-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI US MARKETS ANALYSIS - USD/JPY Stretches to 2021 High

HIGHLIGHTS:

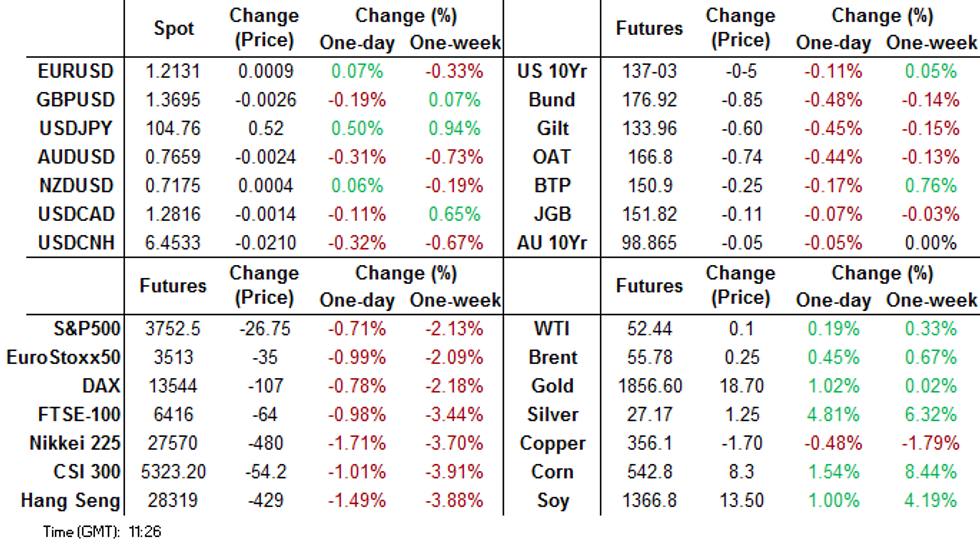

- USD/JPY hits new 2021 high despite equity weakness

- EUR firms as Reuters sources talk down ECB rate cut

- Focus turns to Chicago PMI, PCE data

US TSYS SUMMARY: Weaker Ahead Of PCE Data And MNI Chicago PMI

Treasuries are taking another leg lower at the time of writing, on heavier-than-usual (some of which is likely month-end related) volumes overnight.

- Curve is bear steepening: 2-Yr yield is unchanged at 0.1172%, 5-Yr is up 1.1bps at 0.4383%, 10-Yr is up 3.6bps at 1.0808%, and 30-Yr is up 4.1bps at 1.8453%.

- Mar 10-Yr futures (TY) down 6/32 at 137-02 (L: 137-02 / H: 137-10.5), ~360k traded.

- Not really a risk-on move, with equities weaker and the USD higher (albeit well off session highs).

- Attention still on Gamestop and other short-squeeze stocks - GME shares doubling pre-market as the phenomenon continues.

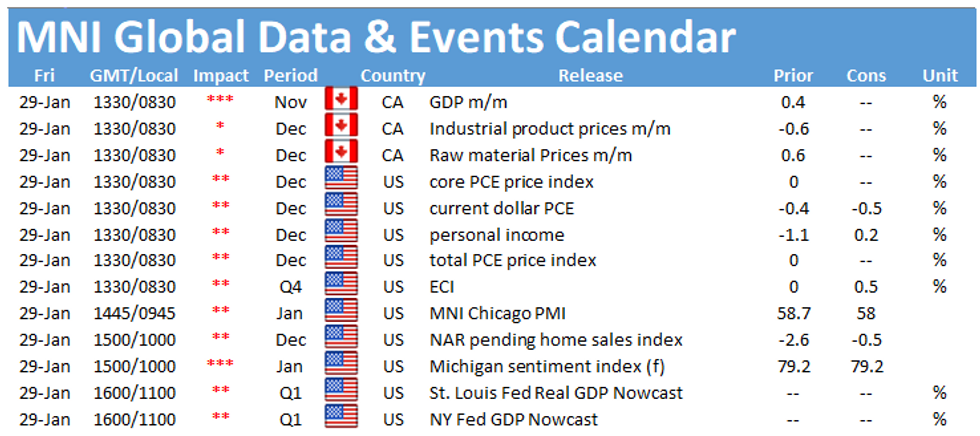

- We get Dec personal income/spending and PCE prices at 0830ET, with MNI Chicago PMI at 0945ET. Final UMich Sentiment and pending home sales at 1000ET.

- Dallas Fed's Kaplan speaks twice today, at 1300ET and 1600ET; SF's Daly speaks at 1725ET.

- No supply today; NY Fed buys ~$1.225B of 7.5-30Y TIPS.

EGB/GILT SUMMARY: Q4 GDP Surprises & Vaccine Politics

Core European sovereign curves have bear steepened alongside soft weaker trading in periphery EGBs.

- Gilts have sold off with yields 1-5bp higher on the day and the 2s30s spread 4bp wider.

- Bunds trade in line with gilts with the curve 3bp steeper.

- BTPs have traded weaker with price action relatively contained so far. Yields are within 1bp of yesterday's close.

- German, French and Spanish GDP data for the fourth quarter came in better than expected.

- As speculation mounts on the possibility of the EU introducing restrictions on exports of Covid vaccines, the International Chamber of Commerce has warned Brussels that blocking exports would risk global retaliation that could undermine the wider vaccination effort.

- After the Novavax Covid vaccine was found to be nearly 90% effective in trials, the UK has secured 60m doses, which could partially mitigate the risk of disruptions to vaccines produced in the EU.

- Supply this morning came from the UK (Bills, GBP4.5bn).

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXJ1 173.50/171.50ps vs RXH1 176.50p, bought the ps for 11 in 2k

RXJ1 172/176.5^^, sold at 53 in 5k

RXM1 174.50/172.50ps 1x1.5, bought for 40.5 in 1k

DUH1 112.30/112.20ps, bought for 2.5 in 6k

UK:

0LK1 100.00/12cs 1x2, bought for 0.75 in 1k

0LM1 100.12/100.00/99.75 broken p fly, bought for 1 in 2k

0LM1 100.00/100.12cs, sold at 2.75 in 5k

FOREX: USD/JPY Streak Extends, Targets November Highs

Upside in USD/JPY extended throughout the Friday morning, with the pair printing up at 104.94, having topped several key resistance levels. The pair's rally appeared to stall ahead of the 104.95 mark, the 76.4% retracement of the Nov 11 - Jan 6 downleg. A break above here would open 105.16 initially, the Nov 13 high. JPY is comfortably the poorest performer in G10.

The greenback is generally firm, extending the week's uptrend, although the week's highs for the USD index remain in tact at 90.880. A break north of here opens 2021 highs of 90.951.

Focus today turns to US personal income/spending figures for December, as well as the latest Canadian GDP. We see the first Fed speakers cross after Wednesday's FOMC rate decision, with Fed's Kaplan and Daly both scheduled.

ECB: EUR Inches Higher, Bunds Hit as ECB Sources Talk Down Rate Cut Chances

EUR inching higher to touch best levels of the session on those Reuters headlines - EUR/USD prints 1.2129 before fading off the highs. Bund futures see additional weight, hitting the session's lowest levels at 177.05.

Reuters cite sources in reporting that the ECB are unlikely to cut the policy rate, with benefits of such a move seen as limited. Instead, sources report that the ECB are focusing on financing conditions, including bond prices, lending rates in policy decisions and much less on exchange rates.

FX OPTIONS: Expiries for Jan29 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E562mln), $1.2050-60(E826mln-EUR puts), $1.2070-75(E1.0bln), $1.2100(E697mln), $1.2200(E801mln), $1.2300(E953mln)

USD/JPY: Y103.80-85($593mln), Y104.35-45($1.3bln)

EUR/GBP: Gbp0.8800(E661mln-EUR puts), Gbp0.8845-60(E1.1bln-EUR puts)

USD/CHF: Chf0.8800($1.46bln-USD puts)

AUD/USD: $0.7400(A$541mln), $0.7610-30(A$778mln-AUD puts), $0.7650(A$866mln), $0.7725-35(A$1.0bln-AUD puts), $0.7750-55(A$503mln), $0.7880(A$812mln)

USD/CAD: C$1.2750-60($830mln-USD puts)

USD/MXN: Mxn19.80($1.2bln), Mxn20.00($1.4bln)

USD/CNY: Cny6.45($740mln), Cny6.47($1.1bln), Cny6.50($1.5bln-USD puts), Cny6.55($782mln)

TECHS: Price Signal Summary - Yen Weakens

- In the FX space, USDJPY has this week cleared two important resistance levels:

- The bear channel resistance drawn off the Mar 24 high and

- 104.40, Nov 11 high.

- The break highlights a key reversal and also an important shift in sentiment. 105.00 is within reach, the focus is on 105.16 High Nov 13.

- EURJPY is also bid this morning. The focus is on key resistance at 127.49, Jan 7 high.

- The key directional triggers in EURUSD are: support at 1.2054, Jan 18 low and 1.2190 resistance, Jan 22 high.

- EURGBP outlook remains bearish with the focus on 0.8808, May 13 low. Resistance is at 0.8925, Jan 18 high

- On the commodity front, Gold remains above near-term support. A deeper sell-off would expose $1804.7, Jan 18 low. Oil contracts remain above support. Brent (J1) support to watch is $54.40, Jan 22 low and WTI (H1) support lies at $51.44, the low from Jan 22.

- In the FI space:

- Bunds (H1) are lower. Support levels to watch are: 177.12, Jan 25 low and 176.63, Jan 22 low.

- Gilts (H1) are pulling away from recent highs. Firm support is seen at 133.79, Jan 29 low

- In equities, E-mini S&P futures traded sharply lower Wednesday. Support to watch is at 3699.29, the 50-day EMA. A break would open 3652.50, Jan 4 low and reinforce a developing bearish theme.

EQUITIES: European Stock Markets In the Red As Late Wall Street Rally Fades

Continental stock markets are uniformly lower, with losses of 1.0-1.4% across Europe. Spanish stocks are underperforming, while Germany's DAX is spared from the bulk of the losses. Index futures in the US are suffering comparable losses, with the e-mini S&P off around 35 points at pixel time.

Financials are the poorest performer, with consumer staples and healthcare not far behind. Sweden's H&M are among the stocks sliding furthest, after earnings this morning showed the profit outlook has deteriorated thanks to lockdowns and discounting.

The e-mini S&P continues to find support at the 50-dma of 3712.39. Indices are seeing heavy volumes, with the e-mini S&P seeing volumes around 80% above average.

COMMODITIES: WTI Bounces Off Overnight Low, But Well Shy of Thursday High

WTI and Brent crude futures trade in very minor positive territory ahead of the final COMEX open of the week, having recovered from weakness seen across Asia-Pac hours. Early selling pressure saw prices ebb to $51.93, but modest USD weakness throughout European hours has seen prices recover to show north of $52.50.

In precious metals space, gold is benefiting ahead of the NY crossover, with the yellow metal narrowing in on yesterday's $1864.24 high. A break above here would open the 100-dma at $1879.28.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.