-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Wanes as Markets Reassess Fed Trajectory

Highlights:

- Norges Bank, SNB tilt hawkish as inflation pervades European regions

- BoE in focus, with 25bps hike the consensus view

- USD wanes further as markets reassess Fed trajectory

US TSYS: Modestly Cheaper After SNB and Norges Bank, BoE Still To Come

- Cash Tsys have seen some modest cheapening pressure through European hours after regional central banks leaned hawkish and with the BoE still to come shortly. The front end outperforms on the day after rallying in Asia hours in a continuation of the sizeable post-FOMC reaction before retracing, but still leaves 2YY currently down 21bps from Tuesday’s close.

- 2YY +1.4bp at 3.950%, 5YY +2.9bp at 3.540%, 10YY +3.6bp at 3.470% and 30YY +2.0bp at 3.672%. 2s10s at -47bps within wide ranges of -80bps to -30bps since regional banking woes escalated on Mar 13.

- TYM3 trades 6+ ticks higher at 115-09+ having earlier come within half a tick of yesterday’s post-FOMC high of 115-19+. That level forms initial resistance after which lies 116-24 (Mar 20 high), whilst to the downside support remains at 113-26 with the key 50-day EMA at 113-15.

- Data: Weekly jobless claims (0830ET), Current account balance (0830ET), Chicago Fed Nat Act Index (0830ET), New home sales (1000ET), Kansas City Fed mfg index (1100ET)

- Issuance: $15B 10Y TIPS auction re-open (91282CGK1) (1300ET)

- Bill issuance: $60B 4W, $50B 8W bill auctions (1130ET)

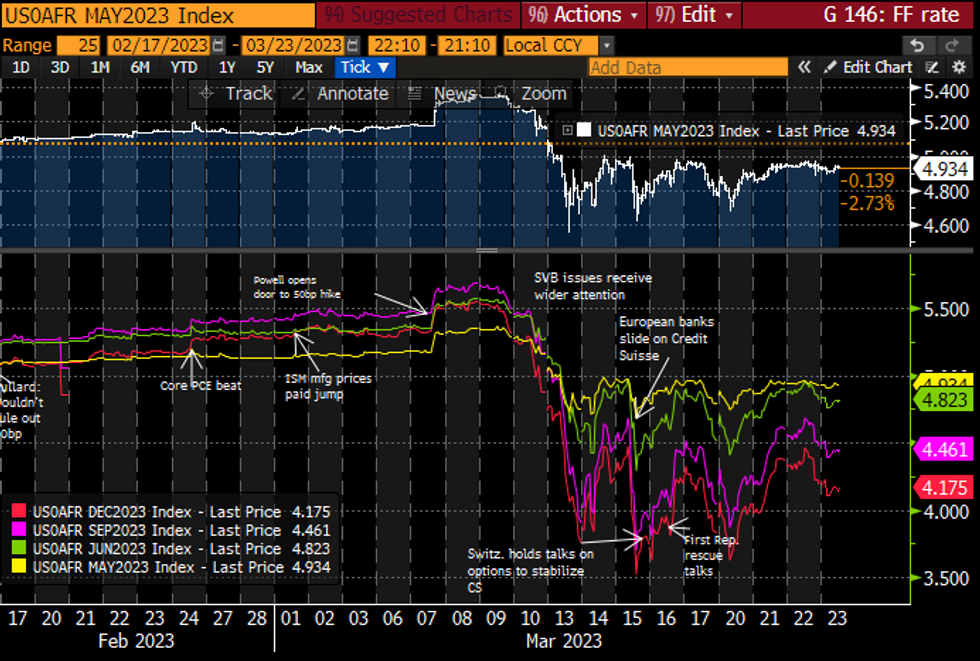

STIR FUTURES: Fed Rate Path Off Overnight Lows After SNB/NB Lean Hawkish

- Fed Funds implied hikes were trimmed further through Asia hours before lifting with the SNB and Norges Bank leaning hawkish. BoE still to come.

- It leaves a 12.5bp hike priced for May’s FOMC to a terminal 4.94% (unch), with the first cut from current levels still seen in Sept with -20bps for Jul (unch). There are 76bps of cuts from the peak to 4.17% by year-end (-0.5bp), the latter off lows of 4.1% overnight but down from 4.36% shortly before the FOMC decision.

- The media blackout continues today as is customary, with Bullard (non-voter) next up tomorrow.

Source: FOMC-dated Fed Funds futures implied rates

Source: FOMC-dated Fed Funds futures implied rates

MNI BOE PREVIEW: Services Inflation Strong; MNI Looks for 25bp from BOE

MNI BOE PREVIEW - MARCH 2023: Services Inflation Strong; MNI Looks for 25bp from BOE

The MNI Markets team look for a 25bps hike from the BOE on the UK CPI release. This data gives the hawks on the MPC ammunition to push for a 25bp hike. The MNI Markets team looks for a 25bp hike from the BOE on the back of this data.

NORGES BANK: Banks Raises Rates by 25bps, Makes Hawkish Tweaks to Path Projections

- Norges Bank raises rates by 25bps to 3.00%, as expected. The policy statement also adds that the policy rate will be raised further in May

- The uptick to the rate path projections slightly ahead of expectations and leaning somewhat hawkish (peak rate in 3.60% by year-end).

- Also worth noting that May was namechecked as next likely hike - this is not an MPR meeting (next is June) so doesn't meet the assumption the bank would proceed with 25bps steps each quarter.

- EUR/NOK initially slipped lower on the release, dropping to 11.2551, before losses were pared and rate is now close to pre-decision levels.

- Governor Wolden Bache press conference due at 0930GMT/1030CET.

New rate path projections:

SNB: Bank Raises Rates by 50bps, Alongside Expectations

SNB raises rates by 50bps, alongside expectations.

Full policy statement here: https://www.snb.ch/en/mmr/reference/pre_20230323/s...

Statement highlights:

- It cannot be ruled out that additional rises in the SNB policy rate will be necessary

- SNB also remains willing to be active in the foreign exchange market

- The measures announced at the weekend by the federal government, FINMA and the SNB have put a halt to the crisis

- Inflation forecasts notched higher: the new forecast is higher through to mid-2025 than in December

All-in-all, the SNB decision generally inline with forecast - CHF rallying slightly as markets close the gap on only partial pricing of 50bps rate hike - market already expected further tightening beyond today's hike, and SNB confirming there is a strong likelihood of such a move.

EUROPE ISSUANCE UPDATE

German Q2-23 issuance update:Germany has confirmed that there are no changes to auctions / auction sizes for Q2-23. It has released further details for the following auctions:

15y Bund auctions:

- 26 April: E1.5bln of the 1.00% May-38 Bund (ISIN: DE0001102598) to be on offer alongside E1.0bln of another issue.

- 24 May: E1.5bln of the 1.00% May-38 Bund (ISIN: DE0001102598) to be on offer alongside E1.0bln of another issue.

- 12 April: E1.5bln of the 0% Aug-52 Bund (ISIN: DE0001102572) to be on offer alongside E1.0bln of another issue.

- 10 May: E1.5bln of the 1.80% Aug-53 Bund (ISIN: DE0001102614) to be on offer alongside E1.0bln of another issue.

- 21 June: E1.5bln of the 0% Aug-52 Bund (ISIN: DE0001102572) to be on offer alongside E1.0bln of another issue.

FOREX: Waning USD, Hawkish Norges Bank Tilt USD/NOK to Fifth Lower Low

- The greenback trades softer following the Wednesday Fed decision, helping pressure the USD Index to a new pullback low at 101.915 as the FOMC statement indicating the Fed are not far off the peak of their tightening cycle. The USD weakness has favoured high beta and growth proxy currencies so far Thursday, putting NOK and AUD to the top of the G10 pile.

- The Swiss National Bank pressed ahead with plans to tighten policy despite local turmoil in the domestic banking sector. This reinforces the SNB's view that liquidity provision and enhanced access to USD liquidity will allow the bank to continue their medium-term focus on inflation, raising the risk for further tightening going forward.

- In Norway, the Norges Bank raised rates by 25bps to 3.00%, as expected, however the accompanying Policy Report erred hawkishly, with the peak rate notched higher this year (3.60% by year-end). Also worth noting that May was namechecked as next likely hike - this is not an MPR meeting (next is June) so doesn't meet the assumption the bank would proceed with 25bps steps each quarter. As such, the Norges Bank outlined a more hawkish approach to policy across 2023, helping EUR/NOK briefly print a new daily low at 11.2551.

- Looking ahead, the BoE decision is expected to see a 25bps hike to 4.25%, with a focus on the vote split among the MPC.

FX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0580-00(E1.8bln), $1.0650-52(E848mln), $1.0800(E874mln), $1.0890-05(E553mln), $1.0920-25(E541mln)

- USD/JPY: Y130.00($574mln), Y130.37-55($1.3bln), Y131.00($631mln), Y131.50($1.5bln), Y132.00($827mln)

- EUR/GBP: Gbp0.8900(E1.1bln)

- AUD/USD: $0.6640-50(A$643mln)

- USD/CNY: Cny6.7500($1.3bln), Cny6.9500($576mln)

EQUITIES: Eurostoxx Futures Pare Most Post-Fed Losses

- The recent strong recovery in Eurostoxx 50 futures from Monday’s low of 4057.00 has resulted in a breach of both the 20- and 50-day EMAs. A continuation higher would signal scope for 4184.50, a Fibonacci retracement. Key resistance and the bull trigger is at 4268.00, the Mar 6 high. On the downside, a reversal lower and a breach of 3914.00 would resume the recent downtrend. Initial support lies at 4069.00, the Mar 21 low.

- S&P E-Minis reversed sharply lower Wednesday. It is too early to tell whether the pullback marks the start of a bearish cycle. However, the move lower means that price has - so far - failed to hold above pivot resistance around the 50-day EMA. The average intersects at 4023.28 and a clear break is required to strengthen bullish conditions. Watch support at 3966.25, yesterday’s low - a break would be bearish. Key S/T resistance is at 4073.75.

COMMODITIES: Trend Conditions in Gold Remain Bullish, Targets $2000 Handle

- WTI futures remain in a downtrend and this week’s recovery appears to be a correction. Note that the latest move higher is allowing a recent oversold condition to unwind. Firm resistance is seen at $73.16, the 20-day EMA. Last week’s extension lower confirmed a resumption of the broader downtrend and has paved the way for a move towards $62.43, the Dec 2 2021 low. The bear trigger is $64.36, Monday’s low.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. The breach on Mar 17 of former resistance at $1959.7, Feb 2 high, confirmed a resumption of the bull trend that started late September 2022. The test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 is seen as a firm support. It is the Mar 17 low and a break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/03/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 23/03/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/03/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/03/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2023 | 1500/1600 |  | EU | ECB Lane Panels Peterson Institute Conference | |

| 23/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/03/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/03/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/03/2023 | 0700/0800 | ** |  | SE | PPI |

| 24/03/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 24/03/2023 | 0730/0730 |  | UK | DMO to Publish Apr-Jun Gilt Op Calendar | |

| 24/03/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/03/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1500/1500 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.