-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US MARKETS ANALYSIS - Yields Off Overnight Highs as Midterm Ballots Open

- Dems in damage control as midterm elections kick off

- Yields off overnight highs as USD bid fades

- Equity futures continue to chew through post-NFP losses

US TSYS: A Mild Bid With Midterms, CPI In Focus

- Cash Tsys have seen a small bid since the start of the European session along with European core FI, unwinding a prior cheapening to leave yields down just 1-2bps across the curve.

- With another light docket, 3Y supply provides some focus in the session, with attention otherwise on today’s midterm elections (85-90% chance implied by bookmakers of Democrats losing full control with Republicans gaining one or both houses) but all with an eye on CPI on Thursday.

- 2YY -1.2bps at 4.709%, 5YY -1.6bps at 4.372%, 10YY -1.7bps at 4.197%, and 30YY -0.8bps at 4.311%.

- TYZ2 trades 4 ticks higher at 109-25, pulling off an overnight low of 109-14 that remained above support at 109-10+ (Nov 4 low). After a relatively busy start to overnight trade, volumes have tailed off and are cumulatively below average for the time of day.

- Bond issuance: US Tsy $40B 3Y Note auction (91282CFW6) – 1300ET

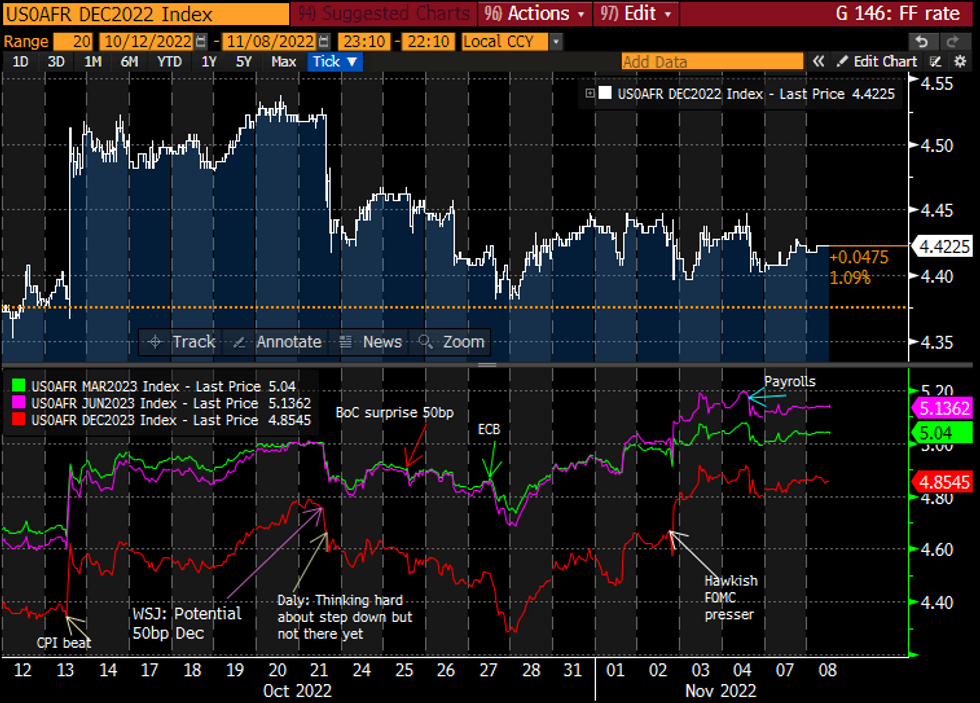

STIR FUTURES: Fed Terminal Rate Pricing Waiting On New Drivers

- Minimal change in Fed Funds implied hikes overnight: 57.5bp for Dec, 99bp for Jan to 4.84%, a terminal 5.13% for Jun and 4.85% for Dec’23, with an eye firmly on CPI inflation on Thu and perhaps less so today's midterms.

- Next scheduled Fedspeak tomorrow with NY Fed’s Williams.

- Barkin (’24) from late yesterday:

- “We have the tools to bring inflation down, no matter what disruptions occur”

- “Inflation should come down but don’t expect its drop to be immediate or predictable”

- "[Business leaders] still view their increased pricing power as temporary. They see it as an episode, not a regime change”

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOREX: Solid Equities Headed into Midterms Keeps Lid on USD Recovery Rally

- Following a somewhat quiet and lacklustre start to the Tuesday session, risk appetite has picked up very modestly headed into the NY crossover with an uptick in equity futures (putting the e-mini S&P further above the 50-dma) helping put AUD toward the top of the G10 pile.

- Contrary to the bump higher in equity markets, JPY gains hold firm, with USD/JPY back below Y146.50 and eyeing support at 146.09. The pair is likely eyeing the beginning of vote counts in the US midterm elections, with results expected to filter through across the Wednesday Asia-Pac session.

- The USD Index is more stable at recent lows, holding the bulk of the decline posted since the Nonfarm payrolls report on Friday last week. Key parameters for the DXY going forward include support at the October lows of 109.535 and the 50-dma on any recovery rally at 111.2375.

- Another day absent any key US data or central bank speakers, keeping focus on the CPI release due Thursday - seen as key for short-term direction headed into the December FOMC meeting. Speeches from BoE's Pill (already spoken today) and ECB's Wunsch could draw some attention.

EUROPE ISSUANCE UPDATE

Gilt syndication update

3.75% Jan-38: Size set at GBP6bln (books closed in excess of GBP47.1bln inc JLM interest of GBP5.1bln), spread set at 1.75% Sep-37 +6.0bps.

Netherlands auction result

E2.49bln of the 0.50% Jul-32 DSL. Avg yield 2.627%.

Austria auction results

E460mln (E400mln allotted) of the 0% Oct-28 RAGB. Avg yield 2.696% (bid-to-cover 2.51x).E690mln (E600mln allotted) of the 0.90% Feb-32 RAGB. Avg yield 2.93% (bid-to-cover 2.38x)

Germany auction result

E6bln (E4.59bln allotted) of the 2.20% Dec-24 Schatz. Avg yield 2.28% (bid-to-cover 0.9x).

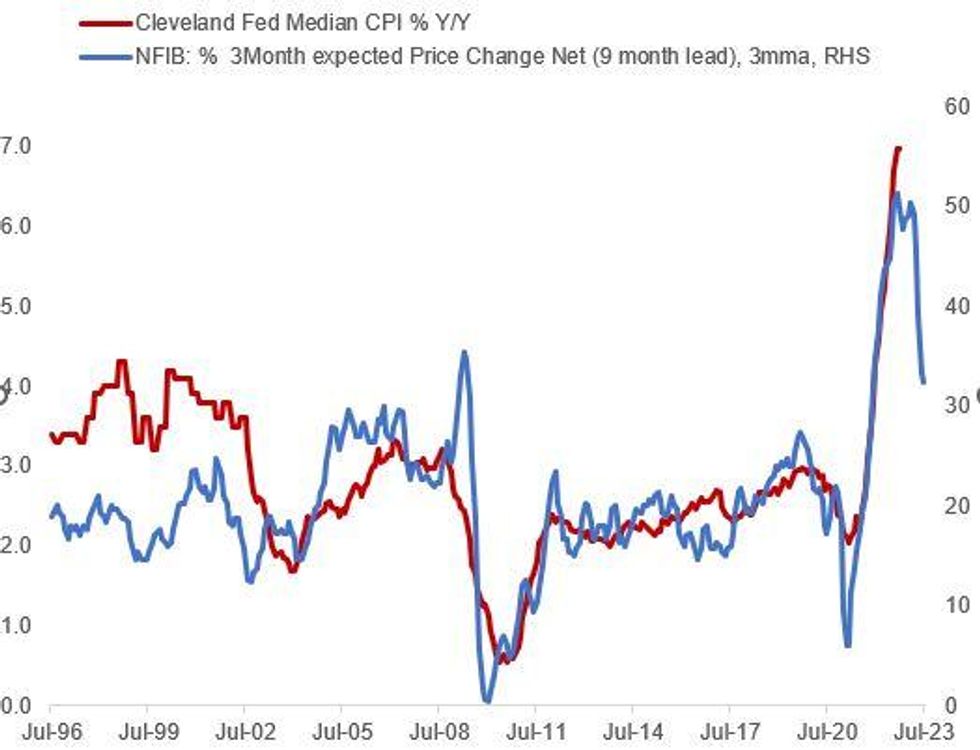

Small Business Survey Presents Mixed Outlook On Future Inflation

There are always plenty of valuable inflation tidbits from the NFIB small business survey. Here are two that stand out from October's report, with each telling a different story on US price pressures going into next year.

- Firstly: Expected net price changes in the next 3 months ticked higher in Oct to 34%, the first rise since May. Even so, the general story is that price expectations have moderated considerably from the peak, pointing to a deceleration in US inflation in 1H 2023:

Source: NFIB Small Business Survey, Cleveland Fed

Source: NFIB Small Business Survey, Cleveland Fed

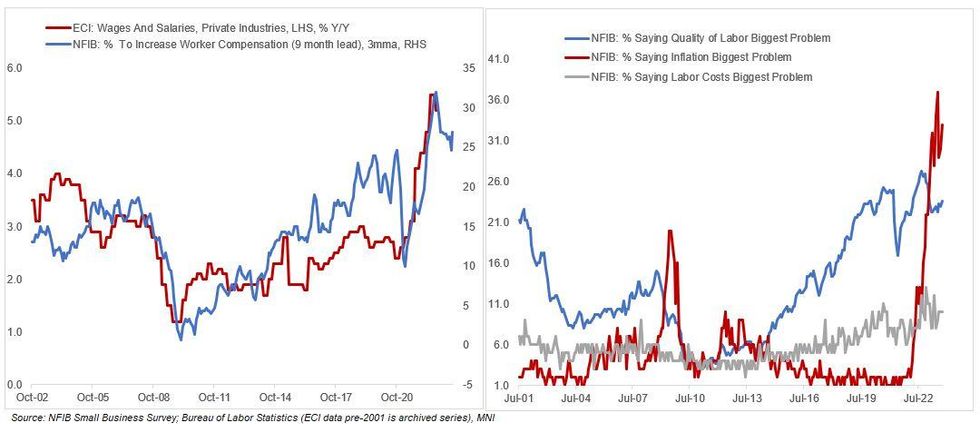

US: Small Business Survey Presents Mixed Outlook On Future Inflation

The October survey also showed however that small business wage pressures took a turn higher - the net % expecting higher worker compensation returned to an all-time high (32%) vs a 16-month low (23%) in September.

- This has been a reasonably good forward indicator for the private Employment Cost Index which the Fed considers in assessing overall wage pressures - it suggests that ECI growth will remain stubbornly elevated into next year.

- Taken together, a plurality of small businesses see overall inflation as their biggest problem. Labor costs are also important, but the "quality of labor" problem (suggesting continued supply-side labor constraints) remains very elevated.

- Indeed, NFIB hiring plans remain robust despite waning business confidence and rising wage bills. That does not augur well for a dovish Fed "pivot".

Source: NFIB Small Business Survey; Bureau of Labor Statistics, MNI

Source: NFIB Small Business Survey; Bureau of Labor Statistics, MNI

FX OPTIONS: Expiries for Nov08 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E1.1bln), $0.9950(E603mln), $0.9970-85(E1.3bln), $1.0000(E922mln)

- AUD/USD: $0.6275(A$714mln), $0.6450(A$1.5bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/11/2022 | - |  | US | Legislative Elections / Midterms | |

| 08/11/2022 | - |  | EU | ECB de Guindos at ECOFIN meeting | |

| 08/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/11/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/11/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 09/11/2022 | 0130/0930 | *** |  | CN | CPI |

| 09/11/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/11/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/11/2022 | 0800/0300 |  | US | New York Fed's John Williams | |

| 09/11/2022 | 1000/1100 |  | EU | ECB Elderson Panels EMEA Event at COP27 | |

| 09/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/11/2022 | 1300/1300 |  | UK | BOE Haskel Speech at Digital Futures at Work | |

| 09/11/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/11/2022 | 1600/1100 |  | US | Richmond Fed's Tom Barkin | |

| 09/11/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.