-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - UK STIR Futures Pressured as Mann Urges Need for More Hikes

Highlights:

- BoE's Mann pressures SONIA futures in argument for further hikes

- EUR/USD still tilted lower, exposing YTD lows

- Weekly jobless claims likely of more relevance than GDP revisions

US TSYS: Modestly Cheaper Ahead Of GDP Revisions, 7Y Supply & Fedspeak

- Cash Tsys see mild cheapening pressure led through 5-10Y tenors, lagging Gilts after a hawkish speech from BoE’s Mann as Tsys broadly consolidate moves after the FOMC minutes.

- 2YY +1bp at 4.704%, 5YY +2.5bp at 4.154%, 10YY +2.7bp at 3.943% and 30YY +1.8bp at 3.932%.

- TYH3 trades 5 ticks lower at 111-01+ and just off session lows of 111-00, close to initial support at 110-30+ (Feb 22 low) after which lies 110-13 (lower 2.0% Bollinger Band).

- Data: 2nd estimates for Q4 GDP/PCE highlight the day’s data, landing at the same time as weekly jobless claims and the Chicago Fed national activity index (0830ET) before Kansas Fed mfg index (1100ET). Among usual GDP revisions, 1st estimates for GDI will provide a helpful alternate take on the strength of economic activity after lagging the bounce in GDP back in Q3.

- Fedspeak: Bostic (’24 voter, 1050ET), Daly (’24 voter, 1400ET)

- Note/bond issuance: US Tsy $35B 7Y Note auction (1300ET)

- Bill issuance: US Tsy 4W, 8W bill auctions (1130ET), $15B 16 Day CMB (1300ET)

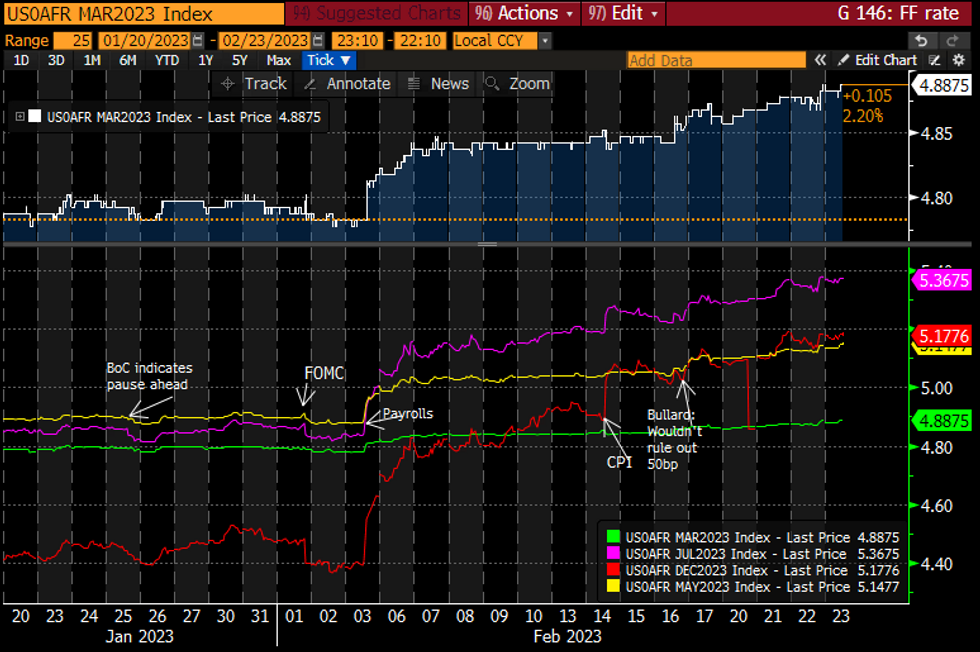

STIR FUTURES: Fed Terminal Near Post-FOMC Minutes Highs

- Fed Funds implied hikes have pushed back towards yesterday’s post-FOMC minutes highs after easing slightly overnight.

- 30bp for Mar, cumulative 56bp for May and 78bp to 5.37% terminal Jul before 19bp of cuts to 5.18% Dec (all within +/- 0.5bp from yesterday close).

- Fedspeak: In case missed, NY Fed’s Williams said late yesterday that goods inflation may not slow as quickly as hoped and non-housing core services prices still high. Ahead, ’24 voters Bostic and Daly speak for first time since Feb 6 and 3 (both after payrolls but before CPI) with the terminal some 25bps higher since then.

Source: Bloomberg

Source: Bloomberg

Gilts underperform core FI as Mann remains hawkish

- Core fixed income has drifted lower in European hours, but Bunds, Treasuries and gilts all still remain some way above yesterday's lows.

- The biggest moves this morning have been seen in gilts with a a largely shift in the curve following a hawkish speech from MPC member Catherine Mann. She was already known to be the hawk on the MPC but she seems a long was off from voting for rates to be unchanged. She has made no reference to the magnitude of future rate hikes but she notes that "more tightening is needed, and caution that a pivot is not imminent."

EUROPE ISSUANCE UPDATE:

EGB SYNDICATION: German 30-year tap: Final terms

- Tap size set at E4bln (the bottom of the E4.0-5.5bln range MNI expected)

- Spread set earlier at 0% Aug-52 Bund + 10bps (Guidance was +11.5 bps area)

- Orderbooks closed in excess of E40bln (pre-rec, inc E7.05bln JLM interest)

FOREX: EUR/USD Downtrend Persists, With YTD Lows in Range

- The modest downtrend in EUR/USD persists through the European morning, with EUR/USD printing a fresh pullback low at 1.0587. This marks the fourth consecutive session of lower lows for the pair, and opens next support at 1.0484 (YTD low) and the 100-dma at 1.0443.

- USD strength following the Wednesday FOMC minutes release remains the key driver, prompting the USD Index to narrow the gap with key resistance crossing at 104.667.

- GBP continues to trade heavy and is among the poorest performers in G10. GBP/JPY is continuing to backtrack the gains posted earlier this week to narrow in on first support of 161.44. Moves come ahead of the nomination hearing for the next likely BoJ governor Ueda, who appears in front of the Japanese lower house at 0030GMT (0930 Tokyo time) on Friday.

- Antipodean currencies are trading well, with AUD and NZD close to the top of the pile. This has paused the February CHF/AUD rally, with the pair oscillating either side of the 100-dma at 1.5727.

- Weekly US jobless claims are the data highlights Thursday, with Q4 GDP revisions also due. Speeches are scheduled from ECB's de Cos, Fed's Bostic & Daly.

EQUITIES: Eurostoxx Futures Touch 4280.0 Following Wednesday Dip Buying

- Dip buyers emerged in EUROSTOXX 50 futures again Wednesday, with prices rapidly bouncing off the 4211.00 lows. Nonetheless, prices remain just below first resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, but still above 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4228.4, the 20-day EMA.

- Further slippage Wednesday put the S&P E-Minis to fresh February lows, with weakness extending through the close. This puts prices below first support at the 50-day EMA at 4031.50 and tilts the near-term view lower. 3901.75 marks next support, the Jan 19 low.

COMMODITIES: WTI Futures Drift Lower Wednesday, Sitting Below 50-Day EMA

- WTI futures drifted lower into the Wednesday close, returning the outlook to neutral for now. Prices now sit back below the 50-day EMA, at $78.34, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $72.25, the Feb 6 low for the continuation contract.

- Trend conditions in Gold are bearish for now, despite the late recovery into last Friday’s close. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback. Vol band support (the 2.0% 10-dma envelope), successfully contained prices Friday, keeping the focus on the level this week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/02/2023 | 0700/0800 | *** |  | DE | GDP (f) |

| 24/02/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/02/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 24/02/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/02/2023 | - |  | EU | ECB Lagarde & Panetta at G20 Finance Minister Meet | |

| 24/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 24/02/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 24/02/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/02/2023 | 1515/1015 |  | US | Fed Governor Philip Jefferson | |

| 24/02/2023 | 1515/1015 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/02/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 24/02/2023 | 1630/1630 |  | UK | BOE Tenreyro Panellist at NY Fed | |

| 24/02/2023 | 1830/1330 |  | US | Boston Fed's Susan Collins | |

| 24/02/2023 | 1830/1330 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.