-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI US Morning FX Analysis - USD Fades as Biden Odds Inch Higher

Dollar in Demand With Polls Too Close to Call

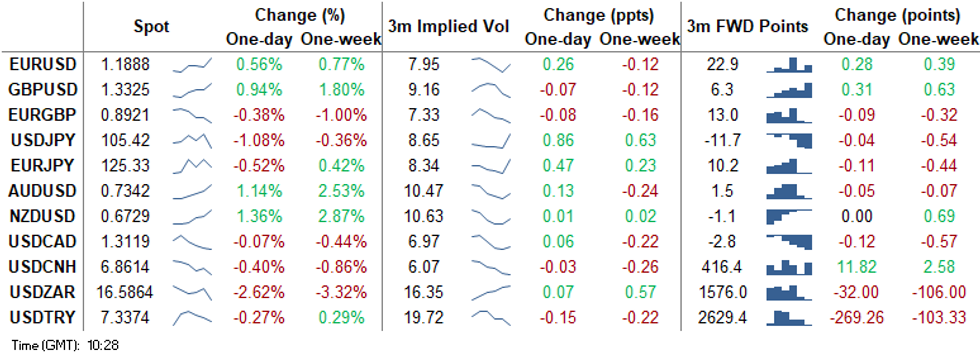

The greenback has rallied against all others, with the USD index bouncing sharply off overnight lows as markets respond to election results that remain too close to call. Vote counting in the key battleground states of Wisconsin, Michigan, Pennsylvania and Georgia remains underway, leaving markets acutely sensitive to headline risk at this point.

Trump's claim to victory in an impromptu speech this morning left little dent, despite the President's proposal to appeal to the Supreme Court in order to stop any more ballots being processed (although his Vice President talked down such action shortly afterwards). This leaves markets at a fractious juncture, with volatility high and price action sensitive.

The USD is stronger against all others in G10, with AUD, NZD and GBP in retreat. Global equity markets are mixed, but the e-mini S&P is holding on to decent gains. The greenback rally has faded marginally in recent trade, with Biden's odds to take the White House marginally improving over the past few hours.

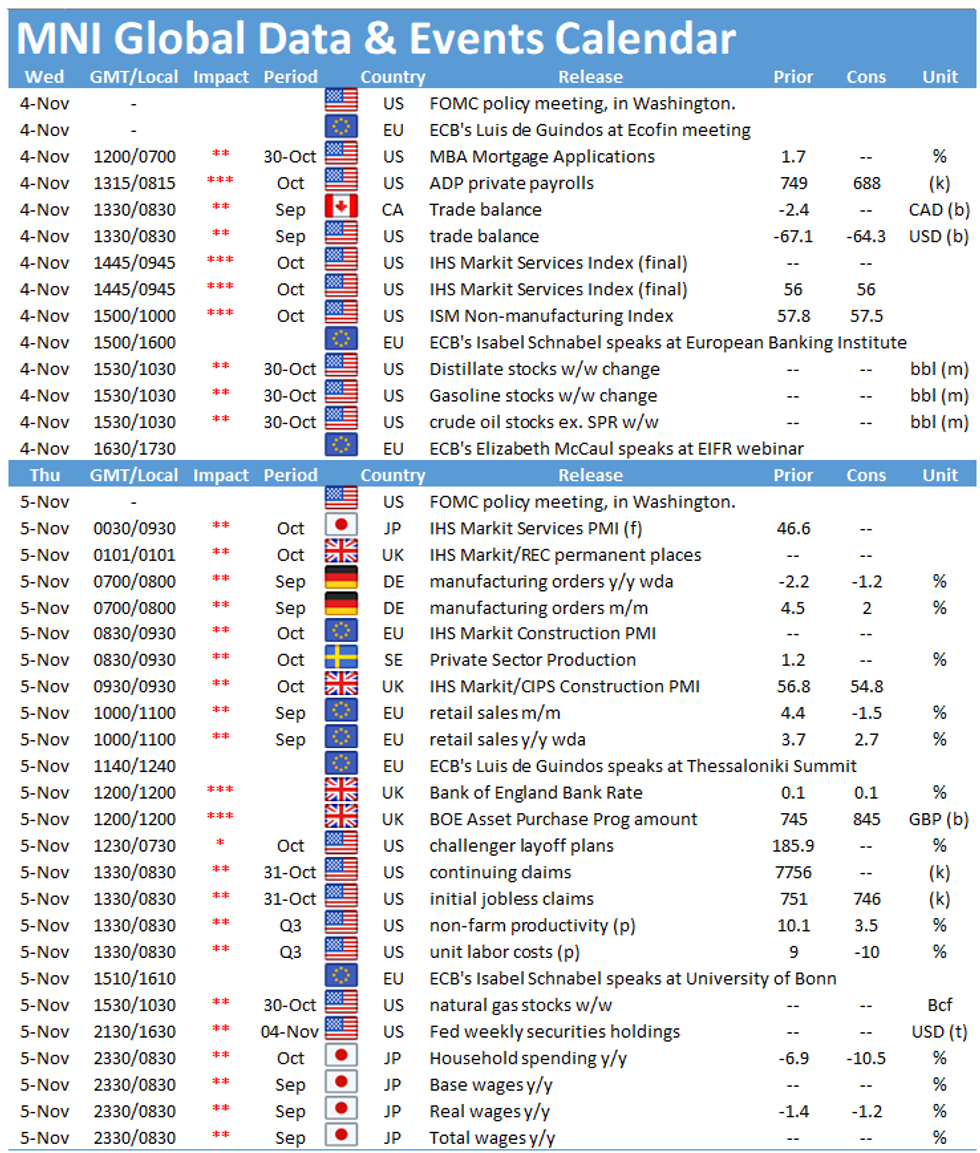

Focus understandably remains on the continued trickle of election results, but ISM services data for October could draw some focus ahead of Friday's payrolls release.

EURUSD TECHS: Bearish Backdrop

- RES 4: 1.1881 High Oct 21 and the bull trigger

- RES 3: 1.1861 Oct 26 high

- RES 2: 1.1798 High Oct 28

- RES 1: 1.1770 Intraday high

- PRICE: 1.1682 @ 10:19 GMT Nov 4

- SUP 1: 1.1603 Intraday low

- SUP 2: 1.1576 0.764 proj of Sep 1 - 25 sell-off from Oct 21 high

- SUP 3: 1.1541 Low Jul 23

- SUP 4: 1.1482 1.000 proj of Sep 1 - 25 sell-off from Oct 21 high

EURUSD is volatile. Technical signals however continue to highlight a bearish backdrop and today's low print of 1.1603 highlights an extension of the recent downleg with price probing key support at 1.1612, Sep 25 low. A clear break of 1.1612 would signal potential for weakness towards 1.1576 next, a Fibonacci projection. On the upside, today's initial resistance is at the overnight high of 1.1770.

GBPUSD TECHS: Volatile And Off Earlier Highs

- RES 4: 1.3357 High Sep 3

- RES 3: 1.3278 2.0% 10-dma envelope

- RES 2: 1.3177 High Oct 21 and the bull trigger

- RES 1: 1.3140 Intraday high

- PRICE: 1.2975 @ 10:24 GMT Nov 4

- SUP 1: 1.2911/2855 Low Nov 3 / Low Nov 2

- SUP 2: 1.2863 Low Oct 14 and key near-term support

- SUP 3: 1.2806 Low Sep 30

- SUP 4: 1.2794 76.4% retracement of the Sep 23 - Oct 21 rally

GBPUSD is volatile, finding resistance at 1.3140 today. The outlook remains bearish following last week's extension lower. However a move below key near-term support at 1.2855, Nov 2 low is required to reinforce bearish conditions. This would pave the way for a move towards 1.2676, Sep 23 low. On the upside, clearance of key resistance at 1.3177, Oct 21 high would reinstate a bullish theme.

EURGBP TECHS: Bearish Trend Sequence Intact

- RES 4: 0.9149 Oct 20 high

- RES 3: 0.9107 High Oct 23

- RES 2: 0.9058 50-day EMA

- RES 1: 0.9032 Intraday high

- PRICE: 0.9008 @ 10:28 GMT Nov 4

- SUP 1: 0.8946 Intraday low

- SUP 2: 0.8924 Low Sep 7

- SUP 3: 0.8900 Low Sep 4

- SUP 4: 0.8866 Low Sep 11 and a major support

EURGBP traded lower in Asia confirming an extension of the current downtrend. The cross has cleared 0.8967, 76.4% retracement of the Sep 3 - 11 rally and attention turns to 0.8900 ahead of the key support at 0.8866, Sep 3 low. The break lower overnight maintains the current bearish price sequence of lower lows and lower highs that defines a downtrend. On the upside, initial firm resistance is seen at 0.9058, the 50-day EMA.

USD/JPY TECHS: Bearish Focus

- RES 4: 105.85 High Oct 12

- RES 3: 105.75 High Oct 20

- RES 2: 105.37 50-day EMA

- RES 1: 105.34 Intraday high

- PRICE: 104.69 @ 10:38 GMT Nov 4

- SUP 1: 104.37 Intraday low

- SUP 2: 104.00 Low Sep 21 and the bear trigger

- SUP 3: 103.67 76.4% retracement of the Mar 9 - 24 rally

- SUP 4: 103.09 Low Mar 12

USDJPY is off earlier highs. The outlook is bearish with attention on the key 104.00 handle, Sep 21 low. Clearance of this support would suggest scope for a deeper USD sell-off within the bear channel drawn off the Mar 24 high. Price is still trading above recent lows. A break above the overnight high though of 105.34 is required to undermine the bearish theme and expose 105.75 instead, Oct 20 high.

EURJPY TECHS: Focus Is On Support

- RES 4: 123.69 50-day EMA

- RES 3: 123.27 20-day EMA

- RES 2: 123.19 High Oct 28

- RES 1: 123.07 Intraday high

- PRICE: 122.36 @ 10:41 GMT Nov 4

- SUP 1: 121.62 Low Oct 30

- SUP 2: 121.50 0.764 proj of Sep 1 - 28 decline from Oct 9 high

- SUP 3: 120.68 Bear channel base drawn off the Sep 1 high

- SUP 4: 120.39 1.000 proj of Sep 1 - 28 decline from Oct 9 high

EURJPY is off recent lows but despite this maintains a bearish tone following last week's sell-off. The cross has recently cleared support at 123.03/02 and 122.38, Sep 28 low. This move lower confirmed a resumption of the downleg that started Sep 1. Scope is seen for weakness towards 121.50 next, a Fibonacci projection. Further out, 120.39 is on the radar, also a Fibonacci projection. Initial resistance is at 123.07, today's intraday high.

AUDUSD TECHS: Watching The Key Support Handle

- RES 4: 0.7314 76.4% retracement of the Sep 1 - Nov 2 downleg

- RES 3: 0.7252 61.8% retracement of the Sep 1 - Nov 2 downleg

- RES 2: 0.7243 High Oct 10 and a key resistance

- RES 1: 0.7222 Intraday high

- PRICE: 0.7116 @ 10:48 GMT Nov 4

- SUP 1: 0.7049 Intraday low

- SUP 2: 0.6991 Low Nov 2

- SUP 3: 0.6965 23.6% retracement of the Mar - Sep rally

- SUP 4: 0.6931 0.764 proj of Sep 1 - 25 sell-off from Oct 9 high

AUDUSD traded firmer Tuesday but is trading in a volatile manner today. Yesterday the pair cleared its key short-term trendline resistance drawn off the Sep 1 high. This signals a potential reversal, exposing resistance at 0.7243, Oct 9 high. Clearance of this hurdle would strengthen bullish conditions. On the downside, key support lies at 0.6991, Nov 2 low. This is also the bear trigger, a break would resume recent bearish pressure.

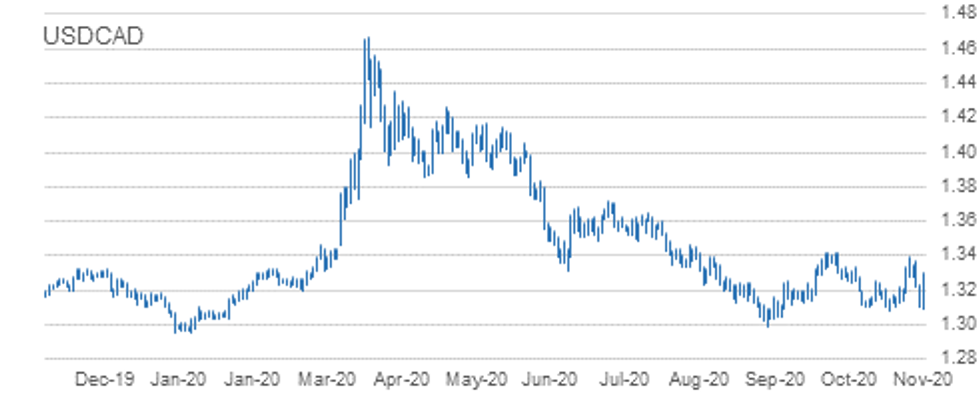

USDCAD TECHS: Holding Above Support

- RES 4: 1.3476 2.0% 10-dma envelope

- RES 3: 1.3421 High Sep 30 and primary resistance

- RES 2: 1.3390 High Oct 29

- RES 1: 1.3300 Intraday high

- PRICE: 1.3212 @ 10:52 GMT Nov 4

- SUP 1: 1.3096 Intraday low

- SUP 2: 1.3081 Low Oct 21 and the bear trigger

- SUP 3: 1.3047 Low Sep 7

- SUP 4: 1.2949 2.0% 10-dma envelope

USDCAD sold off sharply Monday and that trend extended into Tuesday's close. Price action however is choppy today. A bullish outlook remains intact though while support at 1.3081 Oct 21 low holds. Last week's break of resistance at 1.3259, Oct 15 high and of 1.3341, Oct 7 high signals scope for a climb to 1.3421, Sep 30 high and a key resistance. Sub 1.3081 levels would instead expose 1.2994, Sep 1 low.

EUR/USD: MNI KEY LEVELS

- *$1.1938 May15-2018 high

- *$1.1893 Upper Bollinger Band (2%)

- *$1.1855 Upper 1.0% 10-dma envelope

- *$1.1849/51 100-mma/Jun14-2018 high

- *$1.1815 Sep24-2018 high

- *$1.1777/81 50-dma, Cloud top/55-dma

- *$1.1770 Intraday high

- *$1.1757/58 Sep27-2018 high/21-dma

- *$1.1734/36 200-hma/38.2% 1.3993-1.0341

- *$1.1707 Cloud base

- *$1.1672 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *$1.1667/66 100-hma/100-dma

- *$1.1651 Sep28-2018 high

- *$1.1622/21 Lower Boll Band (2%)/Oct16-2018 high, Lower 1.0% 10-dma env

- *$1.1613/09 161.8% swing $1.1497-1.1309/Down Trendline from Jul18-2008

- *$1.1603 Intraday low

- *$1.1570 Jan10-2019 high

- *$1.1554 Lower Bollinger Band (3%)

- *$1.1540 Jan11-2019 high

- *$1.1503 Lower 2.0% 10-dma envelope

- *$1.1490 Jan15-2019 high

GBP/USD: MNI KEY LEVELS

- *$1.3133 Apr12-2019 high

- *$1.3127/31 Upper Boll Band (2%), Upper 1.0% 10-dma env/May07-2019 high

- *$1.3109 Fibo 50% 1.1841-1.4377

- *$1.3080 May08-2019 high

- *$1.3041 May13-2019 high

- *$1.2999/00/02 61.8% 1.3381-1.2382/Cloud top/55-dma

- *$1.2987/88/91 50-dma, 200-hma/21-dma/May10-2019 low

- *$1.2970 May14-2019 high

- *$1.2959 Cloud base

- *$1.2948/50 100-hma/200-wma, 50-mma

- *$1.2941 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *$1.2915 Intraday low

- *$1.2904 May14-2019 low

- *$1.2887/82 100-dma/50% 1.3381-1.2382

- *$1.2867 Lower 1.0% 10-dma envelope

- *$1.2855/52 Lower Boll Band (2%)/May16-2019 high

- *$1.2833/31 Feb12-2019 low/Jan21-2019 low

- *$1.2825 Jan16-2019 low

- *$1.2813/10 May21-2019 high/61.8% 1.1841-1.4377

- *$1.2787/84 Lower Boll Band (3%)/Jun25-2019 high

- *$1.2764/59 38.2% 1.3381-1.2382/Jun12-2019 high

EUR/GBP: MNI KEY LEVELS

- *Gbp0.9134 Sep11-2017 high

- *Gbp0.9122/27 Upper 1.0% 10-dma env/Upper Boll Band (2%)

- *Gbp0.9108 Jan03-2019 high

- *Gbp0.9101 Cloud top

- *Gbp0.9079 Cloud base

- *Gbp0.9069 50-dma

- *Gbp0.9062 55-dma, Jan11-2019 high

- *Gbp0.9048/51/53 Jul16-2019 high/Jul17-2019 high/21-dma, 100-dma

- *Gbp0.9039 Jul18-2019 high

- *Gbp0.9032/35 Intraday high/200-hma

- *Gbp0.9019 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *Gbp0.9010 Jul10-2019 high, 100-hma

- *Gbp0.9005/00 Jul23-2019 high/Jul22-2019 high

- *Gbp0.8974 Lower Bollinger Band (2%)

- *Gbp0.8953 Jul23-2019 low

- *Gbp0.8945/41 Intraday low/Lower 1.0% 10-dma env

- *Gbp0.8936 Lower Bollinger Band (3%)

- *Gbp0.8921 Jul02-2019 low

- *Gbp0.8913 200-dma

- *Gbp0.8874/73/72 Jun19-2019 low/Jun20-2019 low/Jun12-2019 low

- *Gbp0.8865 Fibo 61.8% 0.9108-0.8473

USD/JPY: MNI KEY LEVELS

- *Y106.52 Fibo 61.8% 99.02-118.66

- *Y106.46 Upper Bollinger Band (3%)

- *Y105.98 100-dma, Upper Boll Band (2%)

- *Y105.77 Cloud top

- *Y105.71 Upper 1.0% 10-dma envelope

- *Y105.45 55-dma

- *Y105.40 50-dma

- *Y105.34 Intraday high

- *Y105.17 Cloud base

- *Y105.07/08 Cloud Kijun Sen/21-dma

- *Y104.98 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *Y104.87 Jan03-2019 low

- *Y104.69 Cloud Tenkan Sen

- *Y104.65 100-hma

- *Y104.62 200-hma

- *Y104.56 Mar26-2018 low

- *Y104.37 Intraday low

- *Y104.08 Lower Bollinger Band (2%)

- *Y103.94 200-mma

- *Y103.61 Lower 1.0% 10-dma envelope

- *Y103.60 Lower Bollinger Band (3%)

EUR/JPY: MNI KEY LEVELS

- *Y123.51 May22-2019 high

- *Y123.36 Cloud Kijun Sen

- *Y123.18 Jun11-2019 high

- *Y123.11 Fibo 50% 118.71-127.50

- *Y123.08 Fibo 38.2% 126.81-120.78

- *Y123.07 Intraday high

- *Y123.01 Jun12-2019 high

- *Y122.93 Cloud Tenkan Sen

- *Y122.77 200-hma

- *Y122.56 Jun13-2019 high

- *Y122.53 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *Y122.23 Jul12-2019 high

- *Y122.13 Jun17-2019 high

- *Y122.09 100-hma

- *Y122.07 Fibo 61.8% 118.71-127.50

- *Y121.96 Intraday low

- *Y121.95 Fibo 50% 94.12-149.78

- *Y121.92 Jun20-2019 high

- *Y121.85 Jul15-2019 high

- *Y121.78 100-wma

- *Y121.63 Lower 1.0% 10-dma envelope

AUD/USD: MNI KEY LEVELS

- *$0.7222 Intraday high

- *$0.7206/07 Apr17-2019 high/Feb21-2019 high

- *$0.7190/94 Cloud base/Cloud top

- *$0.7180/81 50-dma/55-dma

- *$0.7162 Upper 1.0% 10-dma envelope

- *$0.7153 Apr17-2019 low

- *$0.7140 Apr16-2019 low

- *$0.7116/20 Apr12-2019 low/100-dma

- *$0.7110/14 Apr10-2019 low/21-dma

- *$0.7085/88 200-hma/Apr08-2019 low

- *$0.7077 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *$0.7073/69 Mar29-2019 low/Apr30-2019 high

- *$0.7058/57/53 100-hma/Jul22-2019 high/Apr02-2019 low

- *$0.7049/48 Intraday low/Jul04-2019 high, May07-2019 high

- *$0.7044 Jul16-2019 high

- *$0.7020 Lower 1.0% 10-dma envelope

- *$0.6994 Lower Bollinger Band (2%)

- *$0.6985 Jan03-2019 low

- *$0.6971/67 Jul12-2019 low/Jun11-2019 high

- *$0.6949 Lower 2.0% 10-dma envelope

- *$0.6935 Lower Bollinger Band (3%)

USD/CAD: MNI KEY LEVELS

- *C$1.3354/58 Upper 1.0% 10-dma env/50% 1.3565-1.3151

- *C$1.3345 Jun12-2019 high

- *C$1.3326/28 Upper Boll Band (2%)/38.2% 1.2783-1.3665

- *C$1.3320 100-dma

- *C$1.3309 Fibo 38.2% 1.3565-1.3151

- *C$1.3297/00 Cloud top/Intraday high, Jun13-2019 low

- *C$1.3286 Jun20-2019 high

- *C$1.3270 100-hma

- *C$1.3242 Cloud base

- *C$1.3236 200-hma

- *C$1.3228 ***CURRENT MARKET PRICE 09:38GMT WEDNESDAY***

- *C$1.3226/24 Jun10-2019 low/50% 1.2783-1.3665

- *C$1.3208/05 50-dma/55-dma

- *C$1.3194 21-dma

- *C$1.3180 50-mma

- *C$1.3164/63/60 Jul23-2019 high/Feb21-2019 low/200-wma

- *C$1.3151/50 Jun20-2019 low/Feb20-2019 low

- *C$1.3120/16 61.8% 1.2783-1.3665/Jul23-2019 low

- *C$1.3113 Feb25-2019 low

- *C$1.3107 Jun26-2019 low

- *C$1.3096 Intraday low

OPTIONS: Expiries for Nov4 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1725-50(E883mln)

- USD/JPY: Y104.50($535mln), Y105.00($1.4bln), Y105.23-30($703mln), Y105.35-50($759mln), Y106.00-10($1.3bln)

- AUD/USD: $0.6930-40(A$665mln)

- USD/CNY: Cny6.56($520mln), Cny6.78($715mln)

Larger Option Pipeline

- EUR/USD: Nov06 $1.1600(E1.8bln), $1.1795-05(E1.5bln); Nov09 $1.1900(E1.5bln-EUR calls); Nov10 $1.1800(E1.2bln)

- USD/JPY: Nov05 Y105.00($964mln), Y106.06-09($1.6bln); Nov06 Y104.89-00($1.2bln); Nov10 Y104.50($1.2bln), Y105.00-05($1.1bln); Nov12 Y103.00($1.4bln)

- EUR/JPY: Nov05 Y124.50(E1.1bln)

- EUR/AUD: Nov12 A$1.6520(E973mln)

- USD/CNY: Nov05 Cny6.75($1.2bln), Cny6.80($1.9bln), Cny6.85($1.3bln); Nov06 Cny6.70($1.2bln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.