-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI US MARKETS ANALYSIS - USD/JPY Back Above Y140

Highlights:

- USD/JPY back above Y140.00 as greenback bounce extends

- Fed implied rates see 25bps off the July terminal rate into year-end

- Markets may be primed for weaker ISM Services given the soft MNI Chicago PMI, ISM Manufacturing prints

US TSYS: Cheaper With ISM Services Eyed, Heavy Bill Issuance

- Cash Tsys trade cheaper having generally trended lower through Asian and European hours, buoyed by an initial cheapening burst in EGBs around the old Eurex futures open. Macro headline flow has been a little limited, save the mark lower in the final Eurozone services PMI (to a still more than healthy 55.1).

- ISM Services headlines the docket, with likely added attention on price components after Thursday’s manufacturing report showed an as expected headline figure but a sharp decline in prices paid. Elsewhere, heavy bill issuance is on the cards.

- 2YY +5.0bp at 4.547%, 5YY +5.3bp at 3.896%, 10YY +5.2bp at 3.743% and 30YY +4.1bp at 3.928%.

- TYU3 trades 13 ticks lower at 113-14 just off lows of 113-12+ on average volumes of 270k. Post payrolls price action saw it clear support at 114-00 (May 31 low) to open a key support at 112-29+ (May 26/30 low).

- Data: S&P Global Service/Composite PMI May final (0945ET), ISM Services May (1000ET), Factory orders Apr (1000ET)

- Fedspeak: Mester welcome remarks at 1330ET but blackout period

- Bill issuance: US Tsy $65B 13W, $58B 26W (1130ET), US Tsy $50B 44D CMB auction (1300ET)

STIR FUTURES: Just 25bp Of Fed Cuts From Terminal To Year-End

- Fed Funds implied rates hold slightly lower for next week’s FOMC decision after relatively little change but otherwise have drifted higher still and only imply 25bp of cuts from the July terminal to year-end vs almost 40bps at Thursday’s close before Friday's mixed payrolls report.

- Odds of a June hike hold that 1/3 to 1/4 range seen since Jefferson’s skip rhetoric, whilst a July hike is still not quite fully priced.

- Cumulative changes from 5.08% effective: +7bp Jun (-0.5bp), +21bp Jul (unch), +19bp Sep (+2bp), +9bp Nov (+3.5bp), -5bp Dec (+3.5bp) and -22bp Jan (+4.5bp).

- Mester (’24 voter) gives brief welcome remarks at 1330ET but being within the blackout period shouldn’t touch on mon pol.

MNI Employment Insight, Jun'23: Something For Everyone Sees Skip Narrative Intact

- We have published and e-mailed to subscribers the MNI Employment Insight including MNI analysis from Friday's payrolls report (and other notable labor indicators) plus summaries from 18 sellside analysts.

- You can find the full report here: https://marketnews.com/mni-us-employment-insight-jun-23-something-for-everyone-sees-skip-narrative-intact

EUROZONE: May's Inflation Improvement Comes With Multiple Caveats

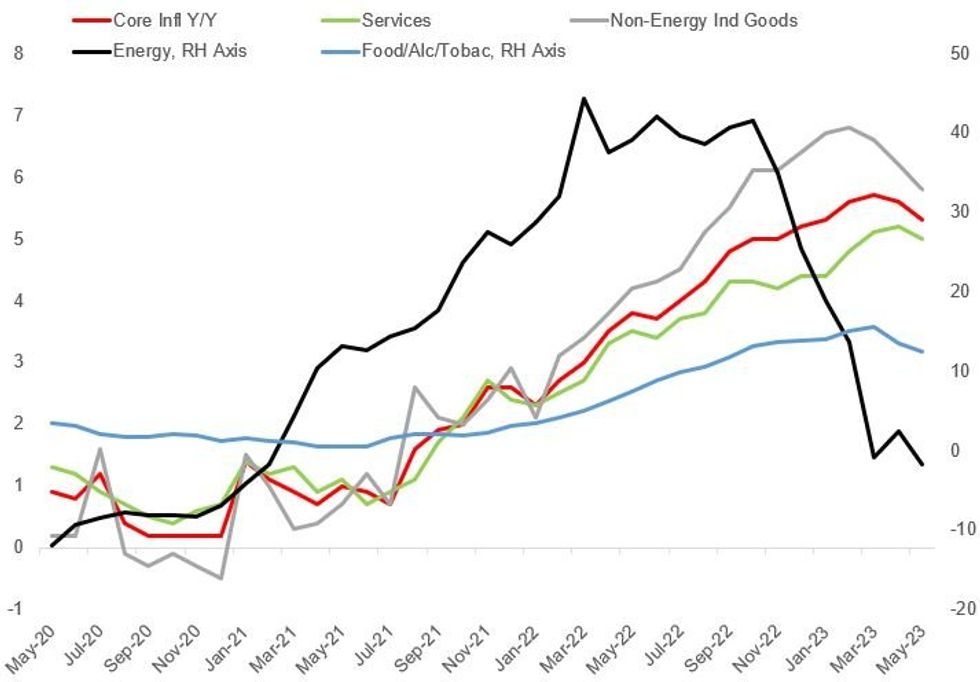

The inflation deceleration evident in May's flash Euro area prints last week brought little surprise after the marked-to-market estimates were implicitly revised down following the mostly softer national-level readings. Headline's 6.1% Y/Y was lower than the 6.3% expected going into the week and down 0.9pp vs April, with core of 5.3% Y/Y likewise softer than the 5.5% survey and 0.3pp down from April.

- Even with this apparent improvement there remains significant debate about both the significance of the May reading and the path forward: how the inflation picture looks for the rest of the year, and ultimately what it means for ECB policy.

- The optimistic appraisal begins with the fact that inflation was seen slowing across the board, from food to energy to core: non-energy industrial goods (5.8% vs 6.2% prior) and services (5.0% vs 5.2% prior) pointed to disinflationary pressures increasing as food (12.5% vs 13.5%) and energy (-1.7% vs 2.4%) continue to recede.

- But there are multiple caveats. Most importantly for the May reading, the services slowdown was impacted by German transportation subsidies in the month, and by several estimates, core inflation may have been flat absent that factor. And overall, core may tick back higher in the coming months, with services seen playing a resurgent role as core goods/energy/food price inflation recedes.

- June 16's comprehensive breakdown of the price data will provide a clearer picture albeit this will be a day after the ECB announces its rate decision.

- In the meantime we survey some of the more interesting angles on the May eurozone reading that we've seen, highlighting the general view that the eurozone is still some ways from seeing significant progress on underlying price pressures.

Eurozone Inflation By Category. % Y/YSource: Eurostat, MNI

Eurozone Inflation By Category. % Y/YSource: Eurostat, MNI

EUROPE ISSUANCE UPDATE

EU dual-tranche syndication mandate (to take place tomorrow):

- 7-year 1.625% Dec-29 EU-bond20-year 3.375% Nov-42 EU-bond

Croatia investor calls (ahead of transaction):

- New 12-year

Estonia syndication mandate:

- Tap of 10-year 3.00% Oct-32. Size: E500mln WNG.

FOREX: Greenback Sits Firmer on NFP Follow Through

- The greenback sits firmer through Asia trade and the European morning after the better-than-expected Nonfarm Payrolls release on Friday. USD/JPY trades back above the Y140.00 handle and within range of the cycle high posted last week at 140.93.

- SEK sits at the other end of the G10 table, weaker against all others following May services and composite PMI, which fell short of expectations and signalled a bumpy recovery for activity from the 2023 low. EUR/SEK is through the Friday high, facing next resistance at 11.6641.

- Outside of G10, TRY has slipped to another cycle low against the USD following confirmation of Mehmet Simsek as the new Turkish economy minister. Markets may be speculated that the more orthodox approach to markets could translate to less official intervention in the exchange rate - and a slower drawdown of FX reserves.

- With markets now inside the Fed's media blackout period, central bank speak focus turns to the ECB, with Lagarde and Nagel both set to speak Monday. Mester will appear, but only delivering brief introductory remarks - not on monetary policy.

- The ISM Services release is the data highlight, with markets expecting activity to rise to 52.4 from 51.9 previously - although markets may be gearing for a weaker release given the poorer-than-expected MNI Chicago PMI and ISM manufacturing.

FX OPTIONS: Expiries for Jun05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-85(E1.0bln), $1.0690-00(E535mln), $1.0820(E959mln)

- USD/JPY: Y138.20($1.6bln), Y139.50-60($557mln)

- AUD/USD: $0.6625(A$548mln)

- USD/CAD: C$1.3430($865mln)

EQUITIES: E-Mini S&P Trend Remains Bullish Following Move Higher Last Week

- Eurostoxx 50 futures traded higher Friday as the contract recovered from last Wednesday’s low of 4216.00. For now, the climb appears to be a correction - price action earlier last week reinforced a bearish theme - support at 4252.00, the May 25 low has been breached. Price has also pierced support at 4233.00, the May 4 low and a key short-term level. Resistance to watch is 4362.00, May 29 high, a break would be bullish.

- S&P E-minis trend conditions remain bullish and the contract traded higher Friday. Resistance at 4244.00, the Feb 2 high and a medium-term bull trigger, has been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. This opens 4327.50 next, the Aug 16 2022 high. The 50-day EMA, at 4144.35 remains a key support. A break of this average is required to signal a reversal.

COMMODITIES: Gold's Bear Cycle Intact as Yellow Metal Trades Lower Again Monday

- WTI futures traded higher overnight and in the process pierced resistance at $74.73, the May 24 high. The contract has pulled back from today’s high. A clear break of $74.73 would strengthen a bullish condition and signal scope for an extension higher. This would open $76.74, the Apr 28 high. For bears, a stronger reversal would instead signal a top and this would once again expose key support at $63.90, the May 4 low.

- The bear cycle in Gold remains intact and recent short-term gains appear to have been a correction. The yellow metal is once again testing trendline support drawn from Nov 3 2022. A clear breach of this trendline, at $1946.9, would reinforce bearish conditions and open $1903.5, a Fibonacci retracement. Initial firm resistance is $1985.3, the May 24 high. Clearance of this level is required to signal a short-term reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/06/2023 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 05/06/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/06/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/06/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/06/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 06/06/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/06/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/06/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/06/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/06/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/06/2023 | 1230/0830 | * |  | CA | Building Permits |

| 06/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/06/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/06/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.