-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Erases Monday Losses

HIGHLIGHTS:

- USD erases Monday losses

- Oil higher for second session, outlook continues to improve

- Fed speak a focus again, Kaplan and Daly due

US TSYS SUMMARY: Modestly Weaker

Tsys have traded with a modestly weak tone overnight Tuesday. A very quiet Asia-Pac session with holidays in both Japan & China and cash closed until London hours, and not much driving in the European session either.

- Jun 10-Yr futures (TY) down 4.5/32 at 132-06 (L: 132-05 / H: 132-11.5), on low volumes (~168k)

- The 2-Yr yield is up 0.6bps at 0.1644%, 5-Yr is up 1.8bps at 0.8414%, 10-Yr is up 2bps at 1.6172%, and 30-Yr is up 0.9bps at 2.2929%.

- Dollar gains are of some note following Monday's weakness; stock futures a little weaker.

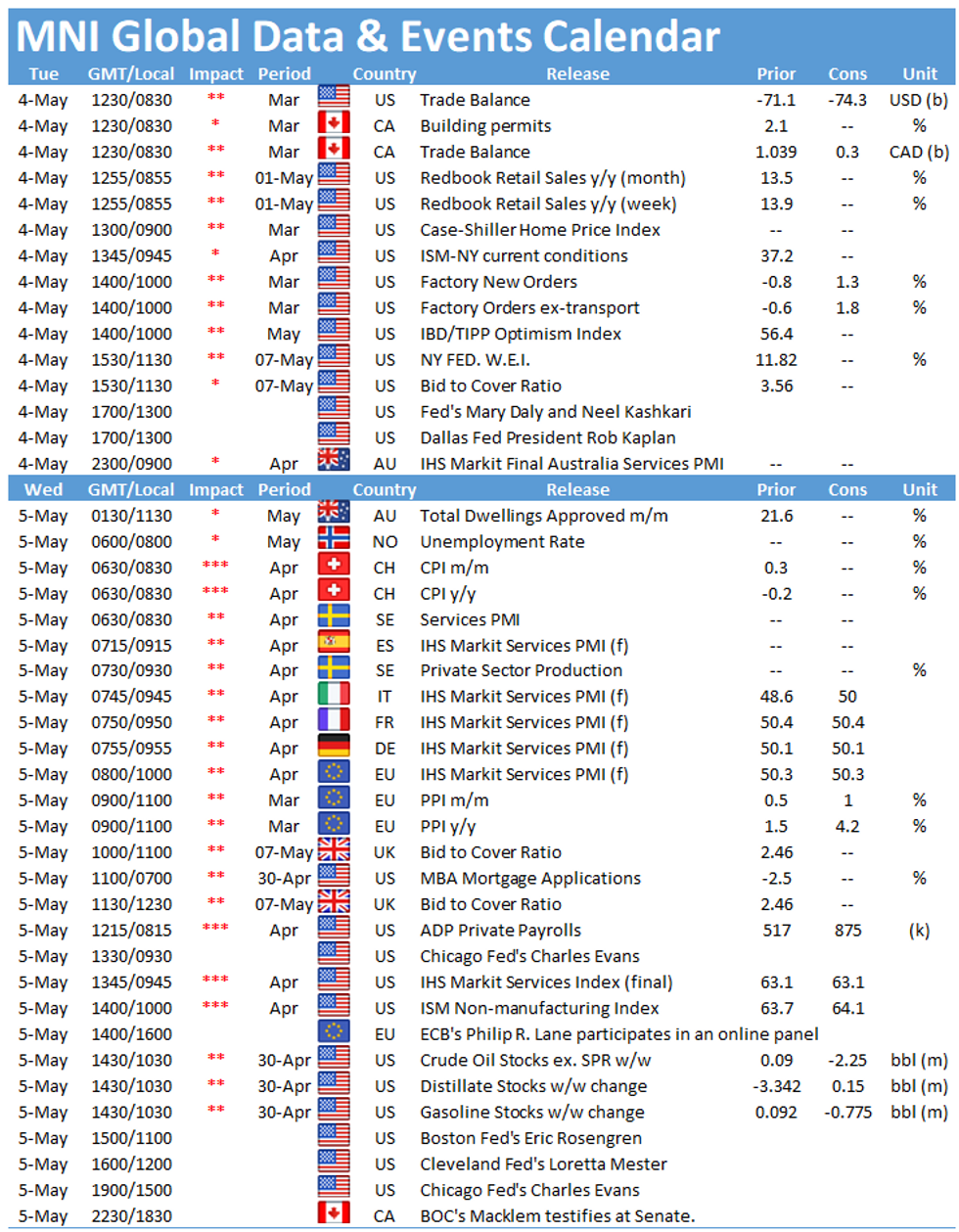

- 0830ET sees Mar Trade Balance, with Mar factory orders/final Durable Goods report at 1000ET.

- Fed speakers include SF Pres Daly and Minn's Kashkari in a moderated Q&A at 1300ET; at the same time in a separate moderated discussion is Dallas' Kaplan.

- Supply consists of $40B 42-day bill auction at 1130ET - we await Wednesday's Treasury Refunding announcement. NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY: A Weak Start

Gilts and EGBs have broadly traded weaker this morning with equities pushing higher and UK stocks slightly outperforming following the public holiday on Monday.

- Following a strong start, gilts gave up early gains to trade close to flat on the day.

- Bunds yields are 1bp higher on the day with the curve flat overall.

- OATs have similarly sold off with yields 1-2bp higher.

- BTPs trade in line with core EGBs with the curve 1bp steeper.

- Supply this morning came from Germany (linkers, EUR578.25mn allotted), Austria (RAGBs, EUR1.495bn), Spain (Letras, EUR6.15bn), Belgium (TCs, EUR1.6bn) and the ESM (Bills, EUR1.5bn).

- The final UK manfacturing PMI print for April came in a touch higher than the initial estimate (60.9 vs 60.7 previously).

EUROPE ISSUANCE UPDATE:

Germany Allots E578.25mn of ILBs:

- E423.25mn of the 0.10% Apr-26 ILB: Average yield -1.88% (-1.15%), Buba cover 2.2x (1.87x), bid-to-cover 1.84x (1.37x)

- E155.00mn of the 0.10% Apr-46 ILB: Average yield -1.27% (-1.29%), Buba cover 1.5x (1.33x), bid-to-cover 1.17x (0.91x)

Austria Sells E1.495bn of RAGBs:

- E0.805bn of the 0% Feb-31 RAGB: Average yield -0.008% (-0.104%), bid-to-cover 2.04x (2.03x)

- E0.690bn of the 1.50% Feb-47 RAGB: Average yield 0.569% (0.19%), bid-to-cover 1.62x (2.45x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

DUN1 112.10/112.00ps, bought for 2.5 in 1.25k

2RM1 100.25/100ps, bought for 1 in 2.5k

3RU1 99.87p, sold down to 4 in circa 4k

UK:

2LZ1 99.62/99.75cs 1x2, sold the 1 at flat in 2.5k

FOREX: Dollar Bounce Putting Major Pairs Under Pressure

- The greenback is staging a decent bounce after suffering through the bulk of the Monday session. The USD is trading at the day's best levels at the NY crossover, with the USD Index looking to progress through the Monday high.

- The USD's strength has pressured EUR/USD through the Monday lows to hit the lowest level since April 22nd and (briefly) below 1.20.

- Antipodeans trade poorly, with AUD, NZD the softest currencies so far Tuesday. The RBA rate decision saw policy unchanged, with the bank dropping the latest signal that their bond purchase program will be reviewed in July, likely shifting the 3-yr bond yield target to the November 2024 bond line. NZD/USD edged through the 50-dma at 0.7146 just ahead of NY hours.

- Focus turns to US and Canadian trade balance data as well as March factory orders and final durable goods orders. Fed speak remains a focus, with Fed's Daly and Kaplan both on the docket.

FX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.0bln)

- GBP/USD: $1.3800(Gbp896mln)

- AUD/USD: $0.8000(A$1.1bln)

- AUD/NZD: N$1.0855-65(A$2.0bln-AUD puts)

Price Signal Summary - USD Bulls Return

- In the equity space, S&P E-minis are consolidating but maintain a bullish tone. The focus is on 4239.26, 1.764 projection of the Feb 1 - Feb 16 - Mar 4 price swing. Key support is unchanged at 4110.50, Apr 21 low. A break of this level would signal a top.

- In FX, EURUSD last week cleared the bear channel resistance drawn off the Jan 6 high but has failed to remain above it. The warning is a false break and if correct highlights a bearish threat. Watch support at, 1.2014/1987, the 20- and 50-day EMAs. A break of this zone would signal scope for a deeper pullback towards 1.1943, Apr 19 low. GBPUSD remains below 1.4009, Apr 20 high. The break Friday of support at 1.3824, Apr 22 low strengthens a bearish case. The focus is on 1.3717, Apr 16 low. The USDJPY maintains a bullish tone following last week's gains. The focus is on 109.96 next, Apr 9 high.

- On the commodity front, the Gold outlook is bullish and the focus is on $1805.7, Feb 25 high. Watch key short-term support at $1756.2, Apr 29 low. Brent (n1) remains above support at $65.59, the 20-day EMA. Bullish conditions remain intact and the focus is on $69.73, Mar 8 high. WTI (M1) also remains above its 20-day EMA at $62.53. The focus is on $66.15, Mar 15 high.

- In the FI space, Bunds (M1) have recently breached 170.05, 76.4% of the Feb 25 - Mar 25 rally. This opens 169.24, Feb 25 low. Gilts risk is skewed to the downside. The next support and intraday bear trigger is at 127.32, Apr 1 low.

EQUITIES: Indices Stall, US Futures Indicate Mildly Lower Open

- Continental stock markets are mixed, with Spain's IBEX-35 and UK's FTSE-100 outperforming while Germany's DAX and the EuroStoxx50 lag. US futures are similarly non-directional, with the e-mini S&P in minor negative territory while the NASDAQ future indicates a lower open later today.

- The energy sector in Europe is outperforming, taking the lead from the shift higher in the US sector yesterday. Oil prices remain buoyant early Tuesday, with WTI crude futures showing back above $65/bbl.

- Communication services also trade well, contrasting with the European tech sector, which underperforms as the semiconductor sub-sector suffers on chip shortage concerns.

- Earnings continue, with Pfizer, T-Mobile US and CVS Health all due today.

COMMODITIES: Oil On the Up, Gold Edges Off Monday Highs

- Benchmark oil futures contracts sit higher for a second session, with WTI and Brent extending the late Monday gains despite today's rebounding dollar. An improved outlook for H2 2021 continues to buoy prices, with re-opening gathering traction across both the European continent as well as a number of US states.

- WTI now faces resistance at the Mar 15th high of $66.15, while Brent may find a focus on $69.73, the March 8th high and key bull trigger.

- In precious metals space, spot gold is edging off yesterday's highs of $1,797.98/oz, and is faring more poorly than silver, which holds the bulk of the Monday gains. This has kept the gold/silver ratio under pressure, touching new multi-month lows in the process.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.