-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI US MARKETS ANALYSIS - Modest Risk-Off Undercurrent

HIGHLIGHTS:

- Modest risk-off undercurrent as Delta variant, Russian hack concerns weigh

- Equities softer, e-mini S&P opens 15 point gap with ATH

- MNI Chicago PMI, ADP Employment Change in focus

US TSYS SUMMARY: Near Session Highs Amid Risk-Off Undercurrents

Treasuries have benefited from a risk-off undercurrent in overnight trade Wednesday, with equities slipping and month-/quarter-end arriving.

- Sep 10-Yr futures (TY) traded flat in Asia-Pac session, but now up 5/32 at 132-13.5 (L: 132-06 / H: 132-14). Gains began around 0400ET when Bild reported a Russian state-backed entity launched a cyberattack on the German banking system (European bank stocks weakened sharply). Some lingering concern on Delta COVID variant spread as well.

- The 2-Yr yield is down 0.8bps at 0.2427%, 5-Yr is down 1.6bps at 0.8734%, 10-Yr is down 1.5bps at 1.4545%, and 30-Yr is down 1.7bps at 2.0667%.

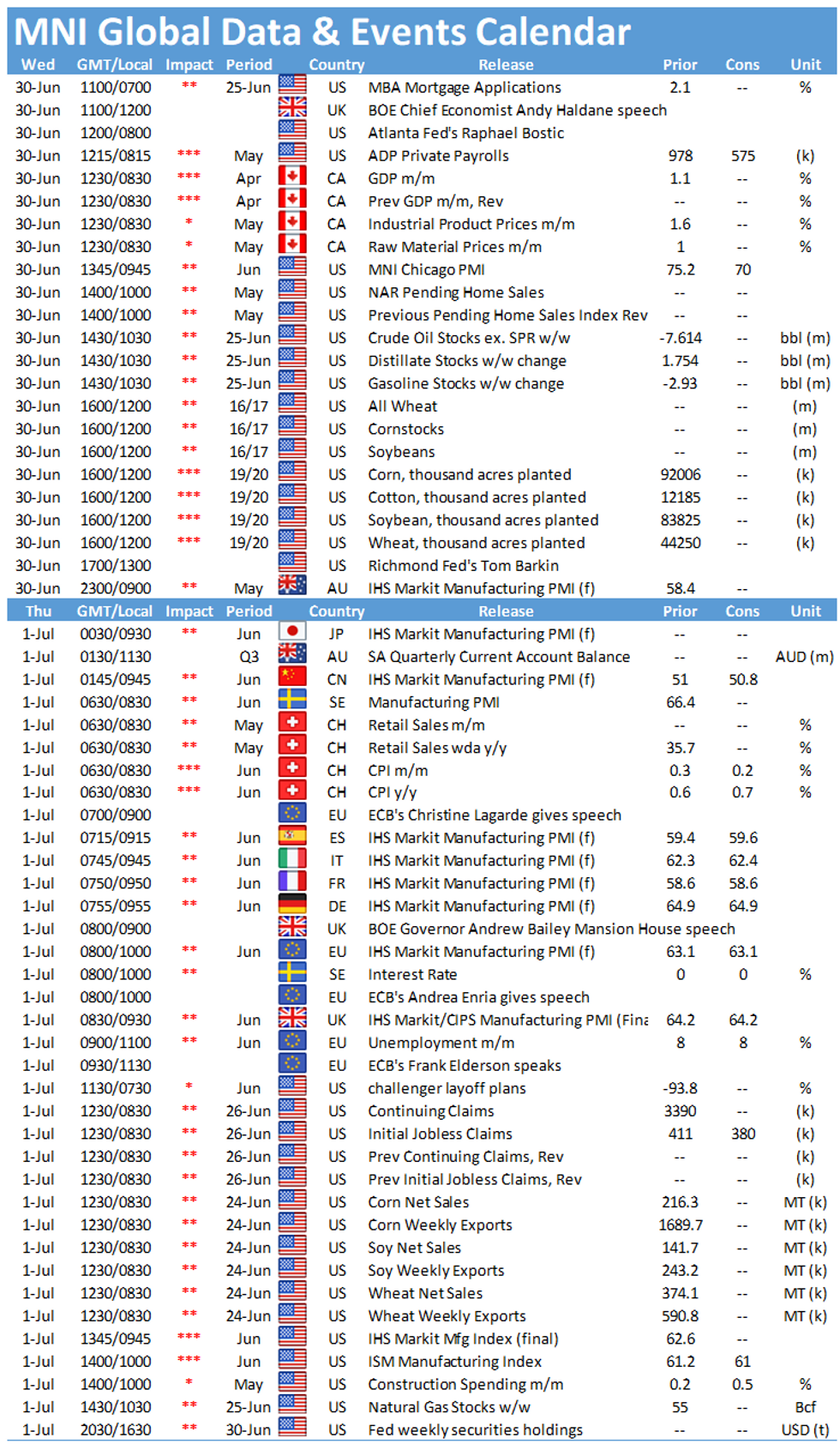

- Data today includes weekly MBA mortgage applications (0700ET), Jun ADP Employment (0815ET), MNI Chicago Business Barometer (0945ET), and May pending home sales (1000ET).

- We hear again from Atlanta Fed's Bostic (0800ET) and Richmond's Barkin (1300ET).

- Only supply is $35B 119-day bill auction at 1130ET. NY Fed buys ~$3.225B of 7Y-10Y Tsys.

EGB/GILT SUMMARY: Bull Flattening

European sovereign bonds have rallied this morning and curves have bull flattened alongside fresh losses for equities.

- Gilts rallied early into the session before losing momentum around mid-morning. Cash yields are 1-2bp lower on the day with the curve 1bp flatter.

- Bunds have slightly outperformed gilts with yields at the very long-end now down 4bp.

- It is a similar story for OATs where yields have pushed down 1-4bp across the curve.

- The final estimate of UK Q1 GDP was a touch weaker than the initial print in Q/Q terms (-1.6% vs -1.5% previously). Elsewhere the preliminary harmonised June CPI print for France met expectations (1.9% Y/Y), while German unemployment fell faster than expected in June (-38k vs -20k survey).

- Supply this morning came from Italy (BTPs, EUR6.0bn) and Greece (GTBs, EUR625mn). In addition, Bloomberg reports a deal size of EUR500n for the Latvia long 7-year.

EUROPE ISSUANCE UPDATE: Latvian syndication

Italy sells:

E3bln 0% Apr-26 BTP, Avg yield 0.120% (Prev 0.170%), Bid-to-cover 1.37x (Prev 1.36x)

E1.5bln 0.95% Aug-30 BTP, Avg yield 0.740% (Prev 1.200%), Bid-to-cover 1.56x (Prev 2.07x)

E1.5bln 0.90% Apr-31 BTP, Avg yield 0.810% (Prev 0.830%), Bid-to-cover 1.57x (Prev 1.50x)

Latvia long 7-year final terms: Size set earlier at E500mln WNG

Spread set at MS+6 (IPT was MS+12bps area, guidance revised to MS+9bps area)

Books above E2.2bln

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 171/170ps, bought for 13 in 1k

RXQ1 172.00/172.50^^, sold at 104 in 1k

RXQ1 170.5p, bought for 15 in 2k

UK:

2LU1 99.25p, sold at 4.25 and 4 16.5k

2LZ1 99.00/98.75 ps with 2LX1 99.25/99.12ps 1x2, sold the strip at flat in 5k

FOREX: USD Index Firmer Despite Softer Yield Curve

- The USD index is on the front foot, building on the late progress made on Tuesday, although the week's best levels are out of reach for now at 92.194. The more solid greenback comes despite an ebb lower in US 10y yields this morning, which have slipped to new weekly lows of 1.460% as equity markets edge further off session highs.

- Haven currencies are trading well, with JPY among the best performers of the day as European and US equity markets slipped on headlines that Russia had conducted a cyber attack on the German banking system, according to reports in Bild.

- Antipodean currencies are faring poorly, with AUD and NZD among the largest decliners ahead of the NY crossover. AUD/USD eyes the mid-June lows of 0.7476. A break below here would mark the lowest rate since December.

- MNI Chicago PMI data is the calendar highlight Wednesday, with activity expected to slow to 70.0 from 75.2 previously. ADP employment change also crosses, which markets will be watching for any clues ahead of Friday's NFP release.

- Outgoing MPC member Andy Haldane speaks on monetary policy at 1200BST, with Fed's Bostic and Barkin also due.

FX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2010-25(E829mln), $1.2064(E522mln-EUR calls)

- USD/JPY: Y109.45-50($1.4bln), Y110.20-25($1.5bln), Y110.50($1.9bln-$1.3bln USD puts), Y110.70-75($1.5bln), Y110.95-111.00($738mln), Y111.50($600mln-USD calls)

- EUR/GBP: Gbp0.8500-05(E505mln-EUR puts)

- AUD/USD: $0.7505-10(A$722mln-AUD puts)

- USD/CAD: C$1.2105($560mln)

- USD/CNY: Cny6.39($1.8bln)

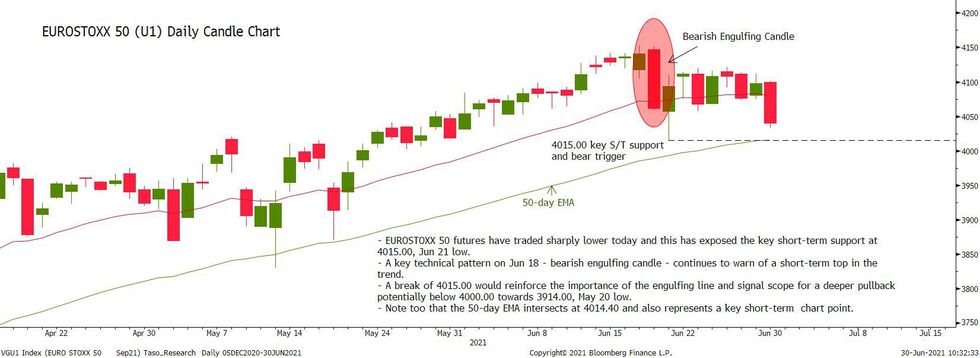

Price Signal Summary - EUROSTOXX 50 Bearish Engulfing Still In Play

- In the equity space, S&P E-minis maintain a bullish theme and sights are on the 4300.00 handle. EUROSTOXX 50 futures have traded sharply lower today and this has exposed the key short-term support at 4015.00, Jun 21 low. A key technical pattern on Jun 18 - bearish engulfing candle - continues to warn of a short-term top in the trend. A break of 4015.00 would reinforce the importance of the engulfing line and signal scope for a deeper pullback potentially below 4000.00 towards 3914.00, May 20 low. Note too that the 50-day EMA intersects at 4014.40 and also represents a key short-term chart point.

- In FX, the USD remains on a bullish path despite the recent corrective pullback. The EURUSD focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable. Attention is on 1.3717 next, Apr 16 low. The bear trigger is 1.3787, Jun 21 low. USDJPY needle still points north. Attention is on 111.30/64, Mar 26, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, the yellow metal broke lower yesterday and cleared support at $1761.1, Jun 18 low. The break confirms a resumption of the downtrend that started Jun 1 and note the move lower also confirmed a bear flag that developed during the most recent consolidation phase. The focus is on $1733.5, 76.4% retracement of the Mar 8 - Jun 1 rally. The Oil market trend condition remains bullish and pullbacks are considered corrective. Brent (Q1) focus is $76.97, 1.23 projection of Mar 23 - May 18 - May 21 price swing. Support lies at $73.37, the 20-day EMA. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing. Watch support at $71.12, the 20-day EMA.

- Within FI, Bund futures are consolidating. The contract last week probed support at 171.80, Jun 17 low. A stronger sell-off would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is at 126.70, Jun 3 low and marks an important pivot level. The key resistance is at 128.39, Jun 11 high.

EQUITIES: Stocks Softer on Variant Concerns, Russia Hack

- Equity markets across the continent are softer, with core indices off around 1.0-1.6%. Peripheral Spanish and Italian markets are underperforming, down 1.6 and 1.3% respectively, but losses are broad-based as US futures are also offered.

- The e-mini S&P has retreated around 15 points off the week's alltime high. Variant concerns remain top-of-mind for markets, with the more transmissible Delta variant now detected across countries from Turkey to South Africa to the US.

- Elsewhere, sentiment was somewhat unsettled by headlines in German press reporting a Russian-based cyberattack on the German banking system. The likes of Deutsche Bank and Commerzbank both trade weaker.

- Europe's utilities sector is leading the decline, with consumer discretionary and financials sectors also adding weight. Healthcare and real estate are faring more favourably, although reman in negative territory.

COMMODITIES: Gold Clears Support, Confirming Bear Flag

- WTI and Brent crude futures trade in minor positive territory as markets unwind early weakness seen yesterday. The ebb higher comes despite modest strength in the greenback, with focus on the full OPEC+ videoconference on Thursday. Talks are clearly fraught, with reports this morning suggesting that negotiations had been delayed as Saudi and Russian representatives clashed on the need for more supply.

- Despite pulling back from the high, the outlook remains bullish. A positive price sequence of higher highs and higher lows remains intact and signals scope for further upside with attention on $75.01, a Fibonacci projection.

- Goldhas broken lower and cleared support at $1761.1, Jun 18 low. The break lower confirms a resumption of the downtrend that started Jun 1 and note the move lower has confirmed the bear flag that developed during the most recent consolidation phase.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.