-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Bounce, US Data Eyed

HIGHLIGHTS:

- Markets bouncing, dip buyers put stocks on track for positive open

- Jobs data in focus, ADP, ISM Services watched for NFP clues

- Oil firms further, WTI & Brent higher for third consecutive session

US TSY SUMMARY: Refunding, ISM Services, And Fed Prez Outlooks Ahead

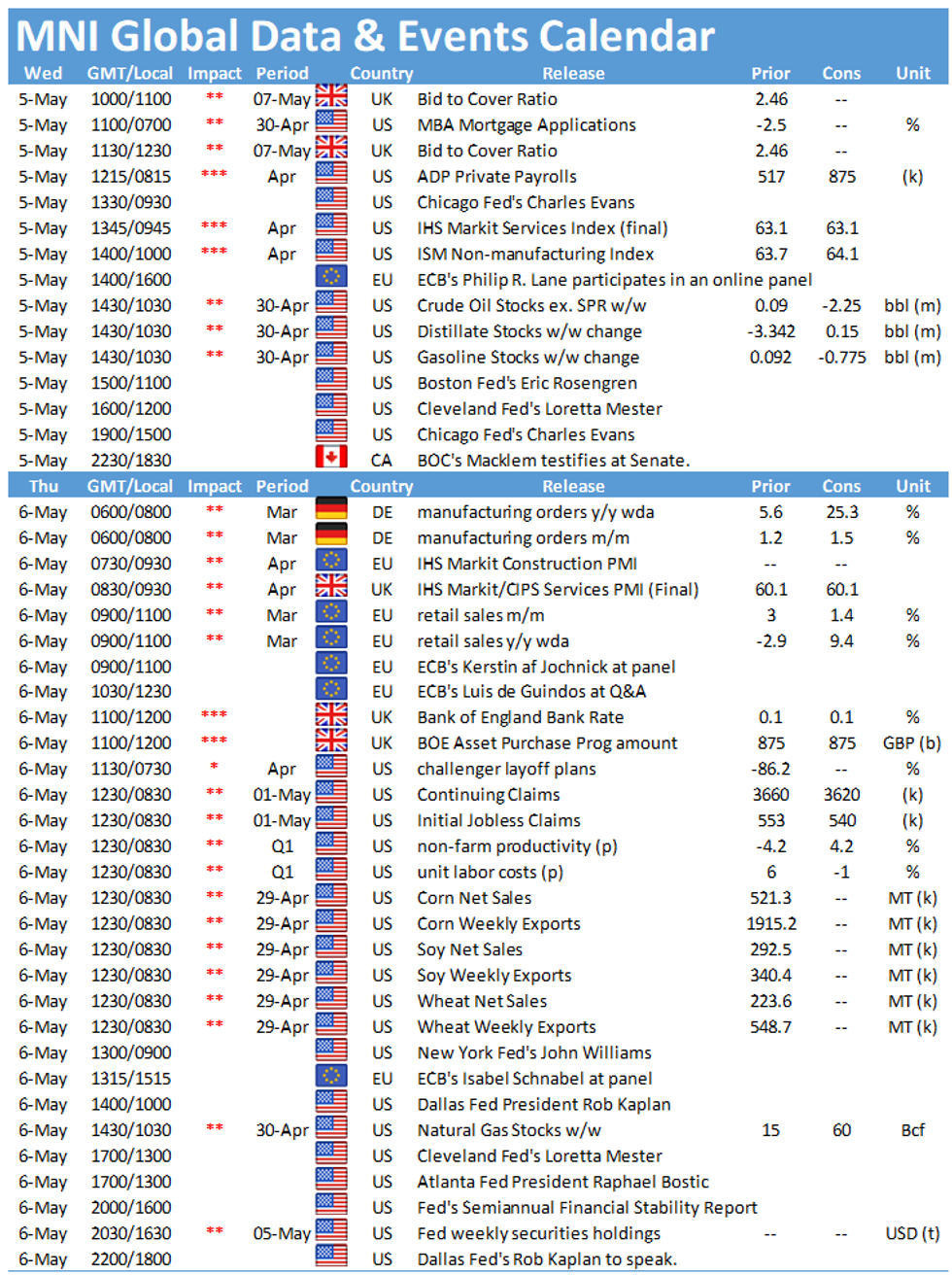

A subdued overnight session for Tsys (again, several Asian markets on holiday), ahead of what looks to be a busy Wednesday calendar.

- Jun 10-Yr futures (TY) down 3/32 at 132-10.5 with minimal price action in the early going (L: 132-10 / H: 132-15) amid light volumes (~200k). The 2-Yr yield is up 0.4bps at 0.1625%, 5-Yr is up 1.1bps at 0.8286%, 10-Yr is up 1.1bps at 1.6032%, and 30-Yr is up 1.4bps at 2.2753%.

- Equities still bouncing from Tuesday's mini-rout, with tech leading the way.

- Attention turns to the Treasury quarterly refunding announcement out at 0830ET, with press conference webcast at 1000ET.

- 0815ET ADP employment report is the early data focus, with final Apr Services PMI at 0945ET, and Apr ISM Services at 1000ET.

- NY Fed's Williams interview w the WSJ this morning, worth a read for his take on asset price "froth", supply/demand pressures on near-term inflation, and global COVID risks for the U.S. outlook.

- Chicago Fed's Evans (0930ET), Boston's Rosengren (1100ET) and Cleveland's Mester (1200ET) each present their economic outlooks, with Q&As.

- In supply, $35B of 119-day bills auctioned at 1130ET. NY Fed buys ~$6B of 4.5-7Y Tsys.

EGB/GILT SUMMARY - Unwinding Yesterday's Gains

European sovereign bonds have traded weaker this morning, retracing some of yesterday's gains.

- Gilts yields are 2-3bp higher on the day with the curve 1bp steeper.

- The bund curve has similarly bear steepened with the 2s30s spread 2bp wider.

- OATs trade broadly in line with bunds.

- BTPs have followed core EGBs lower with cash yields up 1-3bp.

- Supply this morning came from the UK (Gilts, GBP4.75bn), Germany (Bobl, EUR3.328bn allotted) and Greece (Bills, EUR812.5mn).

- Euro area services PMI prints for April were mixed. Germany and France came in slightly below expectations (with the former back in contraction territory), Italy missed by a wide margin (47.3 vs 50.0 consensus), while Spain surprised higher (54.6 vs 50.0),

EUROPE ISSUANCE UPDATE: UK, German Auctions, Greek Syndication

UK DMO Sold GB2bn of the 0.875% Jan-46 Gilt: Average yield 1.332% (Prev. 1.332%), bid-to-cover 2.17x (Prev. 2.54x)

Also sold GBP2.75bn of the 0.25% Jul-31 Gilt: Average yield 0.924% (Prev. 0.892%), bid-to-cover 2.67x (Prev. 2.97x)

Germany Allots E3.328bn of the 0% Apr-26 Bobl, Average yield -0.61% (Prev. -0.66%), bid-to-cover 1.10x (Prev. 1.41x)

Greek syndication: 5-Yr EUR Benchmark Update:

- Guidance is MS+50bps +/-3bps (will price in range)

- IOIs > E14bn

- Books are open, today's business

EUROPE OPTION FLOW SUMMARY

Eurozone:

2RZ1 100.25/100ps 1x1.5 vs 3RM1 100.12/99.87ps, bought the 2yr for half in 3k

3RZ1 99.87/62/50 broken put fly, bought for 2.25 in 5k

UK:

0LU1 99.75/99.625/99.50p fly bought for 3.25 in 7.5k

US:

W1 TY 131.50p vs W2 TY131p, bought the week 2 for flat in 20k (rolling to extend by 1 week)

FOREX: NZD On Top as Unemployment Rate Unexpectedly Slips

- Antipodean currencies are bouncing early Wednesday, with NZD the strongest in G10 after a solid jobs data release overnight which saw the unemployment rate unexpectedly shed 0.2 ppts. This sees NZD/USD bounce back above the 50-dma at $0.7141, with the week's highs of $0.7212 the next target.

- The USD is firmer after an eventful week, with the USD Index showing above Tuesday's best levels to near the 50-dma resistance at 91.7426.

- The weakest currencies so far Wednesday are CHF, EUR and SEK, while NZD, AUD and CAD outperform.

- Today's ADP Employment Change and ISM Services Index numbers will be carefully watched for any further clues ahead of Friday's Nonfarm Payrolls update. Monday's Manufacturing ISM number may have tempered expectations, but markets still expect further resilience in today's ADP number (Exp. +850k, Prev. +517k). Central bank speakers include ECB's Vasle and Lane, with Fed's Evans, Rosengren and Mester also due.

FX OPTIONS: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2025-30(E561mln), $1.2040-55(E1.4bln), $1.2120(E650mln)

- AUD/USD: $0.7750(A$959mln)

- USD/CAD: C$1.2300($1.1bln)

Price Signal Summary - E-mini S&P Support Still Intact

- In the equity space, E-minis traded in a volatile manner yesterday. Support levels to watch are; 4110.50, Apr 20 low and trendline support that intersects at 4099.00, drawn off the Mar 4 low. The support zone will likely determine the outcome of this correction - will it be a shallow one if support holds or develop into a deeper pullback on a break?

- On the commodity front, the Gold outlook is bullish and the focus is on $1805.7, Feb 25 high. Watch key short-term support at $1756.2, Apr 29 low. The Brent (N1) uptrend has resumed. The focus is on the psychological $70.00 level and $71.75, Jan 8 2020 high (cont). WTI is firmer too and bulls are eyeing the key resistance at $67.29, Mar 8 high.

- In FX, EURUSD last week failed to confirm a clear break of the bear channel resistance drawn off the Jan 6 high. The subsequent sell-off highlights a bearish threat. Watch support at, 1.2014/1988, the 20- and 50-day EMAs. This support zone has been probed. A clear break would open 1.1943, Apr 19 low. GBPUSD remains below 1.4009, Apr 20 high. The break on Apr 30 of support at 1.3824, Apr 22 low strengthens a bearish case. The focus is on 1.3717, Apr 16 low. The USDJPY maintains a bullish tone following last week's gains. Attention is on 109.96 next, Apr 9 high.

- In the FI space, Bunds (M1) have recently breached 170.05, 76.4% of the Feb 25 - Mar 25 rally. This opens 169.24, Feb 25 low. Short-term gains are considered corrective. Short-term risk in Gilts is skewed to the downside. The next support and intraday bear trigger is at 127.32, Apr 1 low.

EQUITIES: Stocks Bounce Sharply, Dip Buyers Out in Force

- Following the softer finish on Tuesday, markets are rebounding on the continent, helping to boost European markets higher by over 1% apiece. The EuroStoxx50 is outperforming, rising by close to 1.5% while France's CAC-40 lags slightly, but still trades higher by 0.9% or so.

- In contrast to yesterday's weakness, Europe's tech sector is leading, with materials and industrials also strong. This reversal in sentiment is clearly helping fuel US futures, with the NASDAQ future indicating a strong open later today.

- Dip buying in the late US session helped support prices well ahead of the Apr 20 low and key support at 4110.50, keeping the outlook positive despite near-term volatility.

- T-Mobile US, PayPal and General Motors are among the earnings highlights Wednesday.

COMMODITIES: WTI, Brent Firmer for a Third Session, Narrowing In On Cycle High

- Oil markets are buoyant for a third session, with WTI and Brent hitting new multi-month highs and narrowing the gap with the cycle best posted in early March. The rebounding oil market is countering any downside pressure from the stronger greenback, with further strength noted in the futures curve, in which all contracts out to 2025 now sit above $54/bbl for WTI.

- Precious metals price action has been more muted, with both gold and silver in negative territory. Silver is underperforming, helping correct the gold/silver ratio, which has traded under pressure across April.

- Focus turns to the weekly DoE crude oil inventories data, which are expected to show a draw of near 3mln bbls for headlines stockpiles.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.