-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US MARKETS ANALYSIS - Markets Poised For Further Fedspeak

HIGHLIGHTS:

- Equities flat, but poised ahead of busy Fed speech schedule

- Sterling stronger for second day as markets pull back rate cut bets

- Italian politics finds another crisis

US TSYS SUMMARY: Curve A Touch Flatter Pre-CPI, 30-Yr Supply, Impeachment Vote

The recent steepening of the curve is showing further signs of taking a breather Wednesday, with long end yields retracing slightly.

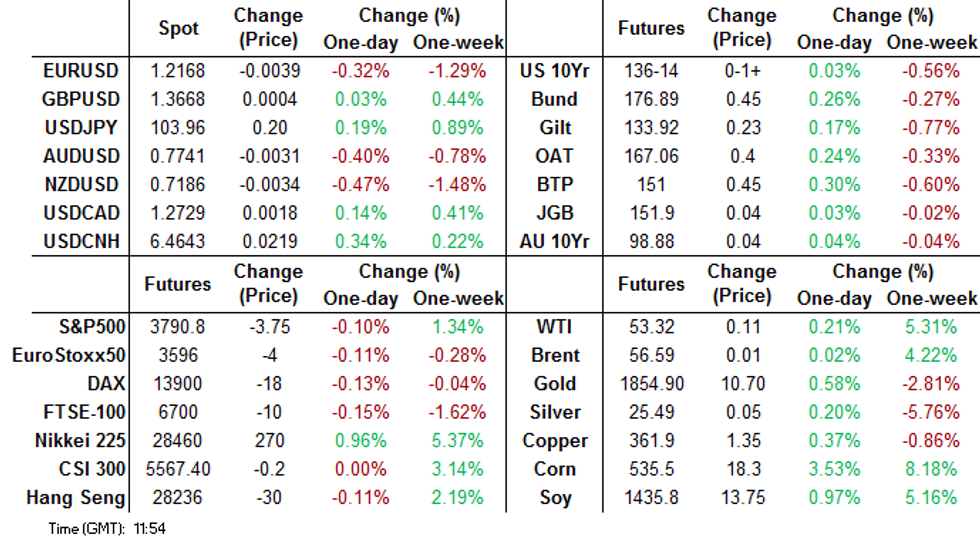

- Mar 10-Yr futures (TY) up 2.5/32 at 136-15 (L: 136-13 / H: 136-19.5) on heavy volumes, ~425k traded.The 2-Yr yield is up 0.2bps at 0.1469%, 5-Yr is flat at 0.4995%, 10-Yr is down 0.5bps at 1.124%, and 30-Yr is down 0.6bps at 1.8655%.

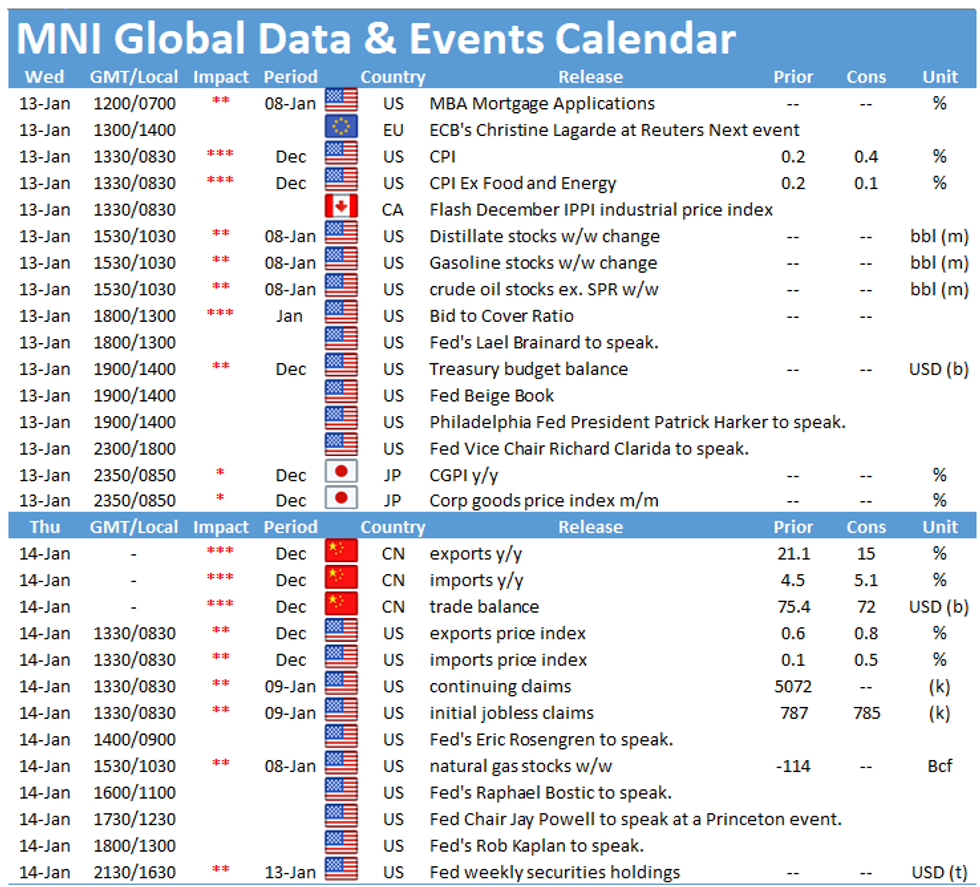

- House of Reps set to vote on Trump's impeachment (debate 0900ET, vote likely mid-/late afternoon) - likely to pass, most attention overnight on reports that McConnell and others in Senate increasingly favoring impeachment.

- Attention also turning to Thursday's stimulus announcement by Pres-Elect Biden, time TBA.

- 0830ET sees Dec CPI data.

- Fed speakers highlighted by Gov Brainard at 1300ET; StL's Bullard and Minn's Kashkari (both 0930ET), Philly's Harker at 1400ET, and VC Clarida at 1500ET also bear watching. Beige Book out at 1400ET.

- $55B of 105-/154-day bills sell at 1130ET, with main event being $24B 30-Yr re-open at 1300ET. NY Fed buys ~$3.625B of 4.5-7Y Tsys.

EGB/GILT SUMMARY

European sovereign bonds have broadly rallied this morning alongside dollar strength and cautious trading in equities.

- Gilts have unwound some of yesterday's sell-off which followed comments from BoE Governor Andrew Bailey on the difficulties of implementing negative rates. Gilt yields are now 1-3bp lower on the day with the curve 1-2bp flatter.

- The bund curve has similarly bull flattened with the 2s30s spread 3bp narrower.

- OATs have traded firmer with the longer end also outperforming. Cash yields are down 1-3bp. Last yields: 2-year -0.6263%, 5-year -0.6188%, 10-year -0.2820%, 30-year 0.4100%.

- The BTP curve has flattened with the the 2s10s spread edging down 2bp on the back of the short end trading weaker and the longer end firming.

- Supply this morning came from the UK (linker, GBP300mn), Germany (Bobl, EUR4.066bn allotted) and Portugal (OTs, EUR1.25bn).

- Eurozone industrial production data for November came in better than expected (2.5% Y/Y vs 0.2% survey).

FOREX: Sterling Within Reach of Multi-Year Highs

GBP trades well for a second session, outperforming all others in G10, as markets trim further their expectations for negative interest rate policy in the near term. GBP/USD now trades well within range of the recent 1.3704 high printed on Jan 4th - the highest level in two-and-a-half years.

Elsewhere, the USD is a touch firmer, partially reversing yesterday's downtick, but price action is muted so far. Antipodean currencies are soft, with AUD and NZD weaker despite generally solid commodities early Wednesday.

Equity futures in the US are broadly flat ahead of the unofficial beginning of earnings season. E-mini S&P sits just above unchanged.

US CPI takes focus going forward, with Fed's Beige Book crossing later in the session. There's plenty of Fedspeak to mull over, with speeches from Bullard, Kashkari, Brainard, Harker and Clarida all due.

OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2095-00(E543mln), $1.2200-10(E1.1bln), $1.2285-00(E985mln), $1.2350(E656mln)

USD/JPY: Y102.00($525mln), Y103.00($1.4bln), Y103.70-80($990mln), Y104.00-15($1.4bln)

USD/CAD: C$1.2750-65($790mln)

USD/CNY: Cny6.45($594mln), Cny6.60($640mln)

USD/MXN: Mxn19.85($520mln), Mxn20.00($500mln)

TECHS: Price Signal Summary - Sterling Remains Bid

- In FX, EURUSD maintains a weaker tone despite the recovery from recent lows. Support levels to watch are:

- 1.2130, Dec 21 low and 1.2090, the 50-day EMA. A break of both would signal scope for a deeper pullback.

- USDJPY attention remains on key resistance at 104.31, the bear channel top drawn off the Mar 24 high. A break would highlight a stronger reversal. Monday's high of 104.40 is the bull trigger.

- Sterling remains bid. Resistance levels to watch in Cable today are:

- 1.3704 High Jan 4 and

- 1.3750 0.764 projection of May 18 - Sep 1 rally from Sep 23 low

- EURGBP cleared key support at 08933 yesterday. The focus is on:

- 0.8867, Nov 23 low and a key support

- On the commodity front, Gold remains vulnerable following the recent sell-off. Watch support at $1810.7 - 76.4% of the Nov 30 - Jan 6 rally. Oil contracts remain bullish. Brent (H1) targets $58.59 - 76.4% of the Jan - Apr 2020 sell-off (cont). WTI (G1) focus is on $54.50 - high Feb 20, 2020 and a key resistance (cont).

- A bearish risk still prevails in the FI space and S/T gains are considered corrective. Resistance levels to watch:

- Treasuries (H1) - 136-26+, Nov 11 low and recent break out level.

- Bunds (H1) - 177.01, Dec 23 low and recent breakout level.

- Gilts (H1) - 134.23, intraday high and 134.82 20-day EMA.

EQUITIES: Mixed-to-Flat Pre-NY

Stocks in Europe are broadly flat ahead of the Wall Street opening bell, with markets awaiting any further macro cues from the deluge of Fedspeak later today. Italy's FTSE-MIB is outperforming, but only marginally, while Germany's DAX is a very slight underperformer.

Financials and consumer discretionary sectors are the laggards, while communication services and real estate are mildly firmer.

In futures space, the e-mini S&P is stable and very slightly higher, indicating a flat open later today. Focus remains the beginning of quarterly US earnings season, with financial giants JP Morgan, BlackRock, Wells Fargo and Citigroup among those due to report.

COMMODITIES: Oil Rally Peters Out, Metals Flat

Having hit new highs in Asia-Pacific trade, the fearsome oil rally over the past few months has petered out slightly ahead of the COMEX open later today. WTI hit $53.95 in early Asia-Pac trade, while Brent futures touched $57.42 and faded from there. Markets watch today's DoE crude oil inventory numbers for direction, with consensus looking for a draw of around 2mln barrels from headline crude stocks.

Precious metals are broadly flat - spot gold remains pinned between the two directional parameters of the $1866.84 50-dma and the $1841.76 200-dma to the downside.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.