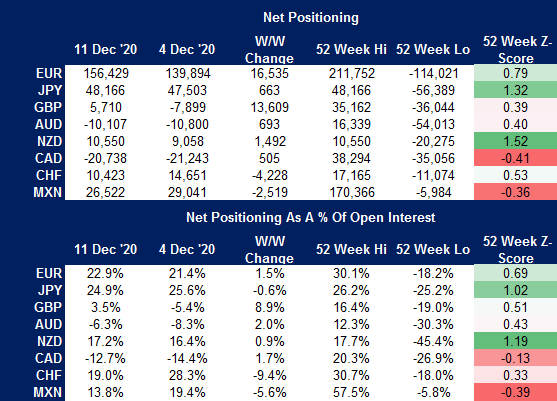

CFTC: CoT Report Takes Positive View on GBP

Friday's CFTC CoT update showed market built the net GBP position by the largest margin, with the market switching to small net long (3.5% of OI) from small net short previously. The shift was equivalent to close to 14,000 contracts and sees GBP positioning shift into the upper end of the 52w range.

- Elsewhere, markets added AUD, CAD, and EUR while the net position in CHF and MXN fell.

- Full update here:

EQUITIES: Strong Showing to Start the Week

Continental equity markets trade firmer Monday, with mainland bourses higher by 1-1.8%. Peripheral stocks outperform, with Italian and Spanish names higher. Core still trades well, however, with the DAX in Germany adding just over 1%. The UK's FTSE-100 lags slightly despite Brexit optimism, as GBP's progress dampens gains.

In the US, futures are also in the green, with the e-mini S&P adding close to 25 points and indicating a higher open later today.

Financials and energy names outperform across Europe, with defensive staples and healthcare stocks lagging, inline with the general risk-on theme so far.

UK banks trade particularly well on positive Brexit newsflow, with the likes of Natwest, Barclays and Lloyds Banking Group higher by 5% or more. Video game maker CD Projekt is the poorest performing stock in the Stoxx 600 after their much awaited Cyberpunk 2077 release was met with poor reviews.

COMMODITIES: NatGas Futures Surge Further on Supply/Demand Mismatch

Energy products are generally outperforming early Monday, with NatGas futures on the front foot and continuing recent outperformance on colder weather forecasts in east Asia prompting a diversion of supplies from mainland Europe. This has helped further support the ~15% rally from last week's lows.

WTI and Brent crude futures also trade with gains, albeit more modest ones. Both benchmarks are higher by around 1% apiece.

In metals space, precious metals are soft as the firmer equity outlook crimps demand - spot gold and silver are lower by 0.4-0.8%, with the weak dollar possibly limiting losses in recent trade.

Focus remains on the key central bank meetings due later this week, most notably the Fed, which announce policy on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.