-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI US MARKETS ANALYSIS - USD Index Holds Just Below 2021 High

HIGHLIGHTS:

- Congress vote in sight, government shutdown looming

- USD rally pauses, but USD Index just below 2021 high

- Powell due to appear again in front of House Finance Panel

US TSYS SUMMARY: Flat Ahead Of Month-End / Gov't Funding Bill, / MNI Chicago PMI

Treasuries are trading fairly steady going into month-/quarter- end with modest bear flattening in the curve early Thursday, with equity futures edging higher and dollar flat. Plenty of Fed speakers, some data, and Congressional votes provide the focal points.

- The 2-Yr yield is up 0.6bps at 0.2951%, 5-Yr is up 0.7bps at 0.9971%, 10-Yr is up 0.2bps at 1.5185%, and 30-Yr is down 0.1bps at 2.059%.

- Dec 10-Yr futures (TY) up 4.5/32 at 131-19.5 (L: 131-14 / H: 131-23.5).

- Much attention on Capitol Hill, with Congress widely expected to avoid a gov't shutdown at midnight tonight (Senate starts by voting on a bill this morning).

- Also, Fed Chair Powell goes back to Congress alongside Treas Sec Yellen for the second time this week, before a House Panel at 1000ET. At the same time, NY's Williams speaks.

- That's followed by Atlanta's Bostic at 1100ET, Philly's Harker at 1130ET, Chicago's Evans at 1230ET, St Louis' Bullard at 1305ET, and SF's Daly at 1430ET.

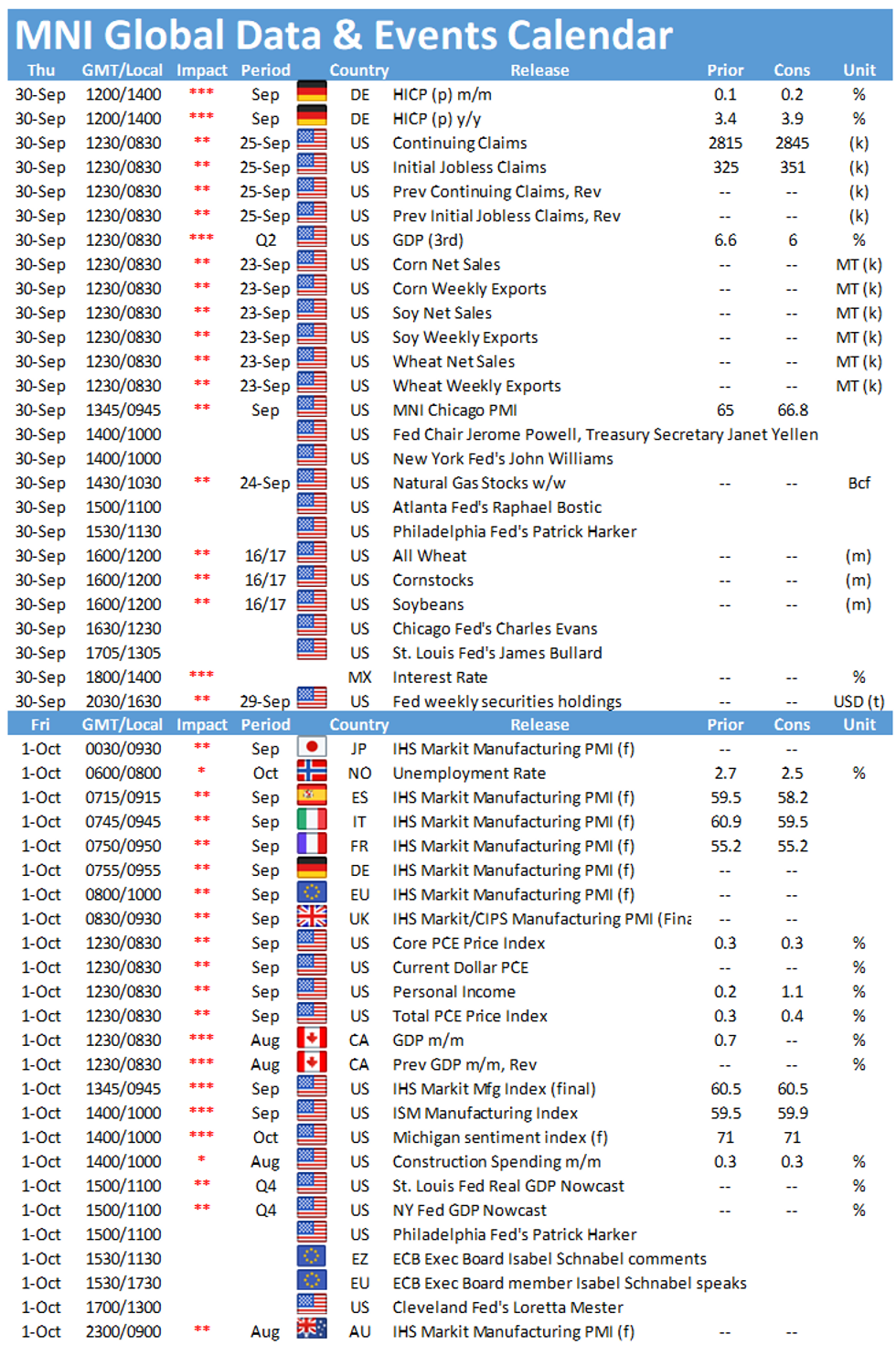

- In data, 0830ET sees jobless claims and final reading of Q2 GDP, with MNI Chicago PMI at 0945ET.

- Supply is $35B combined of 4-/8-week bill auctions at 1130ET.

- NY Fed buys ~$2.025B of 1-7.5Y TIPS.

EGBs/GILT SUMMARY: Core FI off intraday lows but inside yesterday's range

- Core fixed income is off of its intraday lows which were seen shortly after the European cash open. However, the moves are unremarkable compared to recent day's price action and Bunds and gilts remain within yesterday's trading range. Month end extensions remain a talking point in the market.

- This morning has seen CPI data in focus across the Eurozone with data generally in line or marginally below consensus expectations (in contrast to yesterday's Spanish print that was 0.5ppt higher than expected).

- We have also seen UK Q2 GDP revised up from 4.8%Q/Q to 5.5%. Later today we will receive the third print of US Q2 GDP.

Latest levels:

Dec Bund futures (RX) down 8 ticks at 170.07 (L: 169.77 / H: 170.19)

Dec Gilt futures (G) down 25 ticks at 125.41 (L: 125.15 / H: 125.55)

Dec BTP futures (IK) down 4 ticks at 152.41 (L: 152.16 / H: 152.57)

Italy / German 10-Yr spread 0.4bps tighter at 103.3bps

EUROPE OPTION FLOW SUMMARY

UK:

0LZ1 99.12p vs 3LZ1 98.875p, bought the blue for 1.75 in 20k

SFIZ1 99.80/99.85/99.90c fly, bought for 1 in 10k

SFIZ1 99.80/99.90cs, bought for 3 in 5k (ref 99.765)

Eurozone:

SX7E (17th Dec) expiry, 105c bought for 2.60 in 10k

SX7E (18/03/22) 100/115cs vs 90p, bought the cs for 0.775 in 12k

FOREX: USD Index in Holding Pattern Below 2021 High

- The USD Index holds close to Wednesday's multi-month high, with prices in a holding pattern just below 94.432. The slight slowdown in the USD's rise has worked in favour of the currencies hardest hit during the Wednesday rout, with GBP, AUD and SEK today trading slightly firmer.

- Month-end flows are in focus, with most sell-side models pointing toward USD strength into the month- and quarter-end fix. How much of this flow has already been completed across the past few sessions is unclear, but the WMR fix will be carefully watched.

- Elsewhere, NOK is extending this week's underperformance, extending the losing streak against the USD to five consecutive sessions. The roll off the highs for WTI and Brent crude oil prices as well as shakier risk sentiment across global equity markets are undermining the currency.

- The US MNI Chicago Business Barometer takes focus going forward alongside prelim German CPI data and the weekly US jobless claims data. Central bank speak also takes focus, with appearances from Fed's Powell, Williams, Bostic, Harker and others alongside ECB's de Cos and Visco.

FX OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E511mln), $1.1650-54(E621mln), $1.1700(E1.8bln)

- USD/JPY: Y110.00($1.3bln), Y110.30-40($1.5bln), Y111.00($775mln)

- GBP/USD: $1.3640-50(Gbp1.2bln)

- AUD/USD: $0.7200-10(A$643mln)

- USD/CAD: C$1.2675($520mln), C$1.2740-55($2.2bln)

- USD/CNY: Cny6.4490($826mln)

Price Signal Summary - USD Uptrend Extends

- In the equity space, S&P E-minis remain vulnerable following Tuesday's sharp move lower. The contract remains below the 50-day EMA - the average intersects at 4405.51 and represents initial resistance. A deeper sell-off would expose key support at 4293.75, Sep 20 low. EUROSTOXX 50 futures remain below recent highs. A deeper pullback would expose key support at 3974.00, Sep 20 low. 4113.30, the 50-day EMA is initial resistance.

- In FX, EURUSD remains in a downtrend. The pair has cleared key support at 1.1664, Aug 20 low to confirm a resumption of its downtrend. The focus is on 1.1581, Jul 24, 2020 low and 1.1493, 50.0% retracement of the Mar '20 - Jan '21 bull phase. GBPUSD remains under pressure following this week's sell-off. The focus is on 1.3354 next, Dec 23, 2020 low. USDJPY has traded through key resistance at 111.66, Jul 2 high and the bull trigger. The clear break strengthens a bull case and opens 112.23, Feb 20, 2020 high.

- On the commodity front, Gold traded lower again yesterday and the trend needle still points south. The focus is on $1690.6, Aug 9 low and the bear trigger. WTI futures remain below Tuesday's high of $76.67. Dips are considered corrective and firm support is seen at $73.58, Jul 6 high and a recent breakout level.

- In FI, Bund futures remain in a clear downtrend with the focus on 169.46, 1.50 projection of the Sep 9 - 17 - 21 price swing. Short-term gains are considered corrective. Gilt futures remain heavy despite the rebound from Tuesday's low of 124.84. Resistance is seen at 126.44, Sep 24 high. Treasuries remain in a downtrend. Scope is seen for weakness towards 131-03+, Jun 25 low. Gains are also considered corrective.

EQUITIES: Stocks More Mixed But Futures Indicate a Higher US Open

- Markets are more mixed ahead of the NY open, with European indices trading either side of unchanged. The EuroStoxx50, CAC-40 and FTSE-100 sit just above unchanged, while Germany's DAX and Spain's IBEX-35 are in minor negative territory.

- Europe's energy and healthcare sectors are the strongest performing names, while utilities and industrials counter at the bottom-end of the table.

- US futures are more positive, with the e-mini S&P, NASDAQ and Dow Jones futures indicating a modestly positive open. S&P E-minis remain below recent highs following Tuesday reversal lower. The contract is back below the 50-day EMA - the average intersects at 4407.78 today. A deeper sell-off would highlight a bearish threat and the risk of a pullback towards the key support at 4293.75, Sep 20 low.

COMMODITIES: WTI, Brent More Stable, But Silver Recovery Left Wanting

- Oil markets are consolidating early Thursday, with WTI and Brent crude futures in very minor negative territory. The bull trend remains intact for now, with dips considered corrective.

- Following the sharp drawdown on Wednesday, Silver has similarly stabilised but those looking for a bounce will be left disappointed.

- Silver broke lower yesterday and cleared former support at $22.039, Sep 20 low. This ends the recent consolidation, confirms a resumption of the broader downtrend and maintains the bearish price sequence of lower lows and lower highs. The move lower paves the way for an extension towards $20.871, a Fibonacci retracement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.