-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Soft Start to Week for USD, With Midterms, CPI in View

Highlights:

- Fed funds market sticks to post-NFP reaction, sees ~57bps priced for December

- USD Index through last week's lows as focus turns to midterms, US CPI

- Disappointment lingers as China double down on Zero Covid Strategy

US TSYS: Post-Payrolls Twist Flattening With A Light Docket Ahead

- Cash Tsys see a twist flattening as the front-end gently cheapens in only limited retracement of Friday’s post-payrolls rally, with the pivot from 5Y onwards. The main driver remains Chinse health officials pointing to commitment to the zero-Covid system over the weekend.

- The combination sees 2s10s flatten 5bps to -54.5bp, unwinding half the post-payrolls steepening as it remains off the low of -61bp shortly beforehand.

- 2YY +1.7bps at 4.676%, 5YY -0.7bps at 4.324%, 10YY -2.9bps at 4.129%, and 30YY -3.5bps at 4.212%.

- TYZ2 trades just 1+ tick higher at 110-03 on low volumes and with the primary trend direction remaining down. It’s within Friday’s range, the low of which forms initial support at 109-10+ (Nov 4 low) whilst resistance is seen at the 20-day EMA of 110-29).

- Fedspeak: Collins & Mester (1540ET), Barkin on inflation (1800ET)

- Data: Consumer credit (1500ET)

- Bill issuance: US Tsy $57B 13W, $45B 26W auctions (1130ET)

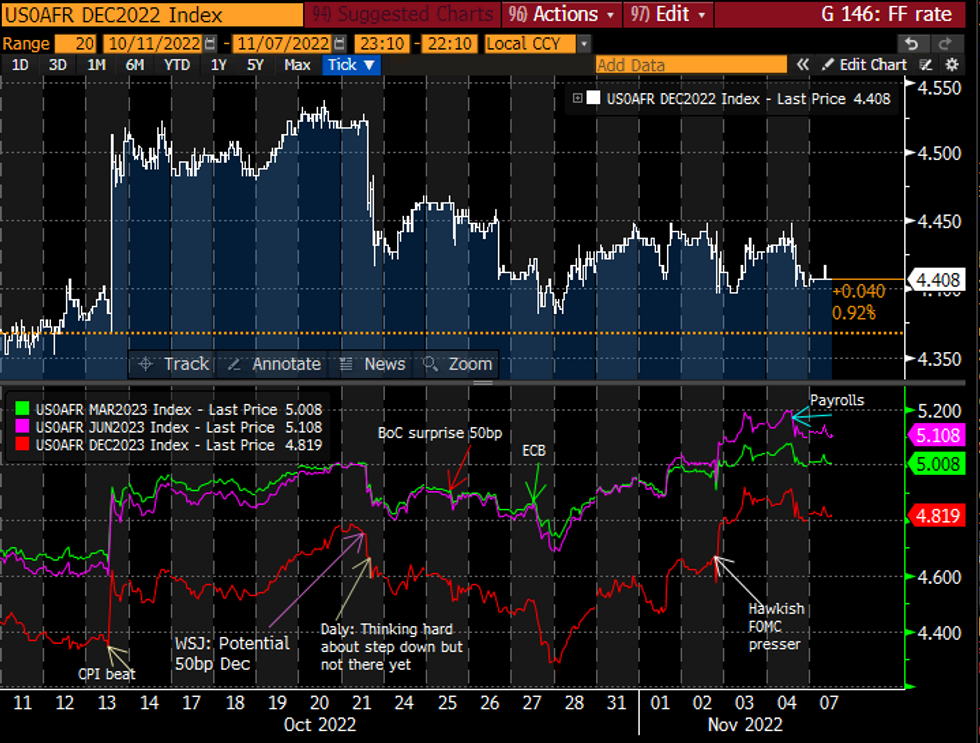

STIR FUTURES: Fed Funds Maintaining Post-Payrolls Reaction

- Fed Funds implied hikes have broadly kept to Friday’s post payrolls move lower off highs.

- 56.5bp for Dec (+0.5bp), 98bp to 4.83% for Feb’23 (+1.5bp), a terminal 5.1% in Jun’23 (+1bp) and 4.82% Dec’23 (+1.5bp).

- Fedspeak late in the session from ’22 voters Collins & Mester (1540ET) and then ’24 voter Barkin (1800ET). Collins said post-payrolls that the Sept SEP forms a starting point for the rate peak with the possibility of a higher path whilst Mester last spoke Oct 11 before last month’s CPI beat.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOREX: USD Index Through Last Week's Lows

- The greenback is generally softer across G10 early Monday, with the USD Index through last week's lows and eyeing 109.535, the near-term support posted at the Oct 27 low. For now, the USD pullback looks corrective in nature, with prices still tied to the medium-term uptrend. The 50-dma continues to trend higher, crossing today at 111.213.

- GBP trades more favourably, with GBP/USD now erasing the entirety of the post-BoE decision move lower. For now, a stronger reversal higher and a break of 1.1645, Oct 27 high, is required to reinstate the recent bull cycle.

- Antipodean and commodity-tied currencies are moderately lower, with NZD and AUD lower as China doubled-down on their Zero COVID Strategy. There had been some speculation that rules could be eased over the weekend - rumours that had driven local asset prices higher. These hopes are fading early Monday, putting CNH, AUD and NZD lower at the NY crossover.

- Datapoints are few and far between Monday, keeping focus instead on the central bank speaker slate. Fed's Collins, Mester and Barkin are all due to speak. This week, however, focus rests on the US inflation release due Thursday. Consensus looks for 0,6% M/M and 7.9% Y/Y.

CHINA: Consensus Sees Broader COVID Strategy Shift in Mar'23

- Fair to say that China reopening hopes drove local markets higher last week (Shanghai Comp +6%, Hang Seng Index +9.5%), while the USD/CNH dropped at it’s fastest rate on record on Friday – dropping as much as 2.2% intraday.

- The majority of sell-side views on the issue see Chinese restrictions being eased domestically, but at a very gradual pace that is probably yet to be decided. This leaves the consensus view that the conclusion of the political reshuffle in March next year is the most likely time at which a broader policy change will be announced.

- Nomura write that markets should lower their expectations of a fast reopening. While Beijing may introduce some fine-tuning of Covid measures, these could be more than offset by local officials’ escalation on Zero Covid Strategy. They maintain the view that Beijing will stick with essential parts of ZCS until at least March 2023, when the political reshuffle is finally completed.

- They believe a difficult period after March 2023 appears unavoidable. If the shift towards “living with Covid” is slow, people might become quite disappointed, reducing their investment and consumption demand.

- However, if Beijing takes material steps towards ditching the zero COVID approach, the infection rate could very likely surge in a short period of time and could lead to some chaos.

- Goldman Sachs see the government as still needing to keep its zero-Covid policy until all preparations are done. This may take a few months, and they continue to expect 2023Q2 reopening as the baseline.

- With the government preparation beginning, increased pricing-in of China reopening in a forward-looking market may be warranted. However, it is worth emphasizing that we are still at least a few months away from the actual reopening. For this reason, they expect GDP growth to be soft in Q4 (3.5% qoq ann) and think the reopening boost to growth may not materialize until H2 next year.

- TD Securities continue to see only a gradual easing of zero-Covid restrictions domestically, suggesting that markets could be in for some disappointment if more rapid easing is expected. They write that if zero-Covid were to be dismantled in Q1 next year, China's growth could move back to around 6-6.5%, rather than the 4.7% they currently assume.

- Should China open up symmetrically it would once again put pressure on the services balance of China's current account, leading to more and not less pressure on the CNY. Rising Covid cases across the country, suggest that consumer caution would persist for a while longer. Given that the economy is struggling under the weight of a highly pressured property sector, it is highly unlikely that the world is about to see a positive demand shock emanating from China.

UK: FT - Chancellor Hunt Targets GBP54bn In Spending Cuts In Autumn Statement

The Financial Times is reportingthat Chancellor of the Exchequer Jeremy Hunt is targeting GBP54bn in public spending cuts as part of the upcoming autumn statement on 17 November.

- FT: "The final spending cuts total is yet to be decided, reflecting daily changes in gilt markets but is now higher than ministers expected a fortnight ago. The Treasury is aiming to overshoot the actual black hole of about £40bn in order to create additional fiscal headroom to allow for the possibility that economic conditions deteriorate more than currently expected."

- The gov't has thoroughly prepared markets and the public for what is expected to be a tough set of measures (in stark contrast to the mini-budget that sank the Truss gov't), but nevertheless the autumn statement could hit PM Rishi Sunak's popularity.

- Initial polling following his taking office still shows Sunak's centre-right Conservatives trailing the centre-left Labour Party, although the gulf between the two has fallen from around 30-35% at the end of the Truss gov't to ~20% now. Leadership polls show Sunak with much higher ratings than his party behind him, but harsh fiscal measures at a time of high inflation and rising interest rates could damage his standing among voters.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2022 | 0930/1030 | * |  | EU | Sentix Economic Index |

| 07/11/2022 | 0930/1030 |  | EU | ECB Panetta Panels EC/ECB Conference | |

| 07/11/2022 | - |  | EU | COP 27 Begins | |

| 07/11/2022 | - | *** |  | CN | Trade |

| 07/11/2022 | - |  | EU | ECB Panetta at Eurogroup meeting | |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/11/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 07/11/2022 | 2040/1540 |  | US | Fed's Loretta Mester and Susan Collins | |

| 07/11/2022 | 2300/1800 |  | US | Richmond Fed's Tom Barkin | |

| 08/11/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/11/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/11/2022 | 0745/0845 | * |  | FR | Current Account |

| 08/11/2022 | 0900/1000 |  | IT | Retail Sales | |

| 08/11/2022 | 0900/0900 |  | UK | BOE Pill Panels UBS European Conference | |

| 08/11/2022 | 1000/1100 | ** |  | EU | retail sales |

| 08/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/11/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/11/2022 | - |  | US | Legislative Elections / Midterms | |

| 08/11/2022 | - |  | EU | ECB de Guindos at ECOFIN meeting | |

| 08/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/11/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/11/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.