MNI US MARKETS ANALYSIS - USD Slides on WaPo Tariff Report

Highlights:

- USD significantly weaker amid Washington Post report on softening Trump tariff policy.

- Markets continue to pare ECB easing bets following Eurozone PMIs and the German inflation print for Hesse.

- German national-level HICP & CPI inflation scheduled to be released later today. US Final Services PMI and Factory Orders also due.

US TSYS: Richer After Belated Reaction to More Targeted Trump Tariff Story

- Treasuries sit firmer across the curve having more than reversed the gap lower at the open. They were much slower to react than FX markets to the Washington Post flagging Trump aides readying a universal tariff plan but one that is much more targeted than some of Trump’s campaign pledges.

- Today’s docket is highlighted by Fed Gov. Cook, final PMIs and the 3Y note auction offering the first coupon issuance of 2025.

- Cash yields are 0.2-2.3bp lower on the day, led by 2s.

- 2s10s at 33.4bp (+1.5bp) trades close to recent highs of 35bps.

- TYH5 trades at 108-22+ (+02) on reasonable volumes of 405k, having lifted off overnight lows of 108-12 but with trend conditions still bearish. Support remains at 108-06+ (Dec 26 low) whilst the session’s high of 108-24 remained firmly below resistance at 109-10+ (20-day EMA).

- Fed Funds futures cumulative cuts from 4.33% effective: 2bp Jan, 12bp Mar, 17bp May and 26bp Jun.

- Data: Serv/comp PMI Dec final (0945ET), Factory orders Nov (1000ET)

- Fedspeak: Confined to Gov. Cook (permanent voter) on the economic outlook and financial stability at 0915ET (text + Q&A). She last spoke Nov 20, with two-sided comments that the Fed could pause if inflation progress slows and job market is solid but the Fed could also cut more quickly if the job market weakens substantially. Her base case is to lower rates over time until near a neutral setting.

- Note/bond issuance: US Tsy $58B 3Y note auction - 91282CMF5 (1300ET)

- Bill issuance: US Tsy $84B 13W and $72B 26W bill auctions (1130ET)

US TSY FUTURES: Short Setting Dominated on Friday

OI data points to net short setting across the curve on Friday, as data flow and setup for a heavy week of $IG & Tsy supply weighed on markets.

- The largest net DV01 equivalent positioning swings came in the 7- to 10-Year zone of the futures curve (TY & UXY).

| 03-Jan-25 | 02-Jan-25 | Daily OI Change | OI DV01 Equivalent Change ($) |

TU | 4,303,833 | 4,271,006 | +32,827 | +1,270,363 |

FV | 6,180,465 | 6,175,390 | +5,075 | +212,900 |

TY | 4,571,307 | 4,545,889 | +25,418 | +1,634,618 |

UXY | 2,184,077 | 2,162,260 | +21,817 | +1,905,950 |

US | 1,924,027 | 1,916,694 | +7,333 | +912,243 |

WN | 1,769,527 | 1,764,866 | +4,661 | +871,755 |

|

| Total | +97,131 | +6,807,828 |

STIR: OI Points to Short Setting in Most SOFR Futures on Friday

OI data suggests net short setting dominated through the SOFR greens on Friday, with long cover then more prominent in the blues.

| 03-Jan-25 | 02-Jan-25 | Daily OI Change |

| Daily OI Change In Packs |

SFRZ4 | 1,121,523 | 1,123,852 | -2,329 | Whites | +26,509 |

SFRH5 | 1,128,024 | 1,106,984 | +21,040 | Reds | +40,855 |

SFRM5 | 1,024,515 | 1,015,549 | +8,966 | Greens | +7,985 |

SFRU5 | 813,715 | 814,883 | -1,168 | Blues | -7,320 |

SFRZ5 | 907,468 | 892,431 | +15,037 |

|

|

SFRH6 | 590,999 | 574,992 | +16,007 |

|

|

SFRM6 | 648,683 | 641,261 | +7,422 |

|

|

SFRU6 | 635,079 | 632,690 | +2,389 |

|

|

SFRZ6 | 723,428 | 720,463 | +2,965 |

|

|

SFRH7 | 463,226 | 461,114 | +2,112 |

|

|

SFRM7 | 376,507 | 377,628 | -1,121 |

|

|

SFRU7 | 275,908 | 271,879 | +4,029 |

|

|

SFRZ7 | 292,163 | 297,059 | -4,896 |

|

|

SFRH8 | 228,241 | 228,109 | +132 |

|

|

SFRM8 | 158,795 | 160,621 | -1,826 |

|

|

SFRU8 | 114,583 | 115,313 | -730 |

|

|

US: Trump Aides Exploring More Limited Universal Tariff Plan, WAPO

The Washington Post reports that US President-elect Donald Trump’s aides are "exploring plans" to apply tariffs to every country “but only cover critical imports” – a step removed from Trump’s more hardline campaign proposal to impose a 10-20% universal baseline tariff on all imports.

- The report suggests that Trump’s initial tariff plan may track relatively closely with the Biden administration’s targeted tariffs, which already applies duties on Chinese imports in sectors deemed critical to national security or subject to “anticompetitive and non-market” practices.

- The Post writes: “Preliminary discussions have largely focused on several key sectors [including] the defense industrial supply chain (through tariffs on steel, iron, aluminum and copper); critical medical supplies (syringes, needles, vials and pharmaceutical materials); and energy production (batteries, rare earth minerals and even solar panels)”.

- As tariffs already cover Chinese imports on many of the above items, market focus will be on potential exceptions for allied countries that run a trade surplus with Washington, including Japan, South Korea, and Germany - and on how robustly Trump will approach closing backdoor routes to US markets via lower-tariff countries.

- A source told WaPo: “The sector-based universal tariff is a little bit easier for everybody to stomach out the gate... why not at least start with these targeted measures? And it would still give CEOs a massive incentive to start making their products here.”

- A Trump spokesperson said in a statement: “As he did in his first term, [Trump] will implement economic and trade policies to make life affordable and more prosperous for our nation.”

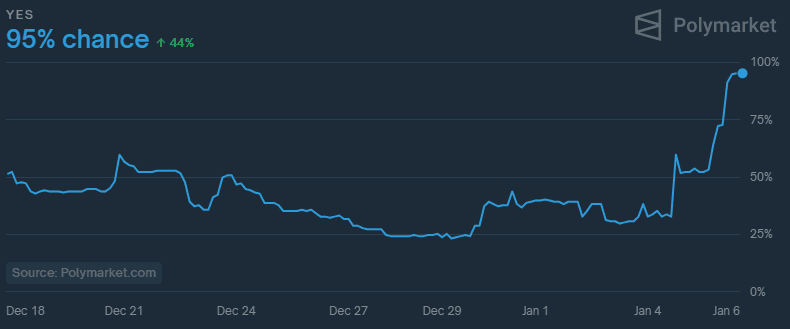

CANADA: Betting Markets Shift to 95% Probability of Imminent PM Resignation

Following earlier headlines in the domestic press claiming that PM Justin Trudeau could resign/announce his resignation as soon as 7 Jan, betting markets have shifted significantly. Data from Polymarket shows political bettors assigning a 95% implied probability that Trudeau will announce his resignation before February, while data from Kalshi shows bettors assigning the same 95% implied probability that Trudeau will resign before April. Prior to the publication of the speculation on 5 Jan, the implied probability of an immediate resignation stood around 50%.

- There has been a flurry of media stories claiming that former BoC and BoE governor Mark Carney could launch a bid for the leadership of Trudeau's centre-left Liberal Party of Canada (LPC). CTV News reports "Since Boxing Day, sources say Carney has made and fielded dozens of calls to Liberal MPs and political organizers who view him as a potential replacement for Trudeau."

- Finance Minister Dominic LeBlanc, a close ally of Trudeau, is seen as a potential interim PM if Trudeau goes immediately. Alternatively, he may seek the LPC leadership. Former Finance Minister Chrystia Freeland, whose resignation in December sent shockwaves through Canadian politics, is another likely runner.

- With the Trudeau gov't currently a minority administration, it remains to be seen whether a new Liberal leader would seek to maintain the current situation or risk a snap election with the LPC trailing Pierre Poilievre's centre-right Conservatives by a double-digit margin in opinion polling.

Chart 1. Betting Market Implied Probability PM Trudeau Announces Resignation Before February, %

Source: Polymarket

EUROZONE DATA: EZ Composite PMI Still Lacklustre But Price Pressures Firm

- The Eurozone services PMI was revised higher in December from a preliminary 51.4 to 51.6, leaving it with a complete reversal of the slide to 49.5 in Nov.

- France drove the upward revision (from 48.2 to 49.3 to also more firmly bounce from the 46.9 in Nov) although Germany was also revised higher from 47.8 to 48.0.

- Whilst already implied, new data showed peripherals continued to outperform in Dec with the Spain jumping from 53.1 to 57.3 (highest since Apr’23) and Italy rising from 49.2 to 50.7 (albeit only highest since Oct).

- Composite activity remains lacklustre though. The Eurozone composite PMI was revised up a tenth to 49.6 to lift further from a particularly weak 48.3 in Nov, but nevertheless marked a fourth month at or below 50.0.

- The press release notes “sustained falls in new business and employment”, with “seven straight months of falling new orders”.

- Broader expectations for growth in the coming year saw their strongest since Sept albeit with confidence still “subdued” when compared with the historical average.

- Price pressures accelerated however: Input cost inflation saw its fastest since July, led by a “notable uptick” for services companies whilst factories input costs were unchanged. Charge inflation hit a four-month high against that backdrop but there’s that same disparity by sector, with discounting by goods producers versus “more aggressive price setting in the services industry driving overall output charge inflation up”.

FOREX: USD Significantly Weaker Amid Report on Softening Trump Tariff Policy

- The Washington Post reports that US President-elect Donald Trump’s aides are "exploring plans" to apply tariffs to every country “but only cover critical imports” providing potential for slightly less protectionist U.S. trade policy. The article has bolstered the existing direction of travel for the greenback on Monday, with the USD index extending session lows and briefly bringing the DXY’s pullback to around 1.5% from last week’s highs.

- EURUSD (+1.05%) surged back above 1.0400, and notably rose above initial 20-day EMA resistance to print a 1.0432 high, having now recovered over 200 pips from the 1.0226 lows on Jan 02. Above here, 1.0458 is the Dec 30 high.

- Similar strength seen across higher beta currencies such as AUD and NZD, which extend gains to around 1% on the day. Cable has risen back above 1.25 and will look to initial firm resistance at 1.2562, the 20-day EMA.

- USDJPY also significantly knocked off its highs, reversing around 70 pips to trade closer to unchanged on the session. USDMXN (-0.80%) prints fresh session lows below 20.50.

- There will be particular focus on the Canadian dollar as betting markets shift to 95% probability of imminent PM Trudeau resignation. USDCAD is down 0.9% on the session with pullback seen as technically corrective at this juncture. Initial firm support has been pierced at 1.4320, the 20-day EMA.

- German national-level HICP & CPI inflation is scheduled to be released later today 13:00 GMT. US Final Services PMI and Factory Orders are due for release, and FOMC Member Cook will speak.

EUROPEAN ISSUANCE UPDATE

New 10-Year OLO: Mandate

- "The Kingdom of Belgium (rated Aa3/AA/AA-; outlook negative/stable/negative) intends to issue a new EURO syndicated benchmark bond maturing 22 June 2035 (OLO 103) in the near future, subject to market conditions."

- "The Kingdom has mandated BNP Paribas Fortis, Crédit Agricole CIB, HSBC, J.P. Morgan and Morgan Stanley as joint bookrunners" (all details as per Bloomberg)

- We had pencilled in a 10-year Belgium syndication in our EGB Issuance, Redemption and Cash Flow Matrix publication for this week, with a size estimate of E7.0bln in line with what we have seen in the past two years with some upside risk.

EQUITIES: Bear Threat in E-Mini S&P Remains Present, Attention on $5866.00

- A bull cycle in the Eurostoxx 50 futures contract remains intact. However, the recent move down continues to highlight a corrective phase and despite the latest bounce, a short-term bear threat remains present - for now. Key short-term support has been defined at 4829.00, the Dec 20 low. A break of it would confirm a resumption of the bear cycle and open 4800.87, a Fibonacci retracement. Initial firm resistance to watch is at 4942.00, the Jan 2 high.

- A bear threat in the S&P E-Minis contract remains present. The reversal lower from the Dec 26 high, highlights the end of the recent Dec 20 - 26 corrective bounce. Attention is on 5866.00, the Dec 20 low and a key short-term support. Clearance of this level would strengthen a bearish theme. Initial firm resistance to monitor is 6107.50, the Dec 26 high. Clearance of this level is required to open key resistance at 6178.75, the Dec 6 high.

COMMODITIES: Gains for WTI Futures Expose Key Short-Term Resistance at $76.41

- WTI futures traded higher last week as the contract extended recent gains. A stronger reversal to the upside has exposed key short-term resistance at $76.41, the Oct 8 high. A firm resistance at $71.97, the Nov 7 high, has been breached, strengthening a bullish theme. On the downside, a reversal lower would expose support at the 20-day EMA, at $70.49. This average is seen as a key short-term support.

- A bear threat in Gold remains present despite the latest recovery, The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low. The first firm support to watch is $2583.6, the Dec 19 low. On the upside, a resumption of gains would instead signal scope for a climb towards resistance at $2726.2, the Dec 12 high.

| Date | GMT/Local | Impact | Country | Event |

| 06/01/2025 | 1300/1400 | *** | HICP (p) | |

| 06/01/2025 | 1445/0945 | *** | S&P Global Services Index (final) | |

| 06/01/2025 | 1445/0945 | *** | S&P Global US Final Composite PMI | |

| 06/01/2025 | 1500/1000 | ** | Factory New Orders | |

| 06/01/2025 | 1630/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 06/01/2025 | 1630/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 06/01/2025 | 1800/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 07/01/2025 | 0001/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 07/01/2025 | 0030/1130 | * | Building Approvals | |

| 07/01/2025 | 0730/0830 | *** | CPI | |

| 07/01/2025 | 0745/0845 | *** | HICP (p) | |

| 07/01/2025 | 0830/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 07/01/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 07/01/2025 | 0900/1000 | *** | Bavaria CPI | |

| 07/01/2025 | 0930/0930 | ** | S&P Global/CIPS Construction PMI | |

| 07/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 07/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 07/01/2025 | 1000/1100 | *** | HICP (p) | |

| 07/01/2025 | 1000/1100 | ** | Unemployment | |

| 07/01/2025 | 1000/1100 | *** | HICP (p) | |

| 07/01/2025 | 1330/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 07/01/2025 | 1330/0830 | ** | Trade Balance | |

| 07/01/2025 | 1330/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 07/01/2025 | 1355/0855 | ** | Redbook Retail Sales Index | |

| 07/01/2025 | 1500/1000 | * | Ivey PMI | |

| 07/01/2025 | 1500/1000 | *** | ISM Non-Manufacturing Index | |

| 07/01/2025 | 1500/1000 | *** | JOLTS jobs opening level | |

| 07/01/2025 | 1500/1000 | *** | JOLTS quits Rate | |

| 07/01/2025 | 1630/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/01/2025 | 1800/1300 | ** | US Note 10 Year Treasury Auction Result |