-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US MARKETS ANALYSIS - USD On Top as Markets Reverse Course

HIGHLIGHTS:

- Greenback rebounds as Treasury yield curve steepens

- Stocks firm further, E-mini S&P tops 4,100 overnight

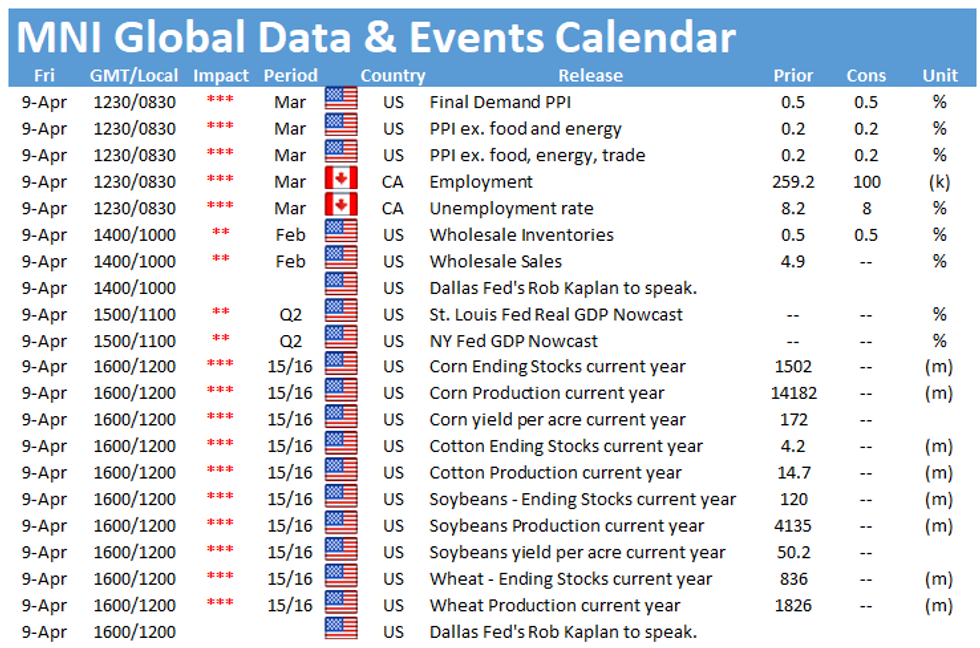

- US PPI, Canadian jobs report on tap

US TSYS SUMMARY: Reversing Thursday's Gains Ahead Of PPI, Clarida

Yields have backed up vs late Thurs/overnight Fri lows. Attention on PPI and an appearance by Fed's Clarida.

- 7Y-10Y segment underperforming. The 2-Yr yield is up 0.8bps at 0.1568%, 5-Yr is up 3.9bps at 0.874%, 10-Yr is up 5bps at 1.6691%, and 30-Yr is up 3.9bps at 2.3457%. Jun 10-Yr futures (TY) down 10.5/32 at 131-21.5 (L: 131-20.5/ H: 132-02.5).

- Fed speakers in focus. VC Clarida is interviewed on Bloomberg TV at 0800ET.

- Late Thurs, SF's Daly said on "substantial further progress", "we don't have to expect it, we have to see it". Dallas's Kaplan (at both 1000ET and 1200ET) also appears.

- Reminder that late yesterday, longer-dated Tsys strenghtened as NY Fed SOMA manager Logan arguably made the most interesting comments on Fed policy post-March FOMC. She said re asset purchase tweaks that 20-Year Tsy buys from the Fed could tick higher, with TIPS buys reducing.

- Logan also noted that O/N RRP policy and/or administered rates could be adjusted, and in coming months the NY Fed is looking to broaden the list of eligible RRP counterparties.

- Data today consists of PPI at 0830ET and wholesale inventories at 1000ET.

- No supply; NY Fed buys ~$3.625B of 7-20Y Tsys.

EGB/GILT SUMMARY: Bear Steeper as Curve Unwinds Thursday Trade

EGBs have mainly bear Steepened today, as curve unwind yesterday's price action.

- No real clear driver, beside some consolidations in Bund.

- BTP dipped on news that Draghi plans to borrow up to EU40bn, to keep the Economy afloat.

- Peripheral are trading wider today, with Italy sitting 3.9bps wider, mostly driven by the Italian news.

- Gilts have traded in line with EGBs, on a lighter volume session.

- Looking ahead, US PPI is the only notable data, as Wholesale Inventories will be final reading.

- Speakers: ECB de Giundos, Riksbank's Ingves and Breman at IMF, and Fed Kaplan

- Jun Bund futures (RX) down 48 ticks at 171.41 (L: 171.39 / H: 172.07)

- Germany: The 2-Yr yield is up 1bps at -0.704%, 5-Yr is up 2.8bps at -0.64%, 10-Yr is up 3.6bps at -0.3%, and 30-Yr is up 3.5bps at 0.259%.

- Jun Gilt futures (G) down 38 ticks at 128.1 (L: 128.09 / H: 128.5)

- UK: The 2-Yr yield is up 1.4bps at 0.06%, 5-Yr is up 2.7bps at 0.367%, 10-Yr is up 4.5bps at 0.794%, and 30-Yr is up 4.6bps at 1.33%.

- Jun BTP futures (IK) down 85 ticks at 148.48 (L: 148.45 / H: 149.27)

- Jun OAT futures (OA) down 51 ticks at 161.87 (L: 161.85 / H: 162.53)

- Italian BTP spread up 3.9bps at 103.7bps

- Spanish bond spread up 1.7bps at 68.7bps

- Portuguese PGB spread up 2.3bps at 59.2bps

- Greek bond spread up 0.8bps at 117.4bps

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXK1 170.5/172.5^^ sold at 37 and 38 in 1.5k

RXK1 173.5c, bought for 5.5 in 4.25k

2RZ1 100.25/100.50 RR, bought the call for 0 in 2.25k

UK:

0LU1 99.75/99.62/99.50p fly, bought for 2 in 5k (ref 99.73)

0LZ1 99.87/100cs, bought for 1.5 in 10k

2LM1 99.62/99.50ps vs 99.87c, sold the ps at 7 in 10k

FOREX: Broad Base USD Buying

Most of the action this morning has been in FX, with broader base buying interest of the Dollar, after the currency was leaning in the red during the overnight session.

- The USD trades in the green against all majors, and leads against the NOK in G10s.

- Immediate resistance in USDMOK comes at 8.5184 (printed 8.5180 high so far), ahead of 8.5300 (38.2% short term retracement).

- The Aussie is the second worst performer against the USD, although off the worst levels at the time of typing.

- Further pressure on the Aussie would open to the April low at 0.7532, which is also the lowest level since 12th of December.

- AUDUSD is off the low (0.7588), at 0.7612.

- Long were seen bailing out as we cleared below the 1.3700 handle in Cable.

- We tested support noted at 1.3670/63 Low Mar 25/Low Feb 5 (traded 1.3671 low), now at 1.3710.

- The move in Cable helped EURGBP towards next initial target at 0.8705 High Mar 1, but the cross just fell short to 0.86975 high.

- Looking ahead, US PPI is the only notable data, as Wholesale Inventories will be final reading.

- Speakers: ECB de Giundos, Riksbank's Ingves and Breman at IMF, and Fed Kaplan

FX OPTIONS: Expiries for Apr09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E904mln), $1.1780(E789mln), $1.1800-05(E1.0bln), $1.1850(E1.2bln-EUR puts), $1.1885-00(E954mln), $1.2000(E583mln)

- USD/JPY: Y109.15($1.55bln), Y109.25-50($1.1bln-USD puts), Y109.75($632mln-USD puts), Y110.45-55($765mln), Y111.00($605mln)

- AUD/USD: $0.7600-20(A$975mln-AUD puts)

- AUD/JPY: Y83.25(A$450mln-AUD puts)

- NZD/USD: $0.6948-50(N$1.35bln-NZD puts), $0.7050(N$521mln-NZD puts)

- USD/CAD: C$1.2540-50($705mln), C$1.2600 ($1.36bln-USD puts), C$1.2635-50($734mln)

- USD/CNY: Cny6.40($800mln), Cny6.4450-65($759mln)

Price Signal Summary - Equity Space Bullish Sentiment Intact

- In the equity space:

- S&P E-minis have traded higher again today with a print just above 4100.00. The next objective is 4124.75, 1.382 projection of the Feb 1 - Feb 16 - Mar 4 price swing.

- EUROSTOXX 50 maintains a bullish tone with the focus on 4000.00. A break would open 4047.72, 2.236 projection of the Dec 21 - Jan 8 - Jan 28 price swing.

- In the FX world, EURUSD maintains a short-term bullish tone. The focus is on 1.1940, the 50-day EMA and a key resistance area. A clear break is required to suggest scope for an extension higher. The GBPUSD outlook remains bearish. Recent gains have stalled at the former bull channel base drawn off the Nov 2 low. Resistance has been defined at 1.3919, Apr 6 high. The key support to watch and bear trigger is 1.3670, Mar 25 low. EURGBP remains bullish. The price pattern on Apr 6 was a bullish engulfing candle. This exposed the next key resistance zone at 0.8646, Mar 24 high and S/T reversal trigger and 0.8653, 50-day EMA. Both have been breached and this opens 0.8731, Feb 26 high. USDJPY traded lower yesterday as the corrective cycle extends. Support at 109.35, the 20-day EMA has been probed. A clear break would open 109.13, Mar 26 low.

- On the commodity front:

- Gold is holding onto recent gains. Key resistance at $1755.5, Mar 18 high has been probed. The yellow metal also needs to clear $1759.8, the 50-day EMA to suggest scope for a stronger bounce.

- Brent (M1) key directional triggers are unchanged with:

- Resistance at $65.39, Mar 29 high and key support at $60.33, Mar 23 low and the bear trigger.

- WTI (K1) directional triggers are:

- Resistance at $62.27, Mar 30 high and support at $57.25, Mar 23 low and the bear trigger

- In the FI space, Bunds (M1) remain vulnerable despite recent gains. Key support to watch is at 170.52, Mar 18 low. Key resistance remains 172.66, Mar 25 high. The key support and bear trigger in Gilts (M1) is unchanged at 126.79, Mar 18 low. Recent price action in BTP futures have defined resistance at 150.39, Mar 11 high and support at 148.36, Mar 18 low as key short-term directional triggers.

EQUITIES: EuroStoxx 50 Touches Post-Financial Crisis High

- Asian equities closed mixed, with Japan's NIKKEI up 59.08 pts or +0.2% at 29768.06 and the TOPIX up 7.61 pts or +0.39% at 1959.47. China's SHANGHAI closed down 31.878 pts or -0.92% at 3450.677 and the HANG SENG ended 309.27 pts lower or -1.07% at 28698.8

- European stocks are mixed, with the German Dax down 13.35 pts or -0.09% at 15190.72, FTSE 100 down 20.18 pts or -0.29% at 6942.22, CAC 40 up 15 pts or +0.24% at 6165.72 and Euro Stoxx 50 up 1.14 pts or +0.03% at 3977.15 (earlier hit post-2008 high of 3,984.07).

- U.S. futures are trading fairly flat, with the Dow Jones mini up 46 pts or +0.14% at 33436, S&P 500 mini up 2.5 pts or +0.06% at 4091.5, NASDAQ mini down 18 pts or -0.13% at 13729.75.

COMMODITIES: Dollar Strength Sinks Precious Metals

- WTI Crude down $0.17 or -0.29% at $59.34

- Natural Gas down $0.02 or -0.67% at $2.506

- Gold spot down $9.55 or -0.54% at $1748.56

- Copper down $3.25 or -0.79% at $406.1

- Silver down $0.24 or -0.96% at $25.2245

- Platinum down $15.71 or -1.27% at $1217.42

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.