-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - JPY Vol Surges as BoJ Take Flexible Approach to Policy

Highlights:

- JPY volatility surges as BoJ take flexible approach to yield curve control

- Equity futures hold late Thursday losses

- MNI projects German CPI cooling to 6.17%

US TSYS: Bull Steeper Post BoJ Ahead Of Further Key Data Releases

- Cash Tsys have seen a bull steepening ahead of the US session getting underway, paring some of yesterday’s data-induced losses. The long-end underperforms with relative cheapening pressure from the BoC tweaking its YCC to allow for a drifting higher in 10Y yields with a cap now at 1%, after heightened volatility following the decision which saw 10Y Tsy yields almost touch 4.04%.

- Fed Chair Powell on Wednesday put particular emphasis on data dependency, hence the strong reactions to yesterday’s GDP, initial claims and less so durable goods beats, and further important releases headline today’s docket. We particularly watch core PCE for June and revisions after yesterday’s softer than expected Q2 advance, plus the ever-important ECI for Q2 for more compositionally robust measures of wage growth.

- 2YY -6.0bp at 4.868%, 5YY -5.4bp at 4.184%, 10YY -3.2bp at 3.967%, 30YY -1.0bp at 4.029%

- TYU3 trades 10+ ticks higher at 111-11 and off lows of 110-25+, after extremely elevated volumes of 600k following the BoJ decision and some European regional inflation prints. The low cleared multiple support points including 110-28 (76.4% retrace of the Jul 7-18 rally) to open a bear trigger at 110-05 (Jul 6 low).

- Data: ECI Q2 (0830ET), Incomes/spending/core PCE Jun (0830ET), U.Mich Jul final (1000ET), KC Fed services Jul (1100ET).

STIR FUTURES: Fed Cuts Push Back Against Yesterday’s Trimming

- With BoJ YCC tweaks and regional German, French and Spanish inflation digested, Fed Funds implied rates nudge lower for 2023 meetings and see larger declines into 2024 with the latter reversing more than half of yesterday’s post-data trend higher. It leaves a broad rate path only slightly lower than levels prior to Wednesday’s FOMC decision.

- Cumulative hikes from 5.33% effective: +4.5bp Sep (-0.5bp), +9bp Nov to terminal 5.42% (-1bp).

- Cuts from terminal: 4bp to Dec’23 (from 3.5bp yesterday close), 54bp to Jun’24 (from 48bp) and 127bp to Dec’24 (from 118bp).

- No FOMC speakers formally scheduled for the first day with the blackout lifted but there are important data releases, including core PCE on track for a soft June or at least soft revisions after yesterday’s Q2 advance, plus the ever-important ECI for Q2.

MNI Projects CPI cooling to +6.17%

We have now received state data that equates to 86.7% weighting of the national German CPI print (due at 1300 BST / 1400 CET).

- MNI calculations estimate that national CPI rose by +0.27% m/m and by +6.17% Y/Y. This is based on the published index values for available state data. The data implies readings broadly in line with expectations, rounded to 0.3% m/m and 6.2% y/y.

- Note: these estimates are in relation to the national CPI print, not the HICP print which feeds into the Eurozone HICP print that the ECB targets. The magnitude of surprises to consensus can sometimes be different due to the different methodologies and weights used in national CPI vs HICP - but the direction of the surprise is normall the same.

| M/M | July (reported) | June (reported) | Difference |

| North Rhine Westphalia | 0.2% | 0.3% | 0.1% |

| Hesse | 0.3% | 0.2% | -0.1% |

| Bavaria | 0.4% | 0.2% | -0.2% |

| Brandenburg | 0.3% | 0.3% | 0.0% |

| Baden Wuert. | 0.2% | 0.3% | 0.1% |

| Berlin | 0.2% | 0.1% | -0.1% |

| Saxony | 0.3% | 0.3% | 0.0% |

| Rhineland-Palatinate | 0.3% | 0.2% | -0.1% |

| Lower Saxony | 0.3% | 0.3% | 0.3% |

| Saarland | 0.3% | 0.2% | -0.1% |

| Weighted average: | 0.27% | for | 86.7% |

| Y/Y | July (reported) | June (reported) | Difference |

| North Rhine Westphalia | 5.8% | 6.2% | 0.4% |

| Hesse | 6.1% | 6.1% | 0.0% |

| Bavaria | 6.1% | 6.2% | 0.1% |

| Brandenburg | 6.7% | 6.7% | 0.0% |

| Baden Wuert. | 6.8% | 6.9% | 0.1% |

| Berlin | 6.1% | 5.9% | -0.2% |

| Saxony | 6.7% | 6.8% | 0.1% |

| Rhineland-Palatinate | 6.1% | 6.4% | 0.3% |

| Lower Saxony | 6.0% | 6.6% | 0.6% |

| Saarland | 5.9% | 6.0% | 0.1% |

| Weighted average: | 6.17% | for | 86.7% |

GILTS: Early Move Lower Consolidates, Curve Twist Steepens On Global Impulses

Gilt futures haven’t got anywhere close to unwinding the opening gap lower, last printing -60 or so after recovering from session cheaps ahead of the 95.00 level. The move lower breached initial technical support. Today’s low (95.11) now provides initial downside focus, while resistance is seen at the July 27/19 highs (96.81/97.84).

- The cash curve sees some twist steepening pressure on read through from the BoJ & various inflation releases out of Europe, leaving the major benchmarks running 2.5bp richer to 6.5bp cheaper.

- SONIA futures are left 5.5bp richer to 5.5bp cheaper through the golds, with twist steepening in play on the strip.

- Local headline flow remains limited, while the domestic docket is essentially empty into the weekend, leaving local focus on next week’s BoE monetary policy decision.

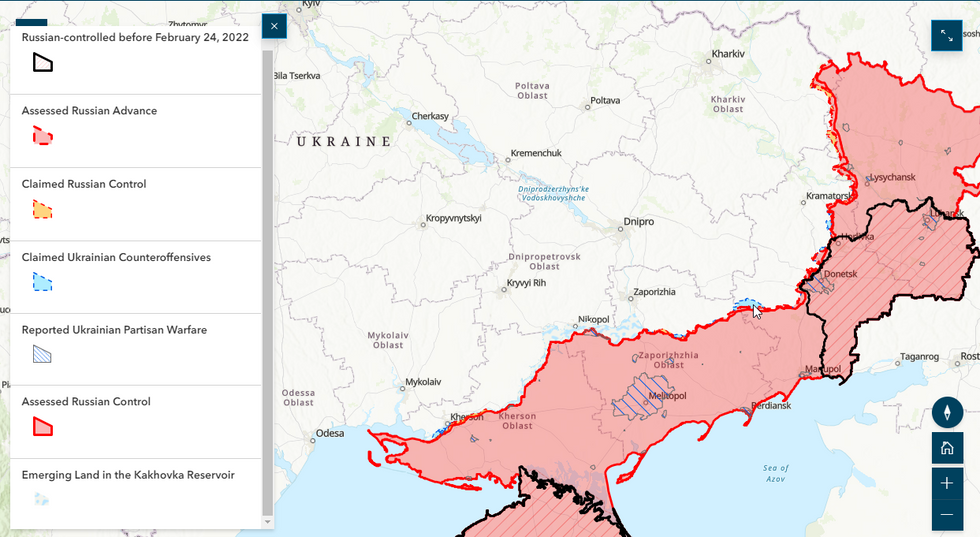

RUSSIA/UKRAINE: Kyiv Claims Village Taken As Southern Counteroffensive Intensifies

Ukrainian President Volodymyr Zelenskyy claimed late on 27 July that his country's forces have retaken the village of Staromaiorske in the Donetsk oblast as its counteroffensive against Russian troops continues in the south and east of Ukraine. The village sits in a strategically important position, 5km from the village of Staromlynivka to the south that military analysts identify as a Russian stronghold in the region. If Staromlynivka can be taken it would mark a breach of the Russian's second defensive line, potentially allowing Ukrainian troops to break through in their efforts to reach the Sea of Azov and cut off Russian troops to the west in the Kherson and Zaporizhzhia oblasts, as well as the Crimea.

- Despite this apparent success, the progress of Ukraine's advance remains slow given that Russian troops have heavily dug in along fortified lines intended to halt both ground troops as well as mechanised battalions. Politico reports that the US-made Abrams M1A1 tanks are expected to reach the Ukrainian front lines by September. The heavy American hardware could prove crucial in providing enough firepower to break through the Russian lines.

- It remains to be seen whether Russian President Vladimir Putin is forced into a risky second mobilisation in order to bolster his forces in the face of Ukraine's attack. Russia's casualties have so far been higher than Ukraine's, but as Kyiv ramps up its counteroffensive this situation could change in the face of embedded Russian forces.

Source: Institute for the Study of War

Source: Institute for the Study of War

FOREX: JPY Volatility Surges as BoJ Adapt Yield Approach

- JPY volatility surged overnight on the BoJ decision, at which the Bank surprised markets by tweaking yield curve control. The Bank are now to see the 0.5% ceiling for 10y rates as a reference point, and not a rigid limit - thereby signalling a change to the long-standing stance. The move had been trailled by a Nikkei news story late on Thursday, however significant market volatility still followed, with USD/JPY over 200 pips before fading into the European crossover.

- JPY is left mixed against most others headed into NY hours, however has been the currency in the spotlight so far Friday.

- GBP is firmer against all others in G10, allowing GBP/USD to recover off the overnight low. Nonetheless, most of G10 remains weaker against the USD after yesterday's sharp greenback rally. AUD and NZD are the poorest performers, with AUD/USD breaking a series of key supports to hit the lowest levels since early July.

- Focus for the coming session rests on the national prelim German CPI release, followed by Canadian GDP and US personal income/spending data. The final reading for University of Michigan sentiment rounds off the week, with markets focusing on any inflation expectations revisions as they begin to capture the soft July CPI.

FX OPTIONS: Expiries for Jul28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E844mln), $1.1050(E2.0bln), $1.1075(E966mln), $1.1100(E876mln), $1.1120-30(E560mln), $1.1190(E1.4bln)

- USD/JPY: Y140.25($1.0bln)

- AUD/USD: $0.6850(A550mln)

- USD/CAD: C$1.3235-50($553mln), C$1.3280($826mln)

Stock Futures Off Highs into Friday Close

- The E-mini S&P contract traded to a high of 4634.50 yesterday before reversing. This highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4638.27 today.

- Eurostoxx 50 futures rallied Thursday. This resulted in a break of key resistance at 4447.00, the Jul 3 high and a bull trigger. A continuation higher would confirm a resumption of the uptrend and mark the end of a broad sideways move that started May 19.

COMMODITIES: Gold Breaks Key Support on Move Lower

- Gold traded sharply lower yesterday. The move down resulted in a break of support at the 50-day EMA - at $1951.1. A continuation lower would threaten the recent bullish theme and instead expose support at $1924.5, the Jul 11 low.

- The uptrend in WTI futures remains intact and this week’s climb confirmed a resumption of the bull cycle. The break above $77.15, the Jul 13 high signals scope for an extension towards the next key resistance at $81.44, the high on Apr 12 / 13.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/07/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/07/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/07/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/07/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/07/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 28/07/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.