-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US MARKETS ANALYSIS - USD On Top Ahead of Busy Fed Slate

HIGHLIGHTS:

- USD on top, but multi-month downtrend intact

- WTI, Brent higher ahead of Iran nuclear deal negotiations in Vienna

- No data to speak of, keeping focus on Fedspeak ahead of this weekend's media blackout

US TSYS SUMMARY: Fed Comms Provide The Focus, With Biden Infra Meeting Also Eyed

Wednesday's overnight session was fairly sedate, with little market-moving headline/market flow - and the day as a whole potentially representing a breather ahead of busier calendars Thurs and Fri.

- Sep 10-Yr futures (TY) up 1/32 at 131-26.5 (L: 131-23 / H: 131-27.5), on uninspiring (<200k) volumes).

- The 2-Yr yield is down 0.2bps at 0.1446%, 5-Yr is down 0.2bps at 0.8028%, 10-Yr is down 0.2bps at 1.6045%, and 30-Yr is down 0.2bps at 2.2846%.

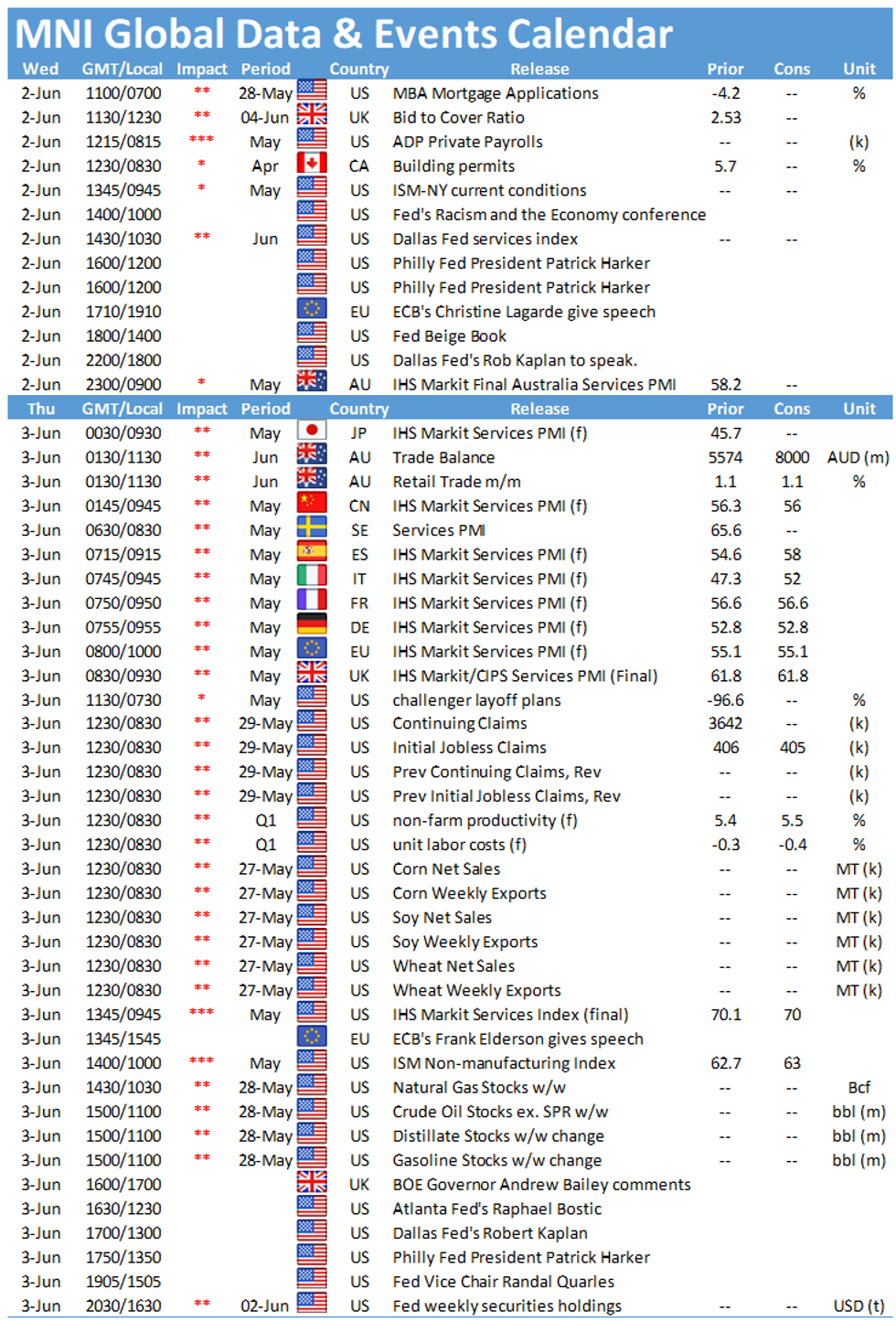

- A thin data calendar (MBA Mortgages at 0700ET) puts the focus on Fed communications ahead of the pre-FOMC meeting blackout period starting Fri night.

- The Beige Book is out at 1400ET; Philly Fed Pres Harker speaks at 1200ET, with Chi's Evans, Atl's Bostic and Dallas' Kaplan appearing at 1400ET.

- In supply, there's a $25B 119D bill auction at 1130ET. NY Fed buys ~$1.225B of 7.5-30Y TIPS.

- Pres Biden meets w Sen Capito on infrastructure at 1445ET, in a meeting Politico bills as "crucial" in terms of getting a bipartisan deal.

EGB/GILT SUMMARY: Divergence in 10s30s

- EGBs and gilts have generally drifted higher today, with 2s10s curves flattening.

- However, there has been some divergence in 10s30s curves with the German, Dutch and Spanish curves relatively flat on the day but gilt, OAT and BTP 10s30s all steepening.

- In terms of supply, we have seen another relatively weak German auction, this time with the Bobl auction seeing a bid-to-cover of 1.00x. UK 10-year and 25-year auctions have been decent. Greek 26-week bills have also been sold.

- Data this morning has seen German retail sales miss expectations, Eurozone PPI largely in line with expectations while UK mortgage approvals were a little better than expected.

- There are a number of ECB members taking part in the Green Swan conference today and between 2-4 June which has a tag line of "Coordinating finance on climate". BOE Governor Bailey is due to speak tomorrow. A full agenda for the conference is available here.

- Gilt futures are up 0.16 today at 127.03 with 10y yields down -1.1bp at 0.814% and 2y yields down -0.7bp at 0.060%.

- Bund futures are up 0.23 today at 170.06 with 10y Bund yields down -1.2bp at -0.191% and Schatz yields down -0.2bp at -0.669%.

- BTP futures are up 0.18 today at 147.68 with 10y yields down -0.7bp at 0.893% and 2y yields down -0.1bp at -0.343%.

- OAT futures are up 0.17 today at 160.54 with 10y yields down -1.2bp at 0.165% and 2y yields down -0.8bp at -0.662%.

EUROPE ISSUANCE UPDATE: UK, German Auction Results

- UK DMO sells GBP2bln 0.875% Jan-46 Gilt, Avg yield 1.359% (Prev. 1.322%), Bid-to-cover 2.40x (Prev. 2.17x), Tail 0.2bp (Prev. 0.9bps)

- UK DMO sells GBP2.75bln of the 0.25% Jul-31 Gilt, Avg yield 0.941% (Prev. 0.924%), Bid-to-cover 2.64x (Prev. 2.67x), Tail 0.1bp (Prev. 0.1bps)

- Germany sells E3.317bln 0% Apr-26 Bobl, Avg yield -0.57% (Prev. -0.61%), Bid-to-cover 1.00x (Prev. 1.10x)

FOREX: USD Clears to Weekly High, With Fedspeak in Focus

- Headed through the European morning, the dollar broke out of a tight overnight range, with the greenback the strongest across G10 ahead of the NY crossover. Fundamental newsflow is few and far between, but the USD strength has pushed GBP/USD through to new weekly lows and lower for a second session.

- EUR is similarly weak, but EUR/GBP continues to gravitate either side of the 50-dma at 0.8626. EUR/JPY holds just below the cycle highs posted yesterday at 134.13.

- AUD and NZD are among the poorest performers so far, but recent ranges have been largely respected.

- There's little data on the slate Wednesday, keeping focus on the central bank speaker slate ahead of the Fed blackout period this weekend. ECB's Villeroy, Elderson, Lagarde and Weidmann are on the docket as well as Fed's Harker, Evans, Bostic and Kaplan.

FX OPTIONS: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-05(E805mln), $1.2200(E348mln-EUR puts), $1.2220-35(E557mln-EUR puts), $1.2400-10(E550mln)

- USD/JPY: Y107.40($523mln), Y111.25($500mln)

- GBP/USD: $1.4200(Gbp444mln-GBP puts)

- EUR/GBP: Gbp0.8655-60(E493mln-EUR puts)

- EUR/CHF: Chf1.0800(E530mln-EUR puts)

- EUR/NOK: Nok10.20(E692mln-EUR puts), Nok10.27(E584mln-EUR puts)

- USD/NOK: Nok8.20($450mln), Nok8.32($350mln)

- AUD/USD: $0.7710-15(E667mln), $0.7740-50(A$1.3bln-AUD puts)

- AUD/JPY: Y83.15(A$943mln-AUD puts)

- NZD/USD: $0.7200-20(N$1.5bln-NZD puts)

- USD/CNY: Cny6.38($760mln), Cny6.40($926mln)

Price Signal Summary - EURUSD Directional Triggers Defined

- In the equity space, S&P E-minis rolled off the week's highs of 4230 on Tuesday and has flatlined since. This keeps key resistance at 4238.25 May 10 high untouched for now, with key trend support unchanged at 4029.25, May 13 low. The 20-day EMA represents initial support at 4166.44. A break would signal scope for a deeper pullback. EUROSTOXX 50 futures outpaced their US counterparts Tuesday, holding the majority of the session's gains into the Wednesday open. Tuesday's show above the 4099.00,1.00 projection of the Mar - Jul - Oct 2020 price swing confirms the resumption of the uptrend and opens 4140.00, Jan 18 high, 2008 (cont)

- In the FX space, EURUSD is offered this morning. The outlook remains bullish and the key directional parameters that have been defined are; 1.2133 support, May 28 low and 1.2266 resistance, May 25 high. The latter is the bull trigger. A break of the former would signal scope for a deeper corrective pullback. GBPUSD traded above resistance at 1.4237, Feb 24 high on Tuesday but has since pulled back and is softer today. A clear break higher would confirm a resumption of the broader uptrend. Support to watch lies at 1.4092, May 27 low. USDJPY is firmer this morning. Attention is on 110.20, May 28 high where a break would resume the recent recovery. Key support is at 108.56, May 25 low.

- On the commodity front, Gold remains bullish despite this week's pullback. The focus is on the Jan 8 high of $1917.6. The trend remains overbought and we continue to monitor this technical warning sign. $1872.8, May 25 low is first support. Trend conditions in Oil remain bullish. Brent (Q1) key resistance at $69.90, May 18 high has been cleared. This opens $71.38, Mar 8 high (cont) next. WTI (N1) has traded through the May highs opening the $70.00 psychological level.

- Within FI, Bunds (M1) are unchanged and remain below the 50-day EMA at 170.39. While it holds, the outlook is bearish. A clear break higher is required to highlight scope for further gains. Support is at 169.02. May 24 low. Gilts (U1) remains below resistance at 127.74/82, highs between Apr 20 and May 26. A bearish risk remains present.

EQUITIES: Uniform Gains Across Europe, But Upside Muted

- Continental stock markets trade uniformly higher Wednesday, with gains of 0.2-0.3% across most core indices. EuroStoxx futures resumed the multi-month uptrend yesterday, with new all-time highs posted at 4,100 which remains the next level to watch.

- Across Europe, energy and consumer staples names are outperforming with the resumption of oil strength providing a tailwind for the oil & gas sector. Technology and communication services firms are the laggards so far.

- US futures are mixed, with the Dow Jones futures in mild positive territory while NASDAQ future lags. VIX futures have held the overnight gains, suggesting volatility may have bottomed for now.

COMMODITIES: Crude Keeps Higher, Gold Lower for Second Session

- WTI and Brent crude futures both trade in positive territory, although both benchmarks sit just below their respective weekly highs.

- Oil markets continue to receive support from buoyant global equities, while markets watch the latest round of talks in Vienna Wednesday, after reports circulated earlier in the week of reluctance in Iran to comply with restrictions on their nuclear programme.

- This keeps first resistance in WTI crude futures intact at $68.87 while Brent eyes $71.34 first and foremost.

- Precious metals, however, sit slightly underwater, with gold and silver lower for a second session. The firmer greenback is weighing, but solid support is intact for now.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.