-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: Peak China Fear In The Rear-View?

Highlights:

- JPY continues to struggle as BoJ stands pat, again.

- Markets beginning to suggest that peak China fear is behind us in light of stimulus speculation.

- Fed & ECB speak dominates ahead of the weekend, with UoM sentiment data also due from the U.S.

US TSYS: Curves Extending Inversion, BOJ Holds Steady

- Treasury futures trading mildly mixed at the moment, curves extending inversion (2s10s -96.218 low) with intermediate to long end climbing off overnight lows over the last hour.

- Treasury futures rebounded briefly in reaction to steady BoJ policy announcement early overnight, followed by moderate position squaring ahead the extended US holiday weekend (Juneteenth national holiday Monday, Globex closes 1300ET) as rates see-sawed lower, 10s tapping113-05 low, trades near steady at 113-13.5, yield 3.7187%.

- Despite the bounce, futures remain in a downtrend and this week’s move lower confirmed a resumption of the trend. Support at 112-29+, May 26 / 30 low has been cleared. Gains are considered corrective - for now. Initial firm resistance is at 114-00, Tuesday’s high.

SITR: Fed Terminal Pricing Slightly Firmer

SOFR futures trading mixed, Whites through Reds (SFRM3-SFRH5) -0.0075 toi -0.045; 3M SOFR rate settled -0.00933 to 5.20684 (-.04254/wk).

- Chances of a 25bp hike at one of the next three meetings firms slightly: July 26 FOMC climbs to 71.6% with Fed funds implied at 17.9bp. September cumulative at +22.9bp to 5.307%, November cumulative 21.4bp to 5.292%. while December cumulative at 12.2bp to 5.200%. At the moment, Fed terminal at 5.295% in Oct'23-Nov'23.

- Morning data ahead: UofM confidence data at 1000ET.

FOREX: JPY remains under pressure

- The Dollar remains on the back foot, despite showing flat against the CAD, EUR, CHF, AUD, SEK and NZD overnight, the Dollar falls lower on the European cash Govie open, with buying orders going through in Equities.

- Expect some potential Gamma volatility in Equites today.

- After a mixed early start, the USD is now back to flat against the GBP, CHF, EUR, NZD, CAD, and in the green against the Yen, up 0.51%, and NOK up 0.16%.

- In terms of technical, resistance in EURUSD is at 1.0986 61.8% retracement of the Apr 26 - May 31 downleg, but only printed a 1.0962 high so far today.

- Cable cleared the 1.2800 psychological level but failed to test the next resistance at 1.2849 0.618 proj of the Mar 8 - May 10 - May 25 price swing, printed a 1.2818 high.

- For the AUDUSD, the 0.6900 figure held, and printed a 0.6900 high so far today.

- Above the latter, would see of 0.6921 High Feb 20.

FX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0900 (3.11bn), 1.0905 (537mln), 1.0915 (718mln), 1.0960 (421mln), 1.0985 (421mln), 1.1000 (1.35bn)

- USDJPY: 140.50 (797mln), 141.00 (676mln), 141.10 (319mln)

- USDCAD: 1.3200 (744mln), 1.3250 (760mln), 1.3300 (415mln)

- AUDUSD: 0.6800 (615mln)

- NZDUSD: 0.6200 (221mln)

- USDCNY: 7.10 (1.19bn), 7.12 (379mln), 7.15 (1.49bn)

- EURSEK: 11.60 (220mln).

CHINA: Peak China Fears In The Rear-View?

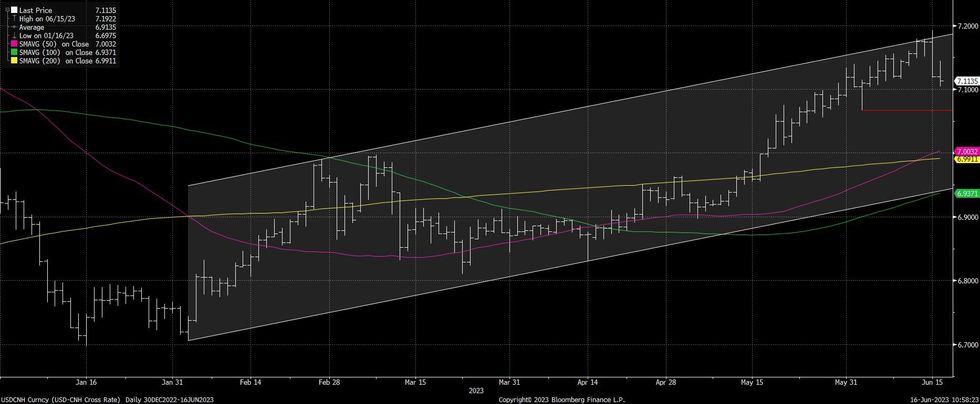

USD/CNH moves as low as CNH7.1041, before retracing to CNH7.1130. The technical uptrend channel remains intact on a closing basis and the 2 June low (CNH7.0670) represents initial support.

- State-run media outlets continue to circulate views re: the potential for yuan strength in H223.

- Peak China fears are seemingly in the rear-view for now, with continued discussion/reporting surrounding the likelihood of a meaningful stimulus package helping (the size and breadth of any package that does emerge will be key).

- That helped Chinese equities to rally further on Friday, with the CSI 300 adding ~1.0%, while international investors bought CNY10.5bn of mainland equities via the Hong Kong Connect schemes, in what was the largest day of net purchases seen since February.

- Chinese 10-Year yields and 5-Year NDIRS rates moved higher again today, once again suggesting that markets are moving beyond peak China fear.

- Participants are on the lookout for any State Council comments after recent speculation surrounding the potential for a meeting today.

- Looking ahead, there is some speculation that the 5-Year LPR could see a more meaningful move lower than the 1-Year LPR at next week’s monthly fixing, in a bid to further support the property and corporate sectors.

Fig. 1: USD/CNH

EQUITIES: S&P E-Minis Bull Rally Extends

- S&P E-Minis traded higher again Thursday. The move confirms a resumption of the uptrend, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4491.19, the top of a bull channel drawn from the Oct 2022 low (cont). Firm support is at 4320.18, the 20-day EMA. Initial support is at 4381.75, the Jun 5 high.

- EUROSTOXX 50 futures traded are trading higher today. Resistance at 4380.00, the May 29 high, has been cleared this week. This is a bullish development and signals scope for an extension higher towards key resistance at 4434.00, the May 19 high. Clearance of this hurdle would represent an important bullish development and open 4448.00, the Jan 2008 high (cont). Initial support to watch is at 4303.00, the Jun 7 low.

COMMODITIES: WTI Bear Threat Remains Present

- The bear cycle in Gold remains intact. The yellow metal is trading below trendline support drawn from the Nov 3 2022 low - the trendline intersects at $1966.8. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

- WTI futures continue to trade below resistance at $75.06, the Jun 5 high and the outlook remains bearish, despite the latest recovery. The pullback from $75.06 reinforces a bearish theme. Support at $67.03, May 31 low, has been pierced, a clear break would open $63.90, May 4 low. On the upside, a break of $75.06 is required to signal a reversal. Short-term gains are considered corrective.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 19/06/2023 | 1100/1300 |  | EU | ECB Lane Fireside Chat | |

| 19/06/2023 | 1140/1340 |  | EU | ECB Schnabel at Euro50 Group Conference | |

| 19/06/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/06/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.