-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Ouster of Barnier Leaves Little Dent

MNI US MARKETS ANALYSIS - Treasuries Steady After Fed Rout

HIGHLIGHTS:

- Norges Bank lay out tightening path, with first hike eyed in September

- Gold remains heavy, nearing $1800/oz support

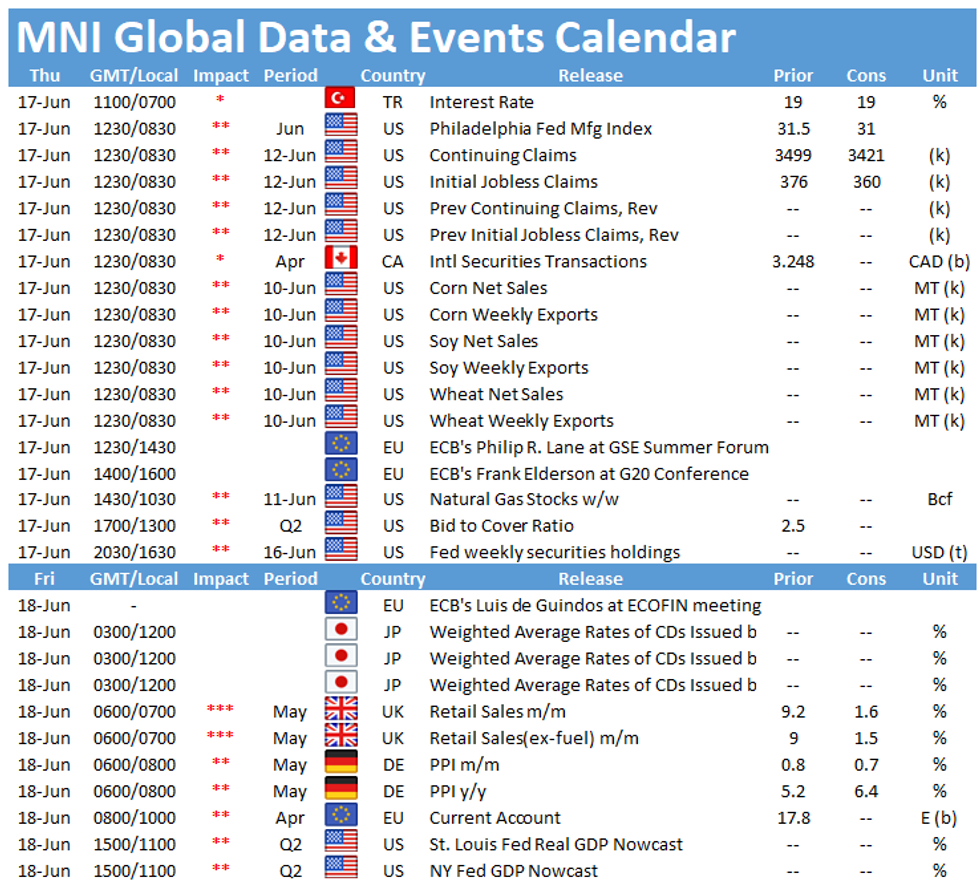

- Weekly jobless claims, Philly Fed and ECB speeches in focus

US TSYS SUMMARY: Steadying Out After FOMC Rout

Tsys have stabilized in overnight trade Thursday following the hawkish FOMC-led sell-off Wednesday.

- The 2-Yr yield is down 0.6bps at 0.1993%, 5-Yr is down 0.8bps at 0.8874%, 10-Yr is down 1.4bps at 1.5617%, and 30-Yr is down 3.1bps at 2.1766%.

- Sep 10-Yr futures (TY) down 1.5/32 at 131-22.5 (L: 131-14 / H: 131-24.5). High volumes (570k+).

- Like TYs, equities remain weaker but off overnight lows; dollar stronger.

- Sell-side analysts' reviews of Wednesday's FOMC meeting are nearly unanimous in declaring the outcome more hawkish than expected, with a fair few expectations for taper/tightening timelines brought forward. Our full review will be out shortly.

- Jobless claims data (0830ET) is the highlight of the calendar, alongside Philly Fed at the same time.

- In supply, 4-/8-week bill auctions ($80B) at 1130ET; $16B TIPS auction at 1300ET.

- NY Fed buys ~$2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: Digesting The FOMC

Following yesterday's hawkish FOMC meeting, European government bonds have sold off alongside fresh losses for equities.

- Gilt yields are 3-7bp higher on the day with the belly of the curve underperforming.

- Bunds opened lower with yields now 1-3bp higher.

- OATs have slightly unperformed bunds with the curve 2-3bp steeper.

- The belly of the BTP curve has similarly underperformed with the 10-year benchmark yield up 5bp.

- Supply this morning came from France (OATs, EUR10bn & Linkers, EUR2.24bn)), Spain (Bonos/Oblis, EUR5.521bn), Ireland (EUR0.75bn).

EUROPE OPTION FLOW SUMMARY: Rate Hike Plays in Short Sterling Following Hawkish Fed

Eurozone:

RXN1 170p, bought for 4 in 8k

RXQ1 175c, bought for 7.5 in 25k (short cover)

RXQ1 174.00/174.50cs, bought for 7 in 2k

3RU1 100.12/99.87/99.62p fly, bought for 3.25 in 4k

UK:

2LX1 99.125/99.00ps vs 99.50/99.625cs, bought the ps for 0.75 in 3k

2LZ1 99.37/99.12ps 1x2 bought for 1.5 in 9.5k total

2LZ1 99.25/12/00/87p condor vs 99.62c, bought the condor for 20k total now. Has traded evens and 0.25

2LZ1 9925/9912/9900/9887 condor vs 99.62/99.87cs, bought the condor for 0.75 in 3k

SFIM2 (SONIA) 9970/60/50p ladder, bought for 0.5 in 5k

US:

TYN1 131.75/131.25/130.75/130.25p condor, bought for10.5 in 8k

EUROPEAN ISSUANCE: Spanish Bonds, French OATs and Linkers

Spain sells:

E1.967bln 0% May-24 Bono, Avg yield -0.440% (Prev -0.356%), Bid-to-cover 2.02x (Prev 1.78x)

E2.164bln 0% Jan-28 Bono, Avg yield 0.011% (Prev 0.171%), Bid-to-cover 1.16x (Prev 1.78x)

E1.39bln 0.85% Jul-37 Obli, Avg yield 0.972% (Prev 0.887%), Bid-to-cover 1.55x

France sells MT OATs and inflation linkers:

- E3.134bln 0.50% May-25 OAT, Avg yield -0.51% (Prev -0.70%), Bid-to-cover 2.53x (Prev 1.72x)

- E3.15bln 0% Feb-27 OAT, Avg yield -0.30% (Prev -0.19%), Bid-to-cover 2.26x (Prev 2.32x)

- E1.88bln 0.75% May-28 OAT, Avg yield -0.21% (Prev -0.28%), Bid-to-cover 2.47x (Prev 2.51x)

- E1.835bln 0.50% May-29 OAT, Avg yield -0.10% (Prev -0.18%), Bid-to-cover 2.31x (Prev 1.90x)

- E751mln 0.10% Mar-25 OATi, Avg yield -1.54% (Prev. -0.46%), Bid-to-cover 2.78x (Prev 7.62x)

- E897mln 0.10% Jul-31 OATei, Avg yield -1.27% (Prev. -1.44%), Bid-to-cover 2.20x (Prev. 1.93x)

- E576mln 0.10% Jul-47 OATei, Avg yield -0.76% (Prev. -0.90%), Bid-to-cover 2.15x (Prev. 2.14x)

FOREX: Norges Bank in Pole Position to Be First DM CB to Raise Rates

- Central bank activity has drawn plenty of focus so far today, with decisions from the Indonesian, Taiwanese, Norwegian and Swiss central banks. All banks opted to keep rates unchanged, with the Norges Bank decision the most notable as they lent on their September decision as the first to see a post-pandemic rate hike. This puts the Norwegian central bank in pole position to be the first developed market to hike interest rates as the global economy recovers.

- The greenback remains firm following yesterday's Fed decision, with the USD Index adding to gains and printing new multi-month highs. The USD Index has now topped the 200-dma at 91.537, and is now within 2% of the 2021 highs printed in late March.

- Meanwhile, the CHF is among the worst performers in G10. While the SNB kept policy unchanged, medium- and long-term inflation forecasts were remarkably subdued, with CPI not seen topping 1.0% at all across the forecast horizon.

- Key data due today include weekly jobless claims and the latest Philly Fed data for June. The Turkish rate decision also crosses, with the CBRT keeping rates unchanged at 19.00%. Speeches from ECB's Lane, Elderson and Visco are all due.

FX OPTIONS: Expiries for Jun17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1985-90(E841mln), $1.2000-05(E1.1bln), $1.2045-50(E1.3bln), $1.2085-00(E1.2bln-EUR puts), $1.2185-00(E1.3bln-EUR puts), $1.2220-35(E3.6bln-EUR puts), $1.2300(E1.9bln-EUR puts)

- USD/JPY: Y108.65-75($886mln-USD puts), Y109.10-20($878mln), Y109.35-50($586mln-USD puts), Y110.20-25($1.6bln-USD puts), Y110.50($985mln-USD puts), Y110.95-111.00($600mln-USD puts)

- AUD/USD: $0.7715-30(A$630mln-AUD puts), $0.7800(A$521mln), $0.7850(A$614mln)

- NZD/USD: $0.7250(N$920mln)

- USD/CAD: C$1.2065-70($1.0bln-USD puts)

Price Signal Summary - USD Bulls Return

- In the equity space, S&P E-minis maintain a bullish tone however the recent pullback suggests the contract remains in a corrective cycle. A deeper pullback would open 1.4155.50, the Jun 3 low and the 50-day EMA at 4139.35. The EMA represents a key support level. A clear break of the average is required to signal potential for a deeper retracement.

- In FX, EURUSD fell sharply yesterday on the back of broad post-Fed USD strength, confirming a bearish cycle. The recent breach of the 50-day EMA and 1.2104, Jun 4 low highlights a bearish theme and today's extension lower reinforces the current bearish tone. The focus is on 1.1919, 61.8% retracement of the Mar 31 - May 25 rally. GBPUSD weakness accelerated Wednesday, with prices breaking below the 50-day EMA. The move through the average strengthens a short-term bearish outlook and opens 1.3935, the 100-DMA and 1.3887, May 7 low. USDJPY traded higher yesterday extending the recovery from 109.19, Jun 7 low. The break of 110.33, Jun 4 high exposes 110.97, this year's high on Mar 31.

- On the commodity front, Gold traded sharply lower yesterday reinforcing the current bearish cycle. The break lower has resulted in a clear breach of the 50-day EMA signalling scope for a deeper pullback towards $1796.8 next, 50% retracement of the Mar 8 - Jun 1 rally. Trend conditions in oil remains bullish and the recent pullback is likely a correction. Brent (Q1) focus is on $75.60, Apr 25 high 2019 (cont). WTI (N1) attention is on $73.20, 3.236 projection of Mar 23 - 30 - Apr 5 price swing.

- Within FI, Bund futures are weaker and remain below recent highs. The current pullback is still considered corrective but there appears scope for a deeper pullback. The next support is seen at 171.37, Jun 3 low. The pullback in Gilt futures exposes 126.70, Jun 3 and a key near-term support.

EQUITIES: Stocks on the Backfoot as Wall Street Weakness Spreads to Europe

- The negative close on Wall Street after Wednesday's Fed rate decision has bled into European markets this morning, with most indices in minor negative territory. The UK's FTSE-100 leads losses with a 0.6% step lower, while Spain's IBEX-35 outperforms modestly, and is the sole index in the green.

- Thursday's move has dragged the Stoxx600 off the alltime highs printed on June 14th, with utilities and real estate leading the way lower. Financials are the sole gainer on a sector-by-sector breakdown, benefiting from steeper global yield curves after yesterday's Fed decision.

- Notable movers in Europe include travel names easyJet, TUI AG, and Ryanair, who all trade firmer, while precious metals miners including Polymetal International and Evraz slide alongside weaker metals prices.

COMMODITIES: Gold Nurses Further Losses, Oil More Stable

- Gold prices suffered sharp losses after the Wednesday Fed decision, and precious metals remain weaker across the board ahead of the NY open. Spot gold is testing the $1800/oz support, and a break below opens losses toward the 100-dma at $1796.2, the first downside level.

- Oil prices stabilised somewhat after WTI hit new cycle highs mid-week. This keeps directional parameters unchanged for now at the $73.20/bbl level, the 3.236 proj of Mar 23 - 30 - Apr 5 price swing.

- Focus turns to the weekly US jobless claims numbers as well as the June Philly Fed index.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.