-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Reverse Support Ahead Supply

MNI INTERVIEW: US Factories To See Expansion By Feb- ISM

MNI UST Issuance Deep Dive: Jan 2025

MNI US MARKETS ANALYSIS - Oil Strikes New Cycle High as OPEC+ Statement Eyed

HIGHLIGHTS:

- Equities resume uptrend, e-mini S&P tops out at new ATH

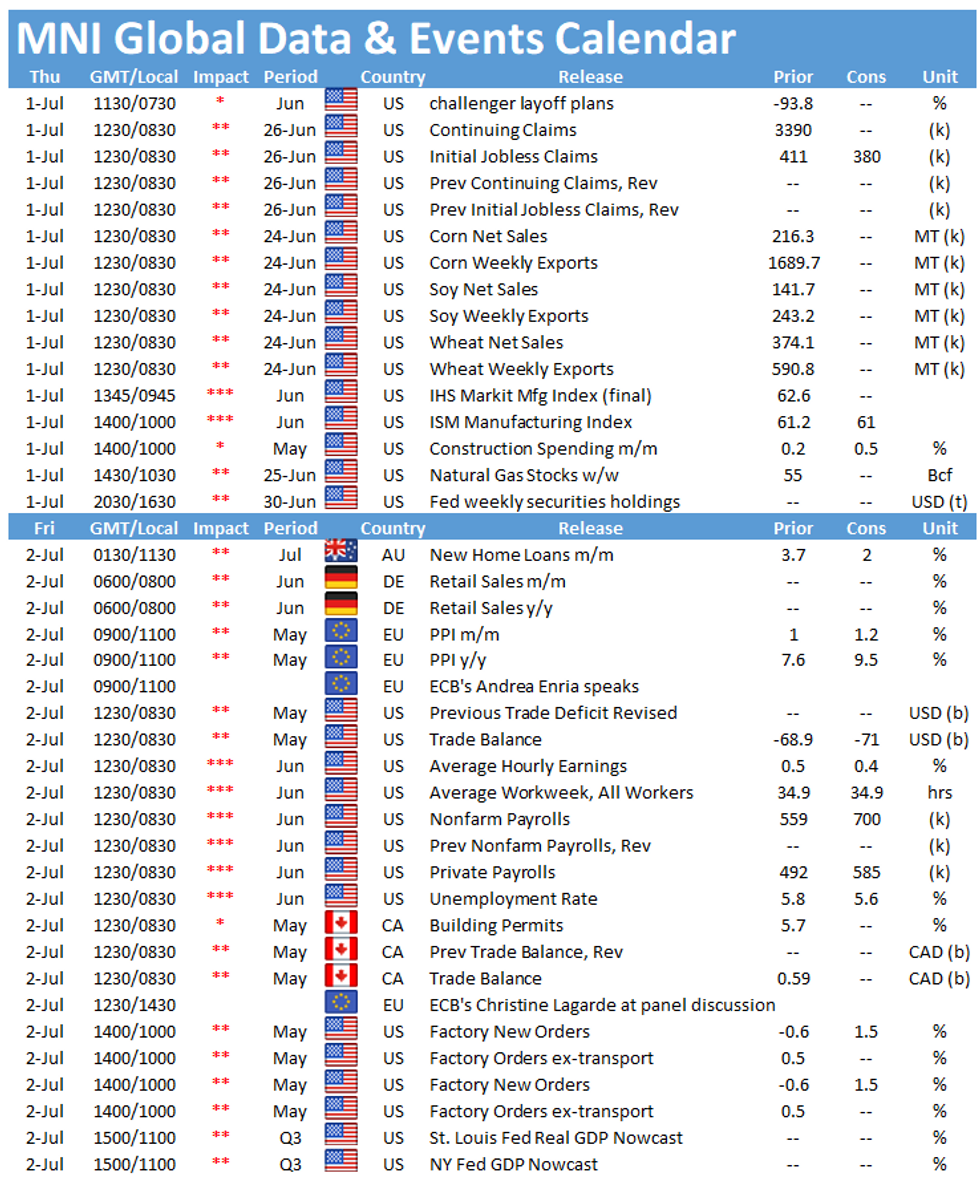

- Focus is on jobs data, with today's weekly claims, Challenger job cuts and ISM Manufacturing ahead of Friday's NFP

- Oil sees support ahead of formal OPEC+ statement

US TSYS SUMMARY: Weaker Ahead Of ISM And Jobless Claims Data

Treasuries have weakened overnight to begin the month/quarter/half, with data providing the focus of Thursday's session.

- Sep 10-Yr futures (TY) down 7.5/32 at 132-10, albeit within a limited range (L: 132-08 / H: 132-12) and <200k traded as of 0630ET.

- The 2-Yr yield is up 0.4bps at 0.2527%, 5-Yr is up 0.5bps at 0.8942%, 10-Yr is up 0.8bps at 1.4764%, and 30-Yr is up 1.4bps at 2.1%.

- Price action elsewhere is a little more inspiring: S&P futures have moved back flat after hitting fresh all-time highs overnight; DXY is at 3-month highs.

- Jun Challenger job cuts (0730ET) and weekly jobless claims (0830ET) give a bit more color on the labor market situation ahead of Friday's employment report. 0945ET sees final Jun Manuf PMI, with ISM Manuf more closely watched at 1000ET, alongside May construction spending.

- The only scheduled speaker ahead of the Independence Day weekend is Atlanta's Bostic (1400ET).

- Tsy auctions $80B total of 4-/8-week bills. NY Fed buys ~$2.025B of 22.5Y-30Y Tsys.

EGB/GILT SUMMARY: Unwinding Yesterday's Gains

European sovereign bonds have traded weaker this morning with curves bear steepening alongside modest gains for equities following yesterday's losses.

- Gilts have sold off with yields the very long end up 3bp. The curve is 3bp steeper.

- Bunds have similarly traded weaker with the longer end of the curve underperforming.

- OAT yields are now broadly 1-2bp higher on the day.

- German retail sales for May came in weaker than expected (-2.4% Y/Y vs -1.0% survey). The final eurozone manufacturing print for June came in at 63.4, a touch above the earlier estimate of 63.1.

- Supply this morning came from the UK (Gilts, GBP3.5bn), France (OATs, EUR10.99bn) and Spain (Bonos/Oblis/ObliEis, EUR5.286bn).

EUROPE ISSUANCE UPDATE:

UK sells GBP3.50bln 0.25% Jan-25 Gilt, Avg yield 0.281% (Prev. 0.189%), Bid-to-cover 2.34x (Prev. 2.60x), Tail 0.1bps (Prev. 0.1bps)

France sells:

E2.794bln 0% Nov-30 OAT, Avg yield 0.03% (Previous -0.07%), Bid-to-cover 2.38x (Prev. 2.04x)

E4.176bln 0% Nov-31 OAT, Avg yield 0.13% (Previous 0.16%), Bid-to-cover 2.14x (Prev. 1.98x)

E2.023bln 1.25% May-36 OAT, Avg yield 0.42% (Previous 0.05%), Bid-to-cover 2.45x (Prev. 2.71x)

E1.999bln 0.50% May-40 OAT, Avg yield 0.62% (Previous -0.07%), Bid-to-cover 2.33x (Prev. 2.51x)

Spain sells:

E1.878bln 0% Jan-26 Bono, Avg yield -0.25% (Prev. -0.25%), Bid-to-cover 1.99x (Prev 1.60x)

E1.652bln 1.40% Apr-28 Obli, Avg yield 0.04% (Prev. 0.05%), Bid-to-cover 1.80x (Prev 2.38x)

E1.209bln 1.00% Oct-50 Obli, Avg yield 1.40% (Prev. 1.41%), Bid-to-cover 1.56x (Prev 1.25x)

E547mln 0.70% Nov-33 Obli-Ei, Avg yield -0.74% (Prev. -0.80%), Bid-to-cover 1.77x (Prev 1.58x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 169.5/168.5ps, bought for 3 in 1.5k

RXQ1 171.50/171/170.50p fly 1x3x2, bought for -3 (receive) in 1.5k

UK:

0LU1 99.37p, bought for 0.75 in 17.5k

0LZ1 99.75/00 cs, bought for 1 in 6k

FOREX: GBP/USD Makes Light Work of June Lows

- GBP is the early underperformer in currency space, with GBP/USD making light work of the Wednesday low to extend losses through the June lows and touch the lowest level since mid-April. Fundamental catalysts and drivers for the GBP weakness are few and far between, keeping markets focussed on the technical break below 1.3787. This opens the Apr16 low of 1.3717.

- The strongest currency so far Thursday is NZD, which recovers modestly against the USD as markets reverse a minority of this week's weakness. The pair needs to top the 200-dma at 0.7058 to solidify and near-term recovery.

- Equity markets across Europe are positive, helping extend the USD/JPY rally that began in earnest around the Wednesday month-end WMR fix. This puts the pair at new multi-year highs, with the price touching 111.50 at the day's high.

- Friday's US jobs data remains top of mind, keeping focus on today's release of weekly jobless claims data, the challenger job cuts release for June and manufacturing ISM. Fed's Bostic is the sole central bank speaker on the docket Thursday.

FX OPTIONS: Expiries for Jul01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1925-40(E571mln), $1.1950-60(E557mln)

- USD/JPY: Y111.00($575mln)

- EUR/JPY: Y131.25(E1.2bln-EUR puts)

- AUD/USD: $0.7500(A$499mln)

- NZD/USD: $0.6900(N$552mln-NZD puts)

Price Signal Summary - USD Extends Gains

- In the equity space, S&P E-minis maintain a bullish theme and today, has traded above the 4300.00 handle today. This opens 4322.15, 0.764 projection of Mar 25 - May 10 - 13 price swing. EUROSTOXX 50 futures focus is on a key technical pattern from Jun 18 - a bearish engulfing candle - that continues to warn of a short-term top in the trend. A break of 4015.00, Jun 21 low would reinforce the importance of the engulfing line and signal scope for a deeper pullback potentially below 4000.00 towards 3914.00, May 20 low.

- In FX, the USD remains firm and has resumed its uptrend. The EURUSD support is under pressure. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. A break would open 1.1795, Apr 6 low. GBPUSD is trading below 1.3787, Jun 21 low. A clear break would signal scope for weakness towards 1.3717, Apr 16 low. USDJPY is trading higher and has cleared 111.30, the Mar 26, 2020 high. The focus turns to 111.71/73, Mar 24, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, the yellow metal broke lower Tuesday and cleared support at $1761.1, Jun 18 low. The break confirms a resumption of the downtrend that started Jun 1 and note the move has also confirmed a bear flag that developed during the most recent consolidation phase. The focus is on $1733.5, 76.4% retracement of the Mar 8 - Jun 1 rally. Resistance is at $1795.0, Jun 23 high. The Oil market trend condition remains bullish and pullbacks are considered corrective. Brent (U1) focus is $76.42, 1.236 projection of Mar 23 - May 18 - May 21 price swing. Support lies at $72.94, the 20-day EMA. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing. Watch support at $71.35, the 20-day EMA.

- Within FI, Bund futures key short-term directional triggers are; support at 171.67, Jun 22 low and resistance at 173.16, Jun 11 high. Key support in Gilt futures is unchanged at 126.70, Jun 3 low and marks an important pivot level. The key resistance is at 128.39, Jun 11 high.

EQUITIES: Stocks Bounce After Month-End Pullback

- European equity markets were sold into the Wednesday close, resulting in EuroStoxx futures testing the 50-dma at 4039.14, but have staged a solid bounce ahead of the NY crossover with European indices on the whole all higher.

- US futures are similarly strong, with the e-mini S&P showing above the 4300 level in Asia-Pac trade to touch new alltime highs. Energy names across Europe are leading the way higher, with financials and materials similarly strong. All sectors are firmer this morning, but tech slightly lags, reflecting in the NASDAQ's underperformance ahead of the bell.

- The US labour market remains top of mind ahead of Friday's payrolls release, prompting markets to keep an eye on weekly jobless claims and Challenger Job Cuts.

COMMODITIES: Oil Markets Watch OPEC+ Arm Wrestle

- Both WTI and Brent crude futures trade higher ahead of the Thursday NYMEX open, with focus on the OPEC+ negotiations in Vienna, which are expected to result in a boost in oil output to the tune of 500,000bpd.

- Despite this, reports suggest there's continued disagreement among OPEC+ members over the size of any easing of output curbs, as Russia press for an increase of as much as 1mln bpd, while Saudi Arabia favour a more gradual approach.

- Most recently, headlines suggest the different factions among the group have settled their differences and reached a preliminary deal of monthly increases of less than 500,000bpd.

- Running against the gold weakness earlier in the week, precious metals having bounced off the lows and are firmer early Thursday. Gold remains below the $1800/oz level, but is narrowing the gap with first resistance at the $1790/oz 100-dma.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.