-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI US Morning FI Analysis: Focus On EU Summit

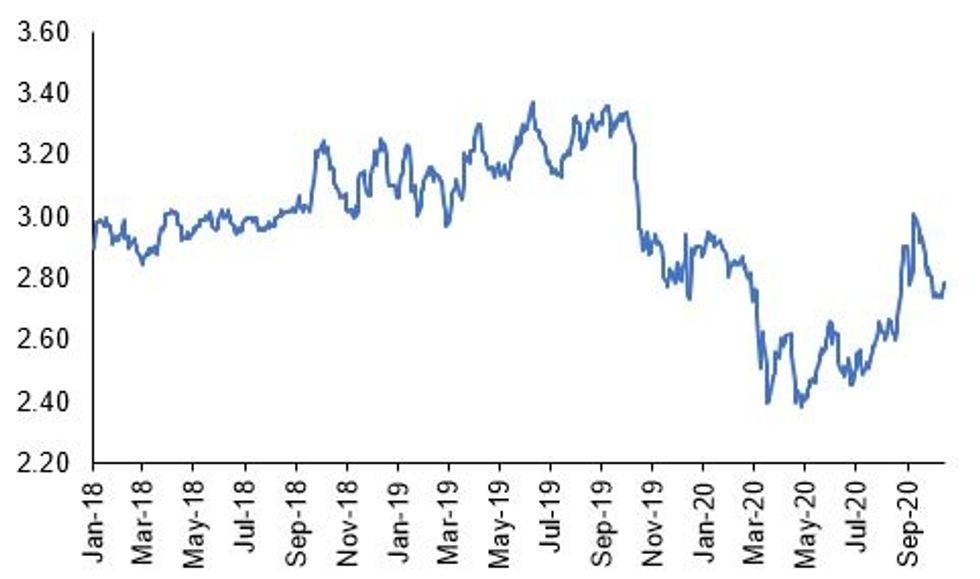

Fig 1. UK 5-Year Breakeven Rate, %

Source: MNI Bloomberg

US TSYS SUMMARY: Steady ahead of Summit

US Treasuries traded within their overnight ranges during our European morning session.

- Curve has remained flat, and the contracts are trading in green territory, with Equities off their best levels.

- Investors have generally stayed on the sideline as the globe awaits on the EU Summit/Brexit conclusion.

- Looking ahead, US Retail sales, industrial production & the Uni of Michigan confidence. Fed William and Bullard.

- Earning season continues with State Street reporting today.

- But most of the attention is on EU Summit conclusion, and potential progress on US Stimulus, after Mnuchin told Pelosi that US President Trump would be willing to put forward a deal they would have agreed upon.

- TY1 futures are up 0-2 today at 139-06

- 2y yields down -0.4bp today at 0.136%

- 5y yields down -0.9bp today at 0.305%

- 10y yields down -1.0bp today at 0.723%-

- 30y yields down -1.4bp today at 1.500%

- 2s10s down -0.6bp today at 58.7bp

- 10s30s down -0.4bp today at 77.7bp

BOND SUMMARY EGB/GILT

Yesterday's bull flattening theme has followed through to this morning with core and periphery EGBs trading firmer.

- Gilt yields are around 1bp lower. The Dec-30 gilt future trades at 136.72, near the top of the day's range (L: 136.47 / H 136.76).

- Bunds are similarly marginally firmer and the curve slightly flatter. Last yields: 2-year -0.7807%, 5-year -0.8048%, 10-year -0.6291%, 30-year -0.2201%.

- BTPs trade in line with bunds with cash yields 2bp lower on the day.

- Focus today is on the EU summit and the risk of discussions breaking down. There is speculation in the media that UK Prime Minister Boris Johnson is willing to talk up the prospect of a no-deal Brexit in a bid to break the impasse.

- Supply this morning came from the UK (T-Bills, GBP1.75bn) and Belgium (OLOs via ORI, EUR505mn).

- The final Eurozone CPI print for September was in line with the initial estimate (-0.3% Y/Y).

DEBT SUPPLY

UK T-BILL AUCTION RESULTS: DMO sold GBP1.75bln in 1-/3-/6-month T-bills

- GBP500mln Nov 16 T-bill, avg yield -0.005273% (-0.0027%), cover 5.40x (4.90x)

- GBP500mln Jan 18 T-bill, avg yield -0.0388% (-0.0230%), cover 9.12x (7.39x)

- GBP750mln Apr 19 T-bill, avg yield -0.031021% (-0.0210%), cover 6.95x (5.34x)

Next week's bill auctions:

- GBP0.50bln 1-month

- GBP0.50bln 3-month

- GBP0.75bln 6-month

BELGIUM AUCTION RESULTS: ORI Results

- E0.325bn of the 4.50% Mar-26 OLO: Average yield -0.639%

- E0.180bn of the 2.15% Jun-66 OLO: Average yield 0.410%

OPTIONS

EGB OPTIONS: Bund PS vs CS

RXX0 175/174.50ps vs 177/177.50cs, bought the ps for flat in 1.5k

EGB OPTIONS: Long end Buxl

UBZ0 225/217ps, bought for 164 in 1.3k.

- Traded over 2k in the past few days

Schatz CS seller

DUX0 112.40/60cs, sold at 4 in 1.25k

TECHS

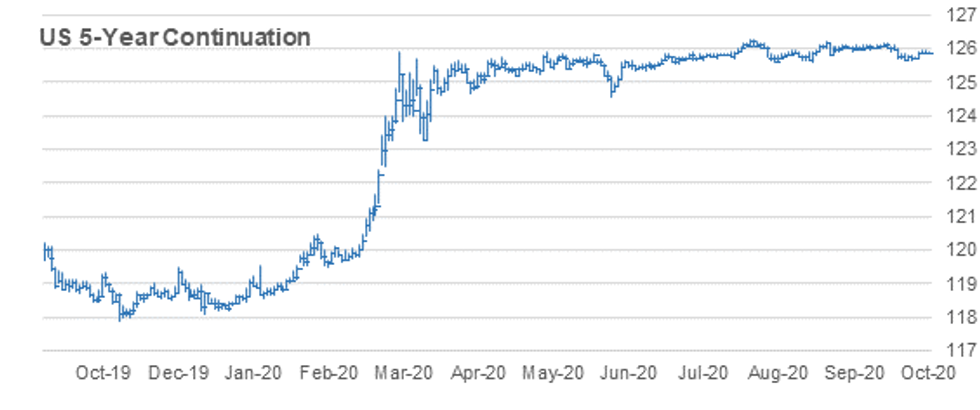

US 5YR FUTURE TECHS: (Z0) Further Appreciation Likely

- RES 4: 126-006 76.4% retracement of the Sep 30 - Oct 7 sell-off

- RES 3: 125-316 High Oct 5

- RES 2: 125-30+ 61.8% retracement of the Sep 30 - Oct 7 sell-off

- RES 1: 125-31 High Oct 15

- PRICE: 125-28+ @ 11:24 BST Oct 16

- SUP 1: 125-262 Low Oct 15

- SUP 2: 125-23+ Low Oct 13

- SUP 3: 125-202 Low Oct 7 and the bear trigger

- SUP 4: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

5yr futures extended the current rally yesterday before finding resistance and giving back the day's gains. Despite this, the outlook remains bullish. This week's climb marks a potential reversal of the recent sell-off between Sep 30 and Oct 7. Futures have traded above resistance defined by the 20- and 50-day EMAs. A clear break would reinforce a bullish theme and open 125-316, Oct 5 high. Initial support is at 125-262, yesterday's low.

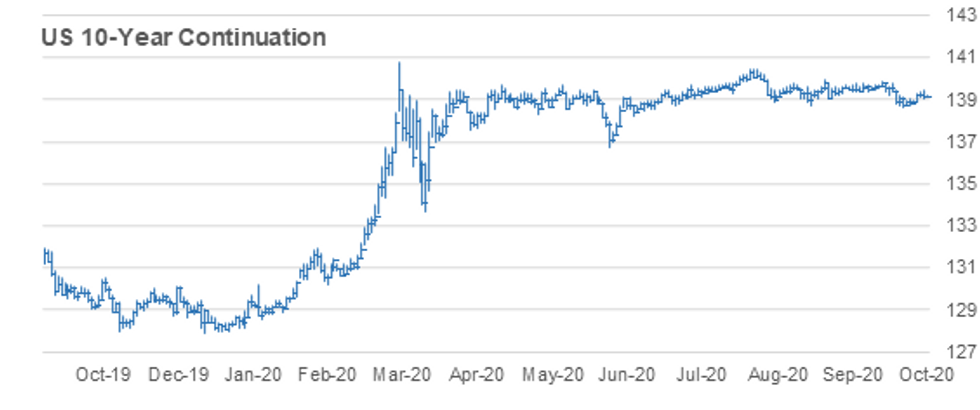

US 10Y TECHS: (Z0) Bullish Outlook Intact

- RES 4: 139-26 High Sep 29 and a key resistance

- RES 3: 139-25 High Oct 2

- RES 2: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-14 High Oct 15

- PRICE: 139-06 @ 11:48 BST Oct 16

- SUP 1: 139-02 Low Oct 15

- SUP 2: 138-28+ Low Oct 13

- SUP 3: 138-20+ Low Oct 7 and the bull trigger

- SUP 4: 138-18+ Low Aug 28 and the bear trigger

Treasuries rallied yesterday but gave back gains to close down on the day. The rejection off the day does dampen the recent positive tone, however at this stage a bullish theme continues to prevail. This follows strong gains since bouncing off the Oct 7 low. Initial resistance has been defined at yesterday's high of 139-14 where a break is required to again signal scope for gains towards 139-17, a retracement level. Support is at 138-28+.

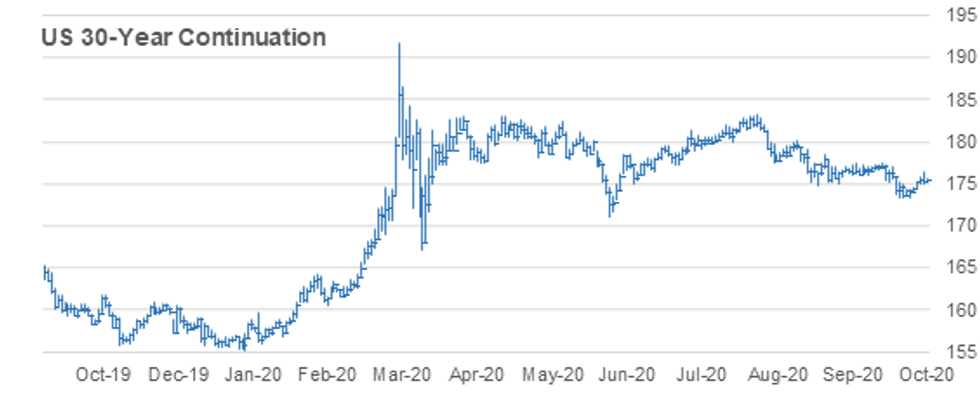

(Z0) Focus Is On The EMA Resistance Zone

- RES 4: 177-24 High Sep 4

- RES 3: 177-14 High Sep 17 and a bull trigger

- RES 2: 177-00 High Oct 2

- RES 1: 176-10 High Oct 15

- PRICE: 175-12 @ 11:50 BST Oct 16

- SUP 1: 175-00 Low Oct 15

- SUP 2: 174.08 Low Oct 13

- SUP 3: 173-10 Low Oct 7 and the bear trigger

- SUP 4: 172-13 0.764 projection of Aug 6 - 28 decline from Sep 3 high

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.