-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: The Hangover

MNI: Italy To Overshoot 2024 Fiscal Target - Sources

MNI US MARKETS ANALYSIS - US10YY Hits New Multi-Month Lows

HIGHLIGHTS:

- Buy-the-dip remains dominant, putting ES1 in range of ATH once more

- Treasury yields resume decline, with 10yy hitting levels not seen since February

- FOMC minutes in view, with focus on any taper talk

US TSYS SUMMARY: Consolidating Gains Ahead Of Fed Minutes

Long-end Treasuries continued to gain overnight Wednesday, with a pickup in risk appetite (equities/commodities higher) presenting little obstacle to further upside.

- While gains have stalled a bit in late morning European trade, notably, the 10-Yr yield touched the lowest level since February (1.3280%). Short-end/belly underperforming.

- The 2-Yr yield is up 0.4bps at 0.222%, 5-Yr is up 1bps at 0.806%, 10-Yr is flat at 1.348%, and 30-Yr is down 0.3bps at 1.9712%.

- Sep 10-Yr futures (TY) up 4.5/32 at 133-11.5 (L: 133-06.5/ H: 133-16).

- The release of FOMC June meeting minutes at 1400ET is the primary focus of the session. Later, we'll put out some sell-side views on what to expect: mostly surrounds composition/timing of taper, as well as color on how the FOMC views recent jobs/price data.

- The minutes are followed later by an appearance by Atlanta's Bostic (1530ET).

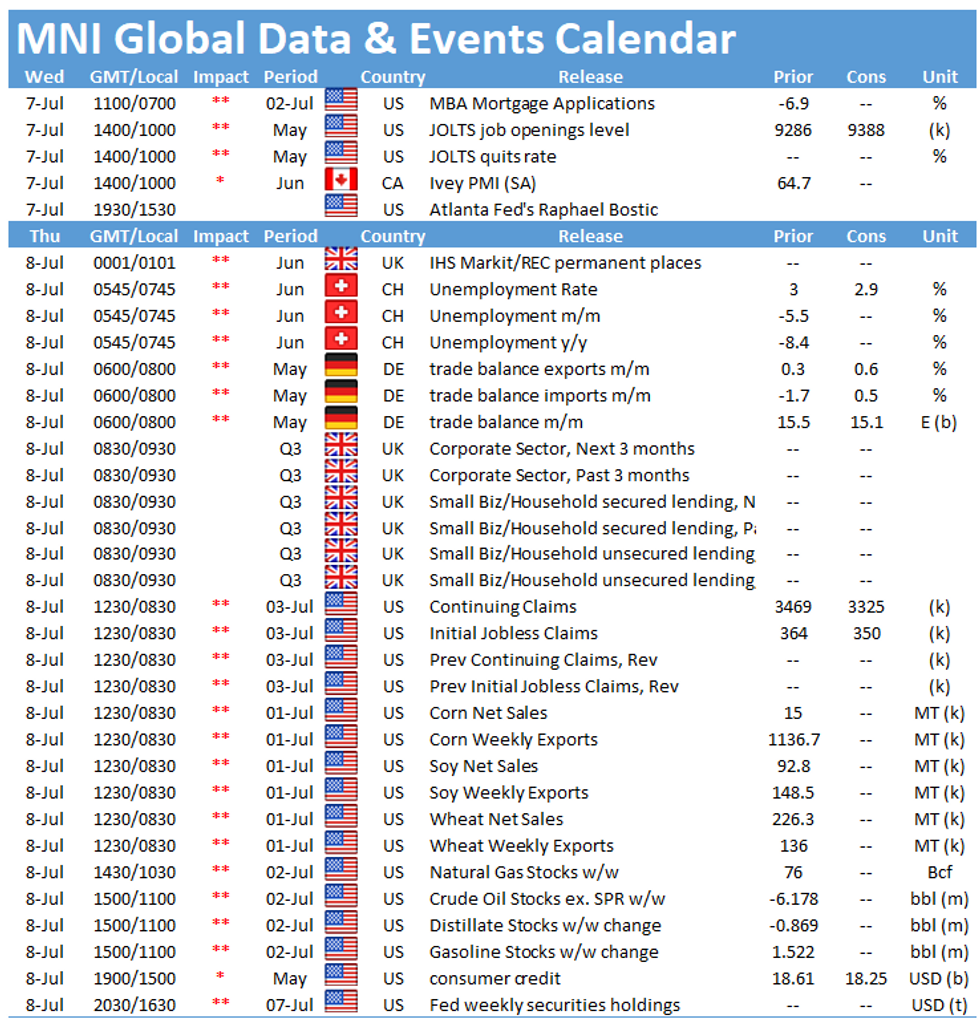

- A quieter day for data, with weekly MBA mortgage applications at 0700ET and May JOLTS at 1000ET. And little in the way of supply (119-day bill auction at 1130ET). NY Fed buys Tsy 10Y-22.5Y for ~$1.425B.

EGB/GILT SUMMARY: Trading Firmer

European sovereign bonds have trade firmer this morning alongside modest gains for equities.

- Gilts rallied early into the session before giving up the early gains to trade back towards yesterday's close.

- Bunds have pushed higher with the longer end of the curve leading the charge. The 2s30s spread is 2bp narrower on the day.

- OAT yields are 1-2bp lower in the belly and long end of the curve.

- BTP yields are broadly 1-2bp lower with the curve marginally flatter on the day.

- German industrial production for May came in weaker than expected (-0.3% M/M vs 0.5% survey).

- Supply this morning came from the UK (Gilts, GBP600mn), Germany (Bobl, EUR3.949bn allotted and Greece (625mn).

EUROPE ISSUANCE UPDATE

Germany allots:

E3.949bln 0% Oct-26 Bobl, Avg yield -0.59% (Prev. -0.57%), Bid-to-cover 0.86x (Prev. 1.00x), Buba cover 1.09x (Prev. 1.21x)

UK DMO sells:

GBP600mln 0.125% Mar-51 linker, Avg yield -2.163% (Prev. -1.979%), Bid-to-cover 2.41x (Prev. 2.31x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ1 173/172ps, bought for 16 in 2k

RXU1 176/176.50/177c fly, 1x3x2 call fly, bought for -2 in 1.5k

RXV1 173c, sold at 48.5 in 4.6k

OEQ1 134.25c, bought for 26 in 4.6k (short cover)

UK:

3LU1 99.375/99.625cs 1x1.5, bought for 3.75 in 3k

FOREX: Markets in Recovery Mode After Tuesday Risk-Off

- Following Tuesday's sharp bout of risk-off, currency markets are mainly in recovery mode, with the JPY weaker alongside the USD, while the likes of AUD, NOK and NZD are clawing back a small portion of yesterday's losses.

- AUD/USD remains either side of the $0.75 handle, as much as a point off the best levels of the week, with traders still cautious over the persistent spread of the more transmissible Delta strain of COVID, the efficacy of jabs against the latest wave of infections and global PMI numbers signposting a near-term peak in global GDP growth.

- US yields are once again lower, with the 10y yield south of 1.35% for the first time since February, although the buy-the-dip approach to equity weakness continues to pervade, as the e-mini S&P narrows in on 4350.

- Focus turns to the Fed minutes release from their latest rate decision, in which markets saw the FOMC as erring on the hawkish end of market expectations. Ahead of that, Canada's Ivey PMI and US JOLTs job openings are on the docket. Fed's Bostic is also due to speak.

FX OPTIONS: Expiries for Jul07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-70(E822mln), $1.1917-24(E1.5bln), $1.1935-50(E1.1bln)

- USD/JPY: Y109.00($1.1bln), Y109.50-57($738mln), Y111.00($1.1bln), Y111.50($1.1bln-USD calls)

- AUD/USD: $0.7575-80(A$552mln)

- NZD/USD: $0.7140(N$1.1bln-NZD calls), $0.7170-85(N$1.1bln-NZD calls)

- USD/CAD: C$1.2560-70($785mln)

Price Signal Summary - Bunds Clear Key Resistance

- In the equity space, S&P E-minis maintain a strong bullish tone, and futures are climbing once again. The focus is on 4400.00 next, a round number resistance. EUROSTOXX 50 (U1) attention is still on the bearish engulfing candle from Jun 18. A break of 4015.00, Jun 21 low would reinforce the importance of this pattern and signal scope for a deeper pullback towards 4000.00 and 3914.00, May 20 low.

- In FX, the USD is holding its ground and the outlook remains bullish. The EURUSD bear trigger is Friday's/Tuesday's low of 1.1807/8. Resistance to watch is at 1.1895, yesterday's low. A break lower would signal scope for weakness towards 1.1704, Mar 31 low. GBPUSD attention is on a break of Friday's 1.3733 low that would open 1.3717, Apr 16 low. Resistance is at 1.3898, yesterday's high. USDJPY bullish conditions remain intact despite this week's modest weakness. The focus is on 111.71/112.01, Mar 24, 2020 high and 1.0% 10-dma envelope. Key short-term support is at 109.85, the 50-day EMA.

- On the commodity front, Gold maintains a firmer tone. Attention is on the 50-day EMA that intersects at $1815.0. A clear break of the EMA is required to suggest scope for a stronger rally. This would open $1833.7, 50.0% of the Jun 1 - 29 decline. Brent (U1) focus is on $77.86, 1.382 projection of Mar 23 - May 18 - May 21 price swing. Watch support at $73.91, the 20-day EMA. WTI (Q1) sights are set on $77.35, 1.618 projection of Mar 23 - May 18 - May 21 price swing. The 20-day EMA at $72.17 marks initial support.

- Within FI, Bund futures are stronger having cleared resistance at 173.16, Jun 11 high. This signals scope for a stronger rally toward 174.28, the 0.764 projection of the May 19 - Jun 11 - Jun 22 price swing. Gilt futures have topped key resistance at 128.39, Jun 11 high, strengthening the bullish case. This opens 129.40, the 1.50 projection of the May 13 - 26 - Jun 3 price swing.

EQUITIES: Stocks on the Bounce as Buy the Dip Dominates

- US equity futures were hit hard in early Tuesday trade, with concerns over the more transmissible Delta COVID variant dominating price action and sending stocks spiralling. This price action was short-lived, however, with the buy-the-dip strategy remaining the dominant play.

- European markets are uniformly in positive territory, with UK's FTSE-100 the leader (+0.7%) while French & Spanish firms lag slightly, but still hold above water.

- Tech names are leading the rebound across Europe, with US futures mirroring the sentiment via strength in NASDAQ futures.

COMMODITIES: Crude Bouncing, But Still Short of Cycle Best

- Both WTI and Brent crude oil benchmarks trade positively ahead of the Wednesday open, but are still shy of the cycle highs posted earlier in the week. Markets are still ruminating over the sell-off Tuesday in the wake of the collapse of the OPEC+ production deal. Some sell-side analysts suspect that markets are speculating that protracted OPEC+ discord could lead to softer curb compliance and a near-term boost to crude supply.

- This keeps directional triggers for oil unchanged, with Brent (U1) focus is on $77.86, 1.382 projection of Mar 23 - May 18 - May 21 price swing. WTI (Q1) sights are set on $77.35, 1.618 projection of Mar 23 - May 18 - May 21 price swing.

- Gold is firmer. Attention is on the 50-day EMA that intersects at $1815.8. The area around the EMA represents a key short-term resistance and a clear break is required to suggest scope for stronger near-term gains.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.