-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Markets on Fed Watch

HIGHLIGHTS:

- Light trade as markets await FOMC, with Powell's presser the focus

- Any mention of taper talk, views on the transitory nature of inflation and the median 2023 dot will be key

- WTI inches to new cycle highs

US TSYS SUMMARY: Edging Higher Pre-FOMC

Tsys are a little stronger Wednesday though within yesterday's narrow ranges ahead of this afternoon's FOMC decision (1400ET; 1430ET press conference).

- Sep 10-Yr futures (TY) up 2.5/32 at 132-19.5 (L: 132-15.5 / H: 132-20), volume <170k.

- The 2-Yr yield is down 0.2bps at 0.1611%, 5-Yr is down 0.5bps at 0.7758%, 10-Yr is down 0.7bps at 1.4854%, and 30-Yr is down 0.2bps at 2.1843%.

- Not much more to say at this point about the Fed decision that's not in our preview.

- Arguably the stage is set for a hawkish surprise given the Tsy rally over the past month; if so, that's most likely to be initially delivered via the decision through the dot plot (in case of a 'solid' 2023 hike dot and maybe some more dots drifting into 2022).

- But the statement won't see major changes, and Powell's messaging is unlikely to be much different from vs previous pressers. The slightly hawkish tilt there (which is widely expected, it seems) would be Powell opening by noting the FOMC is beginning to think through their options on adjusting asset purchases - but with only "transitory" inflation so far and slow jobs growth, are still quite a ways from reaching the "substantial further progress" marker.

- So Powell's emphasis likely on just "talking about talking about tapering" for now.

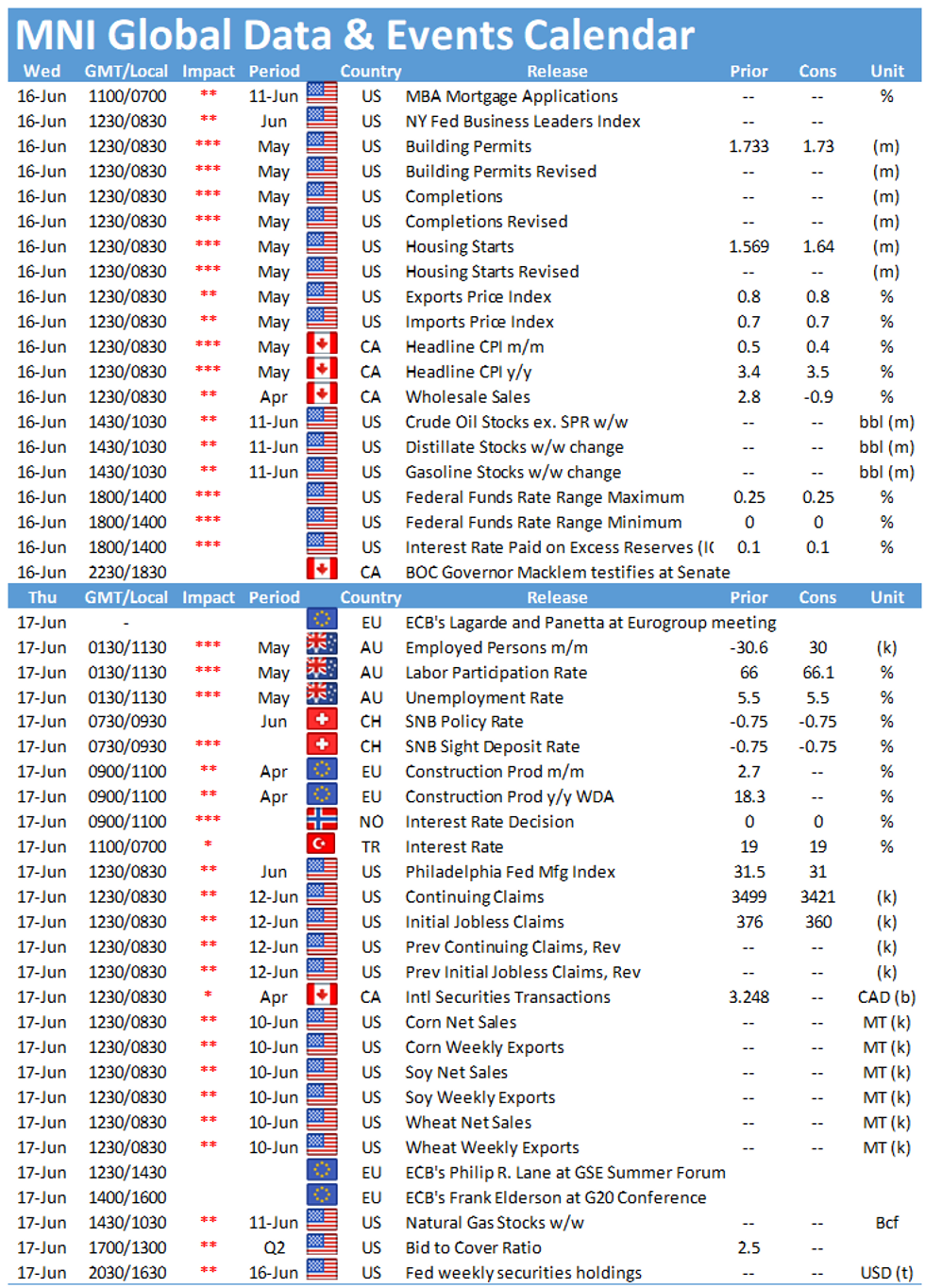

- It's not just FOMC today: housing starts/building permits data out at 0830ET, alongside import/export price indices.

- In supply: $35B 119-day bill auction at 1130ET. No NY Fed operations due to FOMC.

EGB/GILT SUMMARY: Inching Higher Ahead of FOMC

European sovereign bonds have broadly firmed this morning while equities trade mixed.

- The gilt curve has bull flattened with the 2s30s spread 2bp narrower.

- German bond yields are 1-2bp lower on the day with the curve similarly a touch flatter.

- It is a similar story for OATs, which trade in line with bunds.

- BTPs also trade in line with core EGBs. Cash yields are 1-2bp lower this morning.

- UK CPI pushed up to 2.1% Y/Y for May, eating the 1.8% consensus. Core CPI pushed up to 2.0% Y/Y and against exceeded expectations (1.5%).

- Supply this morning came from the UK (Gilts, GBP2.5bn), Germany (Bunds, EUR4.085bn allotted), Portugal (BTs, EUR1.25bn). Italy also conducted a tap issuance for specialists (EUR504mn of the 3.00% Aug-29 BTP and EUR971mn of the 5.25% Nov-29 BTP).

EUROPE ISSUANCE

UK DMO sells GBP2.5bln of the 0.625% Jul-35 Gilt, Avg yield 1.115% (Prev. 1.264%), Bid-to-cover 2.74x (Prev. 2.53x), Tail 0.1bp (Prev. 0.2bp)

Germany sells new 0% Aug-31 Bund:

Allots E4.085bln 0% Aug-31 Bund, Avg yield -0.19% (Prev. -0.09%), Bid-to-cover 1.08x (Prev. 1.08x), Buba cover 1.33x (Prev. 1.28x)

Italy sells Aug-29 and Nov-29 BTPs in Specialist Tap:

- E504mln 3.00% Aug-29 BTP, Average yield 0.508%

- E971mln 5.25% Nov-29 BTP, Average yield 0.523%

OPTIONS FLOW SUMMARY

Eurozone:

RXN1 170.50p, bought for 3 in 2k

DUN1 112.20/112.10/112.00/111.90p condor, bought for 3.5 in 1.5k

3RZ1 100.25/100/99.75p fly,sold at 5.75 in 5k

UK:

0LZ1 99.625^ bought for 18.5 in 4k. Was bought for 18.25 yesterday

2LU1 99.37/99.25/99.12p fly, bought for 1.75 in 3.5k

2LZ1 9937/9912ps 1x1.5 vs 99.62c, bought the ps for 1.75 in 3k

SFIM2 (SONIA) 99.80/99.70ps bought for -1 tick in 2.5k

FX SUMMARY- All eyes on Fed

- FX have generally stayed mixed in the early European session, as market participants awaits the US FOMC.

- As per our MNI Fed preview:

- The 2023 Fed funds rate dots in the SEP are likely to show further support for a hike, with a good chance the median rises. The outlook for "transitory" inflation will also be eyed in the projections.

- The Fed is likely to hold off on tweaking the IOER and ON RRP rates (though prevailing analyst consensus is that this is a very close call).

- Early action in G10s, was better buying interest of the British Pound, following the inflation beat.

- Cable pushed higher to print a 1.4123 high, just short of small resistance at 1.4130, but the cross has now faded to trade back below 1.4100 at the time of typing.

- Worst performers in G10s versus the USD, are the Scandis, with NOK down 0.32% and SEK 0.18%.

- USDSEK tested yesterday's high at 8.3428, printed 8.3430 high so far today.

- Above the latter eye the June high at 8.3619.

- In USDNOK, yesterday's high is situated at 8.3500.

- Nonetheless crosses are in fairly tight ranges on the margin, EURUSD in a 1.217 low, 1.2135 high, so far today.

- Looking ahead, all eyes are of course on the US FOMC and presser.

FX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2115-20(E1.2bln-EUR puts), $1.2130(E428mln-EUR puts), $1.2200(E551mln)

- USD/JPY: Y109.15-25($660mln), Y109.70-75($965mln-USD puts),

Y110.00-05($775mln-USD puts),Y110.25-31($656mln-USD puts) - AUD/USD: $0.7740-45(A$589mln-AUD puts)

- USD/CNY: Cny6.40($726mln-USD puts)

Price Signal Summary - EURUSD Bear Flag?

- In the equity space, sentiment remains bullish and the E-mini S&P (U1) traded higher again yesterday. The focus is on 4264.41, a Fibonacci projection. Further out, the recent break higher also exposes 4300.00. Initial firm support is at 4155.00, Jun 3 low.

- In the FX space, EURUSD still appears vulnerable following Friday's move lower that saw the pair breach the 50-day EMA and probe the 1.2104 Jun 4 low. This week's consolidation appears to be a bear flag. A deeper sell-off would open 1.2052, May 13 low. GBPUSD has tested the 50-day EMA at 1.4041. Attention is on the key support at 1.4006, May 13 low. The outlook is bullish while this level holds. A break of 1.4006 though would suggest scope for a deeper pullback. USDJPY remains above support at 109.19, Jun 7 low. Gains Monday and yesterday have exposed resistance and the near-term bull trigger at 110.33, Jun 4 high.

- On the commodity front, Gold on Monday probed support at $1856.2, Jun 4 low. A deeper sell-off would open $1843.2, the 50-day EMA. Trend conditions in oil remain bullish and price continues to trend higher. Brent (Q1) focus is on $75.60, Apr 25 high 2019 (cont). WTI (N1) registers another high print. The focus is on $73.20, 3.236 projection of Mar 23 - 30 - Apr 5 price swing.

- Within FI, Bunds (U1) maintain a bullish tone and the recent pullback is considered corrective. The focus is on 173.32 next, 76.4% of the Mar 25 - May 19 sell-off. Support is at 171.93, 20-day EMA. Gilts (U1) cleared 127.74/82 last week, the highs between Apr 20 and May 26. This opens 128.50, 1.00 projection of the May 13 - 26 - Jun 3 price swing. Support is at 127.34, Jun 10 low.

EQUITIES: Stocks Mixed, But Non-Directional Pre-Fed

- Stock markets across Europe are mixed ahead of the Wednesday NY open, with France's CAC-40 slightly higher, while Spanish stocks are lower by a similar margin.

- Europe's utilities and healthcare sectors are modestly outperforming, underlining the slight risk-off theme present in markets. Consumer discretionary, real estate and financials are the laggards.

- US futures are non-directional, with traders seemingly sitting on the sidelines ahead of this evening's Fed decision.

WTI, Brent Edge Off New Cycle Highs, But Uptrend In Tact

- WTI crude futures edged higher still in early Asia-Pac hours, resulting in new cycle highs of $72.83/bbl. This marks the 15th consecutive session of higher highs for WTI - boosting the RSI back into overbought territory.

- Today's DoE release will draw focus, with markets expecting the latest week of data to show a draw of just over 2.5mln bbls, while distillates are expected to show a small build.

- Spot gold and silver are largely non-directional, with markets awaiting the Fed decision later today. ,Markets are on watch for any signs that the Fed are to begin considering tapering asset purchases in the near future.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.