-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI US MARKETS ANALYSIS - USD/JPY Losing Streak Extends Pre-CPI

Highlights:

- USD/JPY extends losing streak, hitting six consecutive sessions of lower lows

- US CPI in the balance, FX implied vols running higher pre-release

- Fed speakers out in force; Barkin, Mester, Kashkari, Bostic all due

US TSYS: Mildly Richer Ahead Of CPI, Fedspeak and 10Y Re-Open

- Cash Tsys sit 1-2.5bp richer through 2-10Y tenors, with recent underperformance from 30s as the day’s gains in a sharp move back to the 4% mark. The day’s rally is led by belly with 5s 11bp richer on the 2-/5-/10-year fly week to date. Treasuries lag the rally seen in Gilts and trade more in line with EU FI, but have struggled to push much further on ahead of US CPI (full preview here).

- 2YY -1.2bp at 4.860%, 5YY -2.6bp at 4.202%, 10YY -1.8bp at 3.952%, 30YY -0.1bp at 4.006%.

- TYU3 trades 7+ ticks higher at 111-16 off a high of 111-18+ having cleared yesterday’s range, with subdued volumes of 230k. The trend outlook remains bearish with an ultimate focus on the bear trigger at 110-05 (Jul 6 low), but in the interim further upside could be seen with resistance at the 20-day EMA of 112-09.

- Data: CPI Jun (0830ET), Real average earning Jun (0830ET) plus weekly MBA mortgage data (0700ET)

- Fed: Barkin (0830ET), Kashkari (0945ET), Bostic (1300ET) and Mester (1600ET), plus Fed Beige Book (1400ET) and Senate Banking Committee Hearing on Fed Board nominations (1400ET).

- Note/bond issuance: US Tsy $32B 10Y Note auction re-open (91282CHC8) – 1300ET

- Bill issuance: US Tsy 17W Bill auction – 1130ET

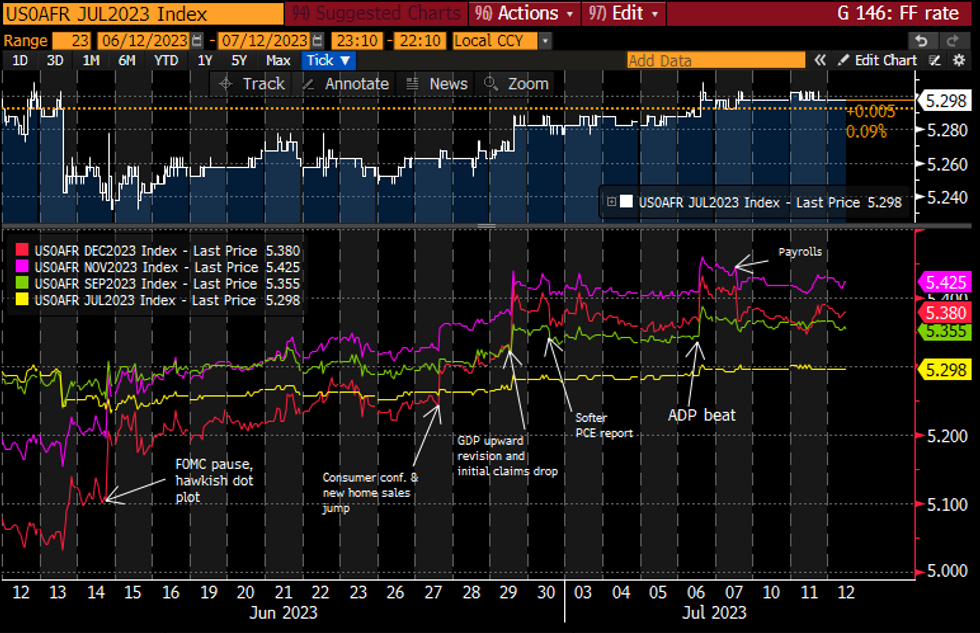

STIR FUTURES: Fed Rates On Balance Lower Ahead Of CPI, Heavy Fed Comms

- Fed Funds implied rates hold slightly lower on the day despite lifting in recent hours, the exception being pricing for the July 26 decision which remains steady at 5.30% for currently +23bp ahead of CPI.

- Cumulative hikes from 5.07% effective (dropped back 1bp on Mon): +23bp Jul (unch), +29bp Sep (-1bp), +35.5bp Nov (-0.5bp), +31bp Dec (-1bp).

- Cuts from Nov terminal: 4.5bp Dec’23, 62bp Jun’24, 136bp Dec’24.

- Heavy Fed commentary today: Barkin (’24) speaks on inflation just as CPI hits at 0830ET, Kashkari on mon pol (’23) at 0945ET, Bostic at 1300ET (’24) and Mester (’24) at 1600ET – only Mester with text. Kashkari is likely the pick of those, having last heard on May 23 (may need rates higher if inflation stays high).

- There is also the Beige Book plus the Senate Banking Committee hearings on Fed Board nominations.

Source: Bloomberg

Source: Bloomberg

US CPI Preview - Core Seen Softer on Used Cars Drag

MNI US CPI PREVIEW: Core Seen Softer on Used Cars Drag

Consensus puts core CPI inflation at 0.3% M/M in June as it slowed from a modest beat of 0.44% in May. It’s seen almost entirely coming from used car prices pulling back after two rapid 4.4% increases. Analysts look for declines of circa -1% although yesterday’s Manheim prices sliding -4.2% caught markets attention. Elsewhere, non-housing core services could have eased a touch (with the usual pitfalls vs its PCE equivalent) and we also watch non-used car core goods after its exactly unchanged May print. There is no evidence that the downside miss in nonfarm payroll gains last Friday has deterred FOMC participants from signalling their preference to raise rates twice more this year.

MNI BoC Preview, Jul'23: A Second Hike Before Assessing

EXECUTIVE SUMMARY

- The BoC is widely, but not unanimously, expected to hike 25bp for the second meeting after coming off the sidelines five weeks ago. 17 of 23 analysts expect such a move, OIS suggests 19bps is priced.

- A hike should see a hawkish initial reaction but a pivot to possibly more neutral language after recent data were more nuanced and open-ended guidance could see the edge taken off this move.

- Along with consensus, we also expect the 25bp hike to 5% to then assess data over an almost two-month period, but as always with the BoC see non-trivial risk of a surprise, this time from a hawkish hold.

PLEASE FIND THE FULL REPORT HERE:

UKRAINE: Zelensky Accepts Decision To Slow Walk Ukraine's NATO Membership

Wires carrying comments from Ukrainian President Volodymyr Zelensky, following his meeting with German Chancellor Olaf Scholz, significantly moderating his bellicose tone of yesterday and appearing to accept NATO's refusal to fast-track Ukraine's membership in the alliance.

- Zelensky said that, although it would have been "ideal" if there had been an invitation to join NATO, "it is understandable that Ukraine cannot join NATO when at war."

- Zelenskiy said: "Recognition that Ukraine doesn't need NATO Membership Action Plan is important," in reference to the burdensome raft of political reforms required for NATO accessional - widely seen as leaving fellow NATO applicant Georgia in limbo since 2008.

- Zelensky commended the defence aid packages announced at the summit, which have included substantial packages from France and Germany, and a statement yesterday from the Netherlands and Denmark to begin F-16 training for Ukrainian pilots in Romania in August.

- The NATO-Ukraine Council with heads of state is now underway with Zelensky scheduled to meet bilaterally with President Biden upon its conclusion, likely around 08:45 ET 13:45 BST.

EUROZONE ISSUANCE UPDATE:

Gilt auction result:Today's 10-year gilt auction is a bit more "back to normal" with good demand, following last month's softer auction (which had seen a 1.0bp tail and LAP below the pre-auction mid-price). Today's LAP of 89.673 was higher than the mid-price on the secondary market at any time in the bidding window while the bid-to-cover of 2.75x was good (but still lower than the 3.04x cover seen in the April auction).

The 3.25% Jan-33 gilt will be on offer again on 9 August and 13 September.

- GBP3.5bln of the 3.25% Jan-33 Gilt. Avg yield 4.595% (bid-to-cover 2.75x, tail 0.3bp).

It was a decent launch for the new 10-year Bund this morning, with a bid-to-offer of 1.54x. This was down only marginally from the 1.62x seen last month despite the larger auction size (E5bln today versus E4bln last month). Post-auction we were already trading above the average auction price of 99.61.

- E5bln (E4.115bln allotted) of the 2.60% Aug-33 Bund. Avg yield 2.64% (bid-to-cover 1.54x).

It was a bit of a mixed auction today, with the IGCP deciding to issue at the bottom of the E0.75-1.00bln target range with over 60% of the nominal allocation to the 4-year OT. The 4-year 1.95% Jun-29 OT in particular was a little on the weak side with the allotment price at auction of 93.45 below the pre-auction mid-price.

However, the 12-year 0.90% Oct-35 OT saw a decent bid-to-cover of 2.27x with the allotment price of 73.74 comfortably above the pre-auction mid-price.

- E467mln of the 1.95% Jun-29 OT. Avg yield 3.181% (bid-to-cover 1.49x).

- E282mln of the 0.90% Oct-35 OT. Avg yield 3.587% (bid-to-cover 6.58x).

FOREX: USD/JPY Prints Sixth Lower Low; Vols Bid Pre-CPI

- USD/JPY has already secured the sixth consecutive session of lower lows today, with the losing streak extending through the 50-dma support and swinging the 14-day RSI closer to technically oversold territory (although not there yet, RSI currently at 37 points - lowest since January).

- This marks the longest streak of lower lows since early November last year - a week or two after the last confirmed Japanese FX intervention on 24th October. In early November, lower lows were printed over 8 sessions, spanning a fall of over 7% in the pair. Rate differentials and an unwind of extreme positioning remains responsible, raising the focus on this Friday's CFTC CoT release (reflecting data as of the close yesterday).

- The greenback sits lower, with the dollar on the backfoot against all others in G10, mirroring the continued modest softening of market-implied Fed rate expectations. The USD Index has inched to new lows, narrowing the gap with the May low at 101.027.

- Looking ahead, the US CPI release takes centre stage, with market consensus looking for inflation to slow sharply on both the headline and core readings (down to 3.1% and 5.0% respectively).

- Markets are clearly primed for an outsized market reaction to today's release, with overnight implied vols well bid across G10 FX: EUR/USD overnight vols have added 8 points to trade at the highest since mid-June, while USD/JPY o/n vols have cleared 17 points ahead of the inflation release at 1330BST/0830ET.

- The frequency of central bank speakers also picks up after a quieter start to the week: Fed's Barkin, Kashkari, Bostic and Mester are set to speak as well as ECB's Vujcic and Lane. The Bank of Canada decision is also due, with the BoC seen resuming their tightening cycle with a 25bps hike to 5.00%.

FX OPTIONS: Hedging Markets Flag SEK, JPY, MXN and ZAR as Most Vulnerable Over CPI

- The very front-end of the implied vol market is well bid ahead of the US CPI and PPI releases this week, as markets anticipate a greater chance of volatility following the data releases.

- The vol premium added this week is not uniform across currencies, however, with overnight vols flagging heightened risk across SEK and JPY in G10, and among MXN and ZAR across emerging market FX.

- JPY vols have been propped this week by the outsized move lower in USD/JPY spot prices, while SEK may also be seeing some support ahead of the June inflation release for Sweden set for Friday.

Figure 1: CPI vol premium most notable for SEK, JPY, MXN and ZAR

- The run higher in implied vol has widened break-evens on an overnight USD/JPY straddle to 95-100pips, close to double the 50 pip break-even pricing at the beginning of the week.

FX OPTIONS: Expiries for Jul12 NY cut 1000ET (Source DTCC)

Larger FX options rolling off at the NY cut later today include sizeable strikes layered just below spot in EUR/USD:

- EUR/USD: $1.0775(E547mln), $1.0780-00(E2.6bln), $1.0900(E599mln), $1.0935-55(E1.1bln), $1.0985-00(E1.3bln)

- EUR/JPY: Y156.00(E891mln)

- USD/CNY: Cny7.2300($816mln)

EQUITIES: Bear Threat Still Present in Eurostoxx Futures Despite Latest Move Higher

- The latest move higher in Eurostoxx 50 futures appears to be a correction and a bear threat remains present. The contract traded sharply lower last week, clearing a number of key support levels. 4241.00, the May 31 low, has been breached highlighting a potential reversal, opening 4208.50, a Fibonacci retracement. Key short-term resistance is seen at 4329.40, the 50-day EMA. A clear break of this average would ease bearish pressure.

- A bull theme in S&P E-minis remains intact and the pullback last week appears to be a correction. First support at 4420.62, the 20-day EMA, remains intact. Clearance of this level would strengthen a bearish threat and expose 4368.50, Jun 26 low and a key support. On the upside, the bull trigger is at 4498.00, the Jun 16 high. A clear breach of this level would confirm a resumption of the uptrend and open 4532.08, a Fibonacci projection.

COMMODITIES: WTI Futures Approach Key Resistance at $75.70, Jun 5 High

- The current short-term bull cycle in WTI futures remains intact. The contract has recently breached resistance at $72.72, the Jun 21 high. This strengthens a short-term bullish condition and a continuation would expose key resistance at $75.70, the Jun 5 high. A break of this level would highlight an important bullish break. On the downside, key short-term support is at $66.96, the Jun 12 low. Initial support lies at $69.69, the Jul 3 low.

- Gold has traded higher again today. The latest climb is considered corrective and the trend condition is unchanged and remains bearish. Recent fresh lows confirmed a resumption of the downtrend, extending the price sequence of lower lows and lower highs. Moving average studies are in a bear mode position highlighting current medium-term sentiment. Key resistance is $1985.3, the May 24 high. Initial resistance is $1943.9, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/07/2023 | 1230/0830 | *** |  | US | CPI |

| 12/07/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2023 | 1345/0945 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/07/2023 | 1345/1545 |  | EU | ECB Lane panels at NBER conference. | |

| 12/07/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/07/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/07/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/07/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/07/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/07/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 12/07/2023 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester | |

| 13/07/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/07/2023 | - | *** |  | CN | Trade |

| 13/07/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 13/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/07/2023 | 1230/0830 | *** |  | US | PPI |

| 13/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/07/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2023 | 2245/1845 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.