-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI US MARKETS ANALYSIS - Markets Steady Despite Trump Hurdle

HIGHLIGHTS:

- Trump throws last minute hurdle in front of stimulus package

- Markets still see strong chance of Brexit trade deal by year-end

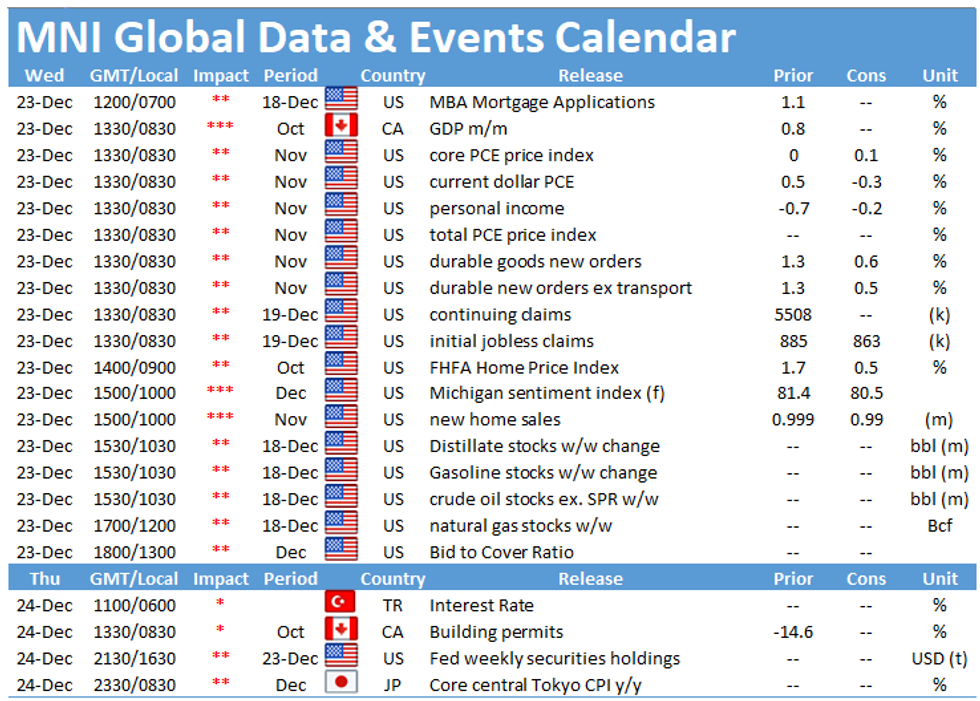

- Last data flurry of the year, with durable goods, personal income/spending, weekly jobless claims and new homes sales all due

TSYS SUMMARY: Tsys Weaker Despite Twist In Fiscal Saga

An unexpected twist in the ongoing fiscal saga has done little to dampen holiday spirits, with Treasuries heading lower in overnight trade, alongside higher equities.

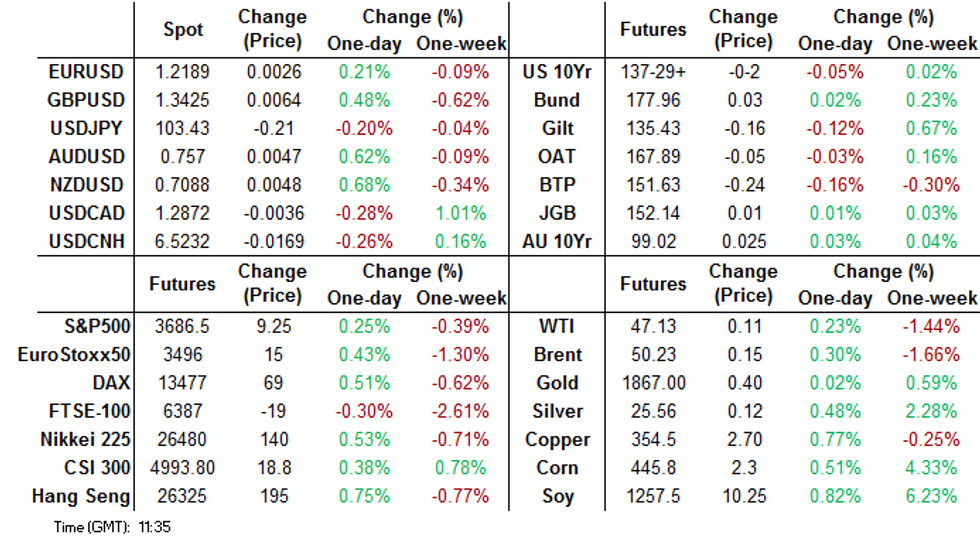

- The 2-Yr yield is up 0.4bps at 0.1169%, 5-Yr is up 0.5bps at 0.367%, 10-Yr is up 0.8bps at 0.9247%, and 30-Yr is up 1.3bps at 1.6609%.

- Mar 10-Yr futures (TY) down 1.5/32 at 137-30 (L: 137-29 / H: 138-03)

- Tsys had risen following Pres Trump's threat late Tuesday not to sign the relief/funding Bill passed by Congress - unless the $600 in payments to individuals is boosted to $2k - setting up another potential gov't shutdown Dec 28 and a delay of relief funding.

- Lots on the agenda, here's the a basic state of play: Trump is expected to veto the National Defense Authorization Act today; House Democrats will try to approve $2k stimulus checks tomorrow via unanimous consent; the House is set to return to session on Dec 28 and the Senate on Dec 29 to override Trump's defense veto.

- Data includes a big slate at 0830ET: Nov durable goods, Nov personal income/spending, and weekly jobless claims. Nov new home sales and Final UMich sentiment at 1000ET.

- In supply, $55B of 105-/154-day bills sell at 1130ET, with 2Y FRN re-open at 1300ET. NY Fed buys ~$6.025B of 4.5-7Y Tsys.

EGB/Gilt Summary

European govies have traded weaker alongside modest equity gains and a leg lower for the USD.

- Gilts have underperformed core EGBs. Cash yields are up to 2bp higher on the day with the curve 1bp steeper.

- Bunds trade close to unch on the day. Last yields: 2-year -0.7333%, 5-year -0.7561%, 10-year -0.5927%, 30-year -0.2013%.

- OATs trade boadly in line with bunds and little changed.

- BTPs have traded weaker with yields broadly 2bp higher.

- UK PM Boris Johnson and EC President Ursula von der Leyen are said to have intensified 'hotline' talks, although a breakthrough on access to the UK's fishing waters remains elusive for now.

- The UK and France have reopened the border, but the backlog of cargo remains.

- The final estimate of Spanish Q3 GDP came in slightly lower than expected at 16.4% Q/Q vs 16.7% previous/survey.

EUROPE OPTIONS SUMMARY

US

TYG1 137.00 puts 3750 blocked at 0-12, looks like a lift

EDH1 20.0K blocked at 99.820, looks like a sale, carbon copy of a trade seen earlier in Asia-Pac hours.

Then EDH1 saw ~15K given at 99.820 on screen on the follow

FOREX: Greenback Slipping as Trump Slows Stimulus Progress

Just ahead of the final hurdle, President Trump slowed the progress of the COVID stimulus package, demanding that direct payments be upped to $2,000 apiece from the agreed $600 payment. Equity futures were knocked lower initially, but the outlook seems more stable ahead of the NY open.

The USD is a touch weaker, with the greenback on the backfoot against most others in G10.

GBP is modestly firmer as markets seem a touch more optimistic about the prospects of a Brexit deal before year-end. Reports this morning suggest EU negotiator Barnier has been sidelined in favour of direct talks between UK PM Johnson and EU's von der Leyen, as well as Germany's Merkel and France's Macron. Fish remain the outstanding issue, but betting markets still apportion a near 70% chance of a deal by the end of the year.

A pre-Christmas deluge of data crosses Wednesday, with weekly jobless claims, personal income/spending, prelim durable goods and new home sales data all crossing. Canadian GDP could also draw interest.

TECHS: Gilts And Sterling Key Level Watch

Recent activity in Gilts and Sterling has been volatile. The ranges highlight a number of key broad levels.

Gilts (H1) key levels to watch are:

- SUP 1: 134.14 Low Dec 16 and the key bear trigger

- SUP 2: 133.52 Dec 2 low and the trigger for weakness towards 133.00

- RES 1: 136.03 High Dec 11 and the bull trigger

- RES 2: 137.10 1.618 proj of Dec 2 - 11 rally from Dec 16 low

Cable has traded in a 489 pip range since Dec 11. Key levels are:

- SUP 1: 1.3135 Low Dec 11 and a key bear trigger

- SUP 2: 1.2900 76.4% retracement of the Sep 23 - Dec 17 rally

- RES 1: 1.3624 High Dec 17 and the bull trigger

- RES 2: 1.4377 Apr 2018 high

Cable is still challenging a key pivotal monthly trendline resistance at 1.3372, drawn off the 2017 high.

EURGBP key levels to monitor:

- SUP 1: 0.8983 Low Dec 4 / 17 and the bear trigger

- SUP 2: 0.8861 Low Nov 11 and primary support

- RES 1: 0.9230/92 High Dec 11 / High Nov 9 and the bull trigger

- RES 2: 0.9501 High Mar 19 and primary resistance

FX OPTIONS: Expiries for Dec23 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2150(E749mln), $1.2200-10(E1.1bln), $1.2250(E951mln-EUR puts), $1.2275-80(E955mln-EUR puts)

USD/JPY: Y101.00($780mln), Y103.00($1.57bln-USD puts)

GBP/USD: $1.3600(Gbp638mln)

EUR/GBP: Gbp0.8800-15(E630mln-EUR puts), Gbp0.9145-50(E656mln-EUR puts)

AUD/NZD: N$1.0700(A$684mln-AUD puts)

EQUITIES: European Stocks Inch Higher, UK Names Lag

European indices are generally higher across core markets, with French, German markets slightly outperforming (posting gains of 0.7% or so) while the UK's FTSE-100 lags slightly on GBP strength to trade roughly flat.

Energy and real estate are trading well, with utilities and consumer discretionary not far behind. Defensive healthcare and consumer staples are the sole sectors in the red.

The e-mini S&P steered clear of any test of the Monday lows at 3596.00, with the Tuesday highs of 3695 in view for now.

COMMODITIES: WTI Holds Range After Bouncing Off Overnight Low

WTI and Brent crude futures both trade in minor positive territory, having erased early weakness in the Asia-Pac trading session after commodities were sold on Trump putting up hurdles to the progress of the COVID stimulus bill. With the initial move lower faded, WTI now holds the lower-end of the recent range and eyes support at the Fib retracement for the November-December rally at $45.59.

Similarly, gold is rangebound - although silver slightly outperforms to trade with gains of 1% or so. USD weakness and equity outlook remains the key driver.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.