-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Offered, Equities Bounce

HIGHLIGHTS:

- USD offered as equities rebound

- US curve modestly bear steeper

- WTI, Brent lower as southern US production gradually coming back online

US TSYS SUMMARY: Heading Lower As Dollar Tumbles

Tsys are trading slightly above early European morning lows and well within Thursday's ranges, with some bear steepening in the curve early Friday.

- The big move overnight has been in the USD, with a 0.4% drop in the DXY further eroding the greenback's gains earlier in the week. Equities have rallied from lows alongside the drop. This backdrop has helped keep Treasuries under a bit of downside pressure.

- The 2-Yr yield is up 0.4bps at 0.1089%, 5-Yr is up 0.8bps at 0.5613%, 10-Yr is up 0.7bps at 1.3025%, and 30-Yr is up 0.9bps at 2.0904%.

- Mar 10-Yr futures (TY) down 4/32 at 135-23.5 (L: 135-21.5 / H: 135-28.5)

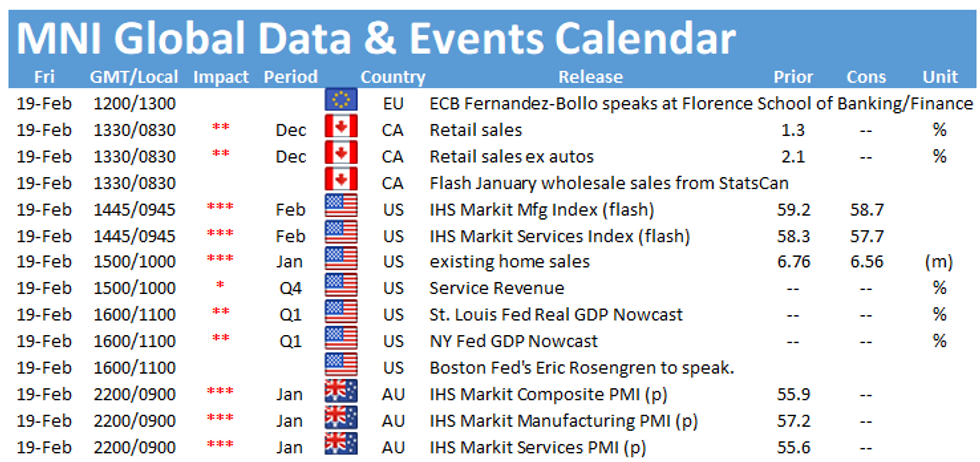

- Data highlight is Feb flash PMIs at 0945ET; we also get Jan existing home sales at 1000ET.

- Richmond Fed's Barkin speaks at 0800ET; Boston's Rosengren at 1000ET.

- No supply; NY Fed buys ~$8.825B of 2.25Y-4.5Y Tsys.

EGB/GILT SUMMARY: Risk-On Theme Pressures Core EGBs

It has been a more characteristic risk-on session this morning with core European sovereign bond markets trading weaker, periphery EGBs firming, equities inching higher and the dollar on the backfoot against G10 FX.

- Gilts have sold off with cash yields 1-2bp higher on the day and the belly marginally underperforming.

- Bunds opened weaker and have traded sideways for much of the morning. The 2s30s spread is 2bp wider.

- OATs have traded in line with bunds. Last yields : 2-year -0.6273%, 5-year -0.5298%, 10-year -0.076%, 30-year 0.7197%.

- BTPs have rallied with the curve marginally bull steepening.

- Preliminary February PMI data for the UK came in stronger than expected (Services 49.7 vs 42.0 survey, Manufacturing 54.9 vs 53.1) and mitigated disappointing retail sales for January (Ex Auto -3.8% Y/Y vs 2.7% survey). Cable hit an intraday high of 1.40 for the first time since 2018.

- Eurozone PMIs were mixed. Manufacturing continues to expand, while services remain in contraction territory, and Germany continues to outperform France.

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXJ1 172.50/173.50/175c fly, bought for 9.5 in 2k

RXJ1 172c, bought for 67 in 1.5k

OEJ1 135.75/136.25cs, bought for 3 in 2k

UK:

0LM1 99.87/100cs vs 3LM1 99.62/99.75cs, bought the 1yr for half in 6.5k

2LU1 99.62/99.75cs x2 vs 3LU1 99.50/99.75cs, bought the 2yr for 3.5 in 12kx6k

3LH1 99.75/99.87cs, bought for half in 2.5k (ref 99.52, 2 del)

3LM1 99.62/99.37ps vs 2LM1 99.75p, bought the put for 0.75 in 5k

3LM1 99.62/99.37ps vs 2LM1 99.75p, bought the put for 0.75 in 5k

3LM1 99.62/99.75/99.87c fly, bought for 1.5 in 2k

FOREX: Dollar Downside Eyes Feb Lows for Greenback

The greenback's been sold throughout European morning hours, prompting the USD index to narrow the gap with February lows printed earlier this week at 90.118. A break through here opens key support at 90.05 and would provide some major impetus for EUR/USD, GBP/USD and USD/JPY rates.

USD weakness this morning has buoyed GBP/USD above the $1.40 handle for the first time since April 2018, a move that's also seen USD/JPY show below the Y105.50 mark. European prelim PMI data has been mixed, with manufacturing generally faring better, but services lagging.

CNH saw some minor volatility on the back of further headlines suggesting China could ban rare earth technology exports if it deems necessary on national security grounds. USD/CNH initially rallied, touching 6.4553, before fading as markets deemed the news had little new information.

Focus Friday turns to Canadian retail sales and prelim February PMIs, existing home sales from the US. Central bank speakers include Fed's Barkin & Rosengren.

OPTIONS: Expiries for Feb19 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000-15(E525mln-EUR puts), $1.2040-50(E496mln-EUR puts)

USD/JPY: Y104.90-105.00($527mln), Y105.40-50($1.1bln)

AUD/USD: $0.7650(A$671mln), $0.7690-00(A$652mln), $0.7900(A$911mln)

USD/CAD: C$1.2720-35($1.3bln-USD puts)

Tech Focus: Price Signal Summary - FI Space Remains Heavy

- Equity indices outlook is unchanged and bullish, E-mini S&P futures still target the 4000.00 handle.

- An initial objective is at 3988.40, 2.236 projection of the Sep 24 - Oct 12 - Oct 30 price swing last year.

- Support lies at 3863.53, the 20-day EMA.

- In the FX space, EURUSD traded lower Wednesday but has since recovered. Tuesday's candle pattern, a shooting star formation, has defined a short-term top at 1.2169, Feb 16 high. A break of this level is required to negate the pattern and resume the uptrend. Support to watch lies at 1.2020, Feb 8 low. EURJPY also appears to have defined a short-term top at Wednesday's 128.46 high. A bearish engulfing candle on this day suggests a corrective pullback is likely near-term. The next key short-term support is at 127.04, Feb 15 low. The bull trigger is 128.46. EURGBP downside has extended this week with 0.8700 cleared. The April 2020 low has been breached, this opens 0.8621, Mar 5, 2020 low. Cable targets 1.4031, Apr 23, 2018 high.

- On the commodity front, Gold has cleared a number of support levels this week. Today the yellow metal has probed the Nov 30, 2020 low. Scope is seen for a move to $1747.6, Jun 26, 2020 low. Oil contracts remain firm despite the pullback from yesterday's high. Brent (J1) targets $65.88 - 1.764 projection of the Apr - Aug - Nov 2020 price swing. WTI (J1) targets $63.17 - 1.618 projection of the Apr - Aug rally from the Nov 2 low.

- In the FI space, Bunds(H1) remain heavy. The focus is on 174.06, 2.00 projection of the Jan 4 - 12 sell-off from the Jan 27 high. Gilts(H1) remain in a downtrend and the focus is on the psychological 130.00 handle.

EQUITIES: Stocks Bounce in Europe, France Leading

Global equity markets have bounced throughout Asia-Pac and European hours Friday, with core European bourses uniformly higher. French stocks are outperforming, with gains of around 0.7%. Financials and tech names in Europe are outperforming, while defensive healthcare and utilities names are the laggards.

The e-mini S&P is higher by 10 points or so, but is still yet to top the Thursday highs which remain first resistance at 3930.00. VIX futures are in negative territory and remain on course to hit new 2021 lows should the current weakness persist in NY hours.

COMMODITIES: WTI, Brent Bull Run Hits Pause

Both WTI and Brent crude futures trade lower early Friday, with prices opening a gap with the week's cycle highs of close to 6%. Prices have eased lower as production in the southern states comes back online after the cold snap. Facilities run by Marathon, Verdun Oil and Devon Energy have come back online with reduced output - but markets have taken that as a sign that normality will be restored when the weather eases over the weekend.

This has relieved some of the technical indicators that had pointed toward crude being overbought - the RSI has edged lower to 70 today after hitting the highest levels since the 1990 oil shock early Thursday.

Gold and silver are rangebound, with the latter finding some support at the 50-dma overnight. ETF flow data released overnight shows ETFs were buyers of palladium and sellers of both gold and silver at the tail-end of this week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.