-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Weekly Jobless Claims Watched for NFP Clues

HIGHLIGHTS:

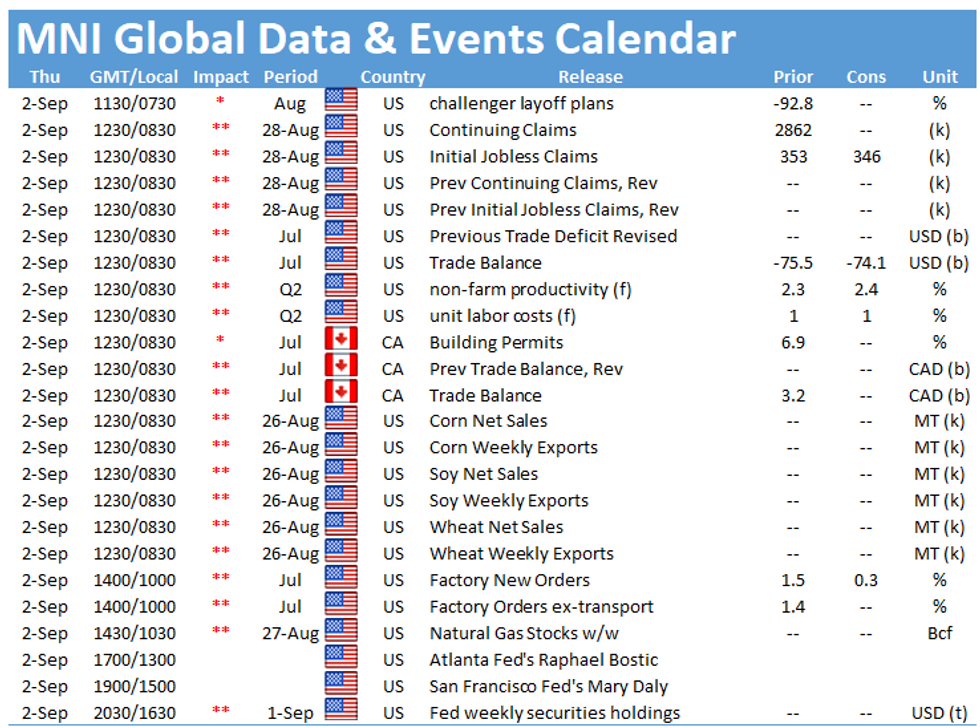

- Markets watch weekly jobless claims for final clues ahead of Friday's payrolls

- Equities in holding pattern just below alltime highs

- AUD extends outperformance, hitting multi-month highs on trade data

US TSYS SUMMARY: More Employment Data Ahead Of Friday's Payrolls

Treasuries have edged upward in European trading after a quiet Asia-Pac session, with Dec TYs testing Wednesday's high (133-20), albeit on moderate volumes.

- Few catalysts for price action so far, with most attention on this morning's labor market data ahead of Friday's nonfarm payrolls release.

- Dec 10-Yr futures (TY) up 4/32 at 133-18.5 (L: 133-14 / H: 133-20)

- The 2-Yr yield is down 0.4bps at 0.2056%, 5-Yr is down 0.8bps at 0.7644%, 10-Yr is down 0.7bps at 1.2869%, and 30-Yr is down 0.8bps at 1.9058%.

- We get more employment data today (following Weds' weak ISM Manuf Employment subindex and ADP numbers): 0730ET is Challenger Job Cuts, followed by 0830ET's jobless claims (also trade balance). At 1000ET, we get Jul (final) durable/cap goods orders and factory orders.

- Today's Fed speakers are Atlanta's Bostic at 1300ET, and SF's Daly at 1500ET.

- In supply, $55B of 4-/8-week bill auction at 1130ET. NY Fed buys ~$2.025B of 22.5-30Y Tsys.

EGB/GILT SUMMARY: Gaining Ground

European sovereign bonds are bid this morning with the EGB periphery marginally outperforming. Equities trade mixed while the US dollar has broadly lost ground against G10 FX.

- The gilt curve has bull flattened with the 2s30s spread is 1bp narrower.

- Bunds have similarly firmed with cash yields 1-2bp lower across the curve.

- OATs trade in line with Bunds. The market easily absorbed this morning's OAT supply.

- BTPs have outperformed with yields 2-3bp lower on the day.

- Supply this morning came from France (OATs, EUR10.4bn) and Spain (Oblis, Bonos, Obli-EI, EUR4.419bn).

- The European data slate was light this morning. Focus turns to US claims data, factory order and durable goods orders later today.

EUROPE ISSUANCE UPDATE:

France Sells:

- E6.315bn of the 0% Nov-31 OAT: Average yield -0.05% (0.00%), bid-to-cover 1.81x (1.65x)

- E1.921bn of the 1.50% May-50 OAT: Average yield 0.70% (0.79%), bid-to-cover 2.02x (1.51x)

- E2.122bn of the 0.50% Jun-44 Green OAT: Average yield 0.55% (0.53%), bid-to-cover 2.14x

Spain Sells:

- E0.8087bn of the 1.50% Apr-27 Obli Average yield -0.288% (1.14%), bid-to-cover 2.51x (2.07x)

- E1.3238bn of the 0% Jan-28 Bono : Average yield -0.133% (-0.08%), bid-to-cover 2.10x (1.63x)

- E1.60175bn of the 0.50% Oct-31 Obli: Average yield 0.309% (0.54%), bid-to-cover 1.69x

- E0.415bn of the 0.70% Nov-33 Obli-Ei: Average yield -1.029% (-0.74%), bid-to-cover 1.88x (1.77x)

EUROPE OPTION FLOW SUMMARY

UK:

0LZ1 99.50c vs 2LZ1 99.375c, bought the 1yr and receives 0.75 in 2k

2LV1 99.25/99.37/99.50c fly, bought for 4.25 in 4k

FOREX: AUD Extends Recent Gains as Exports Surge

- AUD is making further progress early Thursday, rising through the Wednesday highs to cement the move through the $0.7378 50-dma. Trade balance numbers came in ahead of expectations, with exports growth firmer than forecast and helping support recent AUD strength.

- NZD is stronger in sympathy, helping NZD/USD secure its third consecutive session of gains, prompting the rate to top the 100-dma for the first time since June.

- CHF is underperforming, but USD/CHF holds within the week's range. Further strength in equity markets could work further against haven FX, with European indices higher across the board.

- Weekly US jobless claims and trade balance numbers from the US and Canada are the calendar highlights going forward. Fed's Bostic and Daly are also on the docket.

FX OPTIONS: Expiries for Sep02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y109.50-70($897mln)

- USD/CAD: C$1.2600($560mln), C$1.2640-50($556mln)

- USD/CNY: Cny6.4570($960mln)

Price Signal Summary - Bunds Testing Trendline Support

- On the equity front, S&P E-minis are consolidating. The outlook is unchanged and trend conditions remain bullish. The contract traded to a fresh all-time high of 4542.25 on Tuesday and this confirms a resumption of the uptrend once again. The focus is on 4580.21, 1.382 projection of the Jun 21 - Jul 14 - 19 price swing. EUROSTOXX 50 remains firm following yesterday's rally and break of 4238.50, Aug 13 high. This confirms a resumption of the uptrend and opens 4294.20, 1.236 projection of the May 13 - Jun 17 - Jul 19 price swing.

- In the FX space, EURUSD is back above its 50-day EMA and holding onto recent gains. An extension would set the scene for a climb towards 1.1909, Jul 30 high and a key short-term resistance. Support to watch is 1.1735, Aug 20 low. GBPUSD key near-term resistance is unchanged at the 50-day EMA, at 1.3824. A break is required to signal potential for a stronger recovery. Support lies at 1.3680.

- On the commodity front, Gold is consolidating but the outlook remains bullish with the focus on $1834.1, Jul 15 high and the next bull trigger. WTI bullish conditions remain intact. Recent gains suggest potential for a climb towards $70.74, the 76.4% retracement of the Jul 30 - Aug 23 sell-off. Support is seen at $66.92, Aug 25 low.

- In FI, Bunds traded sharply lower Tuesday and breached 175.66, Aug 27 low. Price action has also moved below the 50-day EMA reinforcing current bearish conditions. Note too that futures have tested key trendline support at 175.18. The trendline is drawn from the May 19 low. A break would strengthen bearish conditions. Bulls will be looking for the trendline to hold. Gilt futures on Tuesday cleared support at 128.33, Aug 12 low and 128.24, Aug 12 low. The break lower strengthens a bearish case and signals scope for 128.03, the Jul 6 low (cont).

EQUITIES: Stocks Ebb Off Highs at NY Crossover

- A positive start to the Thursday session has faded into the NY crossover, but underlying strength remains thanks to a decent showing from the European healthcare sector, while industrials and energy counter weaker financials and consumer staples firms.

- US futures are in minor positive territory, with the e-mini S&P around 12 points off the overnight lows, but stalling ahead of resistance into the week's 4542.25 all-time high.

- The downtrend in volatility persists, pushing Sep VIX futures to new contract lows for a fifth consecutive session.

COMMODITIES: Metals Sell-Off Abates, Oil on More Solid Footing

- Following a volatile Wednesday session, commodities markets are more stable Thursday, with the weakness in industrial metals (notably iron ore) abating to trade flat into the Dalian close.

- Similarly, WTI and Brent crude futures are in minor positive territory, recovering off the Russia-inspired lows printed mid-week at $67.12 for WTI. This keeps the near-term outlook somewhat bullish and the contract is holding onto recent gains.

- The recovery from the Aug 23 low defined a key short-term support at $61.74, Aug 23 low where a break is required to reinstate a bearish theme. Short-term, further gains are likely and the focus is on $70.74, a Fibonacci retracement.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.