-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US Stocks Get Further Upside Impetus

HIGHLIGHTS:

- US futures crest at new all-time highs on stellar Apple, Facebook earnings

- Treasury curve bear-steeper in overnight trade

- USD Index bouncing slightly off multi-month lows

US TSYS SUMMARY: Giving Up FOMC Press Conference Gains

The Tsy curve has bear steepened in overnight trade Thursday post-FOMC, and ahead of GDP and jobs data.

- The 2-Yr yield is up 0.4bps at 0.1681%, 5-Yr is up 3.5bps at 0.8861%, 10-Yr is up 4.6bps at 1.6557%, and 30-Yr is up 3.8bps at 2.3268%. Jun 10-Yr futures (TY) down 9/32 at 131-26 (L: 131-25.5 / H: 132-05.5).

- TY futures have now reversed gains triggered by Fed Chair Powell's comments at the beginning of Wednesday's press conference Q&A that the FOMC is not yet talking about tapering. Our FOMC review will be out shortly, including sell-side takes on yesterday's decision.

- Equities higher, suggesting a positive risk backdrop weighing on core fixed income globally (Nasdaq outperforming following strong tech earnings results late Weds).

- No reac to Pres Biden's address to Congress late Weds largely, was in line with expectations.

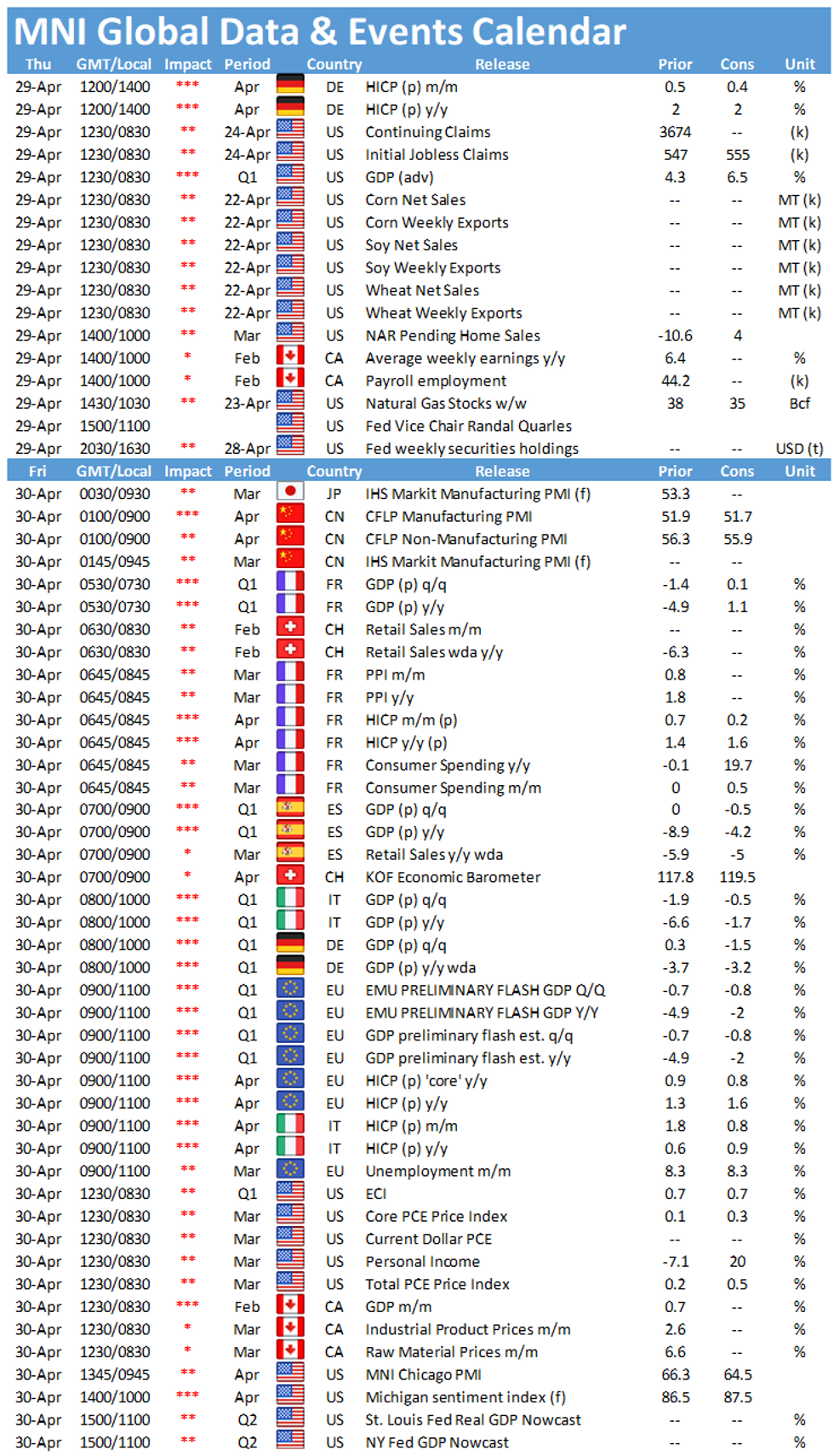

- Busy data calendar: 0830ET sees jobless claims as well as advance Q1 GDP; pending home sales at 1000ET.

- Fed VC Quarles appears at 1100ET (on financial regulation).

- In supply, $80B of 4-/8-week bills auctioned at 1130ET. NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY - Trading Weaker Post FOMC

In the wake of yesterday's FOMC meeting, equities have pushed higher and EGB curves have bear steepened. Focus will shift to the Q1 US GDP print published later today.

- Gilts have traded weaker through the morning with the belly marginally underperforming.

- The bund curve is 3bp steeper on the back of long-end underperformance.

- OAT yields are broadly 1-3bp higher in the belly/long end.

- It is a similar story for OATs. Last yields: 2-year -0.2841%, 5-year 0.1790%, 10-year 0.8956%, 30-year 1.8935%.

- Supply this morning came from Italy (BTPs, EUR7.25bn, CCTeu, EUR1.25bn).

- The regional German inflation data for April showed a broad acceleration from the previous month. Elsewhere, preliminary April CPI data for Spain surprised higher (1.9% Y/Y vs 1.7% survey).

EUROPE ISSUANCE UPDATE: Italy Auction

Italy sells:

- E2.750bln 0% Apr-26 BTP, Avg yield 0.170% (Prev. 0.050%), Bid-to-cover 1.43x (Prev. 1.33x)

- E2.500bln 0.60% Aug-31 BTP, Avg yield 0.880% (Prev. 0.720%), Bid-to-cover 1.44x (Prev. 1.42x)

- E2.000bln 0.90% Apr-31 BTP, Avg yield 0.830% (Prev. 0.650%), Bid-to-cover 1.50x (Prev. 1.38x)

- E1.250bln 0.50% Apr-26 CCTeu, Avg yield -0.060% (Prev. -0.080%), Bid-to-cover 1.92x (Prev. 1.68x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM1 171/172cs, sold at 25 in 1.25k

RXN1 170.5/168.5ps 1x1.5, bought for 33 in 1k

RXN1 170/168ps 1x2, bought for 13 in 1k

RXN1 171/169ps vs 173/175cs, bought the ps for 3 in 1.5k

RXU1 172.5/170ps 1x1.5, bought for 50.5 in 1k

OEM1 134.5/134ps, bought for 9 in 2k

3RZ1 100/99.87/99.75/99.62p condor, bought for 1.75 in 1k

UK:

0LM1 99.62/75/12/25 broken c condor, sold at 9 in 6k

FOREX: USD Index Sees Small Bounce Off New Multi-Month Lows

- Currency markets started the Asia-Pacific session as the US left off, with prevailing USD weakness extending the trend into the European morning. EUR/USD's strength persisted into 1.2150, although these gains have largely faded into NY hours. This leaves the USD index just above the multi-month lows printed this morning at 90.424.

- JPY remains weaker, with EUR/JPY, USD/JPY holding within their bullish short-term trend. This keeps USD/JPY on track to test yesterday's highs at 109.08, with firmer equity markets this morning adding a further catalyst.

- The e-mini S&P now looks comfortable above the 4,200 mark, with Apple and Facebook's earnings yesterday providing support - both companies trade sharply higher pre-market.

- JPY, AUD are the weakest, GBP, CAD and CHF the strongest at the NY crossover.

- Regional German CPIs, advance Q1 GDP data and initial weekly jobless claims from the US take focus going forward. Central bank speakers today include ECB's Weidmann & Holzmann and Fed's Quarles.

FX OPTIONS: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-1.1905(E1.4bln-EUR puts), $1.1940-50(E589mln), $1.2095-1.2110(E1.3bln), $1.2135-40(E562mln), $1.2200(E625mln)

- USD/JPY: Y108.00-15($822mln), Y108.45-50($1.2bln-USD puts), Y108.65-75($526mln), Y108.95-109.00($1.4bln-USD puts)

- EUR/JPY: Y129.85-95(E1.1bln-EUR puts)

- USD/CHF: Chf0.9200($1.1bln-USD puts)

- EUR/CHF: Chf1.0950(E602mln-EUR puts)

- AUD/USD: $0.7650-60(A$842mln-AUD puts), $0.7740-50(A$514mln)

- AUD/JPY: Y81.00(A$1.1bln-AUD calls)

- EUR/AUD: A$1.5385-1.5400(E830mln-EUR puts)

- USD/CAD: C$1.2220-30($815mln), C$1.2400($615mln)

- USD/CNY: Cny6.4500($570mln)

Price Signal Summary - Yen Remains Vulnerable

- In the equity space, S&P E-minis have resumed their climb, extending gains and trading through 4200.00. The focus is on 4239.26, 1.764 projection of the Feb 1 - Feb 16 - Mar 4 price swing. Key support is unchanged at 4110.50, Apr 21 low.

- In FX, EURUSD has cleared the bear channel resistance drawn off the Jan 6 high. This reinforces the current trend and paves the way for strength towards 1.2184 next, Feb 26 high. Monday's high of 1.2117 also represents resistance and a clear break would strengthen bullish conditions. Initial support is at 1.2056, Apr 28 low. GBPUSD is firmer but remains below 1.4009, Apr 20 high. A break is required to signal scope for stronger gains. Support to watch is at 1.3824, Apr 22 low. The Yen remains vulnerable:

- USDJPY has recently found support at 107.48. Just below trendline support drawn off the Jan 6 low. This week's recovery highlights a developing bullish theme while support at 107.48 remains intact. The focus is on 109.23, 50.0% retracement of the Mar 31 - Apr 23 sell-off.

- EURJPY is climbing and has this week confirmed a resumption of the underlying uptrend. The move higher opens 132.36, 2.236 projection of the Jun - Sep - Oct 2020 price swing. The cross remains within its bull channel, drawn off the Oct 30, 2020 low.

- USDCAD resumed its underlying downtrend yesterday with fresh cycle lows. The focus is on 1.2239, 1.236 projection of Jan 28 - Feb 25 - Feb 26 price swing

- On the commodity front, Gold is consolidating. The outlook remains bullish and the focus is on $1805.7, Feb 25 high. Watch support at $1762.7, yesterday's low. Brent (M1) is holding onto this week's gains. The focus is on resistance at 68.08, Apr 20 high. remains below last week's high. WTI (M1) has probed resistance at $64.38, Apr 20 high. A clear break would open $64.68, Mar 18 high and beyond.

- In the FI space, Bunds (M1) are trading lower and have tested key support at 170.05, 76.4% of the Feb 25 - Mar 25 rally. A break would open 169.24, Feb 25 low. Gilts (M1) have traded lower and cleared initial support. The next level to watch is 127.32, Apr 1 low.

EQUITIES: Futures Hit Another High as Earnings Lend Support

- US equity markets got a further after-market boost following the Fed as a slew of corporate earnings came in well ahead of expectations. Shares in both Apple and Facebook trade sharply higher pre-market, lifting the tech-led NASDAQ futures higher by close to 1% ahead of the bell.

- Across Europe, continental markets are almost uniformly higher, with just Germany's DAX in the red as poor trade in the likes of Munich RE and Continental AG let down the index.

- Across Europe, energy names continue to outperform, with tech and financials not far behind. Utilities and materials are the poorest performers so far, but losses are marginal at this stage.

COMMODITIES: WTI Extends Gains to 6% Over Monday Lows

- The energy complex trades well early Thursday, with a number of the week's bullish factors continuing to support prices.

- Yesterday's DoE inventories numbers continue to show solid demand for oil products, with the distillates component showing a far larger draw on supplies than expected. Additionally, yesterday's Fed decision continues to underpin expectations of a solid rebound in economic activity throughout the second half of 2021.

- In metals space, industrials continue to trade well, with copper futures touching new cycle (and decade) highs while precious metals are more subdued. Gold is a touch lower having edged off the overnight highs of $1790.04.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.