-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Stocks Stage Minor Bounce, But Remain Fragile

HIGHLIGHTS:

- Stocks stage mild recovery, but outlook remains fragile

- Oil holds gains as OPEC+ refuse to turn on taps

- ISM Services, ECB's Lagarde in focus

US TSYS SUMMARY: Bearish Tone As Stocks Tentatively Find Their Feet

Tsys have weakened a little in overnight trade, but largely within the previous two sessions' ranges. The slightly bearish tone comes as stock futures tentatively find their feet, and amid continued anticipation of Friday's jobs data.

- The 2-Yr yield is up 0.2bps at 0.2796%, 5-Yr is up 1.3bps at 0.9571%, 10-Yr is up 1.4bps at 1.4928%, and 30-Yr is up 1.1bps at 2.0555%.

- Dec 10-Yr futures (TY) down 4/32 at 131-30.5 (L: 131-28.5 / H: 132-03.5).

- Fed speakers include Chicago's Evans on CNBC at 0845ET, and VC Quarles speaking on Libor transition at 1315ET. Note overnight, Fed announced it's conducting a review over whether some trades by Fed officials broke ethical standards/the law.

- Note Treas Sec Yellen is on CNBC too, at 0730ET. And Pres Biden meets w House Democrats on fiscal matters at 1015ET.

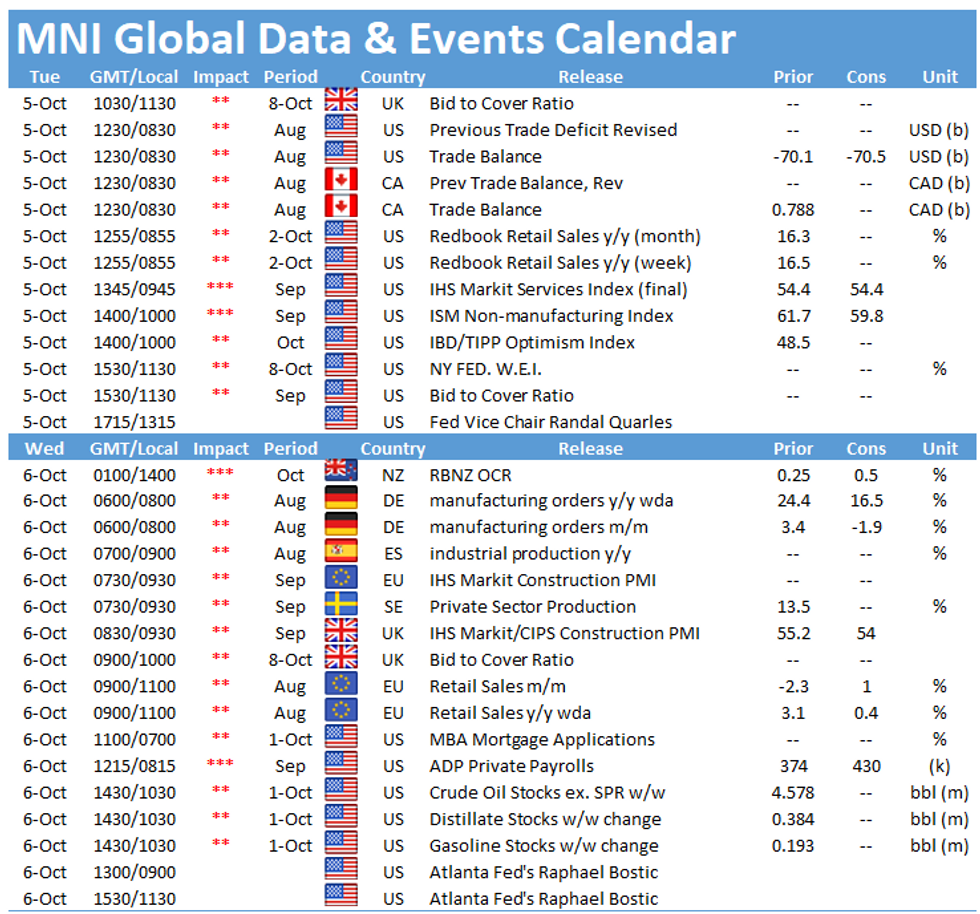

- Data today is highlighted by Sep ISM Services at 1000ET; we also get Aug trade balance at 0830ET and final Sep PMIs at 0945ET.

- In supply, $59B combined of 8-day/52-week bills sell at 1130ET.

- NY Fed buys ~$3.225B of 7-10Y Tsys.

EGB/GILT SUMMARY: Gilts Under Pressure

EGBs have firmed this morning while gilts have sold off alongside modest gains for equities.

- Gilt yields have pushed up 2bp across the curve, which trades close to flat overall.

- Bunds are broadly a touch firmer on the day.

- It is a similar story for OATs, which trade marginally above yesterday's close.

- BTPs have slightly outperformed core EGBs with cash yields 1-2bp lower,

- The ECB's Robert Holzman earlier stated that he was clinging to the hope that the inflation spike is temporary. For the time being, the official line is still that the surge in inflation reflects transient factors, although this view is coming under increasing pressure in the face of higher oil prices and calls for higher wages.

- Supply this morning came from the UK (Gilts, GBP.8.5bn), Germany (ILBs, EUR500mn allotted), Spain (Letras, EUR4.991bn), Austria (RAGBs, EUR1.266bn), Belgium (TCs, EUR1.00bn) and the ESM (Bills, EUR1.5bn).

EUROPE ISSUANCE UPDATE

UK DMO sells:

GBP 2.25bln 1.125% Jan-39 Gilt, Avg yield 1.359% (Prev. 1.086%), Bid-to-cover 2.08x, Tail 0.4bps

GBP 3.00bln 0.25% Jan-25 Gilt, Avg yield 0.491% (Prev. 0.250%), Bid-to-cover 2.51x (Prev. 2.81x), Tail 0.3bp (Prev. 0.2bps)

Germany allots:

E405mln 0.10% Apr-33 ILB, Avg yield -1.91% (Prev. -1.58%), Bid-to-cover 1.09x (Prev. 1.21x)

E95mln 0.10% Apr-46 ILB, Avg yield -1.70% (Prev. -1.68%), Bid-to-cover 0.88x (Prev. 1.51x)

Austria allots:

E550mln 0% Apr-25 RAGB, Avg yield -0.640% (Prev. -0.742%), Bid-to-cover 2.87x 2.90x (Prev. 2.05x)

E550mln 0% Feb-31 RAGB, Avg yield -0.031% (Prev. -0.146%), Bid-to-cover 2.87x 2.90x (Prev. 2.02x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXX1 169/168/167.5 broken put fly, bought for 10 in 5k

RXX1/RXZ1 172.5/173.5cs calendar, bought the Dec for 12 in 7.5k vs RXX1/RXZ1 169.5/168.5ps, sold the Dec at 9 in 1.25k

SX7E (17th Dec expiry) 110/120cs 1x1.5, bought for 0.85 in 10k

FOREX: GBP/USD Keeps Monday High Under Pressure

- Currency markets are in consolidation mode, with the USD Index trading either side of the 94.00 handle. Best performer so far include GBP, with GBP/USD in close proximity to the Monday high of 1.3640. The single currency is faring more poorly, with EUR/GBP lower for a fourth consecutive session. This narrows the gap with key support at the mid-September lows of 0.8501.

- Following yesterday's downtick in equities, markets have stabilised, alleviating some of the upside pressure on haven currencies including JPY and CHF.

- Front-end vols across DMFX have seen some support, with 1m contracts edging higher across EUR/USD, GBP/USD and USD/JPY as realised vol lurches higher, bleeding directly into implied.

- US ISM Services data takes focus going forward, with Canadian/US trade balance numbers also on the docket. Central bank speakers today include ECB's Lagarde & Holzmann and Fed's Quarles.

FX OPTIONS: Expiries for Oct05 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.80-00($1.1bln), Y112.00($823mln)

- AUD/NZD: N$1.0410(A$2.1bln)

- AUD/USD: $0.7450(A$728mln)

- USD/CAD: C$1.2615-25($2.0bln)

- USD/CNY: Cny6.4620($1.0bln)

Price Signal Summary - Oil Continues To Defy Gravity

- In the equity space, S&P E-minis are holding above Friday's low of 4260.00. The outlook remains bearish and scope is seen for weakness towards 4214.50, Jul 19 low. Short-term gains are considered corrective. EUROSTOXX 50 futures outlook remains bearish too. A resumption of weakness would open 3951.50, 1.00 projection of the Sep 6 - Sep 20 - Sep 24 price swing and below.

- In FX, EURUSD remains in a downtrend and recent price action appears to be a bear flag, reinforcing current bearish conditions. The focus is on 1.1493 next, 50.0% of the Mar '20 - Jan '21 bull phase. GBPUSD remains vulnerable following last week's sell-off and despite the recent strong corrective bounce. Last week's 1.3412 low on Sep 29 is the bear trigger. A break would open 1.3354, Dec 23, 2020 low. Initial resistance is at yesterday's high of 1.3640. USDJPY last week traded through key resistance at 111.66, Jul 2 high and the bull trigger. The clear break strengthens a bull case and opens 112.23, Feb 20, 2020 high. Near-term however, attention is on the Sep 30 price pattern - a bearish engulfing candle. This highlights scope for a deeper corrective pullback, potentially towards 110.19, the 50-day EMA.

- On the commodity front, Gold remains in a downtrend and attention is on $1690.6, the Aug 9 low and the bear trigger. Note though that the Sep 30 price pattern is a bullish engulfing candle. This highlights the potential for a stronger corrective bounce. A climb would open $1787.4, Sep 22 high. The trigger for a resumption of weakness is $1721.7, Sep 29 low. WTI futures rallied yesterday and have resumed their uptrend. This opens $79.53, 1.382 projection of the Aug 23 - Sep 2 - Sep 9 price swing.

- In the FI space, short-term gains are still considered corrective. Bund futures remain in a clear downtrend with the focus on 169.46, 1.50 projection of the Sep 9 - 17 - 21 price swing. Resistance is seen at 170.81, Sep 17 and a recent breakout level. Gilt futures remain heavy too. The focus is on 124.64, 1.382 projection of the Aug 31 - Sep 17 - 21 price swing.

EQUITIES: Stocks Stage Shallow Bounce

- Equity markets trade slightly firmer ahead of the Wall Street open, with European indices in the green by just shy of 1%. US futures are seeing similar gains, albeit slightly shallower, with the e-mini S&P higher by 0.4%, while the NASDAQ future very slightly outperforms.

- This puts cash indices on track for a positive open later today, although the outlook remains fragile given the proximity to recent lows for the e-mini S&P. The outlook remains bearish for the index following Friday's break of key support 4293.75, Sep 20 low. The break strengthens a bearish case and confirms a resumption of the bear cycle that started Sep 3. The move also establishes a price sequence of lower lows and lower highs and this reinforces bearish conditions, opening 4214.50, Jul 19 low.

- Across Europe, the tech sector leads the bounce, reflected in the NASDAQ future's outperformance, with materials lagging modestly.

COMMODITIES: Oil Holds Week's Gains as OPEC+ Refuse to Budge

- WTI and Brent crude futures are holding close to this week's multi-month highs, with OPEC+'s decision to keep output policy unchanged signalling to markets that the group will tolerate restricted output in return for higher prices.

- The break higher this week confirms an extension of the current bullish price sequence of higher highs and higher lows and attention turns to $79.53 for WTI, a Fibonacci projection and the $80.00 psychological hurdle.

- Unlike energy products, gold and silver are in negative territory, with gold edging off yesterday's highs as equities bounce off the lower levels of the week. A break of $1721.7, Sep 29 low would confirm a resumption of weakness and open key support at $1690.6, Aug 9 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.