-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US Morning FI Analysis: Looking For ECB Signals

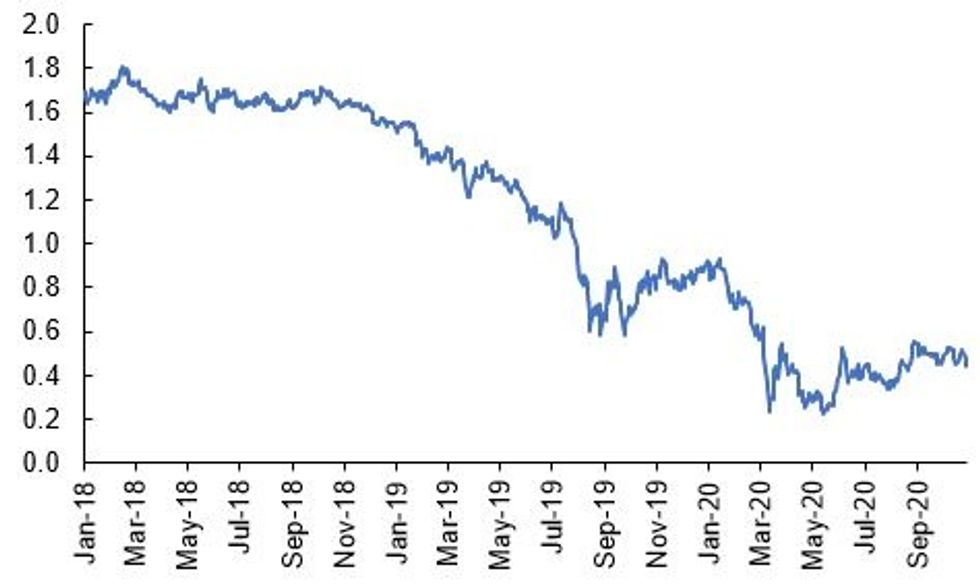

Fig 1. 2s30s EUR Swap

Source: MNI/Bloomberg

US TSYS SUMMARY: Flattening Continues For A 4th Day

Looming European lockdowns (France and Germany weighing new measures to combat a COVID spike) cast a pall on risk sentiment in overnight trade, with equities sinking and extending the Treasury rally/bull flattening to a fourth day.

- Dec 10-Yr futures (TY) up 6.5/32 at 139-01.5 (L: 138-27 / H: 139-02) on solid volume (300+k). The 2-Yr yield is down 0.3bps at 0.1427%, 5-Yr is down 1.6bps at 0.3141%, 10-Yr is down 1.7bps at 0.7509%, and 30-Yr is down 1.6bps at 1.5369%.

- Also weighing on sentiment in Asia trade was the announcement of a DOJ/FBI briefing on a "China related national security matter" today at 1100ET.

- On the campaign trail, Trump is in Nevada and Arizona, while Biden delivers a speech on COVID from Delaware.

- A double auction offering today at 1300ET: $26B of 2-Yr FRN and $55B of 5-Yr Notes. In the undercard, $55B in 105-/154-day bills at 1130ET.

- In data, Sep Advance Trade Balance and Wholesale Inventories at 0830ET.

- NY Fed's next forward schedule of operational purchases to be released around 1500ET.

BOND SUMMARY: EGB/Gilt: Core Curves Bull Flattening

Core European sovereign curves have bull flattened while the EGB periphery has sold off.

- Gilts have rallied with cash yields 1-4bp lower with the 2s30s spread 3bp narrower.

- Bunds have marginally outperformed on the day. The 30-year benchmark yield has traded down 5bp.

- OATs have lagged the rally with yields up to 2bp lower.

- BTPs have traded slightly weaker. Last yields: 2-year -0.3548%, 5-year 0.1177%, 10-year 0.7380%, 30-year 1.6038%.

- Supply came from UK (Gilts, GBP2.5bn), Germany (Bund, EUR1.649bn), Italy (BOTs, EUR6.5bn).

- This morning's data releases were second tier. Spanish retail sales for September printed broadly in line with survey (-3.3% Y/Y SA vs -3.4%).

- Focus is on tomorrow's ECB meeting. Although the monetary policy stance is expected to remain unchanged, most see this as an opportunity for the ECB to signal further easing at the December meeting. MNI has published its ECB Preview online and by email.

DEBT SUPPLY

GILT AUCTION RESULTS: DMO sells GBP2.50bln nominal of 0.375% Oct-30 gilt

- Avg yld 0.244% (0.313%), bid-to-cover 3.00x (2.84x), tail 0.1bps (0.1bps), price 101.287 (100.608).

- Pre-auction mid-price 101.251

- An additional GBP625mln will be available through the PAOF to successful bidders until 13:00GMT.

GERMAN AUCTION RESULTS: Germany Allots E1.649bn of the 0% May-35 Bund

- Average yield -0.46% (-0.31%), Buba cover 1.4x (1.17x), bid-to-cover 1.18x (1.38x)

ITALY AUCTION RESULTS: Italy Sells E6.5bn of 6-Month BOTs

- Average yield -0.478%, bid-to-cover 1.66x

OPTIONS

EURIBOR OPTIONS: Jun21 Ratioed Put Vs Call

ERM1 100.50 put x 1.5 v 100.625 call (v 100.54, 78d), sells put at 2.25 in 18.75k x 12.5k

SHORT STERLING OPTIONS: Midcurve Strangle Seller

2LU1 99.875/100.125 ^^ sold at 21.5 in 1k

EGB OPTIONS: Schatz And Bobl Flow Earlier

Earlier in the session:

- DUZ0 112.40/112.30/112.20 put fly bought for 2.5 in 2k

- OEZ0 135.50/135.75 1x2 call spread bought for -10 in 1k

TECHS

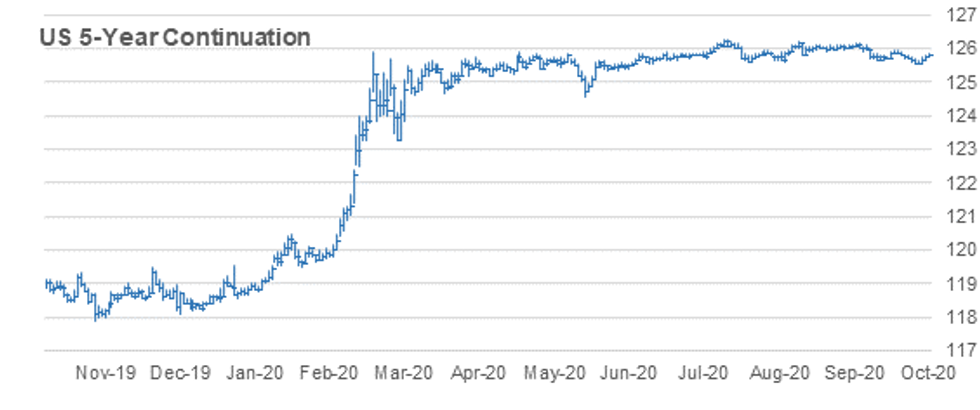

US 5YR FUTURE TECHS: (Z0) Trendline Resistance Under Pressure

- RES 4: 125-31 High Oct 15 and a key near-term resistance

- RES 3: 125-29 61..8% retracement of the Sep 30 - Oct 23 sell-off

- RES 2: 125-27 50-day EMA

- RES 1: 125-266 Intraday high

- PRICE: 125-26+ @ 10:36 GMT Oct 28

- SUP 1: 125-206 Low Oct 27

- SUP 2: 125-16+ Low Oct 22 and 23 and the bear trigger

- SUP 3: 125-156 1.00 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-112 Low Jun 10 (cont)

5yr futures have recovered off recent lows and have extended gains today. The contract is currently testing trendline resistance drawn off the Sep 30 high that today intersects at 125-262. A clear break of the trendline would highlight a reversal of the recent sell-off between sep 30 - Oct 23 and signal potential for further gains. This would open 125-31, Oct 15 high. On the downside, initial firm support is seen at 125-206, Oct 27 low.

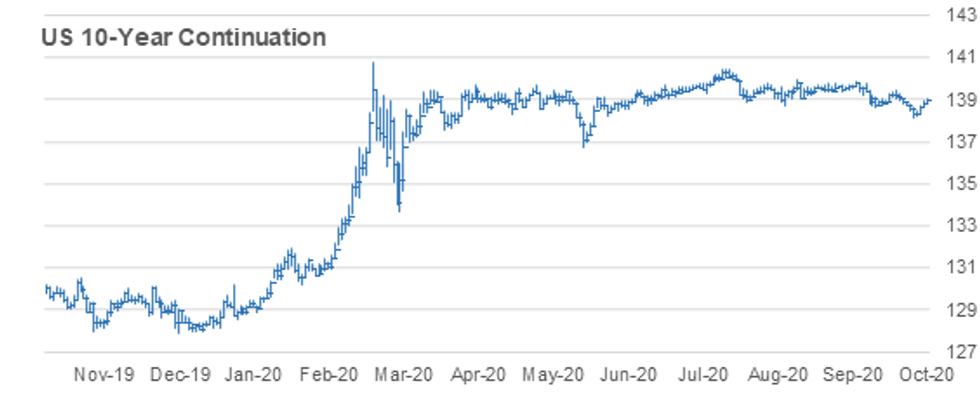

US 10YR FUTURE TECHS: (Z0) Impulsive Rally

- RES 4: 139-17 Bear channel resistance drawn off the Aug 4 high

- RES 3: 139-14 High Oct 15 and a key resistance

- RES 2: 139-07+ High Oct 16

- RES 1: 139-03+ 50-day EMA

- PRICE: 139-01+ @ 10:50 GMT Oct 28

- SUP 1: 138-18+ Low Oct 27

- SUP 2: 138-05 Low Oct 23

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 138-00+ Bear channel base drawn off the Aug 4 high

Treasuries bounced further Tuesday and have done so again today as this week's rally extends. The underlying momentum behind the current rally suggests scope for further upside and attention turns to the top of a bear channel resistance at 139-17. The channel is drawn off the Aug 4 high. Immediate resistance is at the 50-day EMA at 139-03+ and 139-14, the Oct 15 high. On the downside, initial firm support lies at 138-18+, Oct 27 low.

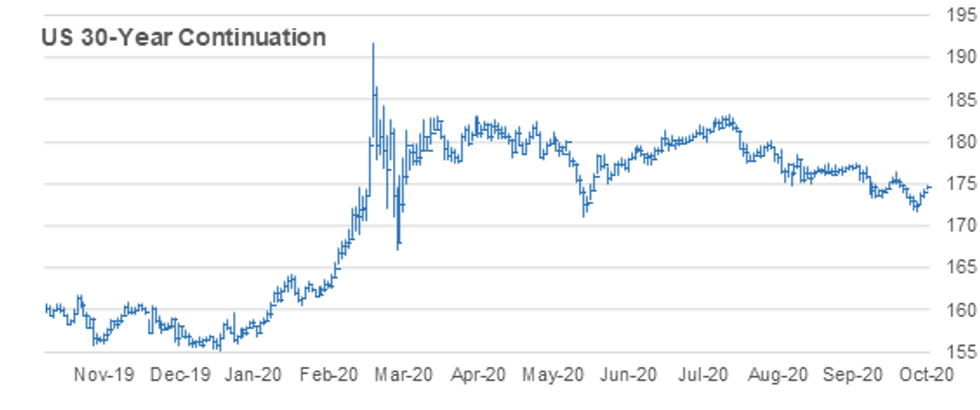

US 30YR FUTURE TECHS: (Z0) Approaching Key Trendline Resistance

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15 and a key resistance

- RES 2: 175-16 50-day EMA

- RES 1: 175-01 Trendline resistance drawn off the Aug 6 high

- PRICE: 173-18 @ 10:47 GMT Oct 27

- SUP 1: 173-12 Low Oct 27

- SUP 2: 171-22 Low Oct 23 and the bear trigger

- SUP 3: 171-00 Round number support

- SUP 4: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures continue to rally and gains have extended once again today. Futures are approaching a key trendline resistance at 175-01. The trendline is drawn off the Aug 6 high. While the line holds, the downtrend that started on Aug 6 remains intact. A trendline break though would strengthen a short-term bullish case and importantly also signal a trend reversal. This would open 176-10, Oct 15 high. Support is at 173-12, Oct 27 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.