-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tight Ranges, But Busy Session Ahead

HIGHLIGHTS:

- Markets tread water ahead of ADP, ISM releases

- NZD trades solidly, RBNZ August hike now fully priced

- Traders look for clues for Friday's Payrolls in today's ADP jobs release

US TSYS SUMMARY: Tight Ranges Despite Fairly Busy Agenda Ahead

Tsys have traded in tight ranges overnight with little direction, though a fairly busy calendar lies ahead, in terms of data, speakers, and the Treasury's refunding announcement.

- Sep 10-Yr futures (TY) steady at at 135-00 (L: 134-29 / H: 135-01). Volumes very light (<160k).

- The 2-Yr yield is unchanged at 0.1703%, 5-Yr is up 0.2bps at 0.6489%, 10-Yr is up 0.3bps at 1.1754%, and 30-Yr is up 1.2bps at 1.8529%.

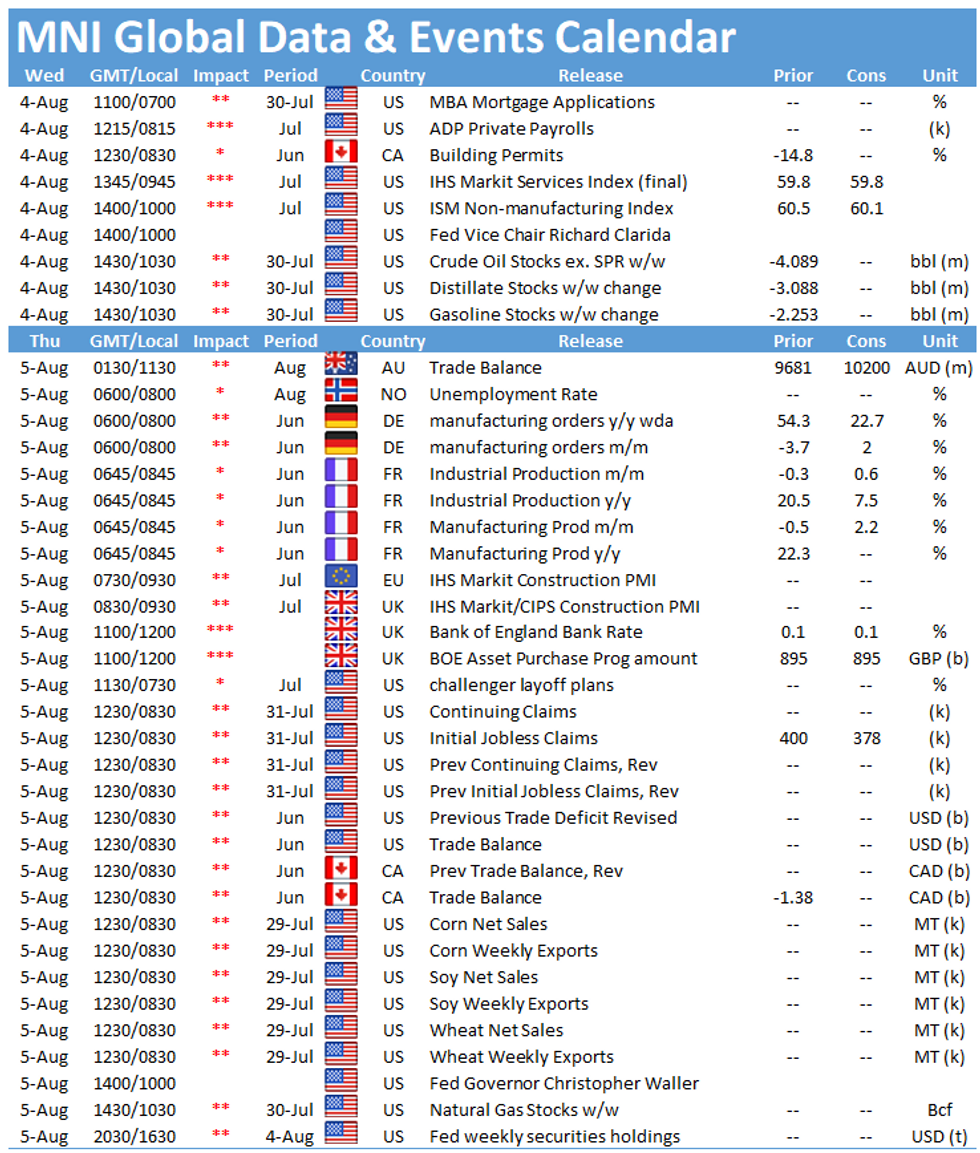

- The ADP employment reading at 0815ET is the first data highlight. Services/Composite PMI at 0945ET are finals. Then ISM Services at 1000ET.

- In between those, we get the quarterly Treasury refunding announcement at 0830ET - expectations are for no change in coupon sizes (and the webcast at 1000ET).

- St Louis Fed Pres Bullard speaks at 0900ET, but the one to watch is Fed Vice Chair Clarida at 1000ET.

- 17-week bill sale for $30B at 1130ET; NY Fed buys ~$3.225B of 7-10Y Tsys.

EGB/GILT SUMMARY - Bund at session high, UK underperforms.

EGBs have traded in tight ranges this morning, and EU PMI services releases had very little impact.

- Bund is better bid at the time of typing, and we still eye next initial target at -0.50%, which equates to 177.24 today.

- Printed -0.491% yesterday.

- Peripheral spreads are a touch tighter, with Italy leading by 0.6bp.

- Gilts are underperforming Bund somewhat, translating into a 0.7bp wider Gilt/Bund spread.

- UK final Services PMI was revised higher, and has kept the upside in the contract in check.

- Looking ahead, US ADP and ISM Services are the notable data, while Fed Bullard and Clarida are the scheduled speakers.

- Also on the calendar, additional financing details relating to Treasury's Quarterly Refunding will be released at 8:30 ET.

- Gilt futures are down -0.02 today at 130.29 with 10y yields down -0.1bp at 0.518% and 2y yields up 1.1bp at 0.061%

- Bund futures are up 0.12 today at 177.09 with 10y Bund yields down -0.9bp at -0.492% and Schatz yields down -0.2bp at -0.778%

- BTP futures are up 0.23 today at 155.20 with 10y yields down -1.5bp at 0.550% and 2y yields down -1.0bp at -0.502%.

- OAT futures are up 0.17 today at 162.64 with 10y yields down -1.2bp at -0.147% and 2y yields down -0.3bp at -0.714%.

EUROPE ISSUANCE UPDATE

Germany allots E3.273bln 0% Oct-26 Bobl, Avg yield -0.76% (Prev. -0.59%), Bid-to-cover 1.32x (Prev. 0.86x), Buba cover 1.61x (Prev. 1.09x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

3RZ1 100.37/100.50/100.62c fly 1x3x2, bought for 1.5 in 1k

UK:

SFIZ1 99.95/100cs 1x2, sold the 1 at -0.25 in 1k

FOREX: NZD Surges as August Rate Hike Now Fully Priced

- EUR/USD is offered ahead of NY hours, with the pair drifting below the 1.1850 mark to chew further through last week's gains. 1.1830 marks first support, the 50% Fib of the late July recovery. A break below here opens 1.18 and the July lows of 1.1752.

- Following a decent spell of strength across the past few months, CHF is at the bottom end of the table ahead of NY hours, with EUR/CHF bouncing 20 pips or so off yesterday's multi-month lows.

- NZD is comfortably the strongest performer, with NZD rallying against all others to top the 50-dma for the first time since early June. The unemployment rate unexpectedly dropped to 4.0% from 4.7% (4.6% when incorporating revisions), prompting markets to bring forward rate hike bets from the RBNZ - an August rate hike is now fully priced in according to overnight index swaps.

- US ADP Employment Change is the data highlight Wednesday, with markets expecting job gains to remain consistent at around 680k. ISM Services Index crosses later in the session, with growth seen inching up to 60.5 from 60.1. Comments from Fed's Clarida and Bullard will be keenly eyed - both speak early on in the US trading day.

FX OPTIONS: Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E598mln), $1.1830-35(E591mln), $1.1845-55($1.8bln), $1.1920-25(E601mln)

- USD/JPY: Y110.50($1.3bln)

- GBP/USD: $1.3750(Gbp502mln)

- EUR/GBP: Gbp0.8550(E841mln)

- EUR/JPY: Y129.25(E710mln)

Price Signal Summary - BTPs Extend Winning Streak

- In the equity space, S&P E-minis outlook is bullish as evidence of dip buying remains solid on intraday pullbacks. Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. EUROSTOXX 50 futures traded firmly from the Monday open, keeping the bullish short-term theme intact. This follows the recent print above a key near-term resistance at 4101.50, Jul 1 high.

- In FX, the USD is weaker. EURUSD traded higher Thursday and Friday to clear a former resistance at 1.1851, Jul 15 high. The extension has exposed the 50-day EMA at 1.1916. GBPUSD traded higher again Friday before fading into the close. The pair has cleared the 50-day EMA. The move above this average strengthens the current corrective recovery. USDJPY extended the slippage Tuesday, taking out first support to trade through the Y109 handle. A bearish focus dominates.

- On the commodity front, Gold has faded off last week's highs, but remains in recovery mode after printing 1790.0 in mid-July. The outlook is bullish and the recent pullback was considered corrective. Brent futures corrected lower still Tuesday, edging through the 50-day EMA support at 71.82. This prompts a further deterioration in the outlook, exposing losses toward levels not seen since mid-July.

- Within FI, Bund futures rallied further Tuesday, extending the current winning streak to touch the best levels since early February. BTPs further cemented the uptrend, extending the gains to hit fresh alltime highs. A positive outlook follows the recent resumption of the uptrend that started May 19 - gains on Jul 6 and 7 resulted in a breach of a former key resistance at 152.47.

EQUITIES: Stocks Holding Late Tuesday Rally

- Equity futures are in a holding pattern ahead of the Wednesday open, with the e-mini S&P just below yesterday's late high of 4417.00. News and trade catalysts have been few and far between so far Wednesday, with focus turning to the upcoming ADP Employment Change data and the ISM Services Index.

- Recent gains have confirmed a resumption of the uptrend and signal scope for a continuation near-term. The sell-off Jul 14 - 19 resulted in a break of 4279.25, Jul 8 low. However the contract found support at the 50-day EMA - this EMA represents an important support and the bounce from it is bullish. The focus is on 4481.75 next, a Fibonacci projection. Key support is 4224.00, Jul 19 low.

- European cash trade is more positive, with Germany's DAX outperforming (up 0.8%) while UK's FTSE-100 lags slightly, albeit with gains of 0.4% or so. Europe's tech and industrials sectors are leading the way higher.

GEOPOLITICS: Iran-'Harsh Retaliation To Any Confrontation' As Tensions Spike In Gulf

According to the Iran's Fars News, the Islamic Revolutionary Guards Corps (IRGC) has issued comments stating that in the event of any 'confrontation' between Iranian forces and others there will be a 'harsh retaliation'.

- Comes as tensions in the Gulf spike following the attempted hijacking of a UAE-owned bitumen tanker, believed to be the Asphalt Princess, yesterday off the coast of Fujairah, UAE. There have been accusations that the Iranian gov't was behind the attempted hijacking, given that the crew were supposedly given orders to divert the course of the ship to Iranian waters. A vessel owned by the same firm as the Asphalt Princess was seized by Iran in 2019 due to allegations of smuggling.

- The incident comes just days after a drone attack on the Israeli-operated MV Mercer Street oil tanker that killed one British and one Romanian national. Iran has been blamed for the attack (something Tehran denies). This set in motion a ratcheting up of rhetoric from the gov'ts of Israel, the UK, and the US. A US Navy official has reported that a US vessel will be sent to the area of yesterday's incident to monitor the situation.

- The relations between Iran and the west are at an inflexion point, with hardline conservative Ebrahim Raisi confirmed as the new Iranian president in a ceremony yesterday. Taking over from moderate incumbent Hassan Rouhani, there remains the possibility that under Raisi the IRGC could engage in even more overt military action in the region, risking further escalation.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.