-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Gilt Volatility Dominates Again

Highlights:

- UK curve steepens sharply as BoE reiterates it will end emergency purchases Friday

- USD mixed, Tsys outperforming ahead of PPI data and September FOMC minutes later in the session

- Central bank speakers ahead include BoE's Pill and Mann, ECB's Lagarde, Fed's Kashkari/Barr/Bowman

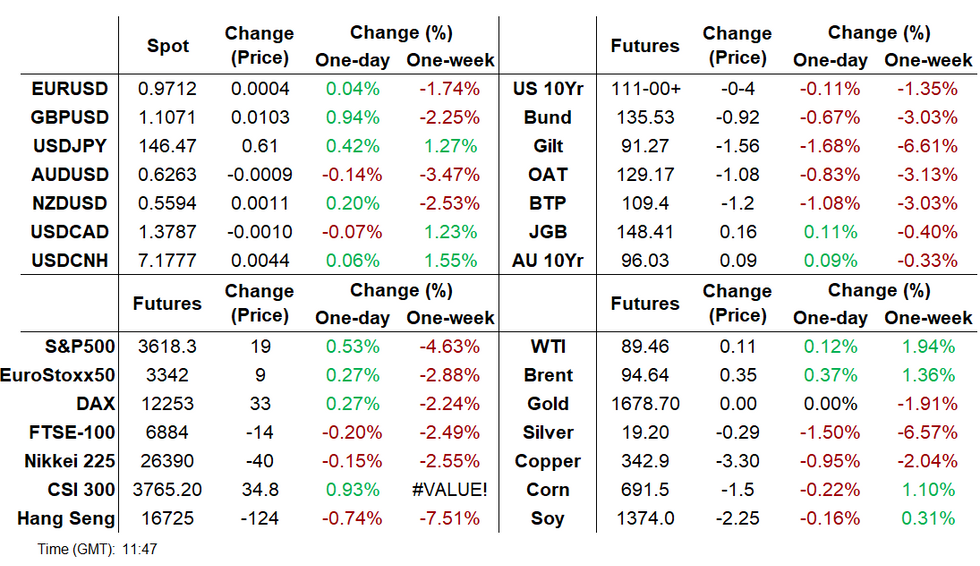

US TSYS: Treasuries Retreat To Little Changed Ahead Of Solid Session

- Cash Tsys currently sit little changed having rallied overnight before cheapening with spillover from sizeable moves in EU FI, helped by a BOE spokesperson reiterating the end to the bond-buying program on Friday. PPI inflation and FOMC minutes headline today - albeit firmly with an eye on tomorrow’s CPI – with additional interest in 10Y supply after yesterday's brief attempt north of 4% for 10YY.

- 2YY -0.6bps at 4.3%, 5YY +0.5bps at 4.176%, 10YY +1.5bps at 3.962%, and 30YY +2.1bps at 3.944%.

- TYZ2 trades 3 ticks lower at 111-01+ having just touched session lows of 110-31 but remains within yesterday’s range. Volumes are moderately above average. Support continues to be the bear trigger of 110-19 ((Sep 28 low) whilst to the upside resistance is 112-30 (20-day EMA).

- Data: PPI inflation (0830ET) with ex food & energy seen dipping a tenth to 0.3% M/M and ex food, energy & trade unchanged at 0.2% M/M, both close to early 2021 lows as producer costs moderate. Focus is more heavily on tomorrow’s US CPI

- Fed: FOMC minutes headline at 1400ET, also see Kashkari (1000ET), Barr (1345ET) and Bowman (1830ET)

- Bond issuance: US Tsy $32B 10Y Note auction re-open (91282CFF3) – 1300ET

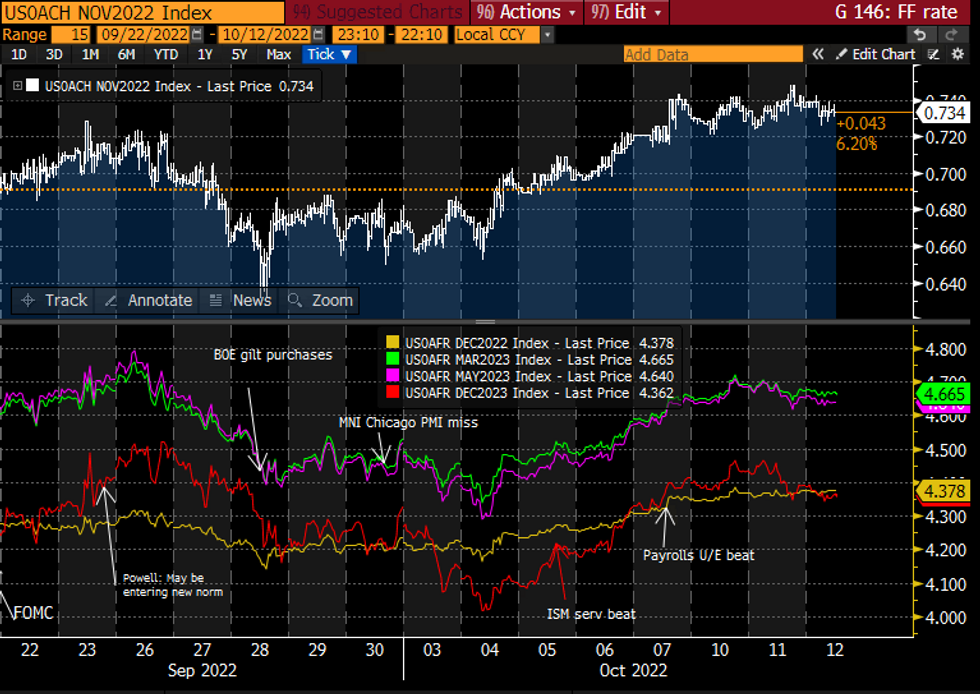

STIR FUTURES: Near-Term Fed Hikes Hold Near Post Sep FOMC Highs

- Fed Funds implied hikes sit with 73.5bp for Nov 2, in the middle of the 72.5-75bp range so far this week.

- The cumulative 130bps to 4.38% for Dec’22 is at post-Sep FOMC highs whilst 2023 rates consolidate yesterday’s easing, with a 4.67% terminal in Mar’23 and 4.36% for Dec’23.

- FOMC minutes at 1400ET take centre stage for Fed commentary. Also have Kashkari (’23) in a townhall discussion on economic development, VC for Supervision Barr on new technologies and then late on Gov Bowman discussing forward guidance as a policy tool (text + Q&A). Bowman last spoke on mon pol on Aug 17.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

BOE: Bond Buying Scheme Will End Friday, FPC Cites No QT Concerns

The Bank of England's bond-buying operation will end Friday as planned, wrapping up on October 14, the central bank confirmed Wednesday.

- The bond-buying scheme, which currently stands to buy up to GBP10 billion a day of Gilts, split equally between conventional and index-linked bonds, is set to end on Friday. The end date was made clear by the BOE in numerous press releases and also through comments from Governor Andrew Bailey on Tuesday, the Bank said.

- The BOE's FPC also made reference to not looking to delay planned gilt sales, due to start Oct 31, seeing no material risk to financial stability.

- Having had 13 trading days to ensure problematic pension funds bolster the resilience of their investment schemes to meet larger margin calls, the Bank is adamant this is sufficient time to have completed the process.

- Anecdotal evidence shows some modest spillover effects from pension fund asset liquidations, but no direct signs of stress

- The BOE further announced the CCyB rate will be maintained at 2% from July 2023 to ensure UK banks remain resilient in lending capacity and the Bank stands ready to vary this rate as quickly as needed.

MNI View: BOE doesn't sound too concerned about the market after it steps away

- The BOE comments at 10:30BST are further confirmation that the intention is that the Bank will not purchase beyond the end of the week - and reaffirm Bailey's comments from last night.

- The key part in here is that the BOE has said that anecdotal evidence shows some modest spillover effects from pension fund asset liquidations, but no direct signs of stress.

- So that suggests they aren't too concerned about what will happen to markets when they step away.- GBP has moved stronger on these comments.

- The CCyB being unchanged was a decision made on Sep 30 so probably can't read too much into that part of the statement as being so current - and is of less importance to macro markets anyway.

FOREX: GBP Trades In Volatile Manner Amid BOE Headlines, Markets Await US CPI

- Volatility in GBP was the clear focus for currency markets in early Wednesday trade as headlines from the Bank of England prompted significant two-way price action.

- Approaching the London open, there was a significant spike in sterling crosses as the Financial Times reported that “the Bank of England has signalled privately to bankers that it could extend its emergency bond-buying programme past this Friday’s deadline." Cable popped aggressively to 1.1057 from around 1.0950.

- However, the pair drifted lower as the European session commenced and came under further pressure as the following headline was run: BOE Spokesperson Says Bond-Buying Scheme Still To End Friday.

- Cable fell to a low of 1.0955 on the news but was unable to gather any downside momentum. Failing to bridge the gap with the lows of the day, GBP once again reversed aggressively as short-term positioning continues to be frustrated, eventually printing another fresh high for the day at 1.1062. Overall, we note that technically, the recent move lower still appears to be a correction of the rally between Sep 26 - Oct 5.

- Elsewhere, currency markets remain subdued with the USD index unchanged and major pairs holding relatively narrow ranges. USDJPY continues to consolidate above 146 after breaking to fresh cycle highs (146.39) overnight.

- Plenty of speeches are scheduled from Fed, ECB & BoE policymakers, with the minutes from the most recent FOMC meeting also due. The clear focus for global markets remains on tomorrow’s release of US CPI.

FX OPTION EXPIRY:

- Of note: EURUSD: 2.15bn at 0.9700/0.9705USDJPY 1.05bn at 147.25 (thu)USDCNY 3.15bn at 7.1000 and 1.45bn at 7.20 (thu)

- EURUSD: 0.9600 (1.19bn), 0.9650 (404mln), 0.9700 (1.61bn), 0.9705 (309mln), 0.9740 (311mln), 0.9750 (408mln), 0.9770 (201mln), 0.9800 (426mln).

- AUDNZD: 1.1200 (250mln), 1.1215 (360mln).

Price Signal Summary - Trend Condition In FI Remains Bearish

- In the FI space, the broader bearish theme in Bund futures remains intact. The focus is on 135.52, the Sep 28 low and key support. A break would confirm a resumption of the downtrend and open 135.27, the Mar 2012 low (cont).

- Gilt futures remain bearish following the reversal from last week’s high. The focus is on 90.99, Sep 28 low and bear trigger. This level has been pierced, a clear break would open 90.57, 2.618 projection of the May 12 - Jun 16 - Aug 2 swing (cont).

- On the commodity front, the recent strong reversal in Gold signals the end of the recovery between Sep 28 - Oct 4 and note that price has moved below the trendline resistance drawn from the Mar 8 high. A continuation lower would expose the key support at $1615.0, the Sep 28 low.

- In the Oil space, WTI futures traded higher last week and cleared both the 20- and 50 EMAs, strengthening a bullish theme. Attention is on $96.82, the Aug 30 high. Initial firm support lies at $87.61, the 50-day EMA. The pullback this week is considered corrective - for now.

- In FX, EURUSD remains in a bear cycle inside the channel drawn from the Feb 10 high. Indications are that the pair is likely to depreciate further near-term. The focus is on 0.9645, 76.4% of the Sep 28 - Oct 4 bull cycle and further out, 0.9536, the Sep 28 low and key support.

- GBPUSD maintains a softer tone. At this stage, the recent move lower appears to be a correction of the rally between Sep 26 - Oct 5. A continuation lower would open 1.0922 and 1.0787, 50.0% and 61.8% of the Sep 26 - Oct 5 bull cycle. Initial resistance is at 1.1215, the 20-day EMA.

- USDJPY maintains a bullish tone and the pair has traded higher today, resulting in a break of key resistance at 145.90, the Sep 22 high. This confirms a resumption of the primary uptrend. Attention is on 146.52 next, the 1.236 projection of the May 24 - Jul 14 - Aug 2 price swing and 147.25, the 3.00 projection of the Aug 2 - 8 - 11 price swing.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2022 | 1135/1235 |  | UK | BOE Pill in Conversation with SCDI | |

| 12/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 12/10/2022 | 1230/0830 | *** |  | US | PPI |

| 12/10/2022 | 1330/1530 |  | EU | ECB Lagarde in Conversation with Tim Adams (IIF) | |

| 12/10/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/10/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2022 | 1700/1800 |  | UK | BOE Mann Canadian Association for Economics Webinar | |

| 12/10/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/10/2022 | 1745/1345 |  | US | Fed Vice Chair Michael Barr | |

| 12/10/2022 | 2230/1830 |  | US | Fed Governor Michelle Bowman | |

| 13/10/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 13/10/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/10/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 13/10/2022 | 0730/0930 |  | EU | ECB de Guindos Speech at (M&A) España y Europa Event | |

| 13/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 13/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/10/2022 | 1230/0830 | *** |  | US | CPI |

| 13/10/2022 | 1300/1400 |  | UK | BOE Mann Speech at Peterson Institute for Internat. Economics | |

| 13/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/10/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 13/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/10/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/10/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.