-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Morning FI Analysis: ECB Meets As European Social Restrictions Tighten

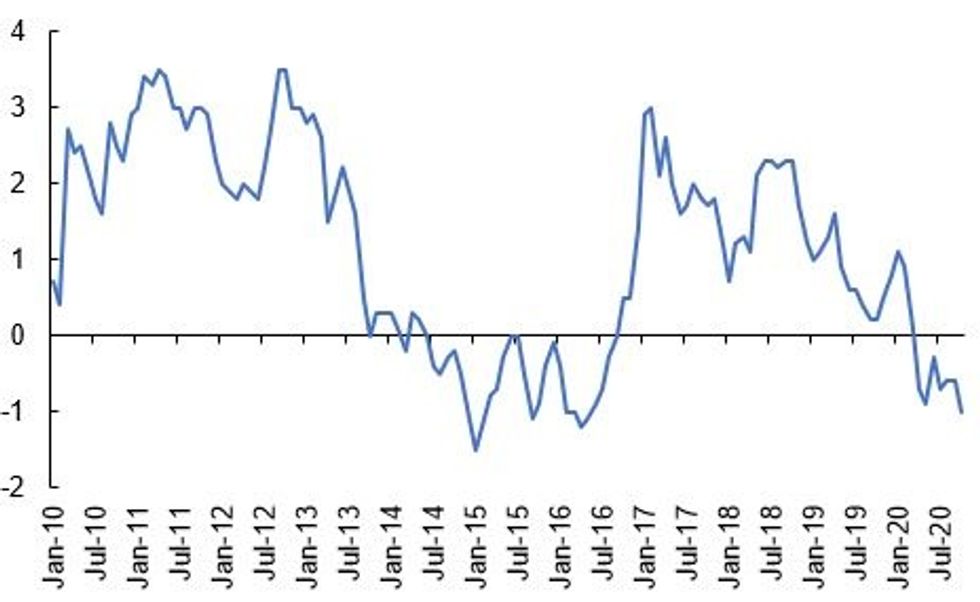

Fig 1. Spain CPI, % Y/Y

US TSYS SUMMARY: Q3 GDP, And 7-Yr Supply Eyed

Treasuries have pared the modest losses seen in Asian trade to trade near flat on the session, with data and 7-Yr supply eyed (some attention on ECB decision as well)

- Stock futures have faded their initial bounce from Wednesday's lows, though sit higher on the day. USD has begun to move higher as well.

- Dec 10-Yr futures (TY) up 0.5/32 at 138-26 (L: 138-22 / H: 138-27.5) on unremarkable volume (~260k). The 2-Yr yield is down 0.4bps at 0.1427%, 5-Yr is up 0.7bps at 0.3368%, 10-Yr is up 0.5bps at 0.776%, and 30-Yr is up 0.5bps at 1.5591%.

- Initial jobless claims and advance Q3 GDP at 0830ET are the immediate highlights of the schedule, with $53B 7-Yr Note auction at 1300ET. (We get a combined $65B of 4-/8-week bill auction at 1130ET too).

- Politico's revelation that Speaker Pelosi wrote to Treas Sec Mnuchin making it clear that the sides are not close to a stimulus deal did nothing to move the needle - it's a moot point at this stage, and we'll see where we are post-election.

- NY Fed announced its new biweekly schedule of purchases Wednesday - today sees ~$1.750B of 20-30-Yr Tsy buys.

- With the Nasdaq leading the equity bounce, worth noting several earnings reports of interest after the close ( Amazon, Alphabet, Apple & Facebook).

BOND SUMMARY: Awaiting The ECB

European govies have traded slightly firmer this morning as lockdown restrictions intensify across the region. Equities have found a footing following yesterday's sell-off, while oil continues to inch lower. Focus is on today's ECB meeting.

- Gilts started the session on the backfoot, but have made incremental gains. Last yields 2-year -0.072%, 5-year -0.0793%, 10-year 0.2087%, 30-year 0.7466%.

- Bunds have similarly firmed with cash yields 1bp lower.

- OATs trade broadly in line with bunds with the curve close to flat on the day.

- BTPs have marginally outperformed with yields 1-2bp lower.

- Supply this morning came from Italy (BTP/CCTeu, EUR6.5bn).

- German regional CPI data for October suggest that prices could be starting to stabilize at a national level, while Spanish CPI data came in below expectations (-1.0% Y/Y vs -0.7% survey).

- UK mortgage approvals spiked in September (91.5k vs 76.1k survey).

- Belgian GDP expanded 10.7% Q/Q in the third quarter following a 12.1% contraction in Q2.

DEBT SUPPLY

ITALY AUCTION RESULTS: Italy Sells E6.5bn of BTPs/CCTeu

- E2.5bn of the 0.50% Feb-26 BTP: Average yield 0.23% (0.35%), bid-to-cover 1.46x (1.59x), allotment price 101.41

- E3.0bn of the 0.90% Apr-31 BTP: Average yield 0.79% (0.89%), bid-to-cover 1.33x (1.27x), allotment price 101.11

- E1.0bn of the Dec-23 CCTeu: Average yield 0.27% (0.45%), bid-to-cover 2.06x (1.68x), allotment price 100.32

OPTIONS

EURIBOR OPTIONS: Call Calendar

0RZ0/3RZ0 100.50 call calendar, sells the 1Y at 4.25-4 in 5k

EURIBOR OPTIONS: Call Seller

0RZ0 100.625 call sold at 1.5 in 3k

TECHS

US 5YR FUTURE TECHS: (Z0) Trendline Resistance Still Under Pressure

- RES 4: 126-00 76.4% retracement of the Sep 30 - Oct 23 sell-off

- RES 3: 125-31 High Oct 15 and a key near-term resistance

- RES 2: 125-29 61.8% retracement of the Sep 30 - Oct 23 sell-off

- RES 1: 125-272 High Oct 28

- PRICE: 125-252 @ 09:33 GMT Oct 29

- SUP 1: 125-206 Low Oct 27

- SUP 2: 125-16+ Low Oct 22 and 23 and the bear trigger

- SUP 3: 125-156 1.00 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-112 Low Jun 10 (cont)

5yr futures have recovered this week off recent lows and extended gains yesterday. The contract has tested trendline resistance drawn off the Sep 30 high that today intersects at 125-256. A clear break of the trendline would highlight a reversal of the recent sell-off between Sep 30 - Oct 23 and signal potential for stronger gains. This would open 125-31, Oct 15 high. On the downside, initial firm support is seen at 125-206, Oct 27 low.

US 10YR FUTURE TECHS: (Z0) Focus Is On Trendline Resistance

- RES 4: 139-16+ Bear channel resistance drawn off the Aug 4 high

- RES 3: 139-14 High Oct 15 and a key resistance

- RES 2: 139-07+ High Oct 16

- RES 1: 139-02/03 Trendline resistance and High Oct 28

- PRICE: 138-25+ @ 10:46 GMT Oct 29

- SUP 1: 138-18+ Low Oct 27

- SUP 2: 138-05 Low Oct 23

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 138-00+ Bear channel base drawn off the Aug 4 high

Treasuries gained further Wednesday but faded off the highs into the close. Nonetheless, the underlying outlook remains bullish and recent momentum behind the current rally suggests scope for further gains. Attention is on a short-term trendline resistance that intersects at 139-02 today. The trendline is drawn off the Oct 2 high. A break would strengthen the bullish theme and open 139-14, Oct 15 high. Initial firm support lies at 138-18+, Oct 27 low.

US 30YR FUTURE TECHS: (Z0) Attention Is On Trendline Resistance

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15 and a key resistance

- RES 2: 175-14 50-day EMA

- RES 1: 174-29 High Oct 28 / Trendline res. drawn off the Aug 6 high

- PRICE: 174-03 @ 10:53 GMT Oct 29

- SUP 1: 173-12 Low Oct 27

- SUP 2: 171-22 Low Oct 23 and the bear trigger

- SUP 3: 171-00 Round number support

- SUP 4: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures traded higher again yesterday although they did find resistance at the day high. Price is approaching a key trendline resistance at 174-29. The trendline is drawn off the Aug 6 high. While the line holds, the downtrend that started on Aug 6 remains intact. A trendline break though would strengthen a short-term bullish case and importantly signal a trend reversal. This would open 176-10, Oct 15 high. Support is at 173-12, Oct 27 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.