-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - UBS, CS Tie-Up Gets Frosty Market Reception

Highlights:

- UBS, Credit Suisse tie-up gets frosty market reception

- JPY brings YTD highs into view as risk sentiment remains fragile

- Monday schedule more muted, with CB risk back-loaded to second half of the week

US TSYS: Unusually Wide Pre-US Session Ranges After Weekend Developments

- Cash Tsys have seen sizeable two-way trade with an unusually large range before the US session gets underway (2YY intraday range 3.63%-4.02%).

- What started as a positive market reaction (with downward pressure on fixed income) to weekend developments with the UBS takeover of CS and coordinated central bank action for USD liquidity swap lines, has been replaced with concerns for AT1 bonds with spillover across asset classes.

- Treasuries currently sit firmly off highs having retraced some of the bid, but maintain richer levels from Friday’s close, led by the belly.

- In yield space, 2YY -2.4bps at 3.813%, 5YY -5.0bps at 3.450%, 10YY -3.9bps at 3.389% and 30YY -0.9bps at 3.610%.

- TYM3 trades 1 tick lower at 115-25 on heavy volumes of 725k. It’s off highs of 116-24 that opens key resistance at 116-28+ (Jan 19 high) having cleared 116-01 (Mar 16 high) and 116-08 (Feb 2 high).

- No data

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auctions (1130ET)

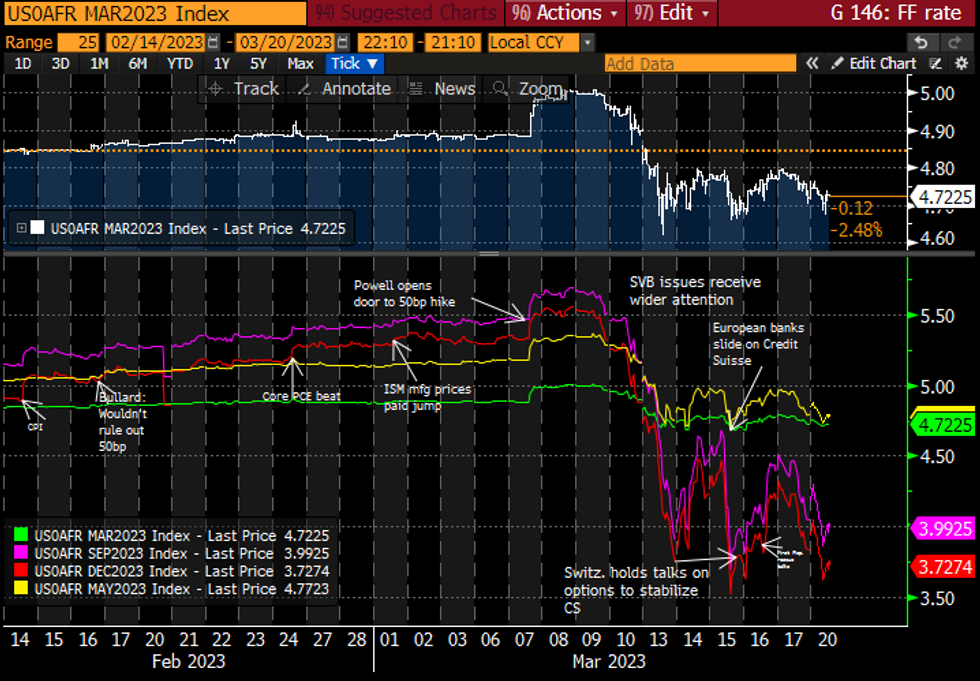

STIR FUTURES: Fed 2H23 Rate Cut Expectations Build Again

- Fed Funds implied hikes are back unchanged from Friday’s close for near-term meetings, with 15bp for Wed and a cumulative 21bp for May.

- It masks sizeable moves already today, with a May terminal of 4.88% as trading resumed after weekend announcements before sliding 20bps and then bouncing 11bps through London hours to 4.79% at typing.

- The move lower weighed more heavily on later meetings, building back to 105bp of cuts to year-end with 3.72% (-11bp), just shy of the most inverted it’s been (at close) since the start of the banking crisis.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE:

Slovakia auction results

- E51mln of the 0.25% May-25 SlovGB. Avg yield 2.911% (bid-to-cover 2.56x)

- E78mln of the 0.125% Jun-27 SlovGB. Avg yield 3.0471% (bid-to-cover 1.15x)

- E143mln of the 4.00% Oct-32 SlovGB. Avg yield 3.2576% (bid-to-cover 1.88x)

- E166mln of the 3.75% Feb-35 SlovGB. Avg yield 3.6951% (bid-to-cover 1.28x).

- Another decent EU-bond auction, with the lowest accepted price comfortably above the pre-auction mid-price for both the 5-year and 10-year issues. However, the auction did see a bit of a drop in the bid-to-cover for both bonds on offer today, but with a similar amount sold.

- E1.85bln of the 2.00% Oct-27 EU-bond. Avg yield 2.66% (bid-to-cover 1.91x)

- E1.746bln of the 1.00% Jul-32 EU-bond. Avg yield 2.81% (bid-to-cover 1.45x)

FOREX: JPY on Top as Haven Trade Persists

- JPY is comfortably the outperformer early Monday, with equities sliding on the open and providing a boost to haven currencies across G10. This extends the USD/JPY pullback off the early March highs, with horizontal support at 129.81 the next downside target for bears. Last week's break and close below the 50-dma was a bearish signal, making the YTD lows printed in January at 127.23 a more realistic prospect over the medium-term.

- European bank stocks traded heavy from the off, with the UBS - Credit Suisse merger agreement being poorly received by markets due to the heavy dilution of AT1 bond holders and the much lower-than-market price being paid for the Credit Suisse assets. Heavy equity trade translated to weakness in the single currency on the opening bell, however much of the down-move has been reversed headed through the NY crossover.

- Growth and risk proxy FX are at the bottom-end of the G10 pile, putting NZD, AUD lower against most others. AUD/JPY weakness as put the cross at fresh 2023 lows, with 87.03 a key level going forward. Weakness through here opens levels not seen since H1 2022.

- Datapoints are few and far between Monday, with the deluge of CB risk to come later this week. The Fed, BoE, SNB, Norges Bank decisions start on Wednesday, with a number of EM banks also on the docket (namely Brazil, Philippines, Turkey and Taiwan). ECB's Lagarde and Centeno are set to be speaking later today, as the ECB President appears in front of European Parliament.

FX OPTIONS: Expiries for Mar20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E706mln), $1.0665(E825mln), $1.0705-15(E1.0bln), $1.0730(E701mln)

- USD/JPY: Y131.00($1.2bln), Y132.00-15($706mln), Y132.35-50($690mln), Y132.90-00($811mln)

- AUD/USD: $0.6730(A$538mln)

- USD/CAD: C$1.3750($599mln)

- USD/CNY: Cny6.9000($535mln)

EQUITIES: Equity Futures Fail to Find Support From Credit Suisse Takeover

- The Eurostoxx 50 futures outlook remains bearish following recent weakness and the contract is trading lower today. Recent short-term gains were considered corrective. The break of the 4000.00 handle signals scope for weakness towards 3865.00, the Jan 4 low and further out towards the 3800.00 handle. Initial resistance is seen at 4129.90, the 20-day EMA. Key resistance has been defined at 4268.00, the Mar 6 high.

- The trend condition in S&P E-Minis remains bearish and recent short-term gains appear to be a correction. Price has recently cleared a key short-term support at 3960.75, Mar 2 low to confirm a resumption of the bear cycle that has been in place since Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4026.76, the 50-day EMA. A break of this EMA would alter the picture.

COMMODITIES: WTI Futures Print Fresh One-Year Low, Attention on $62.43 Fibonacci Projection

- WTI futures remain vulnerable and the contract is trading lower this morning. Last Wednesday’s sell-off resulted in the break of key support at $70.86, the Dec 9 low. The breach confirms a resumption of the medium-term downtrend and reinforces current bearish conditions. Note too that price has also cleared the psychological $70.00 handle. Attention is on $62.43, a Fibonacci projection. Initial resistance is at $69.64, Monday’s high.

- A strong rally in Gold Friday saw the yellow metal trade to fresh YTD high of $1989.4. This confirms a resumption of the uptrend that has been in place since late September 2022. Today’s rally has resulted in a break of the psychological $2000.0 handle and this further strengthens the current uptrend. It opens $2034.0 next, a Fibonacci projection. On the downside, Friday’s low of $1918.3 marks firm support.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/03/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 20/03/2023 | - |  | UK | DMO Quarterly Consultation with GEMMs / Investors | |

| 20/03/2023 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/03/2023 | 1600/1700 |  | EU | ECB Lagarde Intro as ESRB Chair at ECON | |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.