-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY on Top as BoJ Tweak Spooks Markets

Highlights:

- JPY on top as BoJ YCC tweak spooks markets

- US futures recover off post-BOJ lows, but mixed picture remains

- US housing starts, building permits and Eurozone Consumer Confidence make up the docket

US TSYS: Tsys Bear Steeper Ahead Of Housing Data

The Treasury curve has bear steepened overnight in reaction to the BoJ's surprise move to raise the ceiling on 10Y JGB yields by 25bp to 0.50%.

- The 2s10s spread spiked almost 11bp at one point to the least inverted in more than a month (just above -57bp), though the initial move has faded with the spread back to -61.8bp. That's roughly 6bp higher on the session.

- The 2-Yr US yield is up 1.9bps at 4.2743%, 5-Yr is up 5.4bps at 3.768%, 10-Yr is up 7.8bps at 3.6621%, and 30-Yr is up 7.8bps at 3.7129%.

- Fed hike expectations are little changed, though, with an 5.05% terminal rate end seen in May (ie just above a 4.75-5.00% target range), another 55bp from here. 48bp of cuts are seen by end-year.

- The highlight of an otherwise quiet pre-holiday schedule is housing data at 0830ET, following on from Monday's poor NAHB reading.

- Starts and Permits are seen falling again M/M, though at a slower rate than in October.

- Also bearing watching are fiscal developments in Washington, after a $1.66trn omnibus funding package for FY 2023 was released late Monday night, ahead of Friday's deadline to avoid a shutdown.

STIRS: BoJ Hikes Seen By Mid-Next Year

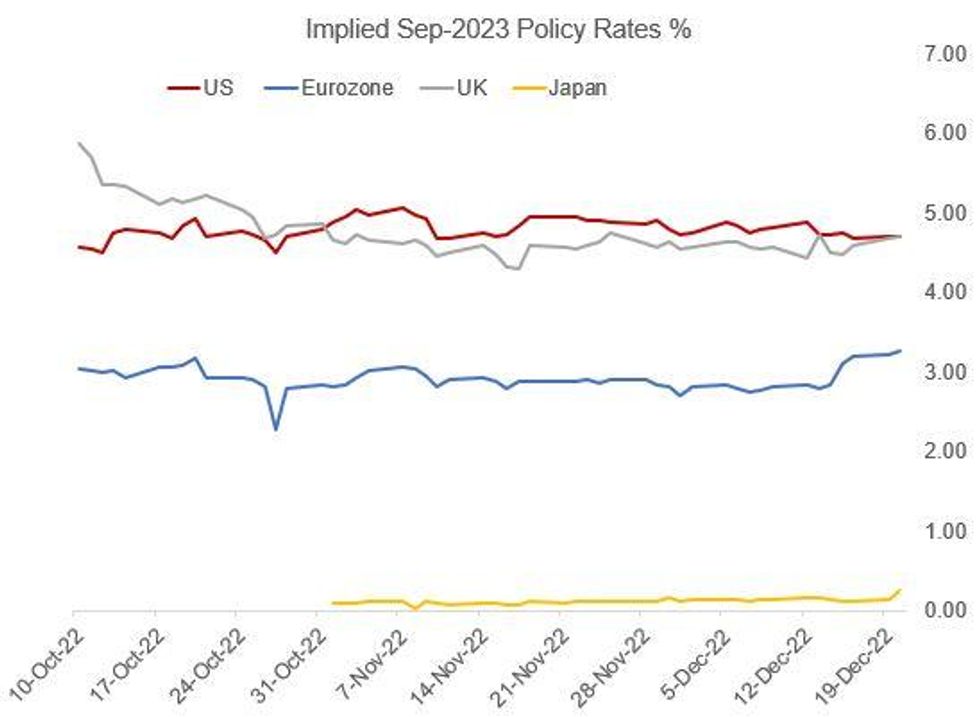

The BoJ's surprise shift in Yield Curve Control policy overnight has inevitably impacted Japanese rate hike expectations, and has had a modest spillover effect on global counterparts.

- The Japanese implied rate path had previously been basically flat through 2023, with modestly positive rates seen later in the year. Post-BoJ decision though, it implies a zero percent rates by April vs the current -0.10% target, with a full 20bp hike (the size of the BoJ's previous target rate move) by the July meeting.

- BoJ rate hike expectations still barely register on a comparison chart with the Fed/BoE/ECB, but the divergence with central bank counterparts in 2023 is now much less pronounced.

- Overnight, terminal ECB pricing has ticked 4-5 basis points higher to +138bp in hikes by Sept 2023 (3.38% depo rate)- BoE terminal pricing had implied another 134bp for Sept 2023, pulling back to currently (127bp in hikes from here, so 4.77% Bank Rate).

- US implied rates meanwhile are flat-to-lower. The Fed is seen peaking much earlier, in May 2023, at 4.87% (implying 55bp of further tightening), and a better-than-even chance by of a 25bp cut by September, with just under 50bp of cuts implied by year-end.

What Happened in Japan?

- The BoJ surprised markets by widening the YCC tolerance band to +/- 50bps.

- The BoJ obviously got to a point where enough was enough, noting that market volatility has heightened in recent months, with a modification in the YCC parameters apparently implemented to improve market functioning (the BoJ now holds over 50% of outstanding JGBs for the firsttime).

- As a countermeasure to the potential for a fairly swift challenge of the BoJ's new YCC settings, it has decided to deploy upsized JGB purchases in Jan-Mar '23.

- JPY sharply stronger, equities lower across the board, but off session lows through the European open.

EUROPE ISSUANCE UPDATE:

Gilt auction result:- GBP3.25bln of the 0.25% Jan-25 Gilt. Avg yield 3.827% (bid-to-cover 2.11x, tail 1.5bp).

FOREX: BoJ Gives Gift of FX Volatility Pre-Christmas

- With markets expecting another copy-paste statement from the Bank of Japan, markets were caught offguard by the bank's decision to widen their tolerance band as part of the yield curve control programme.

- The market read was hawkish, with yields shooting higher across the Japanese curve and the JPY rallying sharply against all others. USD/JPY cleared all nearby support to drop to the Y132.00 handle, making for a 5 point decline in prices.

- EUR/JPY moved similarly, dropping to touch the 200-dma at 140.11. A firm break of this support would be the first since February, adding further pressure to a cross already at multi-month lows.

- Firm JPY strength is pressuring global equity markets, with US futures pointing to a lower open on Wall Street today. This has fed into poor AUD, NZD trade, who remain the weakest currencies in G10.

- Focus turns to US housing starts and building permits releases as well as the prelim December Eurozone consumer confidence.

FX OPTIONS: Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350-55(E725mln), $1.0549-50(E518mln), $1.0700-05(E557mln)

- USD/JPY: Y136.32($573mln)

- AUD/USD: $0.6640-60(A$1.4bln), $0.6725(A$649mln), $0.6900(A$679mln)

- NZD/USD: $0.6179-95(N$725mln)

- USD/CNY: Cny7.0000($580mln), Cny7.2000($991mln)

Price Signal Summary - JPY Bulls Return

- In FX, EURUSD remains below last week’s highs. The latest pullback is considered corrective - for now. Last week’s break higher confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. The focus is on 1.0736 next, the 2.382 projection of the Sep 28 - Oct 4 - 13 price swing. Initial support lies at 1.0528, the Dec 13 low.

- GBPUSD is trading at its recent lows and the short-term outlook appears bearish. Attention is on the first key support at 1.2107, the Dec 7 low. It has been pierced, a clear break would pave the way for a move towards 1.1901, the Nov 30 low. On the upside, key short-term resistance has been defined at 1.2446, the Dec 14 high.

- USDJPY has traded sharply lower today and in the process cleared key support and the bear trigger at 133.63, the Dec 2 low. This confirms a resumption of the current downtrend and paves the way for weakness towards 131.74, the Aug 11 low. Moving averages studies are in a bear-mode position and price remains below the 20-day EMA. This average is a key resistance - it intersects at 137.79.

BONDS: Curves Bear Steepen On BoJ Surprise

A sharp drop in JGBs following the Bank of Japan's shock move to raise the upper limit of its Yield Curve Control band has reverberated across global core FI Tuesday.

- While short-end yields rose on December's latest hawkish central bank surprise, the nature of the BoJ move (raising the ceiling on 10Y JGB yields to 0.50% from 0.25%) has had more of an impact further down the curve with bear steepening.

- Though the move has softened since the initial shock, curves remain steeper: UK and German 2s10s +2bp, US +5bp.

- Periphery spreads initially moved wider on the risk-off move, but have since narrowed as equities have recovered.

- Featuring on the schedule today is more US housing data (starts and building permits), following from yesterday's weak NAHB reading. We also get Dec Eurozone consumer confidence.

Latest levels:

- Mar 10-Yr US futures (TY) down 17.5/32 at 113-19 (L: 113-11.5 / H: 114-05.5)

- Mar Bund futures (RX) down 101 ticks at 136.14 (L: 135.83 / H: 137.22)

- Mar Gilt futures (G) down 100 ticks at 101.45 (L: 100.88 / H: 101.73)

- Italy / German 10-Yr spread 0.5bps tighter at 217.4bps

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/12/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 20/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/12/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/12/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 21/12/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 21/12/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.