-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Bounce Ebbs Headed into NY Crossover

Highlights:

- JPY firmest in G10 as Ueda hints BoJ could formulate rate plans by year-end

- Speaker schedule light, with both ECB and Fed in pre-meeting media blackouts

- US curve sits steeper amid more stable G10 FI market backdrop

US TSYS: Curve Steeper Pre-NY, Aided By BoJ, Outrights Off Cheaps

Tsys based in early London hours.

- Bears couldn’t force a test of technical support in TYZ3 (109-19), while some stabilisation in wider core global FI markets also helped at the time.

- Asia-Pac cheapening drivers included hawkish weekend comments from the BoJ, firmer than expected Chinese credit data and a bid in both Chinese equities (which faded into the close) and e-minis (also off best levels at typing).

- Reports of $-denominated issuance out of the UAE (BBG sources flagging minimum of $1bn of issuance later this month after the UAE hired banks for the deal) did little to the impact the space when the news hit.

- Recovery highs have given way in recent trade, with broader core global FI back on the defensive.

- TYZ3 last -0-06+, a little off Asia lows, while cash Tsys are flat to 3.5bp cheaper as the curve steepens.

- New York Fed inflation expectations highlight a limited NY data docket, with 3-Year Tsy supply also due.

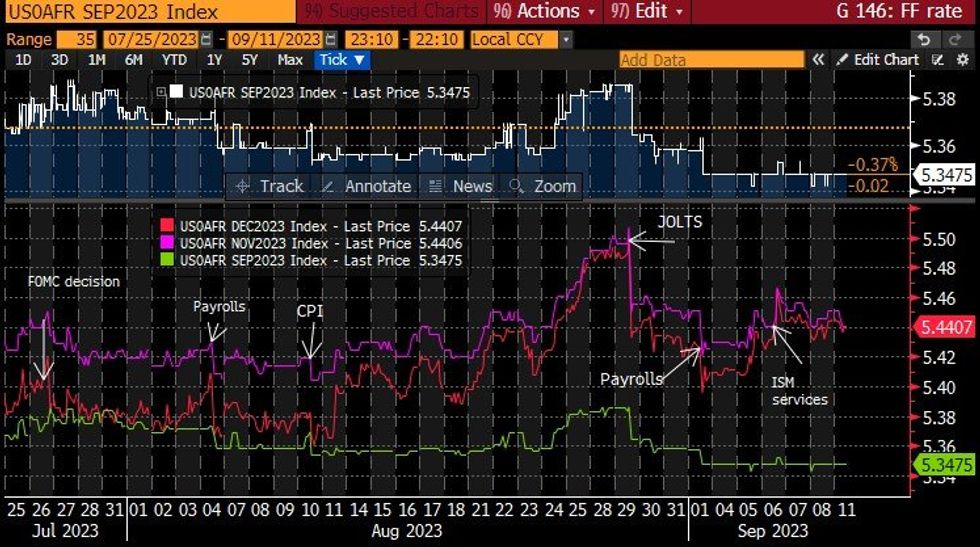

STIR FUTURES: Fed Terminal Seen Split In Nov-Dec With Fed In Blackout

- Fed Funds implied rates are slightly lower for November, with terminal now seen in both Nov and Dec, but are otherwise almost unchanged with cut expectations near recent lows for circa 100bps from the terminal to end-2024.

- WSJ’s Timiraos over the weekend wrote on an important shift in Fed officials’ rate stance as being under way with some officials seeing risks to tightening as more balanced rather than preferring to tighten too much than not at all. More here.

- Cumulative hikes from 5.33% effective: +1.5bp Sep (unch from Fri close), +11bp in Nov (-1bp) and +11bp in Dec (-0.5bp).

- Cuts from terminal: 35bp to Jun’24 (from 36bp) and 101bp to Dec’24 (from 102bp).

Source: Bloomberg

Source: Bloomberg

EUROPE ISSUANCE UPDATE:

EUROZONE ISSUANCE: EU-bond 7-year syndication

- "The EU has mandated BofA Securities, Credit Agricole CIB, Morgan Stanley, Nomura and UniCredit as Joint Lead Managers for its upcoming EUR Fixed Rate RegS Bearer, due 4 December 2030." - Market source.

- MNI expects a transaction size of E5.0bln (with upside risks possibly up to a maximum of E7.0bln).

IRELAND AUCTION PREVIEW: On offer Thursday

The NTMA will look to sell E1.0bln of 4/22-year bonds on Thursday:

- 0.20% May-27 IGB (ISIN: IE00BKFVC568)

- 2.00% Feb-45 IGB (ISIN: IE00BV8C9186)

FOREX: USD/JPY Opens 1% Gap With Cycle Highs

- Comments from Bank of Japan governor Ueda have been the focus for the Monday session so far, after Ueda was cited in the Yomiuri newspaper as saying that it's possible the Bank of Japan will have enough data and information by the end of 2023 to confirm the trajectory of wages into next year, thereby helping the council come to a decision on whether to exit negative interest rate policy.

- The JPY rallied in response, tipping USD/JPY back below the Y146.50 mark to open a 1% gap with the cycle high printed last week at Y147.87. This keeps the JPY as the strongest performing currency headed into the NY crossover.

- The greenback is the poorest performer so far, as the roll off overnight highs for the US 10y yield keeps the USD in check. Despite the pullback in spot, prices remain inside the well-defined uptrend channel drawn off the mid-July lows, keeping the medium-term outlook bullish for the USD Index.

- The strength across Chinese currencies have also been a factor in the poor USD performance: USD/CNH sits just above session lows, last around 7.3000 and tracking lower thanks to a stronger than expected CNY fix. The PBOC stated it has confidence in maintaining a stable yuan, and source reports suggest that dollar bulk buying will now have to be pre-approved by the central, with $50mln the reported limit. Better than expected August lending figures have also aided onshore equities after the break.

- Data points are few and far between, with the speakers slate also quiet as both the ECB and Fed are within their pre-decision media blackout periods. The NY Fed inflation expectations release takes focus ahead, last seen at +3.55% for July.

FX OPTIONS: Expiries for Sep11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.3bln), $1.1030-50(E1.8bln)

- USD/JPY: Y145.00($1.1bln), Y146.00-20($899mln), Y147.75($673mln), Y149.00($599mln)

- EUR/JPY: Y158.90-00(E686mln)

- GBP/USD: $1.2590-00(Gbp939mln)

EGBS: Off Lows, GGBs Marginally Tighter after DBRS Upgrade

Bunds find a base alongside U.S. Tsys as the BoJ-driven weakness seen in Asia-Pac hours moderates a touch.

- That leaves Bund futures -20, while German cash benchmarks are 0.5bp richer to 1.5bp cheaper, twist steepening.

- Bears couldn’t force a challenge of initial technical support in Bund futures (130.35, the Sep 7 low).

- Most other EGB curves twist/bear steepen a little.

- Core/semi-core paper little changed when it comes to spreads vs. Bunds.

- Greek paper is the outperformer, although only marginally so, as 10-Year GGBs tighten by ~1.5bp vs. Bunds post-Greece’s (widely expected) IG status attainment at DBRS Morningstar on Friday. A reminder that achievement isn’t a gamechanger for GGBs on the index inclusion front.

- The regional docket is limited today.

- Eurozone commission marked down Eurozone GDP projections, while lowering its CPI forecast for ’23 & lifting it’s CPI outlook for ’24.

- While there is nothing formally slated on the EGB issuance front on Monday, we remain on the lookout for details of a possible EU syndication after the recent RFP and guidance (some desks look for a new 7-Year line).

- We also note that the net issuance backdrop is much more supportive for EGBs this week (negative net supply when accounting for coupons/maturity repayment).

EQUITIES: E-Mini S&P Bear Cycle Remains in Play

- A bear cycle in Eurostoxx 50 futures remains in play and the contract traded lower Friday before finding support. Price has pierced key support at 4187.00, the Aug 18 low and bear trigger. A clear break of this level would strengthen bearish conditions and open 4177.40 next, a Fibonacci retracement. Key resistance has been defined at 4358.00, the Aug 30 high. Initial firm resistance is seen at 4284.8, the 20-day EMA.

- The E-mini S&P contract traded lower last week and a bear cycle remains in play. Key resistance has been defined at 4597.50, Sep 1 high. A break is required to reinstate the recent bullish theme. A resumption of weakness would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. A break of this support would highlight a short-term reversal. For bulls, clearance of 4597.50 would open 4685.25, Jul 27 high.

COMMODITIES: Uptrend in WTI Futures Intact

- The uptrend in WTI futures remains intact. The recent break of resistance at $84.16, the Aug 10 high, confirmed a resumption of the uptrend and this maintains the bullish price sequence of higher highs and higher lows. Note that moving average studies are in a bull mode position, highlighting current positive sentiment. Sights are on the psychological $90.00 handle. On the downside, initial firm support to watch lies at $82.98, the 20-day EMA.

- Gold is trading closer to last week’s lows. Key support to watch lies at $1903.9, the Aug 25 low. A break of this level would be viewed as a bearish development and highlight the fact that the recovery between Aug 21 - Sep 1 has been a correction. This would expose $1884.9, the Aug 21 low. On the upside, initial firm resistance is seen at $1930.5, the 50-day EMA. Key resistance is at $1953.0, the Sep 4 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/09/2023 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 11/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/09/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/09/2023 | 2300/0000 |  | UK | BOE's Mann to Speak in Canada | |

| 12/09/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/09/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/09/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/09/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Conditions Index |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Expectations Index |

| 12/09/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/09/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/09/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.