-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries Shrug Off Fitch Downgrade

Highlights:

- Markets largely shrug off any impact from the Fitch sovereign downgrade

- ADP employment change eyed for clues ahead of Friday's payrolls

- Quarterly refunding likely to see coupon increases across the board

US TSYS: Twist Steeper Ahead of ADP, Treasury Quarterly Refunding

- Cash Tsys trade twist steeper, with the front end off highs but still pushing further on from the bid seen at the open before some small net cheaper pressures from 20s onwards.

- Macro headline flow remains limited through early London hours, leaving discussions surrounding the one-notch rating downgrade of the U.S. by Fitch at the fore and some dovish commentary from Bostic (’24 voter) late yesterday, along with weakness in equity markets.

- 2YY -4.2bp at 4.860%, 5YY -2.6bp at 4.190%, 10YY -0.6bp at 4.017% and 30YY +0.5bp at 4.097%.

- The front end moves come with only limited declines in near-term FOMC expectations (seen with a cumulative 8.5bp more tightening to a 5.41% terminal in Nov) but rather with rate cut pricing building and more notably into 2H24. The 57bp of cuts from terminal to Jun’24 and 128bp from terminal to Dec’24 is the highest since Jul 26.

- TYU3 trades 8+ ticks higher at 111-04+ off highs of 111-07+ but well within yesterday’s range. Volumes are back at recent relatively elevated averages of 310k after lagging through the first half of yesterday. Support is seen at 110-25+ (Jul 28 low) with the key 110-05 (Jul 6 low) exposed, whilst resistance is seen at the 20-day EMA of 111-29+.

- Data: ADP employment Jul (0815ET) plus weekly MBA mortgage data (0700ET).

- US Tsy Quarterly Refunding announcement (0830ET)

- Bill issuance: US Tsy $46B 17W bill auction (1130ET)

MNI BOE Preview - August 2023: Reaction Function Questions

- Has the MPC’s reaction function changed? That is the question we are asking ourselves as we head into the August meeting.

- At the June meeting we argued that we didn’t think a 50bp move was warranted. The MPC saw things differently, however, largely justifying its decision by pointing to wage growth and services inflation.

- The MNI Markets team still thinks that 25bp hikes are more justified by the current economic data. But we find it hard to make the argument that if 50bp was justified in June that it is not justified now.

- However, 77% of economists look for a 25bp hike while markets price in around a 30% probability of a 50bp hike, and we acknowledge the risk of a 25bp hike is large .

- We have read through and summarised over 20 analyst reviews.

Note: We have corrected our previous email that said markets priced a 30% probability of 25bp (rather than 50bp). The PDF we originally sent was correct - the correction is just in the body of the email.

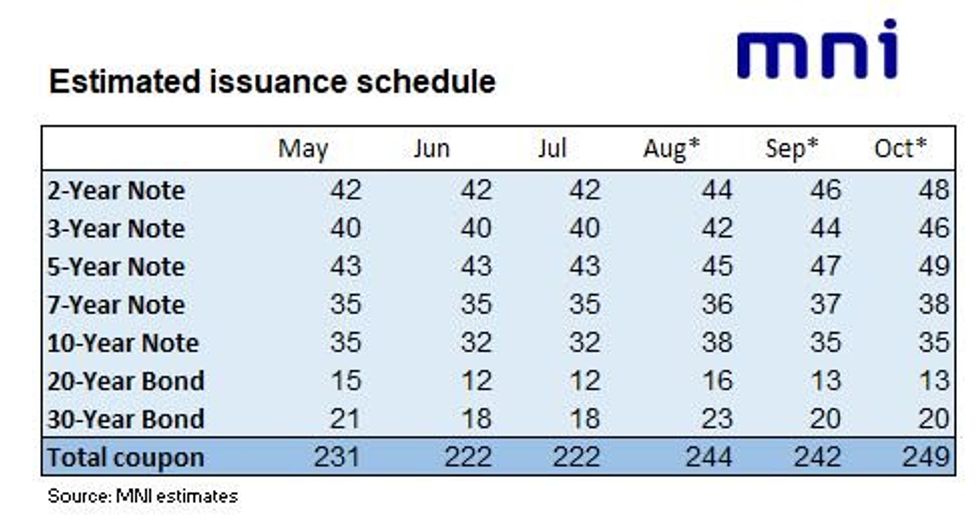

Refunding Preview: Coupon Increases Across The Board

Re-upping our August UST Issuance Deep Dive published yesterday, which previews today's Treasury Refunding Announcement (0830ET / 1330UK):

- MNI’s current expectations for the upcoming quarter include $2B raises to 2s/3s/5s and $1B to 7s in each month, with 10Y sizes $3B higher, 20Y up $1B, and 30Y up $2B. If anything this is conservatively low for 7s, 20s, and 30s. Overall this means nominal sales will total $249B in Oct, vs $222B equivalent in the prior quarter.

- Most analysts are in line with those expectations for 2s, 3s, and 5s, with 7Y seen either steady or up $3B, 10Y up $3-4B, 20Y up $0-2B, and 30Y up $1-2B.

- Attention will also be on TBAC's recommended financing table for the following quarter.

- Apart from the coupon sizes, the refunding announcement could bring more clarity on buybacks.

EUROPE ISSUANCE UPDATE:

German Auction Results:

- Allots E609mln 0% May-36 Bund, Avg yield 2.61% (Prev 0.37%), Bid-to-cover 2.31x (Prev 2.72x)

- Allots E1.105bln 1.00% May-38 Bund, Avg yield 2.67% (Prev 2.64%), Bid-to-cover 2.31x (Prev 2.35x)

That was a decent 15-year Bund auction with the bid-to-offer on the on-the-run 1.00% May-38 Bund higher than the previous auction in May while the lowest accepted price (to 2dp) was the same as the average price for that issue and only 0.01 lower for the off-the-run 0% May-36 Bund. The lowest accepted prices were above the prevailing market prices for both Bunds sold. Now both issues are trading comfortably above the average auction price - albeit both off their highs of the day.

FOREX: USD Bounces Off Fitch Lows, Shrugging Off Ratings Action

- The greenback trades modestly firmer headed into NY hours, allowing the USD Index to retain participation in the uptrend off the July lows despite the ratings action from Fitch late yesterday, and the US losing another of its AAA ratings. Markets have generally adopted the view that the Fitch action is of less relevance than the S&P downgrade some years ago, with Treasury markets already content with the US being of mixed-grade investment ratings.

- JPY is comfortably the firmest currency in G10, rising against all others as equities hold their pullback off the week's best levels. The e-mini S&P is lower by a further 35 points or so, and has briefly shown below last week's lows.

- High beta currencies - namely the AUD and NZD - are the weakest performers so far, helping prompt AUD/USD print a new multi-month low of 0.6566. Next support undercuts at the May 31 lows of 0.6458.

- Focus ahead turns to the ADP employment change release and the Brazilian central bank rate decision.

FX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0975-90(E1.4bln), $1.1050-65(E810mln)

- USD/JPY: Y141.50($875mln), Y142.40-50($588mln), Y143.00($590mln), Y145.50($601mln)

- AUD/USD: $0.6660(A$580mln), $0.6850-70(A$1.0bln)

EQUITIES: Eurostoxx 50 Futures Extend Pullback From Monday High

- Eurostoxx 50 futures have found resistance at 4513.00, Monday’s high, and the contract has traded sharply lower. For now, the pullback is considered corrective. However, the move lower has exposed support at the 50-day EMA. The average intersects at 4371.40 and a clear break, if seen, would threaten recent bullish developments and expose 4331.00, the Jul 26 low and a key support. Key resistance and the bull trigger is at 4513.00.

- The E-mini S&P contract continues to trade below 4634.50, the Jul 27 high. The pullback from this level highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4654.42 today. An extension lower would expose the 20-day EMA - at 4547.38 and a break of it would strengthen bearish conditions. Clearance of the channel top is required to resume the uptrend.

COMMODITIES: Uptrend in WTI Futures Remains Intact

- The uptrend in WTI futures remains intact and the contract continues to appreciate. The break above $77.15 last week, the Jul 13 high, confirmed a resumption of the current bull cycle and this has resulted in a breach of key resistance at $81.44, the high on Apr 12 / 13. This development strengthens bullish conditions and signals scope for a climb towards $83.59, the Jul 11 2022 high. Initial key short-term support lies at $73.78, the Jul 17 low.

- Gold traded sharply lower last Thursday and a bearish threat remains present. Yesterday’s move lower reinforces this warning. The move down has resulted in a break of the 50-day EMA - at $1951.7. A continuation lower would expose support at $1924.5, the Jul 11 low. Clearance of this level would open the key support at $1893.1, the Jun 29 low. Key resistance is at $1987.5, the Jul 20 high. A break would reinstate a bullish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/08/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/08/2023 | 1230/0830 | ** |  | US | Treasury Quarterly Refunding |

| 02/08/2023 | 1400/1000 | ** |  | US | housing vacancies |

| 02/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/08/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 03/08/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/08/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 03/08/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/08/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/08/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/08/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/08/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/08/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/08/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/08/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 03/08/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/08/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/08/2023 | 0900/1100 | ** |  | EU | PPI |

| 03/08/2023 | 0900/1100 |  | EU | ECB Panetta speaks in Bocconi webinar | |

| 03/08/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/08/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 03/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/08/2023 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/08/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 03/08/2023 | 1300/1400 |  | UK | BOE DMP Survey | |

| 03/08/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/08/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/08/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 03/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 03/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.