-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY958.4 Bln via OMO Wednesday

MNI ASIA OPEN: December CPI Housing & Core Goods in Focus

MNI ASIA MARKETS ANALYSIS: Post-PPI Highs Rejected

MNI US MARKETS ANALYSIS - Risk-Off Pervades, Iron Ore Hard Hit

HIGHLIGHTS:

- Risk-off pervades, with European equities off sharply

- Iron ore prices hard hit on China demand slowdown

- USD Index touches new multi-month highs as Fed minutes reinforce taper expectations

US TSYS SUMMARY: Bull Flattening Amid Broader Economic Growth Concerns

Treasuries jumped in European morning trade Thursday, following the rebound from post-FOMC minutes lows and a fairly quiet Asia-Pac session.

- Curve is bull flattening: 2-Yr yield is down 0.8bps at 0.2075%, 5-Yr is down 2.1bps at 0.7475%, 10-Yr is down 3.2bps at 1.2267%, and 30-Yr is down 4.2bps at 1.8548%. Sep 10-Yr futures (TY) up 10.5/32 at 134-15 (L: 134-05.5 / H: 134-17), on elevated volume: ~450k.

- If anything, the Treasury reaction has been relatively muted when compared with the risk-off move across the board: the DXY dollar index has hit a fresh 2021 high, with equities continuing to slide (major index futures off ~0.5%).

- Some citing the FOMC minutes as the risk-off instigator, but that's not particularly clear esp given the release initially triggered Tsy weakness (and the minutes themselves were not particularly hawkish vs expectations). Other explanations include global growth/bottleneck concerns (e.g. see Toyota production cutback headlines overnight), with commodities tanking.

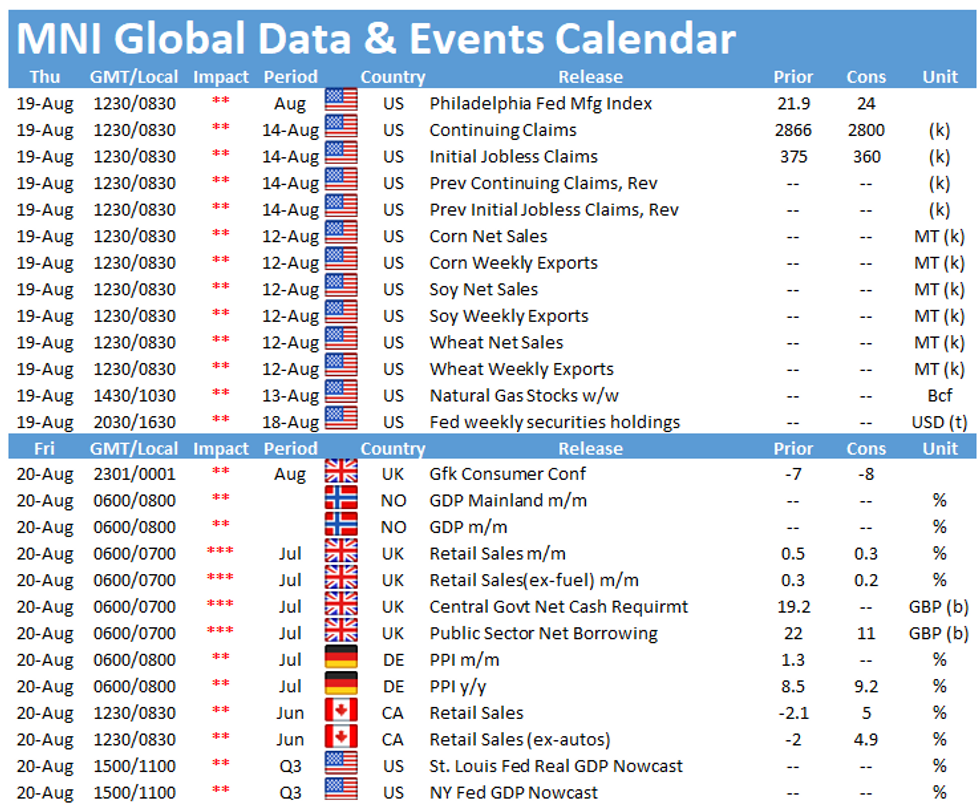

- Jobless claims data and Philly Fed feature at 0830ET. Jul Leading Index at 1000ET.

- In supply, we get $65B combined of 4-/8-week bills at 1130ET, with $8B 30Y TIPS at 1300ET.

- NY Fed buys ~$6.025B of 4.5-7Y TIPS.

EGB/GILT SUMMARY: Fresh Growth Concerns Trigger EGB Buying

The equity slide has dominated this morning with European sovereign bonds also rallying and the US dollar making gains across the board. Today's price action has been underpinned by renewed concerns over global growth in light of another flare up in coronavirus infections (notably in Australia) and yesterday's Fed minutes indicating that the FOMC are preparing to taper asset purchases in the near future.

- Gilts have outperformed EGBs with cash yields 3-4bp lower across the curve.

- The bund curve has bull flattened with the 2s30s spread 2bp narrower.

- OATs have mirrored the move in bunds with yields broadly 1-2bp lower on the day.

- BTPs have bucked the regional trend (even among the EGB periphery) with prices edging below yesterday's close.

- Supply this morning came from France (OATs, EUR6.997bn, & OATi/OATei, EUR991mn) and Ireland (ITB, EUR750mn)

- There were no tier one European data releases this morning. Focus now shifts to US claims data and the latest Philly Fed update for August.

EUROPE ISSUANCE UPDATE

France sells MT OATs and Linkers:- E2.497bln 0% Mar-24 OAT, Avg yield -0.71% (Previous -0.58%), Bid-to-cover 3.38x, (Previous 2.25x)

- E2.506bln 0.50% May-25 OAT, Avg yield -0.62% (Previous -0.51%), Bid-to-cover 2.70x, (Previous 2.53x)

- E1.994bln 1.00% May-27 OAT, Avg yield -0.54% (Previous -0.45%), Bid-to-cover 2.62x, (Previous 2.32x)

- E349mln 0.10% Mar-28 OATi, Avg yield -1.71% (Previous -1.30%) -0.96%, Bid-to-cover 3.30x (Previous 3.08x)

- E642mln 0.10% Mar-29 OATei, Avg yield -1.78% (Previous -1.30% -0.96%, Bid-to-cover 2.61x (Previous 0.39x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

2RH2 100.125 puts bought for 2.25 in 10k

UK:

0LZ1 99.75/99.875 call spread bought for 0.75 in 10k

0LZ1 99.00 / 99.875 combo bought for 0.25 in 20k (+call, -put)

FOREX: Pervasive Risk-Off Puts AUD on the Ropes

- The risk-off feel that's bubbled through markets since the Monday open crystallized further Thursday, with a sharp drop in commodities prices the bleeding through equities, fixed income and foreign exchange this morning.

- Iron ore took focus in the late Asia session, with prices falling as much as 12% from the week's high as markets eye reports on China's intentions to 'aggressively' reduce steel production (thereby trimming demand for iron ore, a key input). This has undermined materials and energy stocks from the open, pressing core European markets lower by over 2% and, in turn, hurting risk sentiment.

- The slip in commodities prices has worked against materials-tied FX, putting AUD, NZD and CAD at the bottom of the G10 pile.

- The USD is firmer following the Fed minutes late yesterday, helping the USD Index trade at fresh cycle highs. The minutes proved hawkish, but were infitting with recent public FOMC speeches, preparing markets for a taper to asset purchases before the end of 2021.

- Focus turns to weekly US jobless claims data, and a particularly frenetic option expiry schedule, with sizeable strikes in EUR/USD, NZD/USD and USD/JPY worth watching.

FX OPTIONS: Expiries for Aug19 NY cut 1000ET (Source DTCC)

A busy option expiry schedule Thursday, with strikes in NZD, EUR and JPY to watch. Close to €6bln notional is due to roll-off between 1.1650-1.1700 which could contain spot going forward, while $1.4bln layered between Y109.65-80 could be a focus. Lastly, a sizeable strike in NZD/USD at 0.6800 (N$1.4bln) is uncharacteristic for the pair, and could draw focus into the 10am NY cut.

- EUR/USD: $1.1600-10(E610mln), $1.1650(E656mln), $1.1670-90(E2.9bln), $1.1700(E2.3bln), $1.1750(E2.0bln), $1.1780-00(E4.0bln), $1.1850(E1.3bln)

- USD/JPY: Y108.15($500mln), Y108.50-70($612mln), Y109.00-20($1.3bln), Y109.35-50($752mln), Y109.65-80($1.4bln), Y110.00($512mln), Y110.50-60($1.6bln), Y111.50($606mln)

- GBP/USD: $1.3800(Gbp720mln)

- EUR/GBP: Gbp0.8500-20(E691mln)

- AUD/USD: $0.7250(A$2.0bln), $0.7320-35(A$1.3bln), $0.7350-60(A$1.4bln)

- NZD/USD: $0.6800(N$1.4bln)

- USD/CAD: C$1.2575-85($1.6bln)

- USD/CNY: Cny6.4720($750mln)

Price Signal Summary - USD Rallies, Equities Under Pressure

- In the FX space, the USD is firm and the uptrend has accelerated with DXY touching a fresh 2021 high of 93.50. EURUSD is weaker and has cleared 1.1704, Mar 31 low . This signals scope for a move to 1.1621, 1.00 projection of the Jan 6 - Mar 31 - May 25 price swing. GBPUSD is lower too and attention turns to the key support at 1.3572, Jul 20 low and the bear trigger. EURJPY has resumed the downtrend with the focus on 127.88, 38.2% retracement of the Oct '20 - Jun rally. AUDUSD has cleared the 0.7200 handle. This paves the way for a move towards 0.7122, 1.618 projection of Feb 25 - Apr 1 - May 10 price swing.

- On the commodity front, Gold remains firm with the focus on the next important resistance at $1797.8, the 50-day EMA. A break would strengthen bullish conditions. WTI futures support at $65.01, Jul 20 low has been cleared. This strengthens the bearish theme and opens $61.06, May 21 low and a key support.

- On the equity front, a short-term corrective cycle has established itself following the extension lower. S&P E-minis are approaching a key support area at 4341.36, the 50-day EMA. EUROSTOXX 50 though is through its 50-day EMA. A deeper pullback would expose 4047.50 next, the Jul 27 low.

- In FI, support to watch in Bunds is at 176.21, the Aug 11 low. Trend conditions remain bullish. Gilt futures outlook is bullish too and attention is on 130.72, Aug 4 high and the bull trigger. The support to watch is unchanged at 129.10, Jul 22 low.

EQUITIES: Drop in Commodities Undermines Materials, Mining, Energy Stocks

- European equities have accelerated losses from the open, with particular weakness noted in France's CAC-40, and the UK's FTSE-100.

- Acute underperformance in the energy, materials and consumer discretionary sectors is weighing on headline markets, with a sharp drop in iron ore and oil prices pressing the likes of Anglo American, ArcelorMittal and BP.

- US futures are lower in sympathy, with the e-mini S&P is now trading at new August lows and fast approaching first support at the 4341.3650-dma.

- A break below here exposes losses toward the 4300 handle initially ahead of firmer support expected at 4224.00.

COMMODITIES: Iron Ore Folds as China Cracks Down on Steel Output

- Pervasive risk-off was evident across the Asia-Pac session, and has accelerated into the NY crossover. Iron ore prices have been hard hit, with prices falling as much as 12% from the week's highs.

- Catalysts and drivers are varied, with some citing China's intentions to 'aggressively' reduce steel production (thereby trimming demand for iron ore, a key input).

- Downside has been exacerbated by the persistent greenback strength, with the USD Index adding to recent gains after yesterday's Fed minutes, which continue to point toward a taper ahead of year-end.

- Gold and silver are more mixed, with gold benefiting from the broad risk-off theme, but silver continues to lag.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.