-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Morning FI Analysis: PMI, Election, Fed, BoE - busy week!

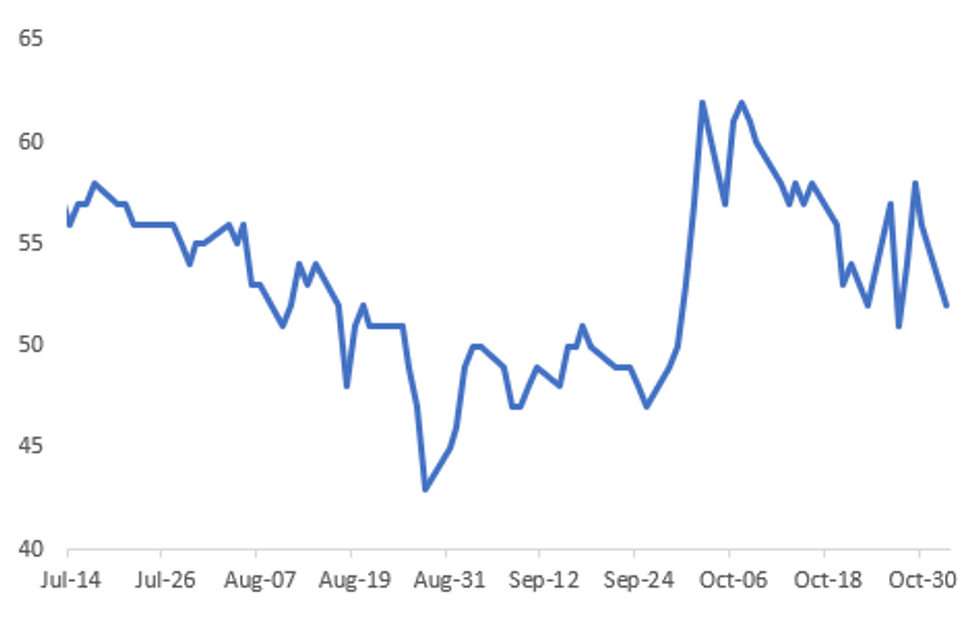

Fig 1. PredictIt Odds of Democratic Clean Sweep

Source: MNI, Bloomberg, PredictIt

US TSYS SUMMARY: Steady As Busy Week Looms

Treasuries are steady in the face of stronger equity futures, as we begin one of the busiest weeks in recent memory (election Tuesday, Tsy refunding announcement Wednesday, FOMC Thursday, payrolls Friday).

- The 2-Yr yield is unchanged at 0.1525%, 5-Yr is down 1bps at 0.3749%, 10-Yr is down 1.2bps at 0.862%, and 30-Yr is down 0.1bps at 1.6591%. Dec 10-Yr futures (TY) up 0.5/32 at 138-7.5 (L: 138-04.5/ H: 138-09.5).

- Little change in outlook on Tuesday's election, though polls over the last few days have if anything been more friendly to Trump than Biden. Looking at one metric: PredictIt odds of Democrat sweep at 52% vs mid-high 50s last week, and highs in the 60s in early October.

- Our FOMC preview (which incorporates a heavy portion of election material) should be out later today, and we sent out our refunding preview last week, let us know if you haven't seen.

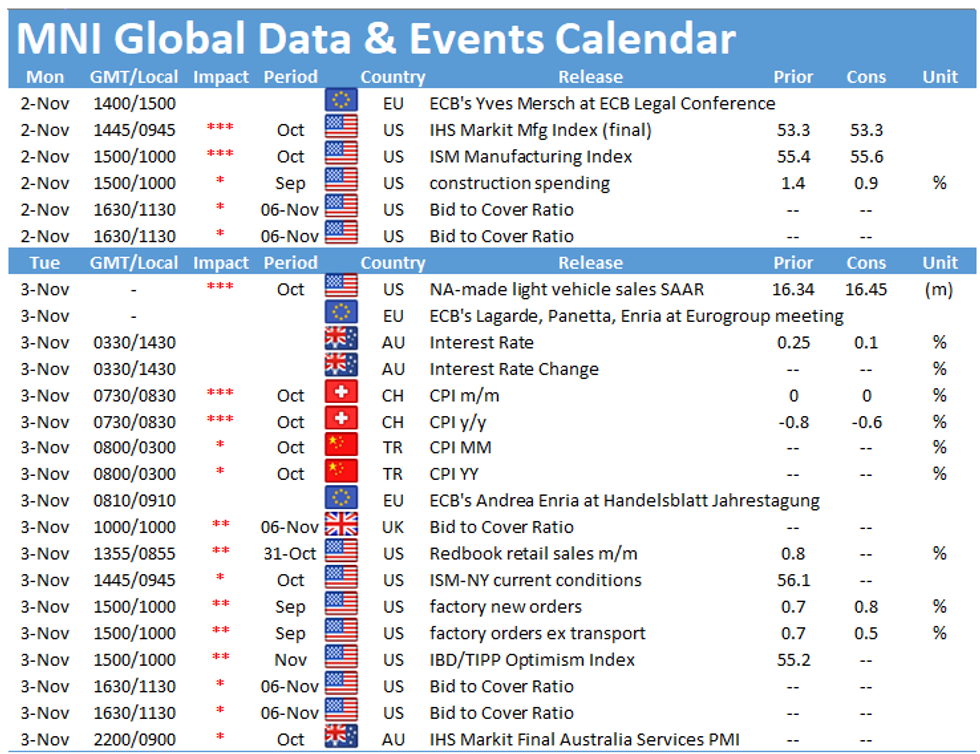

- ISM Manufacturing at 1000ET is Monday's data highlight, preceded by final PMI at 0945ET. Sep construction spending at 1000ET.

- $105B in 13-/26-week bill auction at 1130ET. NY Fed buys ~ $1.750B of 20-30Yr Tsys.

EGB/Gilts Summary

A steady morning session for EGB, with price action taking their cue from the better bid in Risk.

- Bund upside has been limited and the contract has traded heavy, with much better buying noted in Equities throughout the European morning session.

- Initial bid in Equity, was helped by the European PMI beat this morning.

- Nonetheless, price action has lacked momentum bias, as we head into a huge week in terms of risk, which include US Election, Brexit talks continuing, US FOMC, RBA, Norges Bank and BOE, and US NFP to close down the week.

- Peripheral spread have traded mixed, with Greece 1.6bps tighter against Germany, and Italy 1bp wider.

- Gilt are outperforming, despite a beat in the final manufacturing PMI, on lockdown concerns.

- Looking ahead, ECB Mersch and Rehn are the notable speakers, while U.K. Johnson will update lawmakers on lockdown

- Bund futures are down -0.04 today at 176.11 with BTP futures down -0.28 at 149.31 and OAT futures down -0.01 at 170.10.

DEBT SUPPLY

Netherlands Sells E2.05bn of DTC Bills

- Sells E1.03bn of 4-month Feb 25, 2021 DTC (vs E0.5-1.5bn Target): Avg yld -0.705% (-0.597%), cover ratio 2.07x (2.14x)

- Sells E1.02bn of 10-month Aug 30, 2021 DTC (vs E0.5-1.5bn Target): Avg yld -0.695% (-0.585%), cover ratio 1.86x (1.94x)

Germany Allots E1.40bn of 6-month Bubills

Allots E1.402bln of May 5, 2021 Bubill, Avg yld -0.7528% (-0.7201%), Buba cover 2.6x (3.4x), real cover 2.4x (3.4x)

OPTIONS

OTM Bund put

RXZ0 172.50p, bought for 3.5 and 4 in 4k total

Short-Sterling Options: Call Condor

L M1 100.00/100.125/100.25/100.375 c condor, bought for 3 in 4k

Short-Sterling Options: Downside play

0LU1 100.00/99.87ps 1x2, bought the 2 for 1.5 in 1.5k

Short-Sterling Options: Small Vol buyer

LF1 100^, bought for 7.5 in 500

Short-Sterling Options: Upside trade

LH1 99.87/100/100.12c 1x3x2, bought for 2.5 in 5k

TECHS

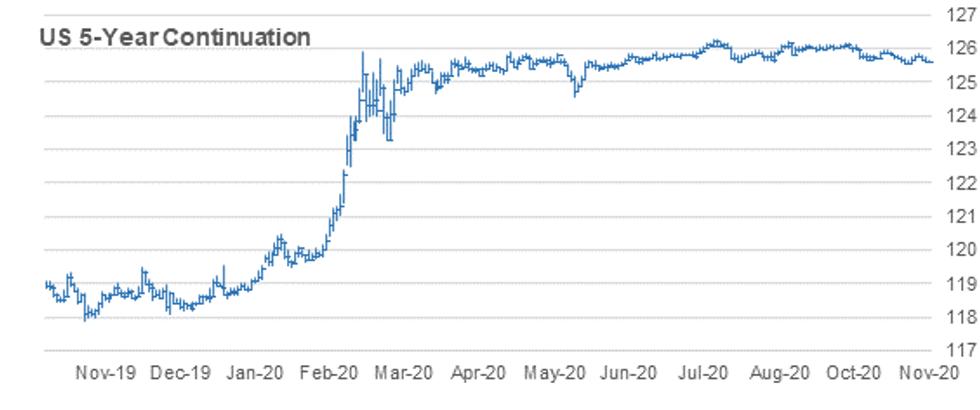

US 5yr Future Techs: (Z0) Bearish Below Trendline Resistance

- RES 4: 125-31 High Oct 15 and a key near-term resistance

- RES 3: 125-29 61.8% retracement of the Sep 30 - Oct 23 sell-off

- RES 2: 125-272 High Oct 28 and the bull trigger

- RES 1: 125-246 Trendline resistance drawn off the Sep 30 high

- PRICE: 125-20 @ 11:37 GMT Nov 2

- SUP 1: 125-196 Low Oct 29

- SUP 2: 125-16+ Low Oct 22 and 23 and the bear trigger

- SUP 3: 125-156 1.00 proj of Aug 4 - 28 sell-off from Sep 3 high

- SUP 4: 125-112 Low Jun 10 (cont)

5yr futures stalled at trendline resistance last week drawn off the Sep 30 high. The trendline intersects at 125-246. A break, reinforced by a move above the Oct 28 high of 125-272 high would signal a reversal of the recent downleg and pave the way for a climb towards 125-31, Oct 15 high. While the trendline holds, support at 125-16+, Oct 22 and 23 low remains exposed. Clearance of this level would confirm a resumption of bearish activity.

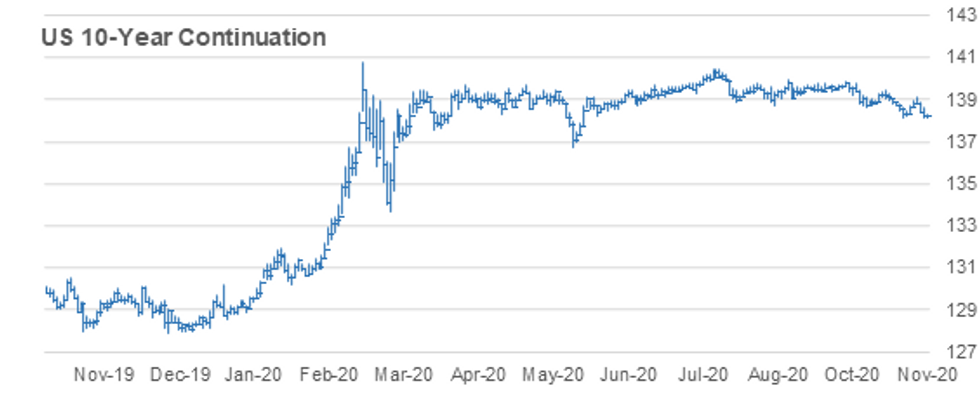

US 10yr Future Techs: (Z0) Probes Key Support

- RES 4: 139-14 High Oct 15 and a key resistance

- RES 3: 139-07+ High Oct 16

- RES 2: 139-03 High Oct 28 and the bull trigger

- RES 1: 138-25+20-day EMA

- PRICE: 138-08 @ 11:48 GMT Nov 2

- SUP 1: 138-03+ Low Oct 30

- SUP 2: 138-05 Low Oct 23

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-31+ Bear channel base drawn off the Aug 4 high

Treasuries maintain a bearish stance following last week's sell-off that followed a failure on Oct 28 at trendline resistance drawn off the Oct 2 high. The trendline intersects at 138-31+. A break of the line, reinforced by a move above 139-03, Oct 28 high would confirm a reversal of the recent downleg and open 139-14, Oct 15 high. While price remains below the trendline and with support at 138-05 breached, Oct 30 low, the risk is for further weakness.

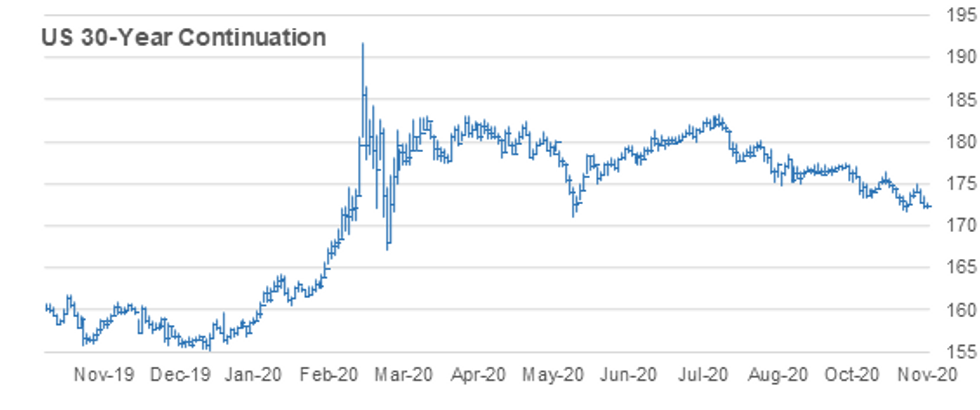

US 30yr Future Techs: (Z0) Support Still Exposed

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15 and a key resistance

- RES 2: 175-07 50-day EMA

- RES 1: 174-22/29 High Oct 28 / Trendline drawn off the Aug 6 high

- PRICE: 172-08 @ 11:54 GMT Nov 2

- SUP 1: 171-31 Intraday low

- SUP 2: 171-22 Low Oct 23 and the bear trigger

- SUP 3: 171-00 Round number support

- SUP 4: 170-16 1.00 proj of Aug 6 - 28 sell-off from Sep 3 high

30yr futures are softer following last week's second half sell-off. The pullback follows an inability to clear trendline resistance drawn off the Aug 6 high. The trendline intersects at 174-22. A break, reinforced by a move above 174-29, Oct 28 high would confirm a reversal of the recent downleg and open 176-10, Oct 15 high. While price remains below the trendline, support at 171-22, Oct 23 stays exposed. A break would resume the downtrend.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.