-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US Morning FI Analysis: Focus On ECB

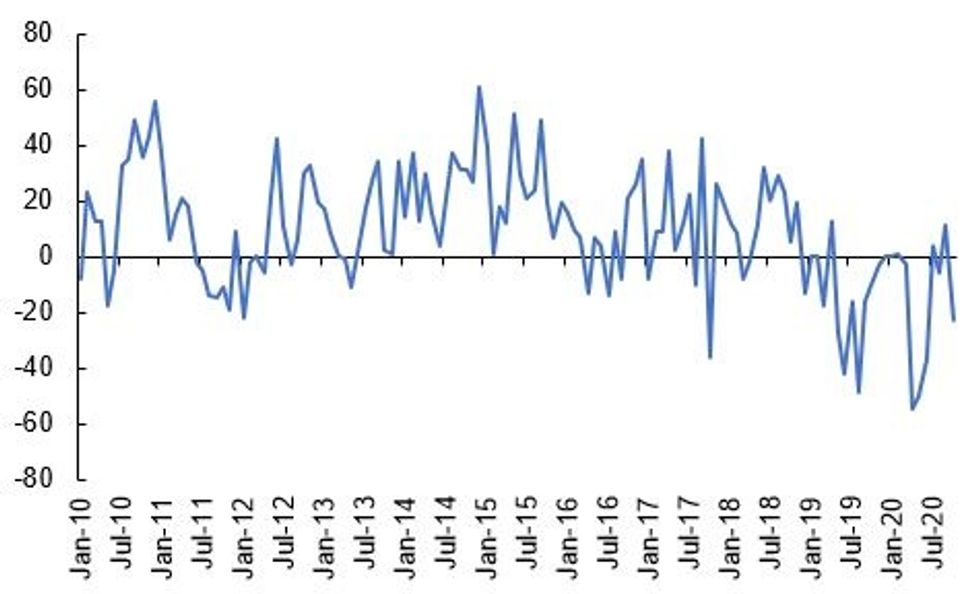

Fig 1. UK CBI Retailing Reported Sales

Source: MNI/Bloomberg

US TSYS SUMMARY: Earnings Reports Boost Stocks, Tsys Unmoved

Tsys are off overnight lows but mostly within late Monday's ranges, alongside equities which have consolidated from yesterday's rout. Data and 2-Yr supply eyed.

- Fairly limited volumes, under 200k traded so far for Dec TYs, which are down 0.5/32 at 138-20 (L: 138-18.5/ H: 138-22).

- Very modest curve steepening: the 2-Yr yield is down 0.2bps at 0.1474%, 5-Yr is down 0.3bps at 0.3477%, 10-Yr is up 0bps at 0.8011%, and 30-Yr is up 0.4bps at 1.595%.

- With pre-election stimulus prospects all but over, market attention remains on the election itself, and COVID case increases globally.

- Strong quarterly earnings reports highlighted by Caterpillar helped boost S&P futures to session highs, but little reaction in Tsys seen so far.

- 0830ET sees prelim Sep durable goods data, with Oct consumer confidence / Richmond Fed Mfg reports at 1000ET.

- In supply, the highlight is $54B 2-Y-Note sale at 1300ET; we get $60B of 42-/119-day bill sales at 1130ET as well. NY Fed buys ~$1.75B of 20-30Yr Tsys.

BOND SUMMARY: AWAITING THE ECB

It has been a relatively uneventful session so far with focus on this week's ECB meeting.

- Gilts have lack momentum this morning and trade close to unch on the day. The Dec-20 gilt future trades at 135.22, in line with yesterday's close.

- Bunds have firmed but gains have been limited. Last yields: 2-year -0.7659%, 5-year -0.7802%, 10-year -0.5864%, 30-year -0.1701%.

- OATs have traded in line with bunds at the longer end. Cash yields are 1bp lower on the day.

- BTPs have rallied and the curve has bull flattened. The 2s30s spread is 3bp narrower

- Supply this morning came from the UK (Gilt, GBP3.25bn) Italy (CTZ/BTPEi, EUR3.25bn) and Greece (Bills, EUR812.5mn). The DMO will also sell GBP1.0bn of the 1.625% Oct-71 Gilt.

- The data calendar is light today with just UK CBI Reported Sales data for October at 1100 London time.

DEBT SUPPLY

GILT AUCTION RESULTS: DMO sells GBP3.25bln nominal of 0.125% Jan-24 gilt

- Avg yld -0.017% (-0.026%), bid-to-cover 2.34x (2.44x), tail 0.2bp (0.2bp), price 100.464 (100.502).

- Pre-auction mid-price 100.449.

- An additional GBP812.5mln will be available through the PAOF to successful bidders until 13:00GMT.

ITALY AUCTION RESULTS: Italy Sells E3.25bn of CTZ/BTPEi

- E2.5bn of the Sep-22 CTZ : Average yield -0.265% (-0.118%) , bid-to-cover 1.56x , allotment price 100.509, pre-auction mid-price 100.50

- E0.75bn of the 0.65% May-26 BTPEi: Average yield -0.15% (0.56%), bid-to-cover 1.55x (1.56x), allotment price 104.48, pre-auction mid-price 104.49

GREECE AUCTION RESULTS: Greece Sells E812.5mn of 6-Month Bills

- Average yield -0.12%, bid-to-cover 1.70x

TECHS

US 5YR FUTURE TECHS: (Z0) Corrective Bounce

- RES 4: 125-31 High Oct 15

- RES 3: 125-266/272 Trendline drawn off Sep 30 high / 50-day EMA

- RES 2: 125-25 20-day EMA

- RES 1: 125-23 High Oct 26

- PRICE: 125-22 @ 10:28 GMT Oct 27

- SUP 1: 125-156 1.00 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 2: 125-112 Low Jun 10 (cont)

- SUP 3: 125-07 1.382 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-06+ Low Jun 6

5yr futures have recovered off recent lows in a move that is for now considered a correction. The Oct 21 breach of support at 125-202, Oct 7 low, confirmed a resumption of the downtrend that has been in place since early August. This paves the way for weakness towards 125-16+ next, a Fibonacci projection and last week's low ahead of 125-112, Jun 10 low (cont). Initial resistance is at 125-22+. Short-term trendline resistance is at 125-266.

US 10YR FUTURE TECHS: (Z0) Off Recent Lows

- RES 4: 139-14 High Oct 15

- RES 3: 139-04 50-day EMA

- RES 2: 138-29+ 20-day EMA

- RES 1: 138-23 High Oct 26

- PRICE: 138-21 @ 10:49 GMT Oct 27

- SUP 1: 138-05 Low Oct 23

- SUP 2: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 3: 138-00+ Bear channel base drawn off the Aug 4 high

- SUP 4: 137-29 76.4% retracement of the Jun - Aug rally (cont)

Treasuries bounced higher yesterday as a correction unfolds off last week's 138-05 low. A bearish theme was reinforced recently on Oct 21 following the break of 138-20+, Oct 7 low. This confirmed a resumption of the broader reversal that occurred on Aug 4 and clears the way for an extension lower. towards 138-04+ next, a Fibonacci projection ahead of 138-00+, a bear channel base drawn off the Aug 4 high. Firm resistance is seen at 138-29+.

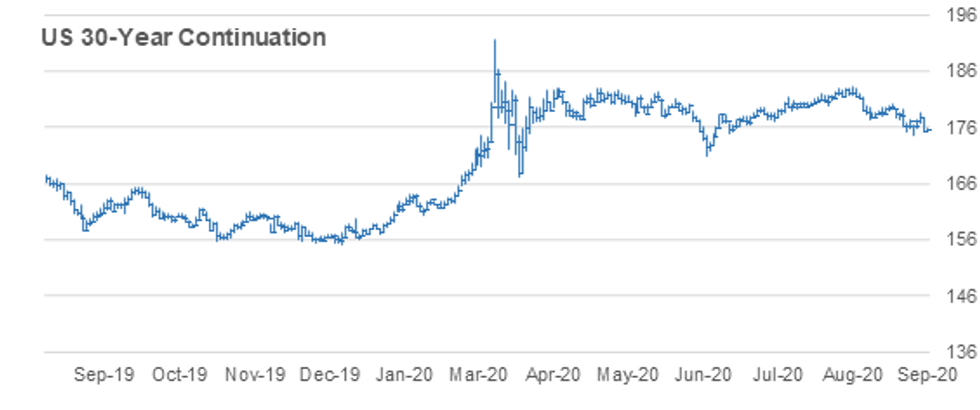

US 30YR FUTURE TECHS: (Z0) Bearish Despite Bounce

- RES 4: 176-10 High Oct 15

- RES 3: 175-04 Trendline resistance drawn off the Aug 6 high

- RES 2: 174-13 20-day EMA

- RES 1: 173-30 High Oct 27

- PRICE: 173-18 @ 10:47 GMT Oct 27

- SUP 1: 171-22 Low Oct 23 and the bear trigger

- SUP 2: 171-00 Round number support

- SUP 3: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

- SUP 4: 170-00 Psychological round number

30yr futures maintain a bearish tone despite the recent corrective recovery. Price on Oct 21 cleared 173-10, Oct 7 low. The break negates recent bullish developments and instead confirms a resumption of the downtrend that has been in place since the Aug 6 reversal. A number of price objectives have already been achieved. Attention is on 170-16 next, a Fibonacci projection. Initial resistance is at 173-24, Oct 21 high. Trendline resistance is at 175-04.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.